Silver Manipulation Cultists Cheer “Proof”

Commodities / Gold and Silver 2016 Apr 14, 2016 - 05:56 PM GMTBy: Dan_Norcini

Ah yes, the silver manipulation crowd is ecstatic this AM as they gleefully point to news that Deutsche Bank has agreed to settle in a class action lawsuit which claimed that it, along with several other large banks, had been rigging the silver price at the London Silver Fix.

Ah yes, the silver manipulation crowd is ecstatic this AM as they gleefully point to news that Deutsche Bank has agreed to settle in a class action lawsuit which claimed that it, along with several other large banks, had been rigging the silver price at the London Silver Fix.

The claim by the silver cultists is that the bank would not have agreed to settle if they had done nothing wrong. Hello? Ever heard of companies settling nuisance lawsuits to make them go away? Nowadays it is called the “cost of doing business”.

Many unscrupulous attorneys make their living targeting corporations and other juicy targets in the full knowledge that such companies will almost inevitably settle to avoid the costs of litigation, not to mention the time, resources, and aggravation that would be involved in taking such a case to trial. Then there is always the risk of a fickle jury.

The funny thing about the way this story has been reported is the ASSUMPTION that because Deutsche Bank agreed to settle the case, it therefore PROVES that they were manipulating silver prices. On the contrary, it proves nothing. What it proves is that Deutsche Bank simply wanted to avoid the aforementioned burden of dealing with a nuisance lawsuit.

Here is the main point however. The entire premise of the silver is always manipulated crowd is that on account of these “nefarious banks”, the silver price has been held down and would be considerably higher than it would otherwise have been were it not for their activity.

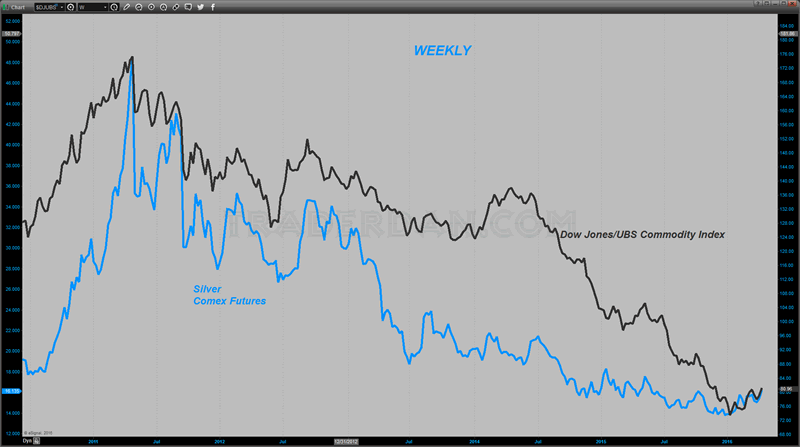

I have long ago debunked that nonsense by simply displaying one chart.

I will do so again for the benefit of those who might have missed those days.

The dark line is the Dow Jones/UBS Commodity Index. This is just one of several commodity indices which are comprised of a basket of select commodity futures markets weighted according to a predetermined formula. While the individual weightings of each commodity can and will vary from one index to another, they all do a very good job of providing a picture of how the overall complex is faring.

Notice how the silver price rises and falls with the rise and falls of the actual index. In other words, the two move in unison, rising together and falling together.

I should note that the commodity index contains such things as crude oil, gasoline, corn, wheat, soybeans, cattle, hogs, sugar, copper, etc. In other words, it is very inclusive which is what one would expect from such an index.

Here is the point. Based on the theory of the silver manipulation crowd, the silver price was being illegally held from rising by the actions of the various banks, included among them, Deutsche Bank.

I would ask these poor souls the following simple question: “on what basis do you claim that silver prices would have been strongly higher were it not for these banks conspiring to force down the price and keep it from otherwise rising?”

Are those of us poor, ignorant, and unenlightened souls such as you silver manipulation cultists, supposed to believe that while the rest of the commodity complex was sinking, silver was to somehow soar in price? While deflation/slow growth fears, oversupply issues, etc., were sinking commodities as an asset class, your gray metal god was somehow to have been immune to all such events? Did Deutsche Bank and its supposed allies among the other banks, work to suppress the price of oil, gasoline, copper, corn, beans, wheat, cattle, sugar, hogs, platinum, cotton, and every other commodity market on the planet? Did they force the entire commodity sector lower? Why then were those latter markets falling in price?

Oh I see, it was all a giant conspiracy foisted upon the poor, defenseless commodity sector by evil, nasty banks.

You may choose to believe whatever nonsense you wish to believe but I will stick with the simpler and more reasonable view that silver prices rise and fall with the fortunes of the rest of the commodity sector. It is no more complicated than that.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.