Gold Commitments of Traders and More

Commodities / Gold and Silver 2016 May 01, 2016 - 02:59 PM GMTBy: Dan_Norcini

Gold is showing some very good strength at this time, as the weaker dollar, combined with negative interest rates, and in some instances, NEGATIVE REAL RATES, has made the opportunity cost in holding the metal practically non-existent. Throw in the continued uncertainty over global equity market valuations, and gold demand continues to remain strong. As noted previously however,the recent lackluster interest in GLD is on my radar screen however.

Gold is showing some very good strength at this time, as the weaker dollar, combined with negative interest rates, and in some instances, NEGATIVE REAL RATES, has made the opportunity cost in holding the metal practically non-existent. Throw in the continued uncertainty over global equity market valuations, and gold demand continues to remain strong. As noted previously however,the recent lackluster interest in GLD is on my radar screen however.

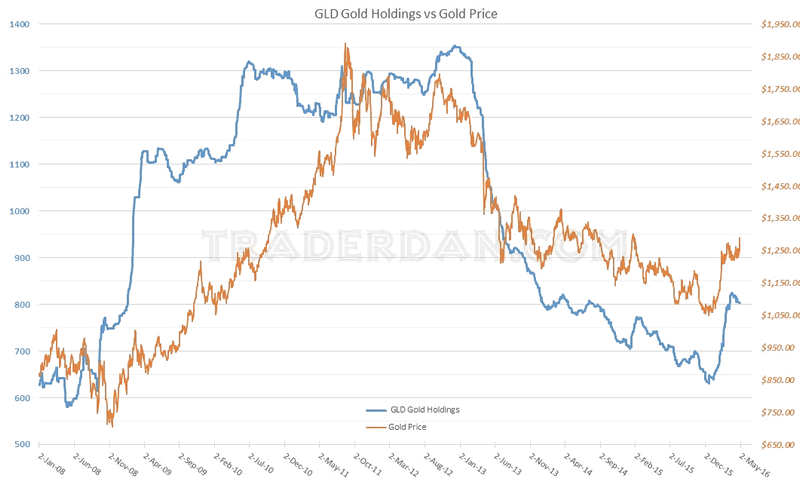

GLD Gold Holdings versus Gold Price

While gold is at its highest level on the charts since January 2015, the reported holdings in GLD are actually below their peak this year in the last week of March. Precisely, at that time, there were 823 tons reported in GLD; this past Friday there were 804, a difference of 19 tons.

Total tonnage in GLD does however remain 162 tons higher than at the start of the year. Thus, while the recent poor showing in the reported holdings of GLD is noteworthy, overall we have not as yet seen anything that would suggest a sharp change in sentiment towards gold among Western-based investors.

I was disappointed in seeing a mere 1.6 ton increase in reported gold holdings since Wednesday, especially when one considers the dovish FOMC statement and the Bank of Japan policy announcement that sent the Yen soaring and the Dollar sharply lower. I would have thought we would see at least a 8-10 ton increase. Maybe we will see that next week. Then again, maybe we will not! Who knows?

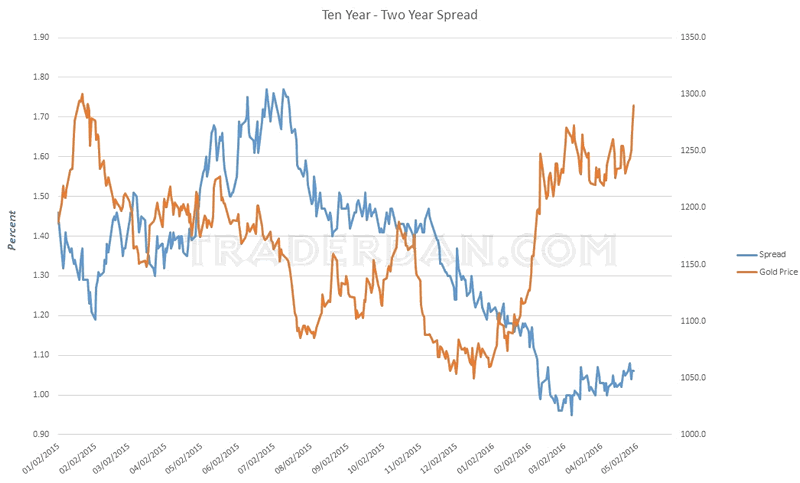

Incidentally, here is an updated chart noting the gold price and looking at the yield curve as illustrated by mapping the spread between the Ten Year Treasury and the Two Year Treasury.

