Government Stimulus is an Oxymoron, Debt to GDP

Economics / Global Debt Crisis 2016 Oct 25, 2016 - 04:36 PM GMTBy: Michael_Pento

The accumulation of Debt, at its very essence, is simply borrowing consumption from the future. And this is true on any level of debt, be it either public or private. Just as savings is deferred consumption, the exact opposite is true for debt. Therefore, it can only be beneficial in the long-term if it leads to an expansion of productivity in the present. If the funds borrowed do not improve output per unit of labor it is much more difficult to pay back that debt and any perceived benefit ends up being nothing more than an ephemeral illusion.

The accumulation of Debt, at its very essence, is simply borrowing consumption from the future. And this is true on any level of debt, be it either public or private. Just as savings is deferred consumption, the exact opposite is true for debt. Therefore, it can only be beneficial in the long-term if it leads to an expansion of productivity in the present. If the funds borrowed do not improve output per unit of labor it is much more difficult to pay back that debt and any perceived benefit ends up being nothing more than an ephemeral illusion.

This is the reason why public debt is the most pernicious variety. The problem with government spending is that it mostly amounts to little more than hole-digging and filling. Borrowing money to pay people to empty the ocean onto the beach may temporarily increase employment and demand in the economy. But since this is merely state directed busy work, it does not grow the economy and expand productivity. Thus, the result is a rise in the debt to GDP ratio.

The 2008 financial crisis led to the passage of the Troubled Asset Relief Program, referred to as TARP, the American Recovery and Reinvestment Act and a rapid increase in government transfer payments, which produced multiple years of record deficits. The accumulation of those deficits sent the U.S. National debt to GDP ratio leaping from 64% in 2007, to over 104% today.

Likewise, the nominal level of government debt soared from below $10 trillion, to over $20 trillion in just a handful of years. The Keynesians promised us that all this debt would eventually lead to robust and sustainable growth. However, what predictably occurred was the first recovery since World War II where yearly GDP growth hasn't gone over 3%.

According to the Congressional Budget Office, the U.S. budget deficit for the fiscal year 2016 ending in September will be $588 billion, or one-third greater than last year. This was a result of spending that rose by $168 billion to $3.9 trillion. However, real GDP for the third quarter of 2016, as modeled by the Atlanta Fed, is set to come in at just 2.0%. This is historically a very sub-par growth rate. With the second quarter of 2016 GDP coming in at 1.4% and the first quarter print a measly 0.8%, it appears years’ worth of government “investment spending” has yielded GDP growth that is slowly faltering.

And while fiscal spending was unable to provide viable economic growth, Central bankers have also failed in the same endeavor. This, despite global central bank balance sheet growth of $15 trillion since 2007, 96 months of virtual zero interest rate policy in the U.S. and even negative interest rate policy (NIRP) around the world. Since their monetary plans have failed, central bankers now want to hand off the responsibility of growth back on the fiscal authorities… as if this was somehow a brilliant new idea.

Deficit spending is not a new concept in Washington DC or around the world and it hasn’t moved the needle on growth. For example, thanks to numerous infrastructure bubbles fueled by government and State Owned Enterprises in China, total debt quadrupled to nearly $30 trillion, from $7 trillion in 2007. And total debt has recently ballooned 465% over the past decade to nearly 300% of GDP in 2016, from just 160% in 2005.

And then we have Japan, the island nation has spent the past 25 years deploying one government stimulus program after another to no avail. With a Government Debt to GDP ratio nearing 230%, it's hard to imagine that increased deficit spending now is going to break new ground, or turn this scary trend around.

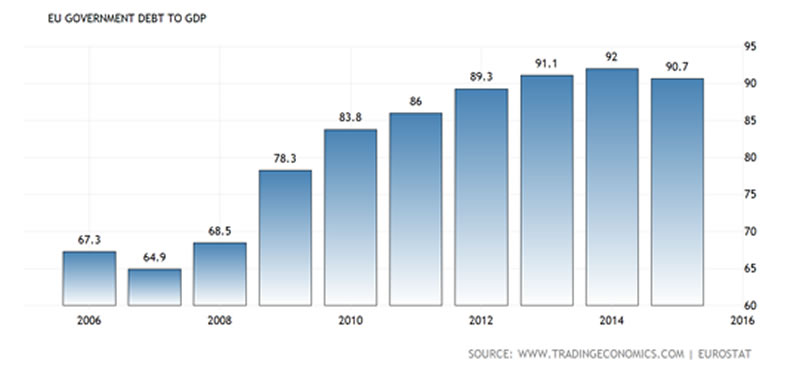

And it’s the same thing in Europe:

And in the United States

If government debt, a.k.a. “investment” led to viable economic growth the debt to GDP ratio around the globe would be falling. The truth is Government debt amounts to nothing more than a gigantic misallocation of capital that brings along with it future anemic GDP growth, higher interest rates, and greater inflation. Perhaps this is the real reason behind the persistent lowering of global GDP growth rates.

Nevertheless, this hasn’t stopped the Keynesian manipulators such as the Fed’s Vice Chair Stanley Fischer from claiming, “Some combination of…improved public infrastructure, better education, and more effective regulation is likely to promote faster growth of productivity and living standards,”

And both presidential candidates have lofty spending plans: Clinton proposes an increase of $35 billion dollars a year to refinance college loans, allocates $27.5 billion for child care, $16.6 billion for IDEA (Individuals with Disabilities Education Act) and another $9 billion for alternative energy investing. In addition to all this Hillary would like to spend $275 billion over five years on a variety of projects, including airport modernization and Wi-Fi accessibility in rural areas. Trump doesn’t bother to go into much details; but just proposes a nice round $500 billion figure for infrastructure spending.

In this carousel, or ping pong match, between monetary and fiscal stimulus it looks like the ball has now landed on the fiscal side of the court. But we shouldn’t pretend that government stimulus hasn’t already been tried in a big way and with negative results, or that the results will be different this time. The endgame will be the unholy marriage between fiscal and monetary stimulus in the form of direct monetization of massive government debt. This too has been tried before…and the pernicious result has always been intractable inflation and economic chaos.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.