Globalization Is Dead, But The Idea Is Not

Economics / Global Economy Aug 10, 2016 - 05:13 PM GMTBy: Raul_I_Meijer

We can, every single one of us, agree that we’re either in or just past a -financial- crisis. But that seems to be all we can agree on. Because some call it the GFC, others a recession, and still others a depression. And some insist on seeing it as ‘in the past’, and solved, while others see it as a continuing issue.

We can, every single one of us, agree that we’re either in or just past a -financial- crisis. But that seems to be all we can agree on. Because some call it the GFC, others a recession, and still others a depression. And some insist on seeing it as ‘in the past’, and solved, while others see it as a continuing issue.

I personally have the idea that if you think central banks -and perhaps governments- have the ability and the tools to prevent or cure financial crises, you’re in the more optimistic camp. And if you don’t, you’re a pessimist. A third option might be to think that no matter what central bankers do, things will solve themselves, but I don’t see much of that being floated. Not anymore.

What I do see are countless numbers of bankers and economists and pundits and reporters holding up high the concept of globalization (a.k.a. free trade, Open Society) as the savior of mankind and its economy.

And I’m thinking that no matter how great you think the entire centralization issue is, be it global or on a more moderate scale, it’s a lost case. Because centralization dies the moment it can no longer show obvious benefits for people and societies ‘being centralized’. Unless you’re talking a dictatorship.

This is because when you centralize, when you make people, communities, societies, countries, subject to -the authority of- larger entities, they will want something in return for what they give up. They will only accept that some ‘higher power’ located further away from where they live takes decisions on their behalf, if they benefit from these decisions.

And that in turn is only possible when there is growth, i.e. when the entire system is expanding. Obviously, it’s possible also to achieve this only in selected parts of the system, as long as if you’re willing to squeeze other parts. That’s what we see in Europe today, where Germany and Holland live the high life while Greece and Italy get poorer by the day. But that can’t and won’t last. Of necessity. It’s an inbuilt feature.

Schäuble and Dijsselbloem squeezed Greece so hard they could only convince it to stay inside the EU by threatening to strangle it to -near- death. Problem is, they then actually did that. Bad mistake, and the end of the EU down the road. Because the EU has nothing left of the advantages of the centralized power; it no longer has any benefits on offer for the periphery.

Instead, the ‘Union’ needs to squeeze the periphery to hold the center together. Otherwise, the center cannot hold. And that is something those of us with even just a remote sense of history recognize all too well. It reminds us of the latter days of the Roman Empire. And Rome is merely the most obvious example. What we see play out is a regurgitation of something the world has seen countless times before. The Maximum Power Principle in all its shining luster. And the endgame is the Barbarians will come rushing in…

Still, while I have my own interests in Greece, which seems to be turning into my third home country, it would be a mistake to focus on its case alone. Greece is just a symptom. Greece is merely an early sign that globalization as a model is going going gone.

Obviously, centralists/globalists, especially in Europe, try to tell us the country is an exception, and Greeks were terribly irresponsible and all that, but that will no longer fly. Not when, just to name a very real possibility, either some of Italy’s banks go belly up or the upcoming Italian constitutional referendum goes against the EU-friendly government. And while the Beautiful Brexit, at the very opposite point of the old continent, is a big flashing loud siren red buoy that makes that exact point, it’s merely the first such buoy.

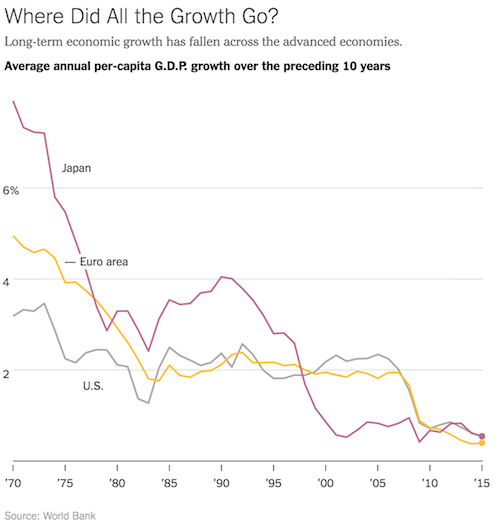

But Europe is not the world. Greece and Britain and Italy may be sure signs that the EU is falling apart, but they’re not the entire globe. At the same time, the Union is a pivotal part of that globe, certainly when it comes to trade. And it’s based very much on the idea(l) of centralization of power, economics, finance, even culture. Unfortunately (?!), the entire notion depends on continuing economic growth, and growth has left the building.

