Global Mints Report Record Silver Coin Sales for 2015

Commodities / Gold and Silver 2016 Jun 01, 2016 - 03:52 PM GMT Gold coin sales register third best year since 2002, 30% increase over 2014

Gold coin sales register third best year since 2002, 30% increase over 2014

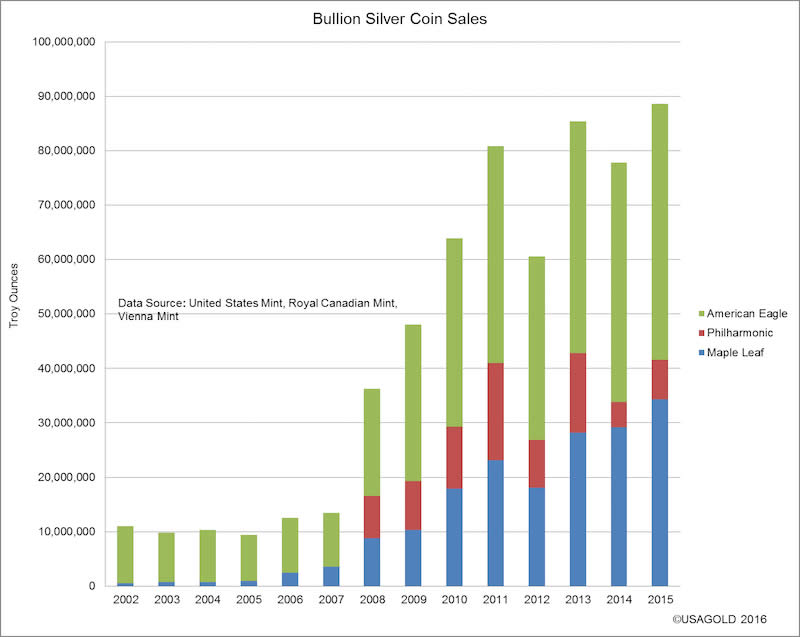

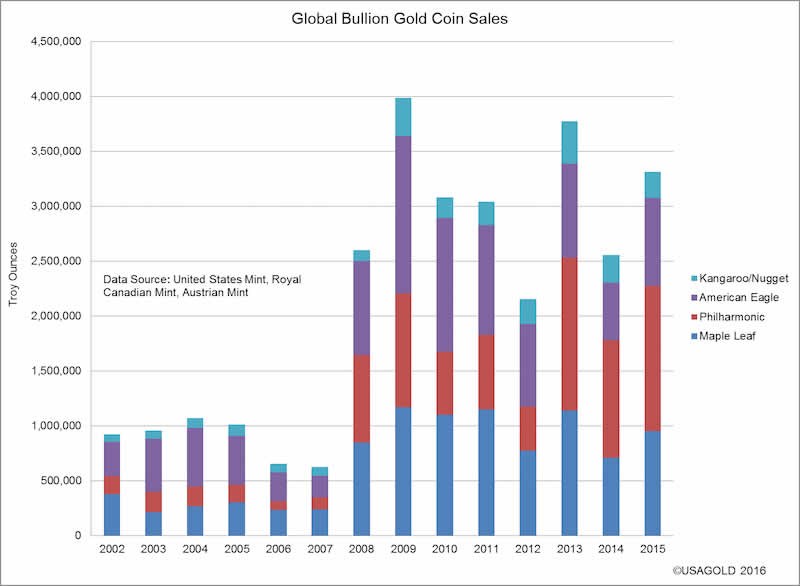

Global investors snapped up a record 89.6 million one ounce silver coins in 2015, according to USAGOLD’s annual survey of global bullion coin sales. The strong 2015 showing follows an equally impressive 2014 for silver coins at 77.9 million ounces and 2013 at 85.4 million ounces. Year over year, silver bullion coin demand was up 14% from 2014. Last year was a banner year for gold bullion coin sales as well – the fifth best since 2002. National mints sold 2.75 million ounces in 2015 – an impressive 30% increase over 2014.

There was nothing to distinguish 2015 from previous years except that the price was right for both metals. Gold started the year at $1188 per ounce and ended it at $1061. Silver, the more volatile of the two metals, began the year at $15.73 per ounce and ended at $13.83. If nothing else, seasoned precious metals buyers – and that is the group that dominated the action in 2015 – like a bargain. Retirement investors are a large and consistent demand source, particularly for the U.S. Mint’s gold and silver American Eagle coinage.

As you can see from the charts, demand for both metals grew significantly after the 2008 financial crisis and never returned to pre-crisis levels. The persistent demand over the period indicates lingering concerns among investors about the economy and the potential for a similar crisis at some future date.

Past supply disruptions signal more of same for future

The U.S. Mint reports sales for the silver Eagle would have been much higher in 2015 if it could have secured more coin planchets. Planchet manufacturers have consistently been unable to supply enough blanks to meet the extraordinary demand over the past several years. The mint suspended silver Eagle sales this past July when a sharp price decline generated huge demand among investors. It did not begin delivering wholesaler orders again until mid-August.

The U.S. Mint has suspended wholesale allocations for one or both metals in 2009, 2011, 2013, 2014 and 2015. Since the 2008 crisis, there have been numerous stoppages at other national mints in the face of strong, unprecedented investor demand for both gold and silver bullion coins that depleted stocks. As a result, worries about potential supply disruptions consistently haunt the bullion coin market.

Bill Bonner, the long-time market analyst who founded the Agora publishing empire, recently warned investors about the potential for further disruptions:

“[T]here will be one important difference between the new super spike and what happened in 1980. Back then, you could buy gold at $100, $200, or $500 per ounce and enjoy the ride. In the new super spike, you may not be able to get any gold at all. You’ll be watching the price go up on TV but unable to buy any for yourself. Gold will be in such short supply that only the central banks, giant hedge funds, and billionaires will be able to get their hands on any. The mint and your local dealer will be sold out. That physical scarcity will make the price super spike even more extreme than in 1980. The time to buy gold is now, before the price spikes and before supplies dry up.”

The U.S. Mint reports continuing high levels of demand thus far in 2016 with mintage figures for both gold and silver bullion coins running well ahead of 2015’s pace.

____________________________

Reader note: You just read the lead article for the June, 2016 issue of USAGOLD’s NEWS & VIEWS. For open access to the rest of this month’s issue, we invite you to register at the link below. You will also receive e-mail notification when future issues are published. Free subscriptions. Over 20,000 subscribe to this newsletter . . . Please register here.

June issue: What’s behind gold’s recent sell-off? What is the real reason why central banks can’t get the economy moving and what does it for future gold demand? Is there a major run on London’s massive gold vaults and where did all the gold go? What do 17th century Dutch tulip bulbs have to do with your portfolio today (the nature of financial mania)? And more.

___________________

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.