UK Government EU Referendum Propaganda Leaflet Backfires as Anger Spurs BrExit Support

ElectionOracle / EU_Referendum Apr 11, 2016 - 01:16 PM GMTBy: Nadeem_Walayat

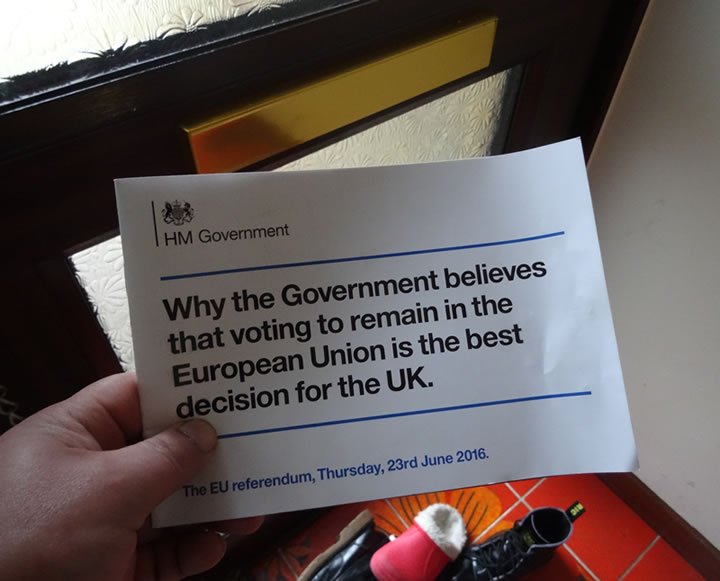

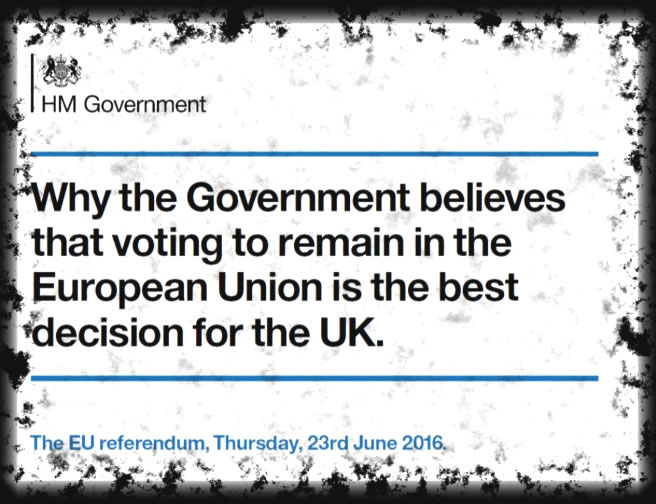

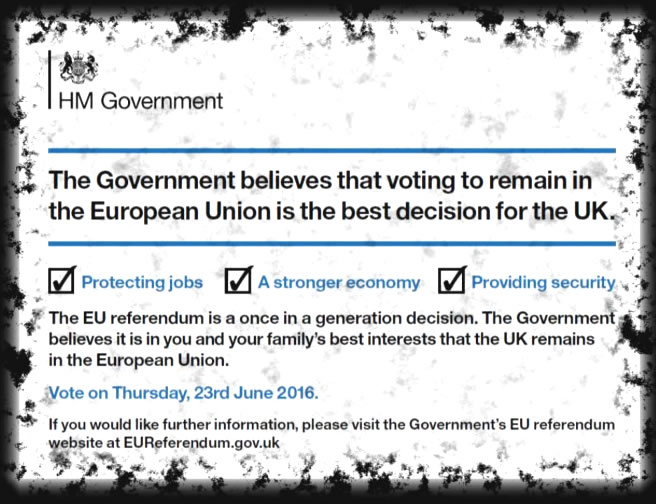

The Conservative government's baldrick-esk cunning plan of using £10 million of tax payers money to send out 27 million pro-Remain propaganda leaflets to Britains households looks to have badly backfired as its announcement has increasingly been met with a wall of anger from the electorate at what is seen as blatant attempts to gerrymander the election by the establishment by spending TAX PAYERs money on a leaflet the cost of which is EXCLUDED from the supposed £7 million election spending limits for either LEAVE or REMAIN camps.