Centralization/Globalization is the only ideology/religion that we have left, but it has one inbuilt weakness that dooms it as a system if not as an ideology. That is, it cannot exist without forever expanding, it needs perpetual growth or it must die. But if/when you want to, whether you’re an economist or a policy maker, develop policies for the future, you have to at least consider the possibility, and discuss it too, that there is no way back to ‘healthy’ growth. Or else we can just hire a parrot to take your place.

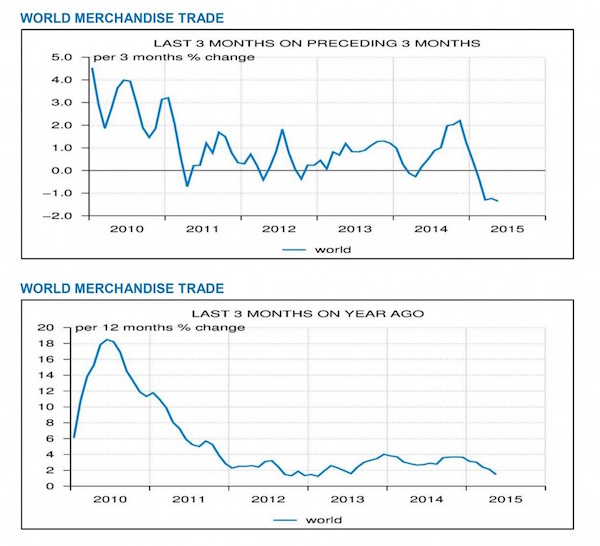

So here’s a few graphs that show us where global trade, the central and pivotal point of globalization, is going. Note that globalization can only continue to exist while trade, profits, benefits, keep growing. Once they no longer do, it will go into reverse (again, bar a dictator):

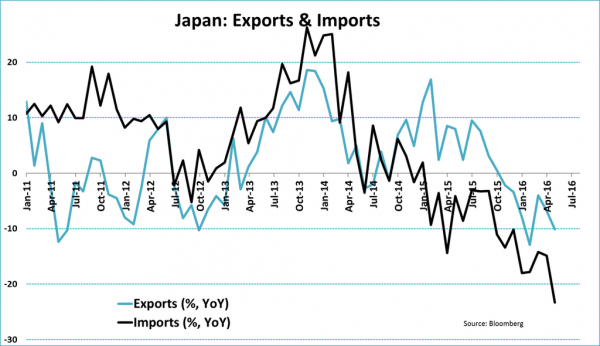

Here’s Japan’s exports and imports. Note the past 20 months:

Japan’s imports have been down, in the double digits, for close to 3 years?!

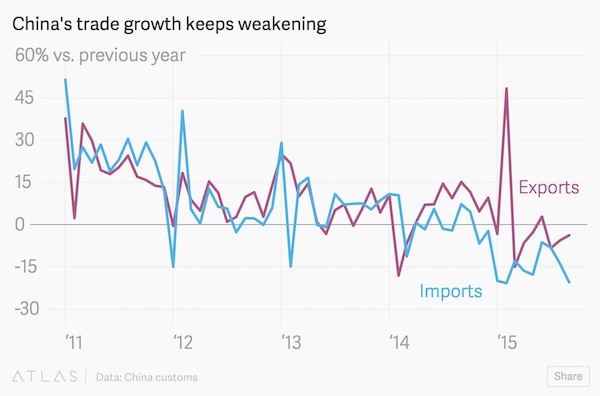

Next: China’s exports and imports. Not the exact same thing, but an obvious pattern.

