Gold Trend- The good, the Bad and the Ugly

Commodities / Gold & Silver Aug 09, 2008 - 11:35 AM GMTBy: Brian_Bloom

Few of us holding gold related investments are happy about the recent performance of the gold price but, in this analyst's view, the appropriate way of looking at this is: “thank goodness the fever is abating”. Paradoxically, I am delighted that the gold price is experiencing a downward technical reaction. I would rather that the patient survived than that it died a spectacular pyrrhic death. A pullback in the gold price at this point in time is a very healthy sign.

Few of us holding gold related investments are happy about the recent performance of the gold price but, in this analyst's view, the appropriate way of looking at this is: “thank goodness the fever is abating”. Paradoxically, I am delighted that the gold price is experiencing a downward technical reaction. I would rather that the patient survived than that it died a spectacular pyrrhic death. A pullback in the gold price at this point in time is a very healthy sign.

Here's why:

Several of the commodity charts were reflecting the potential for what the textbooks refer to as “exponential blow-offs”. An exponential blow-off occurs when prices – which are plotted on semi-log scale to accommodate percentage increases over time – begin to show that the rate of percentage growth is also rising strongly.

One needs to have a gut understanding of the concept of compound growth to fully appreciate what this means, so a simplistic example is shown in the table below. In column “A” $1000 is invested and grows at 10% p.a. compound for ten years. In column “B” $1,000 is invested and grows 10% in the first year, 18.75% in the second year, and the rate of growth grows at 75% p.a. thereafter.

| A | Exponential | B | |||

| Growth Rate | 10% | 10% | |||

| Growth Rate increases by: | 0% | 75.0% | |||

| YrO | $1,000 | 5.00% | $1,000 | ||

| Yr1 | $1,100 | 8.75% | $1,100 | ||

| Yr2 | $1,210 | 15.31% | $1,306 | ||

| Yr3 | $1,331 | 26.80% | $1,637 | ||

| Yr4 | $1,464 | 46.89% | $2,239 | ||

| Yr5 | $1,611 | 82.07% | $3,513 | ||

| Yr6 | $1,772 | 143.61% | $6,748 | ||

| Yr7 | $1,949 | 251.33% | $17,113 | ||

| Yr8 | $2,144 | 439.82% | $61,834 | ||

| Yr9 | $2,358 | 769.68% | $339,975 | ||

| < Yr10 | $2,594 | $2,990,702 | |||

Eventually, the dollar growth in column B becomes so steep that when you plot the values on a chart, the chart looks like a perpendicular line pointing to the sky. Clearly, such growth is not sustainable and the entire exchange mechanism breaks down. The price collapses and this is reflected by a perpendicular line pointing to the ground. It's not a question of “whether” this will happen. It's a question of “when”. The longer it takes for sanity to return, the more money is made by some along the way, but the more painful are the consequences for most. It's very difficult to get the exit timing right.

In a market that is running hysterically out of control, the “years” in the first column become months or quarters; and it follows that when a chartist starts to see a trend-line that is curving upwards on a chart that has been plotted on logarithmic scale to begin with – he/she becomes increasingly concerned that the mechanism of the market may be running out of control.

By way of illustration, the quarterly chart of the Dow Jones Industrials (dating back to 1920) is reproduced below – courtesy Decisionpoint.com. This chart is current to June 23 rd 2008.

The reader will note that the scale on the right is logarithmic and that the lower trend line was, until recently, curving upwards – thus illustrating that the rate of percentage increase was increasing. Had the upper trend-line been penetrated on the upside that would have been a sign that the US stock market would be entering an exponential blow-off phase – and it was ultimately the fear of that occurrence (hyperinflation), that was the reason the gold and commodity prices were also starting to grow at accelerating rates.

Those technical analysts amongst us who are familiar with the exponential blow-off process as described above were becoming increasingly concerned that the entire world's mercantile system was being placed under threat by the outright stupidity of the US Federal Reserve Board policies. Some analysts are still stuck in the thought paradigm that we are headed for hyperinflation and are stubbornly refusing to see that the world is shifting. If the Fed keeps pumping up the money supply the US Dollar will collapse, and that is clearly not (yet) happening.