Ten Year - Two Year Spread

There is still nothing in this spread that would indicate the interest rate markets are the least bit concerned about inflationary pressures building in the US economy. While the spread has steepened from its tightest levels seen in early March of this year, it remains well below where it was a year ago.

I keep referring to this spread because I keep trying to ascertain whether this commodity buying binge has anything fundamental behind it or if the entire thing is merely a function of the weaker Dollar generating hot money flows into a beaten down sector in the hopes of picking up some fast money. Until I see evidence that this spread is suggesting more rapid growth I will be inclined to believe that while this recent push higher across so many metals markets has been impressive, the fundamental underpinnings needed to sustain these higher prices is missing. We'll just have to keep watching to see how things unfold.

Back to the COT stuff...

Through Tuesday of this past week, there was little in the way of significant changes to the positioning of the players.

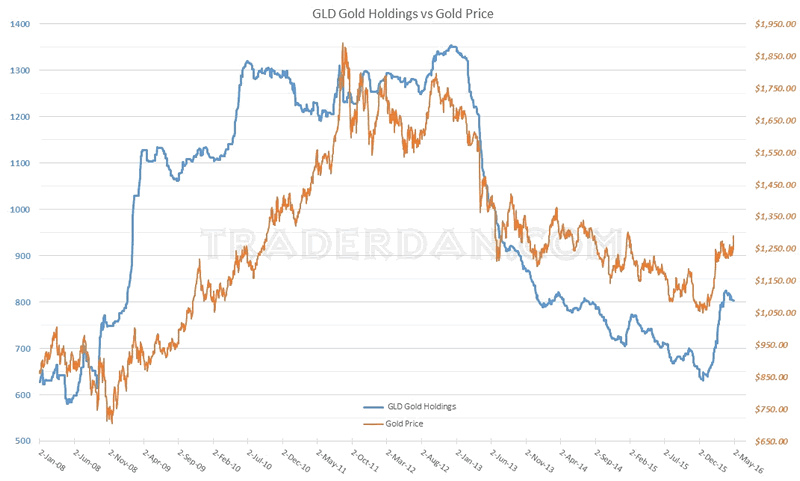

GLD Gold Holdings versus Gold Price Chart 2

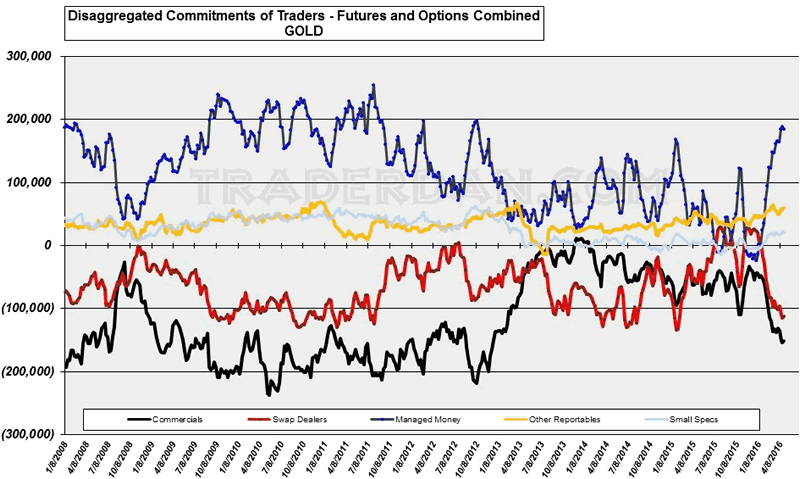

Disaggregated CoT

There was a slight reduction in the net long position of the hedge funds and a slight reduction in the net short positions of the Commercials and Swap Dealers. It should be noted however, that all of the significant events that impacted the gold price in such a positive manner happened AFTER the Tuesday cutoff date. I am of course referring to the FOMC and the BOJ.

