This is the Era of the Democrats and Your Taxes are Going Up

ElectionOracle / Taxes Apr 27, 2016 - 10:12 AM GMTBy: Harry_Dent

If Hillary Clinton and Donald Trump clinch their party’s nominations, Americans will have to pick between the two most hated candidates for the presidency in history.

If Hillary Clinton and Donald Trump clinch their party’s nominations, Americans will have to pick between the two most hated candidates for the presidency in history.

Hillary has an unfavorable rating of 56%. Not much better than Trump at 64%.

Yet recent online polling by Pivit suggests there’s an 80% chance the democrats will win, and a 78% chance it will be Hillary. It’s only a 14% chance for Donald, 4% for Cruz and 2% for Sanders (ouch).

But no one can deny the popularity of Trump and Sanders or the reasons behind their support base. There’s a deep dissatisfaction in a great majority of American workers, whose real wages are 5% below 1975 levels, and 12% below 2000 levels where they peaked.

And as the Fed’s recent policies have pretty much only succeeded in inflating financial assets which the most affluent mostly hold, everyday Americans have seen few of the benefits from this “recovery.”

Whether it’s from “unfair” wage competition from Asian nations, or the outsized gains in income and wealth going to the top 1% (or really the top 0.1% as my analysis shows), one thing is clear – extreme wealth inequality has been a major issue since the Great

Recession, and for good reason.

But you’ll understand why Hillary’s got the odds in her favor when you see the chart below.

I’ve spent my career studying large, economic cycles that have allowed me to predict booms and busts years, even decades in advance.

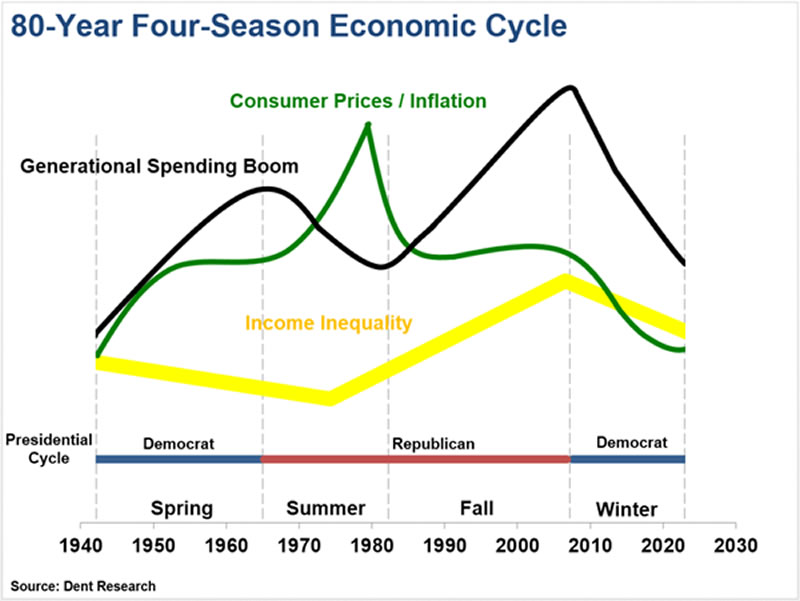

And the clearest correlation with income inequality – the hot topic this election cycle – stems from my 80-Year Four Season Economic Cycle.

Like summer to winter, it shows oscillating extremes between inflation and deflation. It also shows projectable booms from generational spending. So too with income inequality.

See the chart below:

The chart shows that rampant deflation occurs in the winter season, with a sharp fall in consumer prices and generational spending.

But it also shows a steep decline in income inequality, from the peak following the fall bubble boom season.

The yellow line in this chart follows the actual trends of income inequality peaking at the end of the last fall bubble boom season in 1929, and bottoming around 1975.

Notice how it only rises through part of the summer to the end of fall. Income inequality actually falls longer than it rises!

When economists claim that trickle-down economics doesn’t work, I say tell that to the emerging middle class from 1933 through 1975!

So what causes the reversal as we saw from 1975 into 2007?

Several events happen during the summer period. For one, generational spending begins to fall, which causes rising recessions like we saw in the 1970s. Productivity also hits a low point as the technologies of the past start to fade in power. Then there are the high costs of incorporating the young, new generation into the workforce – like the baby boomers into the late 1970s. Kids aren’t productive, but they cost everything!

Those challenges require new innovations that are met by the most entrepreneurial people – similar to the Robber Barons of the early 1900s into the Roaring 20s. And Wall Street finances them.

Into the fall season, this group accrues the biggest gains in income and even more so in wealth. Greater risks equal greater rewards – that’s the nature of entrepreneurship.

But the winter season inevitably hits.

The bubble bursts, and it disproportionately affects this high-wealth sector as they own over 90% of financial assets.

And, as we have seen since 2008, there are natural populist movements that favor higher incomes for everyday workers, and higher taxes on the rich.

Look at the red and blue lines at the bottom that roughly correlate with income inequality trends and the four seasons.

The winter shake-out and spring boom favor the democratic party (innovations trickling down). The inflationary summer and bubble fall boom seasons (new innovation) favor the republicans.

From 1933 through 1968 – the span of the winter and spring seasons – we saw democrats in the white house 28 years starting with FDR, versus only eight for the republicans when Eisenhower held office.

That’s 78% democrat! And Eisenhower had a clear advantage being the winning general of the greatest war in U.S. history. If not for that he might not have been in the race!

Then, from Nixon in 1969 through Bush in 2008 – the summer and fall seasons – only republicans held the office for 28 out of those 40 years, or 70% republican. Clinton had an upset after the early 1990s recession hurt Bush, and then had the strongest boom in U.S. history, as I forecast in advance, to favor him for a second term.

Like it or not, the republican party is splintering and has almost no chance of winning the election, even though a sluggish economy under a democratic president naturally favors them.

But, as they say – it’s not over until the fat lady sings!

If stocks crash into July, as is more likely than most think, it will give a boost to the anti-establishment – Trump and Sanders…

But the democratic party is still likely to win, and if this cycle proves correct, they’re also likely to dominate into at least 2036.

That means taxes are likely to rise on the rich, very favorable capital gains rates are likely to disappear, and your wealth is likely to vanish faster than any time since the early 1930s.

Act now! QE is losing its magic, and time is running out to take the steps to protect your wealth from the inevitable bubble burst and rising taxes.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.