Those who have been arguing that the underlying cause of these exponentially growing commodity prices sheets back to population growth were missing a very important point: The world population is not growing exponentially. It has been growing logarithmically, and the rate of growth is slowing . By way of illustration, the Draft Garnaut report on Climate Change that was recently published in Australia refers to a world population which is being forecast to begin contracting from 2080 (at page 94) and, by the end of the 21 st Century, the world population is anticipated to be 40% higher than at the end of the 20 th Century. The Garnaut report's source of information was long term UN forecasts. This implies that, in over 90 years time, world population will likely be less than 9 billion people. In this analyst's view, this level of population (which will then be contracting) is supportable given that our technologies and agricultural knowhow are becoming ever more sophisticated. Malthus was proven wrong and all doomsdayers after him were also proven wrong. Humanity will not only survive, the quality of life will very likely continue to improve across the board (subject to certain conditions precedent relating to the quality of our leadership).

Those who have been arguing that the underlying cause of these exponentially growing commodity prices sheets back to the rate at which China and India have been consuming raw materials were probably partially correct. But the implicit assumption which underlies this argument was that “therefore, the world economy is going to start growing exponentially (because, as yet only a small proportion of these populations are better off)”. Clearly, such an assumption is nonsense. If China and India are going to grow at an above average rate, then the rate of growth of the rest of the world will need to slow down to compensate. At best the overall growth rate might level out at a higher plateau, but the uncomplicated truth is that – going forward – standards of living in the East can be expected to grow at a faster rate than in the West. It's even conceivable that standards of living in the West may deteriorate as the debt cauldron bubbles over; and that standards of living will continue under pressure until this debt issue has been addressed.

Unfortunately, in their own personal interests and in the interests of the kingmakers behind them, the politicians in the West were not prepared to come clean to the various electorates about the true state of the Industrialised economies. Some even tried to prevent their electorates from coming to understand what was happening. They did this by encouraging the illusion – via an increase in money supply –that things were just fine in the West. It's ironic that Alan Greenspan was knighted for his efforts. What he really did was he pumped money into the US economy which facilitated infrastructural growth in the Rest of the World. His policies facilitated hedonistic consumption in the West (in particular the US) which drove growth in Eastern economies.

Unfortunately, the Western politicians didn't only move to create an illusion of wealth, they also moved to drive home the fact that climate change was manifesting and some even fomented hysterical fear amongst the community regarding Carbon Dioxide emissions.

Even though it is now beginning to dawn on some that it has been our unusually active sun which has been causing global warming (by a complex mechanism which impacts on cloud formation), this action on the part of the politicians was not entirely evil – because Carbon Dioxide is a pollutant and we do need to begin managing the concentration levels in our atmosphere. Professor Garnaut is probably correct when he talks in terms of a target of 450 parts per million. But, having said this, my view is that the concept of carbon emission trading is going to turn out to be a HUGE mistake – because it is being motivated by the same ol' same ol' objective of looking after vested interests and it will also drive inflation. It seems to this analyst that we have the technologies to allow us to address our problems and, if some vested interests get hurt along the way because we move away from some old technologies to embrace new ones, then that will be just tough. They've had a great run to date and they will need to just suck it up.

But something else was happening. In simplistic terms, the fear of CO 2 emissions – that some politicians deliberately fomented – conveniently served to deflect attention away from the financial issues. As was inevitable, we are now facing a situation where the financial issues have begun to manifest in spades. More people in the West are starting to understand the real damage that the Fed policies have been causing and the happy-face charade cannot continue. Unfortunately, however, climate change is real and the politicians – in pointing to the wrong cause – have done humanity a massive disservice. In crying wolf they (and many scientists) have lost credibility and few are going to listen when they start to voice concerns about the possibility of a cooling environment from 2012 onwards. That they may have genuine believed the argument that CO 2 causes Global Warming; and that they may have had the best of intentions is not relevant. The damage to their credibility will be significant.

Unfortunately, the end result of the politicians' disingenuousness/erroneous views (you choose which; it's not all that important) is now visible for all to see: We have a situation where wealth has been transferred from West to East. What the populations in the West are left with is “Debt” and a weakened ability to cope with a climate which is certainly changing, but not in the way the IPCC was forecasting. The economic party is over and the last thing we now need is to devote valuable resources to solving the wrong environmental problem and backing the wrong energy horses.