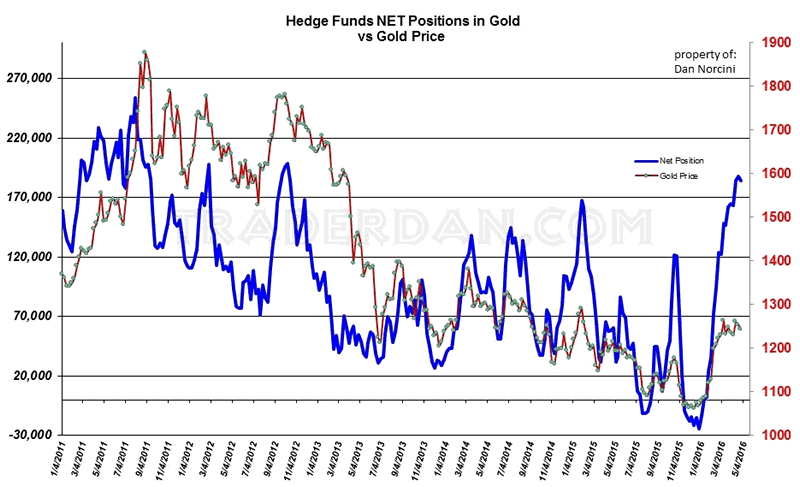

In looking at the hedge fund position alone, you can see that it remains elevated but is below previous record highs.

Hedge Funds Net Positions in Gold

Here is a chart showing the hedge fund OUTRIGHT positions and the gold price.

Hedge Fund Longs and Shorts

Note that compared to previous high points in the outright long position by this group of traders, that there remains more skeptics as their outright short position still remains larger than at other peaks in the long position.

There is therefore additional fuel for further gains should technical chart levels get tripped to the upside that would force these short positions to be covered.

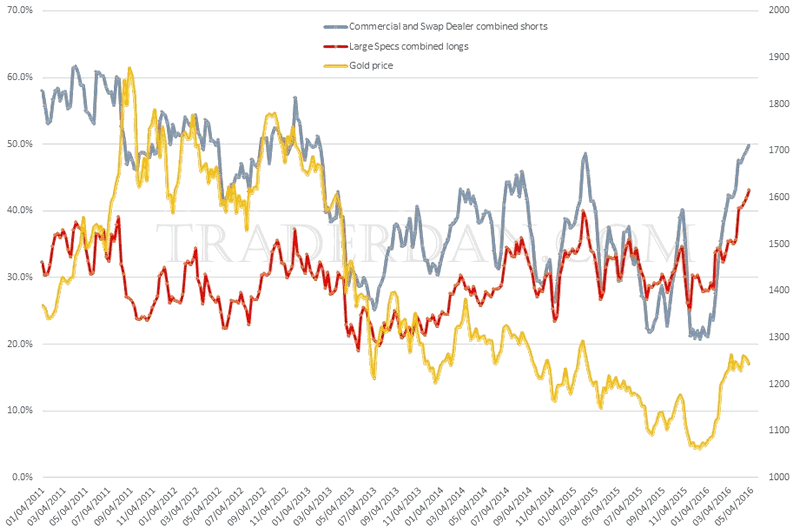

Another look, based on percentages of combined large spec longs versus combined commercials and swap dealer shorts is rather interesting.

CoT

While the combined Commercial and Swap Dealer short position remains well below its previous peak above 60% back in 2011, the combined large spec long position is at an all time record high.

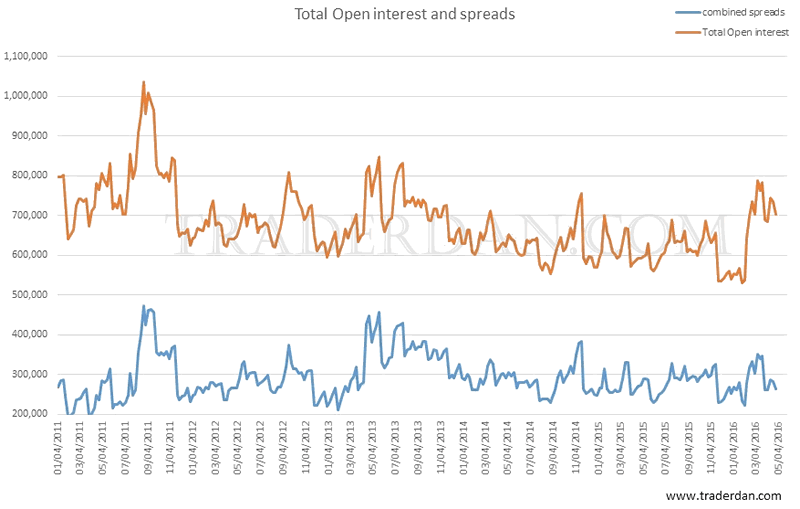

Some of this is due to the fact that a fair number of spreads were taken off this past week and that drops the overall total open interest making the naked futures and options positions take on a greater weighting when measured in this manner.

