Bitcoin Crash - Is This The End of Cryptocurrencies?

Currencies / Bitcoin Jul 17, 2017 - 03:22 PM GMTBy: Jeff_Berwick

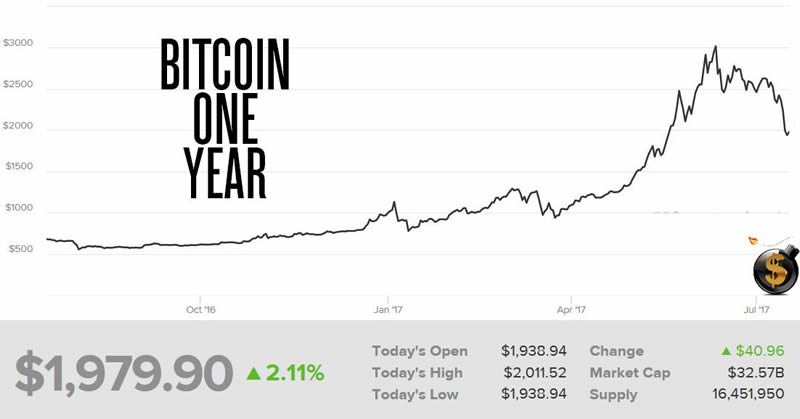

The selloff in cryptocurrencies continues today with bitcoin now falling below $2,000 to a low of $1,841 after hitting its all time high of $3,108.54 on June 11th, marking a 41% drop in the last five weeks.

The selloff in cryptocurrencies continues today with bitcoin now falling below $2,000 to a low of $1,841 after hitting its all time high of $3,108.54 on June 11th, marking a 41% drop in the last five weeks.

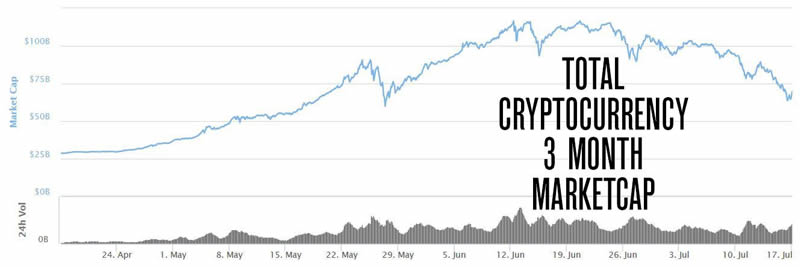

And the total value of all cryptocurrencies dropping to near $60 billion, down from their all time high of $116 billion on June 20th marking a nearly 50% drop in the last month.

And there were massive profits!

Those who bought when we recommended buying bitcoin at $3 in 2011 made a 100,000% gain when bitcoin peaked over $3,000. And those who bought Ethereum at $2 in 2016 when we recommended it, made a 20,000% gain when Ethereum hit $400.

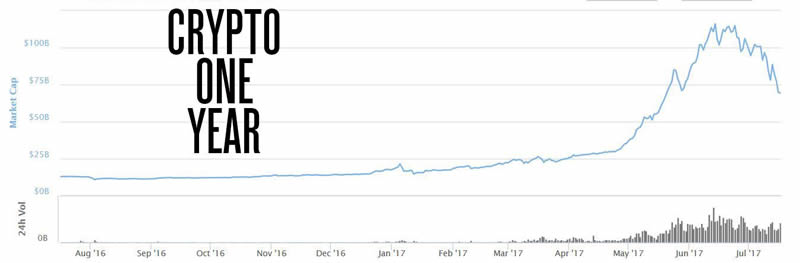

A pullback of about 50% in the cryptocurrencies here is very healthy… and very needed. Even at today’s levels, if you had bought a basket of all the cryptocurrencies a year ago, you’d still be up 400% in the last year.

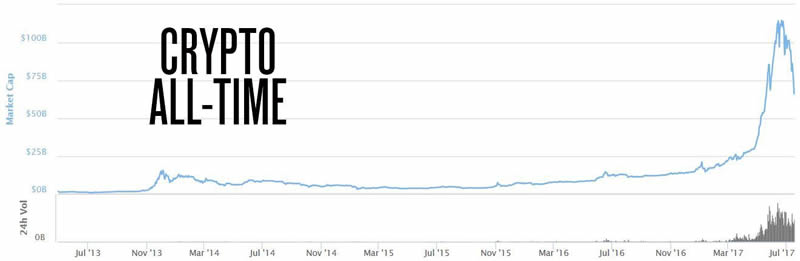

A look at the all time chart for all cryptocurrencies shows that this is just a reasonable pullback after such a massive runup.

I said numerous times in the last few months how shocked I was at how high many cryptos like Ethereum rose.

I was not expecting this kind of market interest in the cryptos this quickly. I was expecting it maybe a year from now, but not now.

And so this major move higher has shown the market interest and demand for cryptocurrencies. As I’ve said numerous times in the past, the cryptocurrency (r)evolution is the biggest thing to happen since the invention of the internet.

It changes absolutely everything. Bitcoin has already changed the world of money and banking. Ethereum has already changed how decentralized applications and smart contracts work. Steem has already changed social media. And we are JUST getting started!

For those who missed the massive runup in the last year you have just been given your second chance by the market!

Is this the bottom? Possibly. Although we could see a rebound and one more leg down before the next bull move. But, while I stopped recommending buying cryptocurrencies a month ago and advised subscribers to sell them… I am now thinking it has dropped enough to start wading back in.

I’ll advise subscribers to The Dollar Vigilante newsletter (subscribe here) exactly what to do in our next issue coming out this week. They should be very cashed up after taking profits at the peak and ready to reinvest at much lower levels!

And yesterday, I just told subscribers which cryptocurrency I think can overthrow Ethereum. It is trading below $2, just like Ethereum was when I recommended it last year, and I think it could surpass Ethereum in the next 1-2 years… which would mean at least a 5,000% gain from here.

You can get access to it immediately by subscribing now HERE.

And if you still don’t understand why cryptocurrencies are the biggest thing since the internet, check out my free four video webinar HERE. If you accept our offer at the end I’ll even personally send you your first $50 worth of bitcoin.

As well, this week I’ll be speaking in Las Vegas at Freedomfest. It is from July 19th to 22nd and I’ll be on a panel with my mentor, Doug Casey and others on Saturday as well as speaking on Saturday at 4:30pm on, “The Bloodless (r)Evolution: How Bitcoin Will Destroy Government And Central Banking.”

You can get a discount of $100 off registration by registering at Freedomfest.com with the discount code “VIGILANTE”.

You can see more here:

And, at 5:30pm, right after my speech, we’ll have a free and informal Dollar Vigilante meetup for anyone who’d like to drop by at the Beer Park bar at the top of the Paris Hotel.

I’ll look forward to seeing many of you there.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.