Trump Win and Brexit - What the Two Biggest Events of 2016 Are All About

Stock-Markets / Financial Markets 2016 Nov 10, 2016 - 09:10 AM GMTBy: Harry_Dent

Like Brexit, Trump staged a surprising win last night, proving every poll wrong.

Like Brexit, Trump staged a surprising win last night, proving every poll wrong.

This is a sign of an underlying trend more massive than the winter economic season that began in 2008. It’s clear evidence of the end of globalization (at least for now). And that’s an important point to take away from the election… and from Brexit.

People are angry. They’re discontent. They’re sick and tired of how small the world has become and they’re ready to revolt. This brings us to the heart of my 250-Year Revolution Cycle.

The very success of globalization, which has flourished since World War II, has taken us to the point where it’s put very different factions at each other’s throats (I’m talking globally AND locally).

It’s become a case of domestic workers versus foreign workers and immigrants… the affluent versus the middle class and poor… Sunni versus Shia and other religious divides… the young versus the rapidly growing burdens of the aging… and big government versus individual freedom…

And, most potent in the U.S., the red versus the blue states!

Our political divide today is the worst it’s been since the Civil War… and I see no way for compromise anymore. We’re beyond it. We’re quite literally at the end of our tether.

This goes beyond the extreme income and wealth inequality today that we also saw in the late 1920s on my 80-year economic cycle. It’s about extreme social and political divides, again more like the Civil War era.

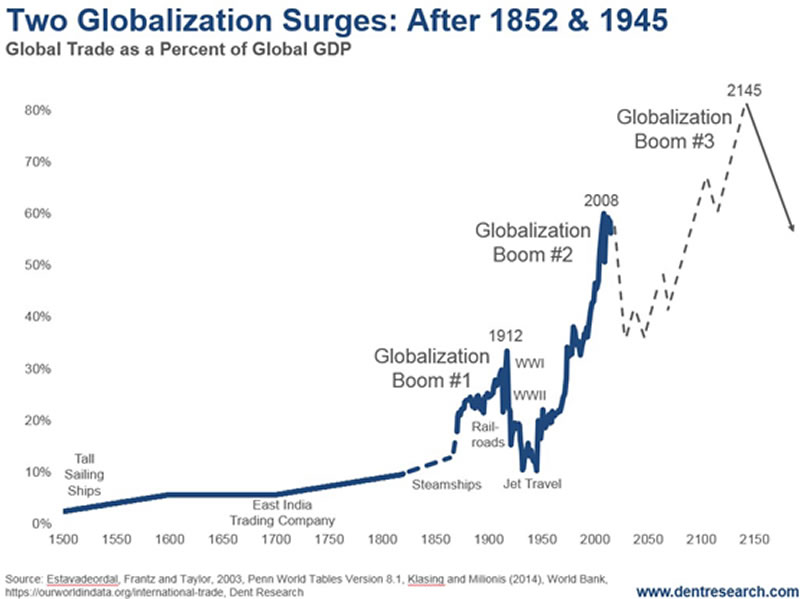

No better graph sums up globalization than this one.

Technological waves have made the world more global with each passing, and they run in 500-year and 45-year cycles.

Mega-innovations, like tall sailing ships, the printing press and gunpowder, started the globalization trend just over 500 years ago, but slowly at first, like any S-Curve. The 500-year cycle of inflation, urbanization and demographic progress that started in the very late 1800s is not due to peak until around 2145. That strongly suggests there IS one more wave of globalization that will bring the entire world into urban and middle class living standards – but it won’t happen until we regress and realign countries and regions around cultural and political lines that are more humanly acceptable and sustainable.

Steamships on the 45-year cycle ignited the first accelerated wave of globalization starting in the early 1850s, and railroads extended that. But that came to an abrupt end with World War I, when globalization retreated dramatically through the Great Depression and World War II.

Then jet travel, followed by the Internet, facilitated an even steeper, second globalization boom from 1946 into 2008.

The Greek bailouts were the first shot across the bow of the second surge in global interconnectedness, and the Eurozone’s huge disparities in income and competitiveness have threatened to tear it apart ever since. The demise and/or a major restructuring of the euro and Eurozone is inevitable in the years ahead.

And again, two of the biggest events of this year prove it. Our election… and Brexit.

Brexit happened against the polls, in large part, because of the migrant crisis tipping the British towards protection of its borders. Sounds a lot like Trump’s wall and deportation threats, doesn’t it?

And the Scottish and the Catalonians in Spain may be next to exit. Italy and other countries may have to exit the euro when they don’t receive the bailouts Greece did. And then Quebec could finally exit from Canada, and so on.

From all the evidence popping up the world over, I call this second great globalization boom over. We’ll see separatist, trade protectionist and anti-immigrant policies around the world adopted at alarming rates. Walls and fences on national borders have already been going up exponentially since 2000. We’ll see many more Brexits, including in the U.S. (a “rednexit” because the red states have made their voices heard). Countries and regions are going to have to realign around common ethnic, religious, political and financial roots before globalization can advance again.

This is bigger than the bubble burst ahead, or even the second half of the winter economic season we’re struggling through. This is likely to take decades, not years.

And the U.S. has one of the most deeply divided populations. Today we’re nearly as divided as we were before the Civil War! That’s why I’ve dedicated the November issue of The Leading Edge to this topic. It’s going to have massive impacts on your investing success and you need to adapt your investing strategies accordingly.

Even when we finally have the necessary financial crisis to deleverage our massive bubbles, the world will look very different coming into the next global boom. Investors and businesses will need to be more selective to find growth – and there will be very strong growth, but in areas like emerging markets, commodities and aging industries like nursing homes (not across the board, as we saw after 1932 or even 1982)!

Time to get ready.

- Harry

P.S. Despite Trump’s massive victory against the odds all the way, I predict one of two things for him: he will either be shot in his first year, or he will be a one-term president given the very adverse trends in the next three years. He definitely is not going to be the greatest job creator in history, no matter how hard he tries.

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.