Total Open Interest and Spreads

While I am alarmed by what I see in silver, the recent COT report for gold does not give me any cause for concern. At least not yet.

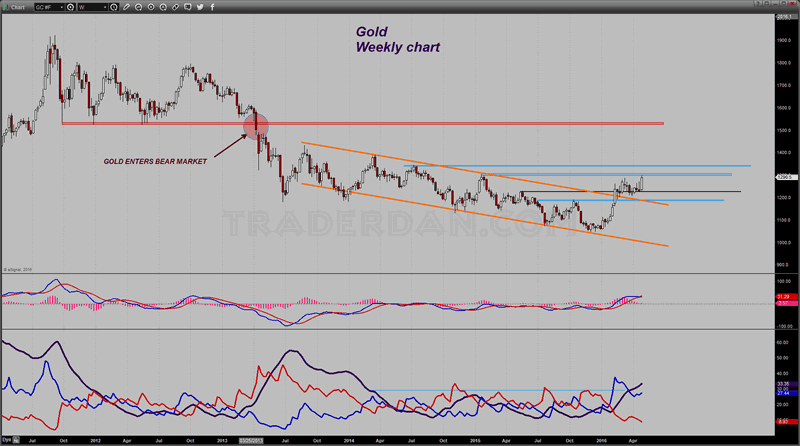

In taking a look at the intermediate term or weekly chart, gold has put in the highest WEEKLY CLOSE since the last week of January 2015.

Gold Weekly Chart

As you can see, the last 3 months or so, it has spent moving sideways just below $1300 and above roughly $1220. A weekly close above psychologically significant $1300 would allow this market to have a real shot at getting to $1340-$1350.

Above that and you have to put $1400 into play.

As long as the Dollar remains weak, gold will garner buying support. It will however need some catalyst to send hot money flows really flooding into it.

In the greater scheme of things, gold entered into a bear market when it lost weekly chart support near $1525 in 2013. It had since fallen as low as $1050 ( round number) before finding a solid bottom and recovering in price.

It has since recovered HALF OF THOSE LOSSES by moving above $1287.50, the halfway point between those two numbers. While impressive, it has a long way yet to go to make it back to $1520. Maybe it will, maybe it won't. The truth is no one, including the gold perma bull cult leaders, have any idea where this market is headed in price. Before it moves to the price that some of them are already back announcing once again ( these people simply never stop with their "to the moon" predictions) let's first see if it can manage to get back above $1525, and then we can talk about $1800. Until then, all such wild claims are simply that - wild claims by those who have a vested financial interest in promoting all things gold.

I have said it before and will say so again - you own gold for protection/insurance against monetary disorder and in times of economic uncertainty. It provides peace of mind. One does not cheer on the burning down of their own home in order to collect on the insurance.

That is the reason I still cannot stomach so many of these gold cult members who seem to not understand that when they are cheering on predictions of $5000, $50,000 ,etc gold prices,they are cheering on the ruin of everything around them. There is something seriously wrong with people who have that sort of mindset. It is almost pathological when one's entire focus of life is the latest gold price quote.

Personally, I would love nothing better than to be able to completely ignore the price of gold. That would entail a stable, sound currency, a government that runs a balanced budget, a responsible Federal Reserve that has not sent interest rate levels so low that no senior citizen can possibly hope to live off of their life's savings, a stock market that is priced on sound valuations and is moving higher not because of gargantuan sums of cheap money that has been conjured into existence but is instead moving higher because the underlying economy is sound, with reasonable and not oppressive and idiotic government regulation and sound fiscal policy. If that were the case, and sadly it is not, we could safely ignore gold and let the gold cult have their closed meetings and preach to themselves. Wouldn't that be nice!

Sadly, as Solomon warned us so many years ago: "There is nothing new under the sun".

The world of gold will always be infested with hucksters, quacks, and charlatans that prey on the unsuspecting or the naive. As long as they can sell fear, and fear sells well, they will be among us.

That will never change.

That is the real tragedy here - because gold indeed has a role to play in our portfolios. Many who might otherwise consider owning it, do not, because they have been so badly burned by these quacks in the past that they want nothing to do with it, even when they should own some for peace of mind. That is the true legacy that so many of the gold hucksters have left in their wake of ruin and misery - not that they helped save some from ruin but that they directly led to the ruin of so many.

I have kept copies of the emails that i have received from so many of their victims to help remind me of the terrible trail of devastation inflicted upon their many victims. It just underscores why none of them are to be trusted, believed or listened to even when gold is moving higher.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.