From another perspective, the question needs to be asked as to how seriously the high growth countries like China are taking climate change. The Olympic athletes are faced with a pea soup atmosphere in Beijing thereby indicating that China has also not bought into the CO 2 argument.

When I watched the Chinese soldiers goose-stepping at the opening of the Olympic Games yesterday, I was reminded of the Olympic Games that were held in Germany a few years before World War II broke out. Germany was beginning to come out of its Depression and Nationalist fever was high. For a few minutes there I found my anxiety levels rising – until I watched another scene where the concept of “Harmony” was being emphasised. But, what was also being emphasised was the extraordinary discipline of the Chinese citizens. This is in stark contrast to Western laid back attitude. The Chinese were correct to emphasise the need for harmony, but the risk is that they may mistake their discipline for superiority. If they try to lord it over the West and define a set of rules which is in their interests only, it seems virtually certain that World War III will eventually erupt and we will blow ourselves to smithereens. Let's hope it never comes to that.

The reality is that the world is an interdependent organism where we are all dependent on each other. The rate of growth in the West is likely to slow – if not turn negative – and this will cause the rate of growth in the East to slow also. Overall, its still seems possible that the Global GDP growth rate can remain positive, but if China continues to grow at 8% - 12% p.a. then the growth rate in the West will need to turn negative in order for overall growth to remain at around (say) 3%. If, indeed, “harmony” is to be the outcome, then I suspect that the reality will be that China's and India's growth rates will slow significantly, and the West's rate of growth will remain low or even stagnant for many years to come. This situation will likely be obscured by the unexpected turn of events in climate change – unless the world moves to embrace the concept of decentralised power generation in a similar manner to which it embraced the Personal Computer in preference to the Mainframe. If we move to a low carbon emission, point-of-consumption energy production thought paradigm then this will allow us to cope with climate change – whether it is warming or cooling. It will also be economically stimulative. (The rationale for all this is explained in my recently published novel, Beyond Neanderthal, which can be purchased at www.beyondneanderthal.com ).

Ultimately, growth will be constrained by resource availability – which will be offset partially by the rate of technological advancement, particularly in the field of nano-technology. The oceans are rich in resources and scientists are starting to understand that the elements on the periodic table (and the molecules of other matter which they combine to form) are not as “finite” as they previously appeared to be.

For example, in a recent experiment, when water was exposed to both X-Rays and extreme pressure, a new and previously never seen crystal was formed. For example, when metals were exposed to certain combined wavelengths of electromagnetic energy, their composition morphed from being a solid and they become jellified. An entirely new body of knowledge and understanding of physics is beginning to emerge, at the forefront of which is a dawning understanding of the true power and value of gold.

Gold lies at the epicentre of all biological life. In this analyst's unsubstantiated opinion the evidence seems to point to the hypothesis that life emerged from the primordial soup because gold – which resonates at the wavelength of DNA – was the catalyst to the initial formation of DNA. It may take decades to prove it but my “intuition” tells me this is so. And, it's also telling me that if I'm wrong, I won't be too far off the mark. The scientists have already proven that Gold and DNA are closely linked. The details of how the emerging understanding of gold's physical characteristics might impact us – from a technological perspective in both energy and agriculture – are also set out quite clearly in the storyline of Beyond Neanderthal.

In summary, the bad news is that we are facing the twin threats of a possible global cooling and an unwinding of debt levels in the West (to say nothing of peak oil). We are facing a period of consolidation in the Equity markets as can be seen from the chart of the Dow Jones above. If one takes a straight edged rule and one extends the bottom trend line from its base in 1932 – in a manner which is parallel to the top trend line – one discovers that we are faced with “up to” 20 years of consolidation; which will likely be similar to the 1966 – 1980 consolidation. At the coalface it will appear that we will be experiencing volatility, but this will unlikely be significant in the larger context. The economic wheels will keep turning.

Of course, within the “churning”, there will be some legacy companies that fall by the wayside, and some emerging businesses that grow very quickly to become large. The trick will be to find those latter companies, and the risks associated with equity investment will therefore rise. It won't just be about throwing darts at the dartboard anymore. With due respect to them, the 25-30 year old spreadsheet jockeys are about to learn some painful truths about the realities of life.

