Financial Markets All is Quiet

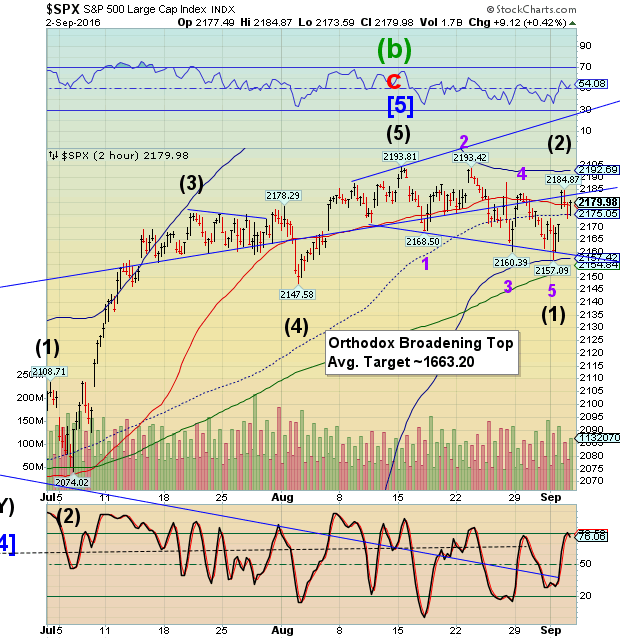

Stock-Markets / Financial Markets 2016 Sep 06, 2016 - 03:07 PM GMT It has been a very quiet weekend. The SPX Premarket is mildly positive as I write. The market is basically directionless.

It has been a very quiet weekend. The SPX Premarket is mildly positive as I write. The market is basically directionless.

ZeroHedge writes, “The return from summer holidays has started in much the same way as we left off August, with another subdued session that has seen European stocks little changed, Asian shares advance and S&P futures are modestly in the green amid a flurry of M&A. The US dollar weakened, with the Bloomberg Dollar Index down 0.2% for the 2nd day in a row as prospects for a U.S. interest-rate hike this month remained subdued.”

Morgan Stanley’s Adam Parker has thrown in the towel and turned bullish again. He states, “

This call option on EPS growth relative to low expectations today we think offers more attractive risk-reward than most other major asset classes. We left our base case EPS for the S&P500 unchanged, but raised our price-to-earnings assumption from 17x to 17.7x. For our bear case, we raised our EPS assumption from $100 to $106.9 two years out, viewing the flat EPS so far this year as a relative positive, implying that the acute drop-off factored into our prior bear case as increasingly unlikely. We are raising our bear case multiple from 16x to 16.8x. For the bull case, we are leaving our EPS essentially unchanged, moving the out year from $137.1 down to $136.5, but raising our bull case multiple from 18x to 19x, yielding our new 2500 bull case forecast.”

ZeroHedge points out, however, that earnings have been decreasing dramatically, contrary to Parker’s assumptions. It reports, “From June 30 through August 31, the value of the index increased by 3.4% (to 2170.95 from 2098.86). This quarter marked the 16th time in the past 20 quarters in which the bottom-up EPS estimate decreased during the first two months of the quarter while the value of the index increased during the first two months of the quarter.

The blended earnings decline for Q2 2016 is -3.2% (with 2 companies yet to report). The second quarter marked the first time the index has seen five consecutive quarters of year-over-year declines in earnings since Q3 2008 through Q3 2009.”

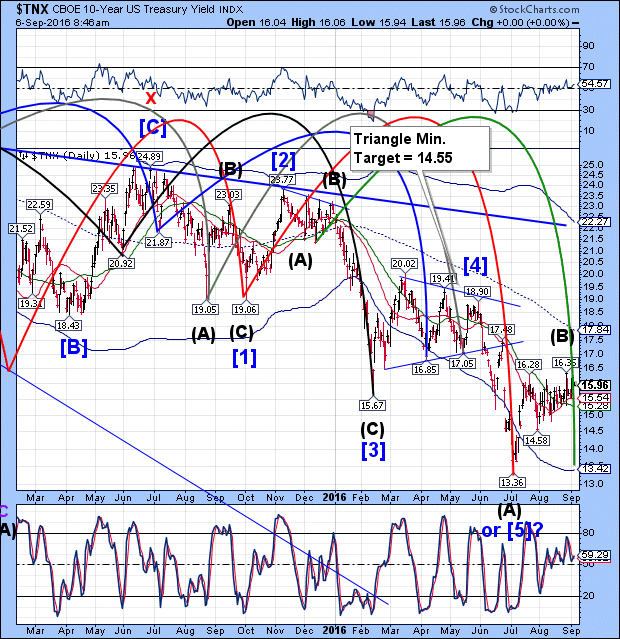

TNX is increasingly overdue for a Master Cycle low. It is now eleven days beyond the average 258 day term, so it is stretched. This suggests that the all-time low may have been made on July 8 instead of being due now. The Cycles Model suggests a decline to Cycle Bottom support at 13.42, but considering the shortness of time, it may not go that far.

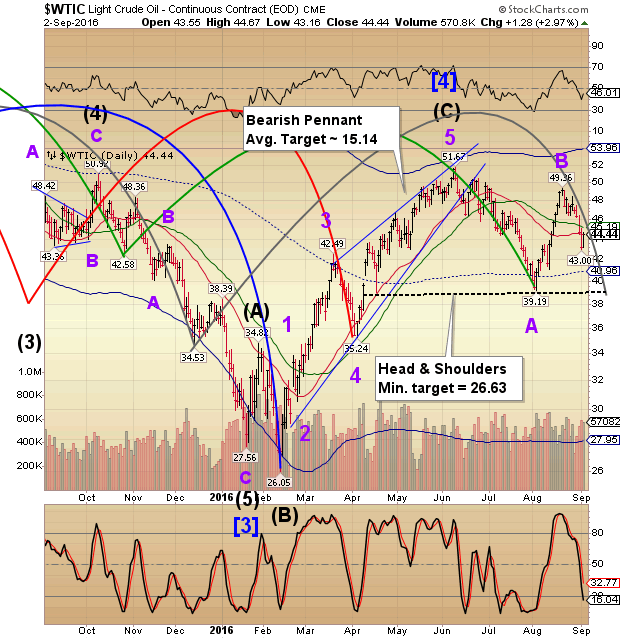

This morning’s action in Crude suggests that the decline may not be over yet. While it hasn’t taken out last week’s low at 43.00, it has the potential to do so. The Master cycle low is also overdue in crude, so we may see some resolution rather quickly.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.