Charles Hugh Smith: "Why Our Status Quo Failed & Is Beyond Reform!

Stock-Markets / Financial Markets 2016 May 12, 2016 - 06:18 PM GMTBy: Gordon_T_Long

The Financial Repression Authority is delighted to have Charles Hugh Smith, prolific writer on the web and author of the highly acclaimed book, Why Our Status Quo Failed and is Beyond Reform. FRA Co-Founder, Gordon T. Long delineates with Charles on the core topics that are mentioned in his book as well as go over key diagrams to supportive diagrams.

The Financial Repression Authority is delighted to have Charles Hugh Smith, prolific writer on the web and author of the highly acclaimed book, Why Our Status Quo Failed and is Beyond Reform. FRA Co-Founder, Gordon T. Long delineates with Charles on the core topics that are mentioned in his book as well as go over key diagrams to supportive diagrams.

Charles Hugh Smith is the Publisher of the site “Of Two Minds”. From its humble beginnings in May 2005, Of Two Minds now attracts some 200,000 visits a month and has been listed No. 7 in CNBC’s top alternative financial sites. His commentary is featured on a number of sites including: Zerohedge.com. The American Conservative, Peak Prosperity and AOL’s Daily Finance site (www.dailyfinance.com. He has written eight books. Charles Hugh Smith graduated from the University of Hawaii, Manoa in Honolulu. Charles Hugh Smith currently resides in Berkeley, California and Hilo, Hawaii.

Mr. Smith’s articles, which critique the status quo, had influence from Braudel’s historical account of early capitalism. Smith’s economic works stress the value and efficacy of decentralizing power and wealth, the individual’s power of self-determination and the value of community, which in his view has been diminished by the state. His blog covers an eclectic range of timely topics: finance, housing, Asia, energy, long term trends, social issues, health/diet/fitness and sustainability.

“I wanted to encapsulate in a very short form that the status quo is broken and it is not going to be able to solve the problems. In order for us to move forward we first need to accept this reality.”

The core thesis in this book is that humanity has 6 problems which are interconnected:

- Entrench poverty: There are hundreds of millions of people who remain in severe poverty and they do not have access to resources to better their situations.

“The idea that we are going to reach every human on the planet has been proven incorrect.”

- Using more of everything in a world of finite resources: We have to adopt a ‘de-growth model,’ which is to make better use of the resources we have instead of just relying on consuming more.

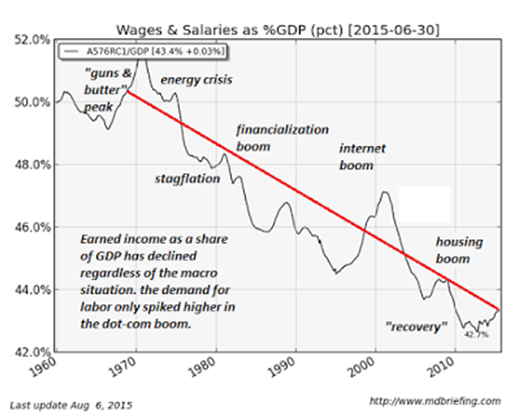

- Wages is the only way we have of distributing the output of an economy:

“The share of our national output that is going to wages is declining. The rise of automation and technology has decreased the demand for human labour and this will continue as a trend into the indefinite future.”

- When you consolidate power in a central state you consequently give an upper hand to the wealthy to have influence over that centralized power:

“I call it cartel state capitalism and we see it everywhere where the industries are controlled by a handful of players who have a great degree of influence.”

- Depending on credit for everything.

“We are borrowing from the future to fund present day consumption.”

- The current system pays people regardless of their productivity and contribution:

“People need work, they need livelihoods and they need a positive social role within their community. Paying them to sit home and do nothing creates a whole new assortment of problems. People need work and a sense of importance and contribution.”

THE NEW NORMALS

It is all the central planning arrangements and policies that have been implemented since the 2008 Financial Crisis. One new normal is the federal government ownership of student debt. It is now on this incredible increase where the government is buying all of the student loans because it is the only way to mask the bankruptcy of the student loan system. The GDP in the US, EU, Japan and other developed economies has been subpar. It has been barely over 1% and it is being driven by extraordinary expansion of debt. More debt is working against us because there is not enough real wealth being generated to pay for it. Throwing more debt at it does not work. Another new normal is this increasingly popular practise of growing more debt to hide your nonperforming loans.