The good news is that in migrating to localised energy production in a big way across the planet, this will be economically stimulative. It will have the same effect as investment in infrastructure. We might, at the same time, accelerate the move away from dependence on the internal combustion engine towards less polluting technologies, and this will also be economically stimulative.

The weekly chart of the dollar below (courtesy decisionpoint.com ) is of great interest in context of the above argument that new technologies might have an economically stimulative effect.

The 64,000 Euro question is whether the dollar index will penetrate the downward pointing trend line on the upside.

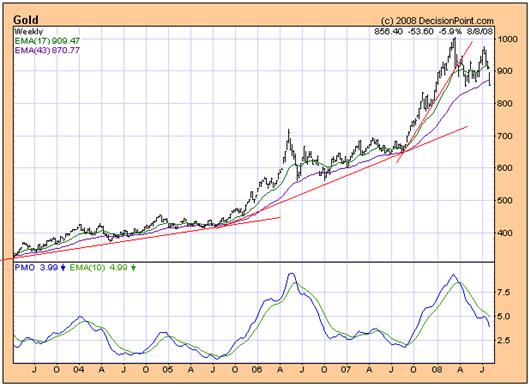

Unfortunately, it's too soon to form a view, but the weekly chart of the gold price is sending messages which are simultaneously good, bad and ugly.

The good: The gap at $900 will very likely be covered by a rising gold price at some point in the future – but it may take some time. Nevertheless, the existence of this gap supports the argument that the gold price is firmly entrenched in a primary bull market which will likely continue for many years to come

The bad: At its current level, the gold price is sitting below its 43 week moving average. This indicates that the “hype” has likely gone out of the gold price for the time being. Of course, traders will be arguing for a bounce around this level, but I am not so sure. If (by no means certain) the $850 level is penetrated on the downside, then a price of around $700 - $750 is possible within the context of gold's primary bull trend.

The ugly: Within the context of a credit crunch, marginal and undercapitalised gold mines may find themselves in financial difficulties.

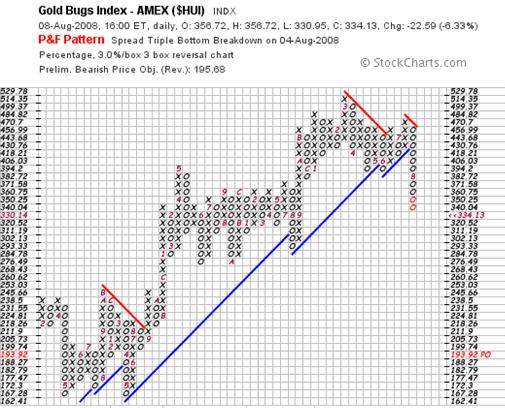

This risk of this can be clearly seen from the 3% X 3 box reversal point and figure chart below (courtesy stockcharts.com ) – which is pointing to a target of 193.68; which represents a potential 42% fall from current levels.

Conclusion

Gold seems likely to consolidate for the foreseeable future and this will likely have both positives and negatives. From one perspective, undercapitalised mines will likely suffer in an environment where capital raising is going to become more difficult. From another perspective, gold seems likely to remain in a primary bull market for many years to come – for technology related reasons which are outlined in detail in Beyond Neanderthal. From a third perspective, whilst the world economy seems likely to continue growing – aided and abetted by the introduction of new energy technologies which will slowly replace fossil fuels – standards of living in the West are likely to deteriorate and standards of living in the East will likely continue to improve as the West works through the debt overhang and repairs its collective balance sheets.

The good news, on which we should all be focussing, is that within an environment of positive world growth there will always be special situation opportunities. But we need to stop being dogmatic and we need to be prepared to change our minds when the facts change.

By Brian Bloom

You may now order your copy of Beyond Neanderthal from www.beyondneanderthal.com . My guess is that we will both be glad you did. The feedback from readers has been very positive, and I am grateful for that. Via its light hearted storyline, the novel points a direction as to what we should be doing in the event that global cooling starts to manifest; and it also sows some seeds of ideas on how we might defuse the clash of civilisations

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.