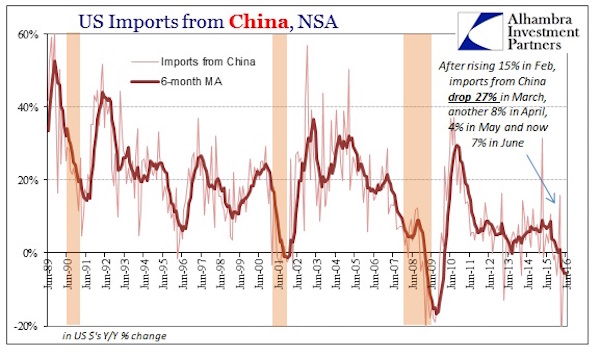

If only imports OR exports were going down for specific countries, that’d be one thing. But for both China and Japan, in the graphs above, both are plunging. Let’s turn to the US:

Pattern: US imports from China have been falling over the past year (or even more over 5 years, take your pick), and not a little bit.

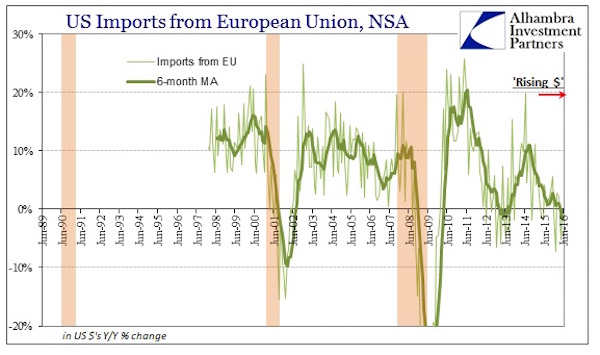

And imports from the EU show the same pattern in an almost eerily similar way.

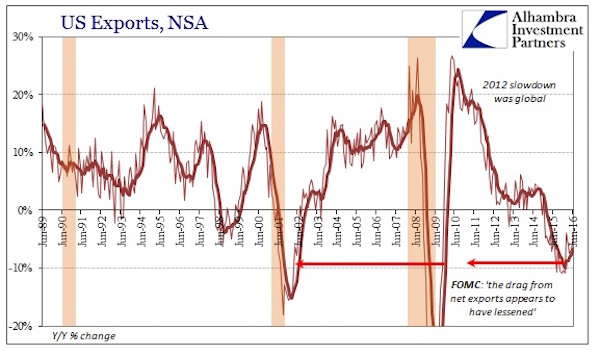

Question then is: what about US exports, do they follow the same fold that Japan and China do? Yup! They do.

And that’s not all either. This one’s from the NY Times a few days ago:

And this one from last year, forgot where I got it from:

Now, you may want to argue that all this is temporary, that some kind of cycle is just around the corner and will revive the economy, and globalization. By now I’d be curious to see how anyone would want to make that case, but given the religious character of the centralization idea, there’s no doubt many would want to give it a go.

Most of the trends in the graphs above have been declining for 5 years or so. While at the same time the central banks in these countries have been accelerating their stimulus policies in ways no-one could even imagine they would -or could- just 10 years ago.

All of the untold trillions in stimulus haven’t been able to lift the real economy one bit. They instead caused a rise in asset prices, stocks, housing, that is actually hurting that real economy. While NIRP and ZIRP are murdering 95% of the people’s hope to retire when they thought they could, or ever, for that matter.

No, it’s a done deal. Globalization is pining for the fjords. But because it’s become such a religion, and because its high priests have so much invested in it, it’ll be hard to kill it off even just as an -abstract- idea. I’d say wherever you live and whenever your next election is, don’t vote for anyone who promotes any centralization ideas. Or growth. Because those ideas are all in some state of decomposing, and hence whoever promotes them is a zombie.

Lastly, The Economist had a piece on July 30 cheerleading for both Hillary Clinton and ‘Open Society’, a term which somehow -presumably because it sounds real jolly- has become synonymous with globalization. As if your society will be hermetically sealed off if you want to step on the brakes even just a little when it comes to ever more centralization and globalization.

The boys at Saxo Bank, Mike McKenna and Steen Jakobsen, commented on the Economist piece, and they have some good points:

Priced Out Of The ‘Open Society’

[..] The biggest problem facing globalism, however, is neither its hypocrisy nor its will-to-power – these are ordinary human failings common to all ideologies. Its biggest problem is much simpler: it’s very expensive. The world has seen versions of the wealthy, cosmopolitan ideal before. In both Imperial Rome and Achaemenid Persia, for example, societies characterised by extensive trade networks, multicultural metropoli and the rule of law (relative to the times) eventually succumbed to rampant inequality, inter-community strife, and expensive foreign wars in the case of Rome and a death-spiral of economic stagnation and constant tax hikes in the case of Persia.

