UK Property Market: Slow Growth Does Not Equate To Decline

Housing-Market / UK Housing Oct 18, 2016 - 03:09 PM GMTBy: Nicholas_Kitonyi

The property market is one of UK’s main economic drivers given the clear link to the financial industry. Right now, several people have expressed doubts on how the UK economy could fair following the separation from the EU single market. And as analysts have pointed out, the most problematic aspect comes from the uncertainties surrounding the separation process.

The property market is one of UK’s main economic drivers given the clear link to the financial industry. Right now, several people have expressed doubts on how the UK economy could fair following the separation from the EU single market. And as analysts have pointed out, the most problematic aspect comes from the uncertainties surrounding the separation process.

Many now believe that the slow growth rate experienced in the UK housing market following the referendum vote could be sign of things to come.

As demonstrated in the chart above, the UK House Price index growth rate has slowed significantly after hitting multi-year highs of 701.4 points in June. In the last three months, the index has been pegged at about 693 point on average, which mirrors similar levels achieved in March and May this year.

The UK house price index is calculated using the market value of the properties sold. However, as you may have noticed, not all properties are actually sold at their market value in a given month. For instance, ready steady sell offers property owners an opportunity to sell their houses quicker, but at a discount. Sellers can get up to 95% of the market value. However, most quick sell agencies buy properties at up to 20% discount of the listed market value.

This means that the figures we are getting from the property market may not necessarily be reflective of what exactly changed hands during a particular month. Quick sell property agencies buy houses and related assets at a discount and then sell them later at the market value. The final sale could take place a month or two later, or even longer.

It’s the risk of holding property for sale that UK house owners should be scared of according to earlier price predictions following the Brexit vote. Former Chancellor George Osborne expressed his optimism on the UK property market indicating a potential 18% decline in housing prices by next year. However, there are those who believe that even though those predictions appear to be way off the mark, an 18% squeeze will only take the market back to last year’s levels.

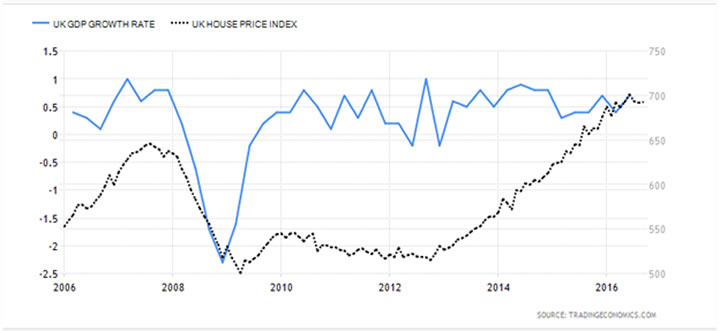

In addition, when you look at the current trend of the UK house price index versus the UK GDP growth, it’s pretty clear that investors are paying less attention to the status of the economy.

As demonstrated in the comparison chart above, the UK House Price index has taken an upward trend, which appears to be barely disrupted especially when assessing the movement on a long-term basis. As such, given the circumstances, it is hard to argue that there could be a slowdown ensuing due to unpredictable economic condition in a post-Brexit Britain.

On the bright side, the UK House Price index could actually continue to rally in the coming months due to the recent developments in the property market. In April, a supplementary 3% stamp duty charge on second homes came into effect. This change is likely to have minimum effect on people’s decisions to buy homes. However, the impact on the average price of a house in the UK could be enormous. This is because, investors (buy-to-let owners) will likely transfer that cost to the tenant.

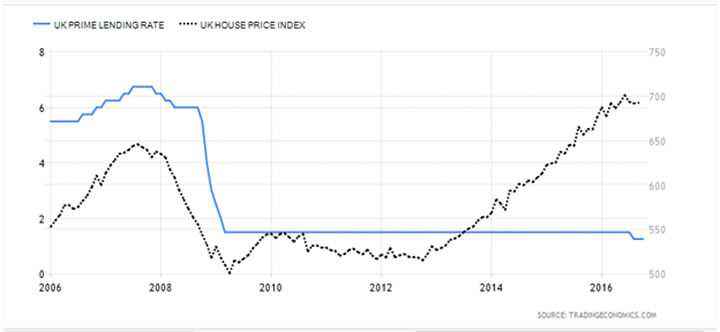

Another thing that makes the UK property market more attractive is the fact that the prime lending rate was cut by 0.25 percentage points to bring it down to 1.25% from 1.50%. This makes accessing lines of credit much cheaper to investors thereby increasing investment activity in the housing market.

The relationship between the UK Prime Lending Rate and the House Price Index has also been intriguing, especially when you look at things from the late 2013 to present. Prior to 2013, the UK Prime Lending rate and the House Price Index appeared to have a direct relationship but since then, things have changed.

As shown on the comparison chart above, the UK House Price Index has maintained an upward trend since late 2013 whereas the Prime Lending Rate has remained vastly unchanged, bar the last two months.

The sound explanation to this scenario can be pinned on the fact that with stable lending rates, people have managed to access credit easily. In addition, while the UK GDP growth has been rather volatile during the same period, the general outlook has been promising.

Another attribute could be due to the fact that in 2014, the then Chancellor George Osborne introduced a new stamp duty system which allowed progressive levying on house sales. This reduced the gaps between stamp duty fees paid by house sellers in various pricing brackets.

Conclusion

In summary, there are fears that the separation of Britain from EU could end up denying it an opportunity to access the single market. This could have devastating effects on UK’s financial industry and by extension the property market. There are reports that Prime Minister, Theresa May is prepared to make payments to Brussels in order to retain access to the single market.

Whether or not the UK retains access to the single market, chances are that the housing market will continue to thrive because it has already demonstrated high levels of autonomy on other economic drivers over the last few years. The growth might not be as much as it used to be, but this does not equate to a decline.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.