Desperate Saudi Arabia Turns to Asia for Investment

Economics / Saudi Arabia Mar 15, 2017 - 09:37 AM GMTBy: John_Mauldin

BY XANDER SNYDER : King Salman of Saudi Arabia visited Malaysia on February 26. It was the first trip to the country for a Saudi monarch in over a decade. In his tour through Asia, visits also included Brunei, Japan, China, and Indonesia. Jakarta has not received a formal Saudi visitation in nearly five decades.

BY XANDER SNYDER : King Salman of Saudi Arabia visited Malaysia on February 26. It was the first trip to the country for a Saudi monarch in over a decade. In his tour through Asia, visits also included Brunei, Japan, China, and Indonesia. Jakarta has not received a formal Saudi visitation in nearly five decades.

The king’s decision to tour these countries did not come out of nowhere. It was driven by Saudi Arabia’s increasingly challenging economic situation. As we’ve written about before, he is trying to find more capital to sustain the regime.

He went looking for it in Asia in the form of participation in Saudi Aramco’s initial public offering (IPO).

Depressed Oil Prices Demand Extreme Measures

Saudi Arabia is a petro-state. The nation’s major oil company, Saudi Aramco, is the source of the country’s oil wealth. That wealth is funneled to the royal family and the state. The state is highly dependent on oil revenues. The petroleum sector accounts for about 87 percent of its 2015 budget.

Depressed oil prices mean there’s less money available to pay for social programs. There is less money for commodities subsidies funded by oil revenues. This has put the regime in a dangerous position.

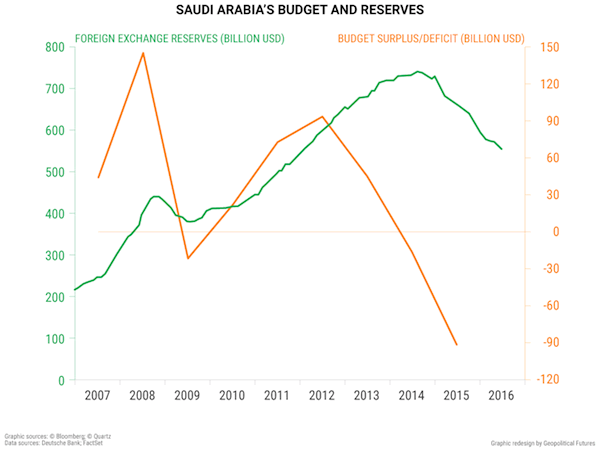

Stopping payment on social spending risks creating a crisis of confidence among elites. That would challenge the regime’s position and the country’s stability. Saudi Arabia has so far avoided this problem by digging into its foreign exchange reserves.

But these continue to fall and won’t last forever.

Selling the Kingdom’s Most Valuable Asset

To refill the state coffers, King Salman last year announced that Aramco would go public. The ruling family had resisted an IPO since Aramco was fully nationalized in 1980.

The regime wanted to avoid this because an IPO entails disclosure requirements. That would make Aramco’s operations more transparent.

Selling shares also represents a small step toward the royal family losing control of the company. But harsh economic realities have forced its hand.

Saudi Aramco will now seek capital for up to 5 percent ownership of the company. That’s a large enough share to bring in cash proceeds and small enough for the royal family to retain control. That King Salman personally traveled to Asia to seek investment is a sign the kingdom really needs the money.

Given the lack of detail about Aramco’s finances, it’s difficult to determine what a 5 percent equity sale represents in dollars. Deputy Crown Prince Mohammed bin Salman claimed the company will be valued at $2 trillion. But these statements need to be taken with a grain of salt. The royal family obviously has a vested interest in inflating the company’s value.

Wood Mackenzie, a consultancy group, estimated that Aramco may only be valued at $400 billion. (This excludes the company’s downstream business.) If Aramco does sell 5 percent of stock, it leaves a wide range of potential capital the IPO may raise. Figures vary from $20 billion to $100 billion.

Why Asia

Aramco’s operations are not widely publicized, and the royal family wants to keep it that way. This explains the turn to Asia. While Saudi Arabia would like to have investment capital from the West, it knows it would come at a high price. That price is a greater transparency that the kingdom isn’t willing to pay.

Aramco could float some of its shares on the Saudi Arabian stock exchange. But the sheer size of Aramco’s IPO—perhaps the biggest in history—means it will need support from other exchanges.

The Hong Kong Stock Exchange has already begun to court the bankers leading the process. Some Asian stock exchanges are less stringent than US-based ones. Seeking capital in parts of the world with fewer disclosure requirements would suit the royal family just fine.

Saudi Arabia’s Asian customers have a vested interest in keeping Aramco up and running. Japan, a country we’ve discussed before which is highly dependent on foreign resources, imports 34 percent of its oil from Saudi Arabia.

Riyadh is Japan’s biggest supplier. Saudi Arabia is also the largest exporter of oil to Indonesia and China. They receive 28 percent and 16 percent of oil imports, respectively, from the kingdom.

These three countries are economically vulnerable to Saudi Aramco’s financial problems. If they end up committing capital to Aramco’s IPO, it won’t be because they’re seeking investment yield. They must keep the supply of oil flowing, and if that means kicking up some cash now to do it, there’s a good chance they will.

Time Is Running Out

At the 2016 annual rate, a best-case valuation would provide the kingdom with about a year of additional time. Then, its reserves would run out.

Saudi Arabia may be gambling on a resurgence in oil prices. But even if this did happen, it wouldn’t fix the challenge that the kingdom has limited productive alternatives to fund social payments.

In 2015, the International Monetary Fund predicted that if oil prices did not recover and state expenses remained, foreign exchange reserves would empty by 2020.

King Salman’s tour isn’t important in itself. But the underlying imperatives that caused him to feel compelled to make these visits personally are.

Saudi Arabia is currently facing struggles. Those struggles are a result of a political economy built on a shaky foundation hardwired in petroleum exports. Seeking a one-time cash infusion alone will not solve its problems. The kingdom is a house built on sand.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.