Bitcoin PullBack Is Over (For Now): Cryptocurrencies Gain Nearly A 50% In Last 48 Hours

Currencies / Bitcoin Jul 19, 2017 - 02:28 PM GMTBy: Jeff_Berwick

So much for the cryptocurrency correction. Two days ago when bitcoin hit nearly $1,800 and the market capitalization of all cryptocurrencies nearly touched $60 billion, I wrote in my article entitled, “Coinpocalypse”, “I am now thinking it has dropped enough to start wading back in.”

So much for the cryptocurrency correction. Two days ago when bitcoin hit nearly $1,800 and the market capitalization of all cryptocurrencies nearly touched $60 billion, I wrote in my article entitled, “Coinpocalypse”, “I am now thinking it has dropped enough to start wading back in.”

And, it appears I nailed it almost down to the minute. As soon as that article went live, the cryptocurrencies began staging a comeback. And they continue to do so as we speak.

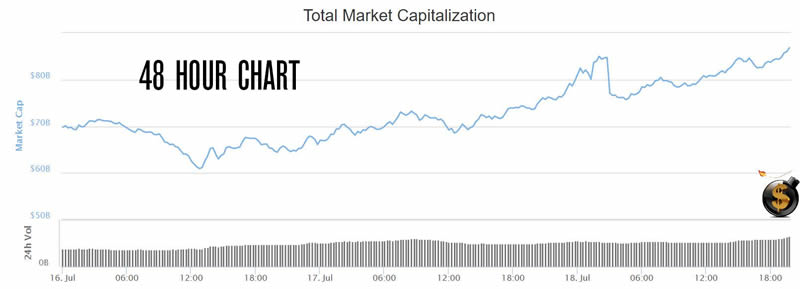

The total market capitalization of all cryptocurrencies increased from $60 billion to currently $88 billion for a nearly 50% gain in just the last 48 hours.

Bitcoin is up over 10% in the last 24 hours while Ethereum has skyrocketed 38% and all major cryptocurrencies are heavily in the green.

So much for that. He is already wrong just 24 hours later. Really, stick to the vitamins.

In his most recent, totally wrong article, he calls bitcoin an “unraveling Ponzi scheme.”

Unlike Ponzi schemes, Bitcoin will still have value and continue to function even if no new participants join the ecosystem.

The purpose of using bitcoin isn’t to recruit new market participants.

And there is no centralized entity that funnels money up to the top.

The first main point in Mike’s article he warns to remember is: “Bitcoin isn’t backed by gold.”

Yeah, no one ever said it was Mike. Thanks for the warning though.

But, you know what else isn’t backed by gold? Federal Reserve Notes, which most people call dollars. You seem to have absolutely no problem taking dollars, though, for your health products.

He goes on to say bitcoin is backed by nothing at all.

To which we’d say bitcoin is backed in part by the power/electricity needed to produce it, in addition to the math and cryptography which are the basis of its value compared to fiat paper and gold.

And, not to mention, we live in the digital age. Almost every person in the world has a smartphone and internet access now. With that phone, you can have a bitcoin account (while many still remain without bank accounts) and can transfer money anywhere in the world for nearly free, nearly instantaneously and no government or other thieves can steal it.

When fiat currencies collapse… and they will… what is more likely to become used as money by the world? Gold coins? Or bitcoin?

The answer is blatantly obvious. Bitcoin. Try sending a gold coin to someone in China for the latest cheap techno gadget and see how well that goes.

Mike goes on to say that bitcoin is nothing but a digital fiat currency. Here, again, he shows his complete lack of understanding of money.

The definition of fiat currency is, “Legal tender whose value is backed by the government that issued it.”

Bitcoin isn’t legal tender in any country I know of. And bitcoin certainly isn’t backed by a government that issued it.

So, totally wrong again Mike. Keep trying though… I can’t believe how you stick with it!

He also says bitcoin has a big problem because “one of the ‘fixes’ being discussed by the bitcoin community right now might result in lifting the limit of 21 million bitcoins, allowing potentially unlimited future Bitcoins to flood the marketplace.”

It’s unclear if Mike is talking about the potential bitcoin fork creating a second coin which will result in the expansion of the supply of the second coin. If that is what he is referencing, then he should realize that when Ethereum forked, the combined value of the two ethereum coins ended up being greater than the single ethereum coin that existed before the fork.

And, besides, why would bitcoin “flood the marketplace with potentially unlimited future bitcoins”? Most of the reason bitcoin is so valuable is because it is so limited.

Why would bitcoin commit suicide by just removing the limit? And why would anyone accept that change?

They wouldn’t. No one is even discussing this as a possibility because it is so outside the bounds of reality.

But, Mike “The Bitcoin DeRanger” Adams seems to have dreamed up a new reason for his audience to completely miss out on an evolution in money and banking that is making a lot of people a fortune.

In any case, with cryptocurrencies haven risen nearly 50% since Mike declared them dead, they probably will have a pullback in the coming days.

Take that opportunity to load up and subscribe to The Dollar Vigilante newsletter HERE. We’ll be discussing where cryptocurrencies go from here and where the best buy and sell areas are located.

And, if you subscribe now you’ll get access to my most recent cryptocurrency pick which I think could be the next Ethereum. We recommended Ethereum at $2 in 2016 and made a 20,000% gain since. And I expect this new cryptocurrency could perform even better.

So, yeah, if you want information and analysis on cryptocurrency investing and speculation, you can stick with The Dollar Vigilante which has been covering bitcoin since it was $3 in 2011… or go with the vitamin guy who knows nothing about money, finance or economics.

You can add him to the 140 others who have declared bitcoin dead to date.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.