The Conservative government's baldrick-esk cunning plan of using £10 million of tax payers money to send out 27 million pro-Remain propaganda leaflets to Britains households looks to have badly backfired as its announcement has increasingly been met with a wall of anger from the electorate at what is seen as blatant attempts to gerrymander the election by the establishment by spending TAX PAYERs money on a leaflet the cost of which is EXCLUDED from the supposed £7 million election spending limits for either LEAVE or REMAIN camps.

To illustrate the degree of outrage an online petition has already secured over 200,000 signatures that will prompt a debate on the leaflet in Parliament. Even the electoral commission has stepped in to criticise the leaflet by stating “We don’t think the government should have done it, but it’s not illegal.”

And whilst the leaflets drop so does the Panama Papers tax dodging scandal headlines continue that has seen David Cameron scrambling to cover his back as his father is revealed as being a serial tax avoider, something that he apparently has benefited by at least £500,000 that makes a mockery of the 'we're all in it together' slogan that Cameron and cronies trumpet on a near weekly basis.

However, worse still is that the leaflet itself fails to stand up to close scrutiny in its pro-Remain claims due to gaping omissions as the following comprehensive analysis reveals.

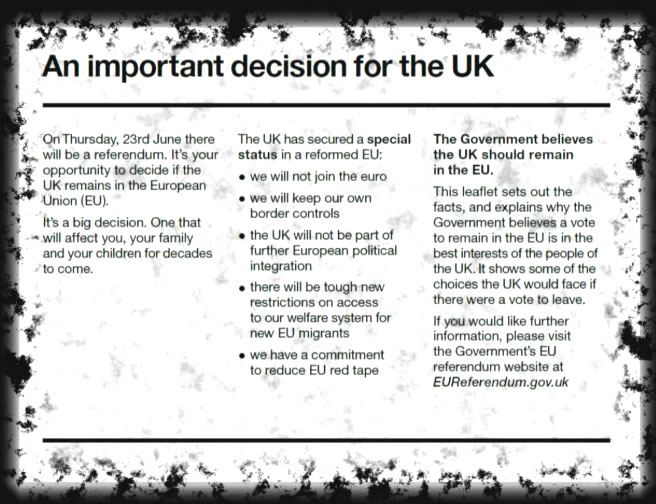

The first claim concerns itself with the so called special deal that David Cameron secured in February, which in reality were very mild watered down measures as I covered each of the points in this video, in which I explain that the so called deal fails on EVERY point and worse still is that the deal is NOT binding on member states as there will be no treaty change which means no matter what the member states have been stating before the EU Referendum, afterwards they change any point of the deal which effectively makes it a worthless smoke and mirror exercise.

