US Government Spending - 3 Big Stories Not Being Covered – Part III

Economics / Government Spending Aug 21, 2016 - 05:40 PM GMTBy: Andy_Sutton

The third and final (for now) portion of this series might be a tad anticlimactic. If so, we apologize. Most people know America is in debt beyond comprehension. A small subset of people understand that the numbers published by the government are missing a whole bunch of important items and use accounting methods that would land most business people in prison. An even smaller subset understands the idea of generational accounting.

The third and final (for now) portion of this series might be a tad anticlimactic. If so, we apologize. Most people know America is in debt beyond comprehension. A small subset of people understand that the numbers published by the government are missing a whole bunch of important items and use accounting methods that would land most business people in prison. An even smaller subset understands the idea of generational accounting.

What we are going to discuss this time around is not the long-term situation, but rather the medium to short-term situation because some really bad things are going to take place within the next 5-7 years absent major, MAJOR policy changes. At that point, the policy changes will have to be drastic since our government fiddled while Rome burned for the last 3 decades.

If you take nothing else away from this article, understand that our ‘leaders’ – of all political affiliations and stripes – KNEW this was going to be the result if they did nothing, yet that’s precisely what they did. The blame game this time around ought to be one for the ages, however a well-informed populace can short-circuit the traditional mudslinging by inserting the following statement: “You all knew. You knew and you did nothing. You are guilty of dereliction of duty. You failed your constituents and your country. ALL of you.” The few statesmen of the group of 535 will be echoing what we just said above. Former Congressmen and Senators who tried to warn their colleagues and the American people will be echoing the above sentiment. The guilty ones will play the blame game. The media will enable it and create an ‘emergency’, which will give the government cover to do something that the establishment that owns most of our leaders has wanted for some time now – the nationalization of the retirement system, means testing, higher taxes, a continued decline in the standard of living, and further debt accumulation.

The CBO’s Projections (2015 – 2025)

Every year after the government budget is passed, the Congressional Budget Office updates its projections for the fiscal situation of the US. As far as government reporting goes, the CBO doesn’t do too badly a job, but even it omits some pretty important information. We’ll preface the following analysis with the warning that the percentages and figures stated, while coming from the CBO’s report (which will be linked in this report), are missing what are called intergovernmental borrowings or intergovernmental holdings.

An example is in order. Say Social Security has a shortfall (which it does) and borrows money from Medicare. The money is owed, but since we ‘borrowed it from ourselves’ instead of China or Russia or whoever, it is not counted as being publicly held debt. The CBO’s numbers and percentages are based on the debt that is held outside the government. Even the term ‘by the public’ is misleading since it implies that US citizens or institutions own this debt. While it is partially true, much of the debt is external in nature, although we have a feeling that is going to change as countries seek to divorce themselves from the USDollar.

A second and equally important caveat of the CBO numbers is that they don’t apply all principles of GAAP (Generally Accepted Accounting Principles). When the government takes spending off balance sheet (which resulted in the few years of ‘surpluses’ you’ll see in the charts below, that violates GAAP. When it fails to compute and reveal the present value of future liabilities, that violates GAAP. So why bother? The CBO reports, despite their shortcomings, have their uses, especially in terms of trend and sustainability analysis.

We’re going to pick this report apart piece by piece, citing direct quotes and graphics, then offering commentary and analysis. We’ll go in order so you can download the actual report and follow along if you wish.

“Under the assumption that current laws will generally remain unchanged, the budget deficit is projected to decline in 2016, to $455 billion, or 2.4 percent of GDP, and then to hold roughly steady relative to the size of the economy through 2018. Beyond that time, however, the gap between spending and revenues is projected to grow faster than GDP: The deficit in 2025 is projected to reach $1.0 trillion, or 3.8 percent of GDP, and cumulative deficits over the 2016–2025 period are projected to total $7.2 trillion.”

First there are a couple of assumptions. We’re assuming around a 2.5% per annum growth rate in GDP. Given the last couple of quarters – the most recent of which showed a ‘growth’ rate of roughly half that CBO’s assumption when annualized, this is a stretch. The second – and the most important assumption – is that GDP will grow at all when debt levels continue their parabolic increase virtually unchecked. Don’t forget it isn’t just the government that is overstretched, but consumers too. Slack GDP growth is a rich environment for consumers borrowing more just to make ends meet, not to mention Americans’ need for all manner of toys befitting their self-imposed status as economic royalty.

Then there is the matter of another $7.2 trillion added to what is almost $20 trillion now. And keep in mind, this is not GAAP accounting. The numbers are much, much higher.