“The problem is that the debt is inextinguishable. The central banks can do a great job in creating liquidity but they cannot solve solvency problems. And this is suggesting the central issue that debt is a solvency problem now”

The fed creates money out of thin air and buys more assets and then it levels off until markets and the economy weaken. Then the Fed ramps up the balance sheet again which is shown by the stair step pattern of the figure. The Feds’ balance sheet never declines it only plateaus briefly and then goes up again. The new normal is that central banks are cropping up markets because if the markets collapse to their true value it would reveal the bankruptcy of the entire system.

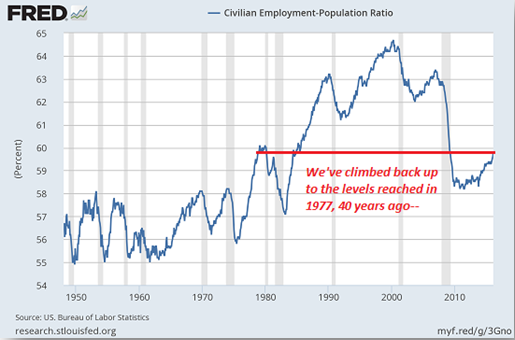

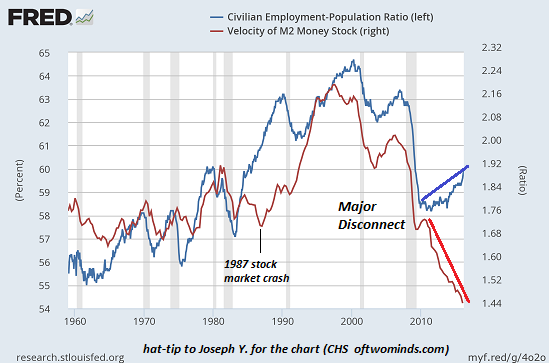

In The New Normal “recovery,” the percentage of the population with a job has advanced all the way back up to where it was 40 years ago, in the late 1970s. During booms eras many more people were employed, but today we are at employment levels similar to that of the 1970s. Fewer people are working and they are earning less money if we were to adjust for inflation, it’s stagnation.

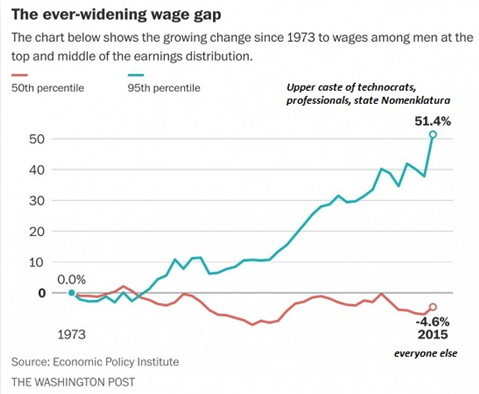

“Most of the gains that have been registered are flowing to the top 5%. This is not just because of a few greedy people at the top have taken the gains, but also the factor of mixing global competition with technology places a premium on workers who have the skillet set to generate value with increasing technology. Just working in a factory or doing some white collar job does not create a premium in an economy that is pressured by global competition and automation. “

Money velocity has been falling and everybody is concerned as to why it is doing so, but the fact of the matter is that there is no growth. The jobs themselves are paying minimal which is why people are dropping out of the labour force to start their own personal endeavour of sorts.

“A notable feature of the chart is the divergence being shown in 2008-2009 and this is when we went into hyper printing of money to put the system on life support. The productivity numbers in the developed world has fallen off; there is lack of growth. Growth in present day is not real, the growth we are seeing is artificial.”

STRUCTURAL REFORM

“We all know the system broke since the last crisis. We now need structural reform of entitlements. We need a new form of capitalism that is more accessible to people and that is not just controlled from the top through central planning. We are having a hyper-monetary policy where the status quo is looking to central banks to solve all the problems by issuing more debt and liquidity. These problems cannot be solved this way; we have to deal with the reality that we need deep structural reforms.”

If you observe caterpillars in construction sites you will notice the driver has many levers in front of him to control. An economy is managed the same way, there are many levers to pull, but we are running the economy pulling the same lever and that is monetary policy. The other levers are fiscal policy which we are not using, public policy, and taxation policy and so on. These are elements that come out of the political process, it is on political leaders to realize this and make appropriate decisions.

“One of the things you can have a lot of faith in is mankind. It will reset, we will survive and we will come out of it, but unfortunately it leads to crises and it is always the innocent that are most burdened.”

Abstract written by, Karan Singh Karan1.singh@ryerson.ca

Video Editor: Sarah Tung sarah.tung@ryerson.ca

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.