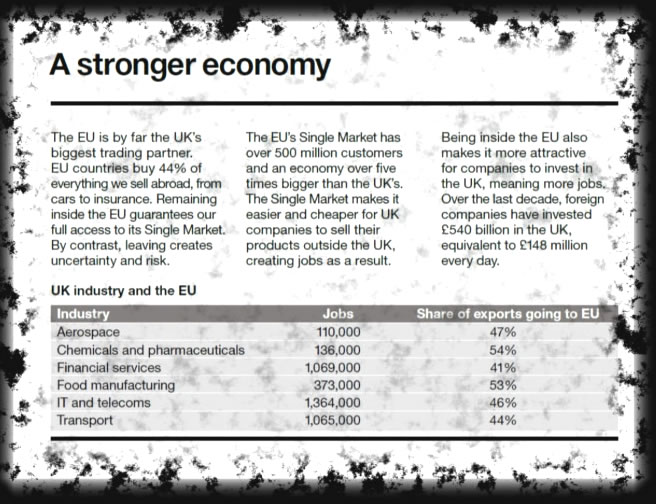

A stronger economy paints a picture of 4 million UK jobs reliant on the EU. Which even if true has a gaping omission which is that Britain has an annual trade deficit with Europe of over £90 billion per year! What does this mean? It means that Britain employs net several millions more German, French and other EU workers at an annual cost of £90 billion a year. So the truth is that the European Union would bend over backwards to retain this net annual jobs subsidy from Britain that supports so many millions of European Union jobs, for if there were trade balance rather than the current imbalance then that £90 billion could create and sustain 3 million UK jobs if Britain stopped paying for EU jobs effectively bringing jobs home from Europe.

Improving Our lives concerns itself with the fact that the British Pound could fall if the UK left the EU. This appears completely blind to the ongoing currency war that has virtually every major nation trying to competitively devalue their currencies against one another that has seen a series of central banks this year such as those of Japan and Europe cut their interest rates to below zero, Negative interest rates in an attempt to get their currencies to FALL. So a fall in the British pound in reality would amount to Britain winning an currency war battle, all without doing anything. And Secondly, actually probability would favour the British Pound rising post brexit because the market would conclude that the huge trade imbalance with Europe would likely shrink.

Whilst the statements on travel mainly concerns itself with tourism as though anything would change, after all Britains can relatively easily travel to virtually any civilised nation on the planet and so it will remain for britians traveling to the EU. Also ignoring the consequences of out of control immigration, one of 5 million low paid eastern europeans flooding into Britain and driving down wages for everyone, economic migrant workers supported by the tax payer through in work benefits such as tax credits, and in the process creating crisis in housing, schooling and in fact every state service, all ignored by the propaganda leaflet and that is before one considers the migration crisis Europe faces due to its weak southern borders.

What happens if we leave is a pure play on fear, of Britain being cast adrift in the atlantic for a decade, diminished trade and influence. Again this misses the point that the European Union is on an unsustainable trend trajectory, one of forces that will rip it apart, forces such as the bankrupt southern states requiring bailout after bailouts, the disparity between the western and eastern civilisations as illustrated by extremist, governments of the likes of Poland and Hungary clamping down on free speech and freedom, whilst at the same time the EU is trying to incorporate the Ukrainian civil war into its borders.

Instead the fundamental truth is that the European Union has a destiny with disintegration and so it would be better for Britain to LEAVE sooner rather than later to better limit the damage from a disintegrating European Union.

Controlling immigration and securing our borders.

This section is pure fantasy, those who wrote it must be living on another planet for everyone understands that Britain has NO real control over its borders, for we can see the consequences of out of control immigration with our own eyes. The latest immigration statistics paint a bleak puncture of not just continuing out of control immigration but a worsening trend where annual net migration has risen from 100k a year, to 200k to 300k and now stands at 340k a year and is on a trajectory towards net migration of 1/2 million a year before the end of this decade.

And where security is concerned, well the Paris and Brussels attack don't paint a reliable picture for a secure European Union, instead the reality is of very weak an porous southern borders.

The benefits of EU membership is basically a summery of the leaflets previous pages, whilst lavishing praise on the EU forgets to mention that the EU costs the UK a net £175 million per week.

And lasting we are reminded that the 23rd June referendum is a once in a generation decision.

Which is true because with each passing year the price for LEAVING the EU will just keep increasing, so whilst a Brexit today could cost Britain between 2% and 5% of GDP, letting things roll on for another decade and we will likely pass the point of no return where the costs of a Brexit would be too painful and so Britain would be permanently locked into a death embrace with a European Union that had a destiny with disintegration,

Ensure you are subscribed to my always free newsletter (only requirement is an email address) for new analysis and forecasts including for the following :

- US Dollar Trend Forecast

- UK Housing Market Trend Forecasts

- US Stock Market Forecasts

- US House Prices Detailed Multi-Year Trend Forecast

- Gold and Silver Price Forecast

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.