That’s the center vs periphery issue all empires run into. US, EU, and all the supra-national organizations, IMF, World Bank, NATO, (EU itself), etc, they’ve established. None of that will remain once the benefits for the periphery stop. McKenna is on to this:

It seems near-axiomatic that, in the absence of the sort of strong GDP growth that characterised the post-World War Two era, the pluralist ideal might begin to show strains along the seams of its own construction. Such strains can be inter-ethnic, ideological, religious, or whatever else, but the legitimacy of The Economists’s favoured worldview largely came about due to the wealth and living standards it was seen to provide in the post-WW2 and Cold War era. Now that this is beginning to falter, so too are the politicians and institutions that have long championed it. In Jakobsen’s view, the rising tide of populist nationalism is in no way the solution, but it is a sign that globalisation’s elites have grown distant from the population as a whole.

I’d venture that the elites were always distant from the people, but as long as the people saw their wealth grow they either didn’t notice or didn’t care.

“The world has become elitist in every way,” says Saxo Bank’s chief economist. “We as a society have to recognise that productivity comes from raising the average education level… the key thing here is that we need to be more productive. If everyone has a job, there is no need to renegotiate the social contract.” Put another way, would the political careers of Trump, Le Pen, Viktor Orban, and other such nationalist leaders be where they are if the post-crisis environment had been one of healthy wage growth, inflation, an increase in “breadwinner” jobs, and GDP expansion?

Here I have to part ways with Steen (and Mike). Why do ‘we’ need to be more productive? Why do we need to produce more? Who says we don’t produce enough? When we look around us, what is it that tells us we should make more, and buy more, and want more? Is there really such a thing as “healthy wage growth”? And what says that we need “GDP expansion”?

Most people do not spend a great deal of time imagining ideal economic and political systems. Most just want to live satisfying lives among their friends and family, and to feel as if their leaders are doing all they can to enable such a situation. What matters are the data, and if these are not made to become more encouraging, calls for this particular empire’s downfall will come with the same fervour and the same increasing frequency that they have throughout history.

The problem is not that people are choosing the wrong system, it is that they are unhappy enough to want to change course at all. Unless the developed world can find a way to reform itself out of its present malaise, no amount of media-class vituperation over xenophobia, insularity or “the uneducated” will be sufficient to turn the tide.

McKenna answers my question, unwillingly or not. Because, no, ‘Most just want to live satisfying lives among their friends and family..’ is not the same as “they want GDP expansion”, no matter how you phrase it. That’s just an idea. For all we know, the truth may be the exact opposite. The neverending quest for GDP expansion may be the very thing that prevents people from living “satisfying lives among their friends and family”.

How many people see the satisfaction in their lives destroyed by the very rat race they’re in? Moreover, how many see their satisfaction destroyed by being on the losing end of that quest? And how many simply by the demands it puts on them?

The connection between “satisfying lives” and “GDP expansion” is one made by economists, bankers, politicians and other voices driven by ideologies such as globalization. Whether your life is satisfying or not is not somehow one-on-one dependent on GDP expansion. That idea is not only ideological, it’s as stupid as it is dangerous.

And it’s silly too. Most westerners don’t need more stuff. They need more “satisfying lives among their friends and family”. But they’re stuck on a treadmill. If you want to give your kids decent health care and education anno 2016, you better keep running to stand still.

Mike McKenna and Steen Jakobsen seem to understand exactly what the problem is. But they don’t have the answer. Steen thinks it is about ‘more productivity’.

And I think that may well be the problem, not the solution. I also think it’s no use wanting more productivity, because the economic model we’re chasing is dead and gone. A zombie pushing up the daisies.

But since it’s the only one we have, and even smart people like the Saxo Bank guys can’t see beyond it, it seems obvious that getting rid of the zombie idea may take a lot of sweat and tears and, especially, blood.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.