“With such deficits, CBO projects that federal debt held by the public would amount to 73 percent or 74 percent of GDP over the next several years—more than twice what it was at the end of 2007 and more than in any previous year since 1950 (see Figure 2 on page 4). By 2025, in CBO’s baseline projections, federal debt rises to 77 percent of GDP.”

Keep in mind that these percentages (as stated above) are for the publicly held portion of the debt. According to the government, real GDP as of last quarter stood at $16.575 trillion and the national debt at $19.429 trillion. So while our publicly held debt/GDP ratio is expected to be 73-74% over the next several years, the total debt/GDP ratio is already 117% and climbing. Given that the CBO expects debt growth to outstrip GDP growth through 2025, we can expect the total debt/GDP ratio to climb near 130% in the best case. This is way out of the range of any of the nations which have had debt crises to date. Can we assume the US is somehow different? Can we assume there will be a market for debt from a government that has no ability nor even willingness to control its spending? We can assume lots of things, but even the CBO goes on to say:

“Such high and rising debt would have serious negative consequences for the nation: When interest rates returned to more typical, higher levels, federal spending on interest payments would increase substantially. Moreover, because federal borrowing reduces national saving over time, the nation’s capital stock would ultimately be smaller and productivity and total wages would be lower than they would be if the debt was smaller.

In addition, lawmakers would have less flexibility than otherwise to use tax and spending policies to respond to unexpected challenges. Finally, a large debt increases the risk of a fiscal crisis, during which investors would lose so much confidence in the government’s ability to manage its budget that the government would be unable to borrow at affordable rates.”

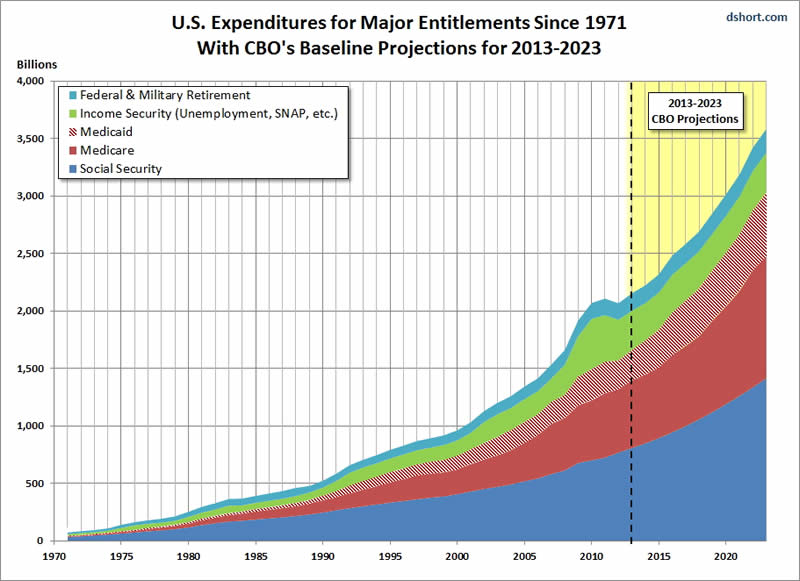

Essentially the CBO is saying that the longer this goes on, the less wiggle room the government will have to deal with any unexpected crisis. Like bailing out banks. Or continuing entitlement programs. Let’s take a look at a graphic that is from 2013, but is a perfect illustration of the burden entitlement programs are putting on the federal balance sheet:

Again, this is from 2013; derived from the CBO’s numbers at that time. The magnitude of the numbers has not changed significantly; and moreover, look at the slopes. Social Security, depicted in blue, shows a gentle, but rising slope; however, Medicare and Medicaid absolutely take off for the stratosphere as do the various income security programs like food stamps and unemployment. All told, the above chart shows a near 75% increase in the cost of entitlement programs from 2013-2023, such that unless US tax codes or entitlement spending were to change significantly, entitlements alone would eat up ALL of the $3.3 trillion budgeted in 2016. Please note this is JUST ENTITLEMENTS! There is no allowance for any other programs, interest on the national debt, fixing roads, war, and all the other fun things government loves to do that are beyond the scope of its existence. Granted, the GDP, and therefore the tax base, will grow between now and 2023, but if the CBO is right, there is no big growth boom for the US in the next 10 years. However, there is a big boom in costs for entitlement programs. Notice also, the CBOs choice of words regarding interest rates. The statement doesn’t read ‘if interest rates rise’, but rather ‘when interest rates rise’. The rationale, as you’ll see below, is rather paradoxical and indicative of ‘Flat Earth’ economic thinking:

“CBO expects the government’s interest payments to rise sharply during the coming decade, largely as a result of two conditions. The first is the anticipated increase in interest rates as the economy strengthens. Between 2015 and 2025, CBO projects, the average interest rate on 3-month Treasury bills will rise from 0.1 percent to 3.4 percent and the average rate on 10-year Treasury notes will rise from 2.6 percent to 4.6 percent.

