Watch The EU Banks After The US Election Gyrations Are Over

Stock-Markets / Financial Markets 2016 Nov 08, 2016 - 01:28 PM GMTBy: Gordon_T_Long

We may not know for a fact who will win the US election, but what we do know is that the Credit Cycle has turned. This will turn out to be more important in the near term, once the expected US Election market gyrations have subsided!

We may not know for a fact who will win the US election, but what we do know is that the Credit Cycle has turned. This will turn out to be more important in the near term, once the expected US Election market gyrations have subsided!

Credit Cycle Has Turned

It's time for investors to refocus on the banks who live via the credit cycle, and specifically the troubled EU Banking sector.

When the Credit Cycle turns, those banks most over-extended always "pay the piper"!

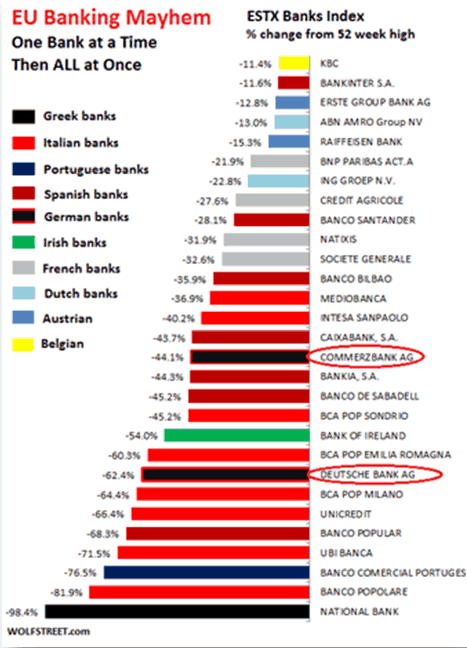

Problem banks are spread right across the Eurozone. Most in the financial media are presently focused on Deutsche Bank, as Angela Merkel currently claims they won't get "bailed out". No doubt the markets will force her to change her mind even if she was to stay in power in 2017. You can be assured that DB will get "bailed out".

It's some of the lesser well known banks which are now the scariest.

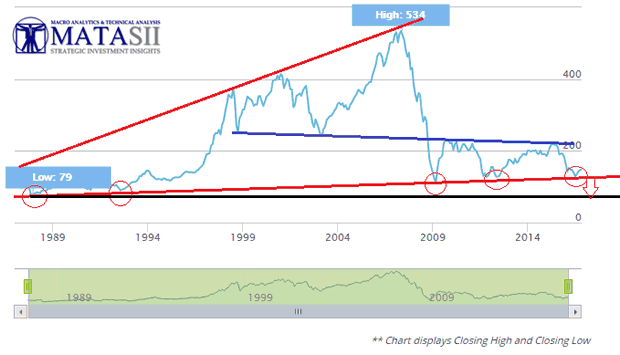

Eu Stoxx 600 Bank Index At Trend Line Support Going Back To The Initiation Of The Eu Concept In Late 80's!

Some analysts expect another STOXX 600 Bank Index down-leg of a similar magnitude to the initial down-leg from last July (~228) into the February low (~130). That decline equated to approximately 43%. Thus, a similar sized decline from the recent high might bring prices down below the 90 level, or some 31% below current levels and approaching the all time lows of 79.

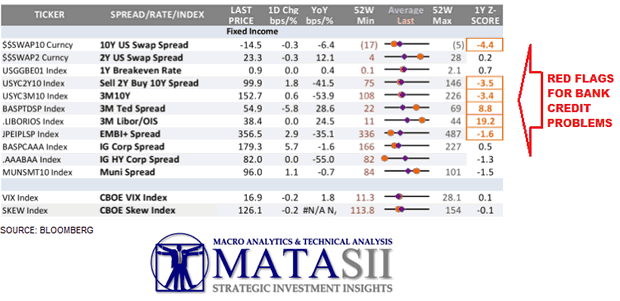

Clearly Problems Somewhere - Red Flag Flying

Switzerland's Credit Suisse is one of them. The constituency to get them "bailed out" is not nearly as powerful. They are going to be a big problem.

Or it could be Italy's UniCredit or Spain's Banco Popular, whose demise could infect the bigger banks who hold humongous derivatives exposure.

The election and other matters have put the massive problems at the banks on the back burner. And it has certainly helped to have a distracting rally in the banking shares since the September lows. But forgetting about them would be a mistake. They are about to become headline news again, regardless of the election outcome.

WHY? - the credit metrics are telling us this!

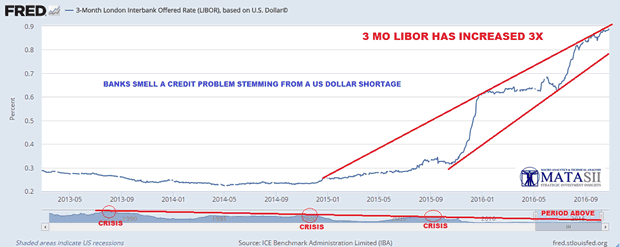

Banks Are Worried About Something!

Three-month LIBOR rates – the European benchmark cost of short-term borrowing for the international system – has tripled this year to 0.88% as inflation worries are mounting.

Something more fundamental is at work. The cost of global capital is going up, full stop ~ Steen Jakobsen, Saxo Bank

"The LIBOR rate is one of few instruments left that still moves freely and is priced by market forces. It is effectively telling us that the Fed is already two hikes behind the curve," said Steen Jakobsen from Saxo Bank.

"This is highly significant and is our number one concern. Our allocation model is now 100% in cash. This is a warning signal for the market and it happens extremely rarely"

Goldman Sachs estimates that

- Up to 30% of all business loans in the US are priced off LIBOR contracts,

- As well as 20% of mortgages and most student loans,

- It is the anchor for a host of exotic markets,

- Used as a floor for 90% of the $900B pool of the leveraged loan market,

- It underpins the derivatives nexus and

- The chain reaction from the LIBOR spike is global.

The Bank for International Settlements warns that the rising cost of borrowing in dollar markets is transmitted almost instantly through the global credit system.

Libor-Ois Spread Near Eurozone Debt Crisis Levels & Past Bouts Of Stress

Credit analysts are becoming nervous about the spread between LIBOR and the overnight index swap, the so-called LIBOR-OIS spread that is used to gauge problems in the plumbing of the credit system. It has widened to near levels seen in the eurozone debt crisis and past bouts of stress.

LIBOR-OIS Spread at 4 Year High

LIBOR is risky in the sense that the lending bank loans cash to the borrowing bank, and the OIS is stable in the sense that both counter-parties only swap the floating rate of interest for the fixed rate of interest. The spread between the two is, therefore, a measure of how likely borrowing banks will default.

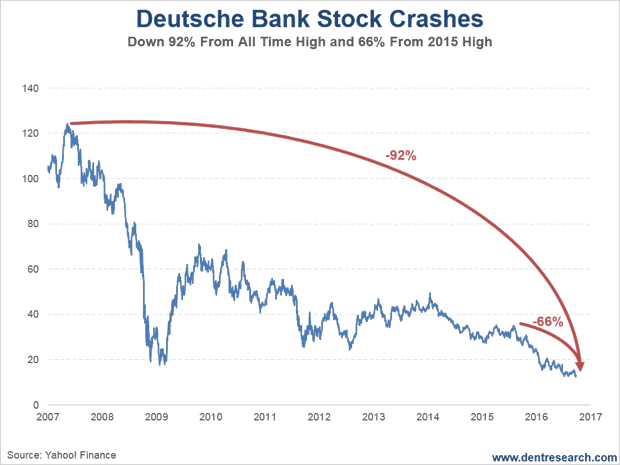

The Deutsche Bank Problem Is Far From Resolved

The Deutsche Bank problem has not gone away this easily by laying off another 10,000 to reduce their employment by 20%.. It has only been shoved from the headlines as US Elections dominate. It will soon be back with a vengeance because of its Derivatives exposure as a result of increasing interest rates. As Jeff Gundlach recently explained, the market will keep pushing the price of DB lower until it either fails, or is bailed out!