Second, debt held by the public is projected to increase significantly under current law. Debt held by the public consists mostly of securities that the U.S. Treasury issues to raise cash to fund the federal government’s activities and to pay off its maturing liabilities. The net amount that the Treasury borrows by selling those securities (the amounts that are sold minus the amounts that have matured) is influenced primarily by the annual budget deficit. In addition, the Treasury borrows to provide financing for student loans and other credit programs; in the baseline, such additional borrowing, often referred to as other means of financing, is projected to average $61 billion per year during the 2016–2025 period (see Table 4 on page 11).

After accounting for all of the government’s borrowing needs, CBO projects that, under current law, debt held by the public will rise from $13.4 trillion at the end of 2015 to $21.2 trillion at the end of 2025. Relative to the size of the economy, the debt is projected to stay at 73 percent or 74 percent of GDP through 2021 but then increase, reaching 77 percent of GDP at the end of 2025. “

So in essence what they’re saying here is that interest rates are going to rise sharply due to a strengthening economy. 10-year rates will almost double. Imagine what such movement – even if it happens over a period of years – will do to the debt appetite for the engine of the American economy – the US Consumer? We are not buying this for a second. The not-so-USFed has been so sloth to raise even the shortest term interbank overnight rates for fear of tanking the stock market and causing havoc with the yield curve.

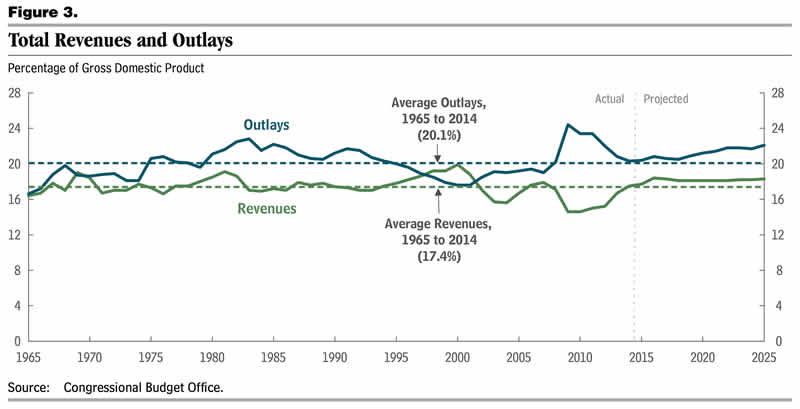

What will the move outline above do? First it means people and institutions who hold bonds for long periods of time are going to lose their shirts. Think pension plans and their relatives. Their actual interest receipts won’t go up as is often misunderstood, but the prices of their bonds will go down. So they’ll get the same coupon payments – for those instruments that pay coupons, but their portfolio value will drop. Not a good combination. As we mentioned above, imagine the USEconomy having to deal with even ‘normal’ market rates of interest. The CBO itself mentioned the government having less and less wiggle room. Triple that for consumers because they are forced to adhere to rules the government can conveniently ignore. For a while anyway. Below is a graphic illustration of the outlay receipts situation:

Notice how the government revenue function remains pretty flat after 2016. Where is this healthy economic expansion spoken of in the above paragraph? Surely a robust and growing economy would provide more government revenue even absent a change in the tax laws.

Conclusion

We could go on, but there is no need to. The situation is unsustainable. It will likely go on for quite a bit longer than we imagine due to intricacies of the global dollar standard and the US Military, which we figure will become a big part of enforcing US economic hegemony even in the face of abject failure of the economic model being used. We’ve already seen that. If you buck the Petrodollar, you get labeled, marginalized, then bombed. Actually it is close to being that simple. The bottom line is it will end. Whether slowly as we believe (the unwinding has already started) or quickly as in a black swan type of event, it will end. The BRICs among others are already taking steps to hasten such an end. And yes, we believe such an end will likely not come without a major regional war. Or several, perhaps even a global war depending on how far the provocations go. We are basing our conclusions not so much on what the CBO has to say, but on our history and what has happened in the past when countries try to rip each other off and provoke while offering political subterfuge and general denials of any wrongdoing to the masses. I guess when it comes down to it, the saying that you can fool some of the people all of the time and all of the people some of the time, but not all of the people all of the time really does apply.

Graham Mehl is a pseudonym. He currently works for a hedge fund and is responsible for economic forecasting and modeling. He has a graduate degree with honors from The Wharton School of the University of Pennsylvania among his educational achievements. Prior to his current position, he served as an economic research associate for a G7 central bank.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.