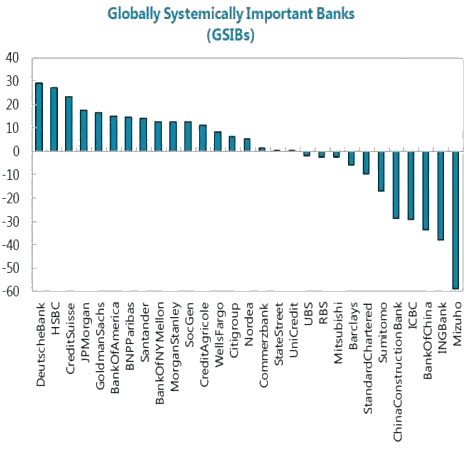

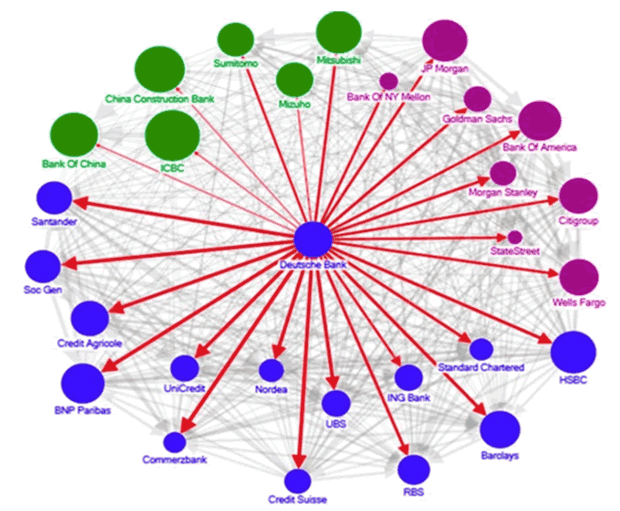

Deutsche Bank is currently assessed as globally the most systemically important bank. A dubious honor.

As JPMorgan's Nikolaos Panigirtoglou also warns:

In our opinion it is not so much funding issues but rather derivatives exposures that more likely to trouble markets going forward if Deutsche Bank concerns continue.

This is especially true if these concerns propagate into a confidence crisis inducing more rapid unwinding of derivative contracts.

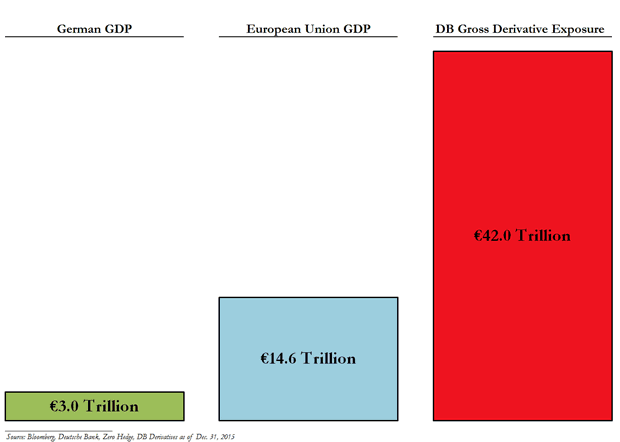

As we have detailed previously, Deutsche has the world's largest so-called derivatives book -- its portfolio of financial contracts based on the value of other assets. As Forbes notes, it peaked at over $75 trillion, about 20 times German GDP, but had shrunk to around $46 trillion by the end of last year. That's around 12% of the total notional value of derivatives outstanding worldwide ($384 trillion), according to the Bank for International Settlements.

As a reminder, if the liquidity run forces DB to start unwinding or being forced to novate derivatives, it could get ugly.

JPMorgan bank analysts confirm the size of DB's book, and note that BIS data provide an alternative but indirect way to gauge the size of derivatives exposures. According to BIS data the exposure of foreign banks to German counterparties via derivatives contracts stood at $312bn as of Q1 2016.

... any problems at Deutsche Bank will immediately have broad reaching impact. Even further hints of more problems might be enough to light a derivatives 'match'.

We can likely expect the EU banking situation to turn chaotic after the US Elections as the December 4th Italian Referendum looms which heightens worries within an already unstable Italian Banking situation.

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.