Stock Market Bears Are Getting Desperate

Stock-Markets / Stock Market 2017 Aug 01, 2017 - 07:55 AM GMTBy: Avi_Gilburt

Last weekend, I noted that I expect the market to move up towards the 2487SPX region before we are able to see a market top. And, this past week, we struck a high of 2484.04, and saw a strong reaction to the downside.

Last weekend, I noted that I expect the market to move up towards the 2487SPX region before we are able to see a market top. And, this past week, we struck a high of 2484.04, and saw a strong reaction to the downside.

While the market has continued higher since February 2016 as I expected, we have all read those articles which suggest the top is going to be seen any day now. And, yes, we have seen them almost daily for the entire 40% rally we have experienced since that time.

Many analysts have been pointing to so many different reasons as to why they believe the market is “wrong.” And many more have pointed to reasons they expected the market to crash imminently, such as terrorist attacks, Brexit, Frexit, Trump election, cessation of QE, interest rate hikes, and many more that we all have read. Yes, most were quite certain that the market would never see its current heights and have fought this rally tooth and nail.

But, have any of them even considered why they missed this rally? Have you?

If you are like them, you have focused on news events and commonly followed economic indicators suggesting that the market “should” be dropping like a rock. But, have you ever considered that market direction is not determined by such factors? I mean, should it not be obvious based upon the fact that we are now near all-time highs most of you never even fathomed?

First, I want to address many of your expectations that the substance of news is what directs the market.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

Now, for those that are still unconvinced, how many of you expected that the market should have hit its high at Brexit, or Frexit, or the various terrorist attacks we experienced the past few years, or the Fed ceasing QE, or interest rate hikes, or the Trump election, etc.? Come on . . . at least admit it to yourself. The great majority expected each of these individual events to have “caused” the top to the market from a long-term perspective. Yet, even taken cumulatively over the course of the last year and a half, it could not even slow the market down, as it still experienced a 40% rally. At the end of the day, the market clearly showed those who are willing to listen that it did not care.

Should you not be questioning what you believe drives the market?

You see, most market participants believe that a news event is what moves the market. Most see the market move, then scour the news sources to find the “cause” of that move. Last week, I showed how this has been taken by most to a truly absurd point:

You see, most in the market believe that they can apply the laws of Newtonian physics as the basis for their market analysis. They see a market move, look for the latest news event hitting the wire, and then claim that the immediate news event clearly “caused” the move in the market. However, this analysis is simply wrong.

Allow me to show you the ridiculous results of using this as the basis for one’s analysis:

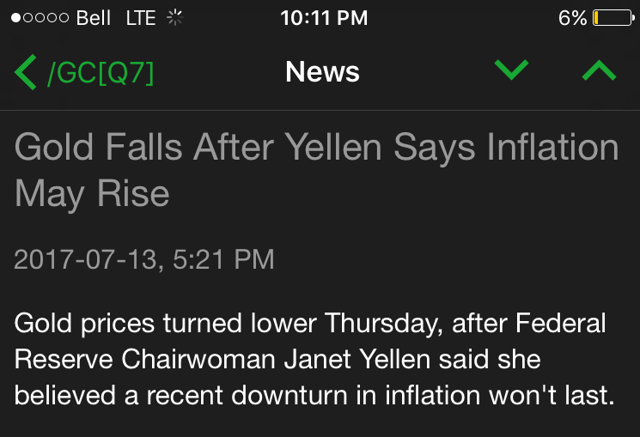

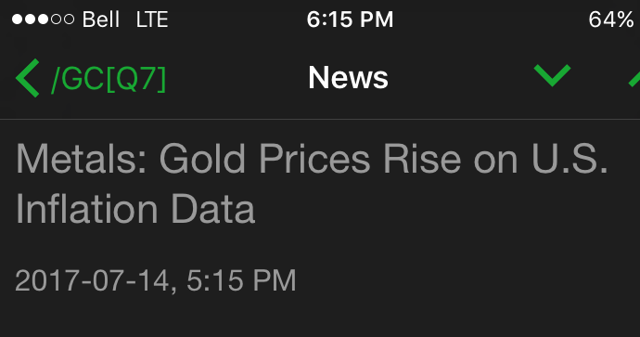

As you can see, on a day when the metals fell, there was news regarding a rise in inflationary expectations. So, what do the Newtonian-based market analysts claim? Yup, they claim that the news caused the drop in the metals.

The VERY NEXT DAY, we got further data of potential inflationary expectations, and the metals rallied that day. So, what do these same Newtonian-based market analysts claim? Yup, they claim that the news caused the rise in the metals.

If you really look at the market with an open mind, you can see this occurring almost daily. This past week provided us with yet another example. As we were expecting the market to strike a top and drop back down towards the 2455SPX region, we saw a sharp reaction to the downside. I am sure many of you looked to the news to see what “caused” this downside reaction, yet could not find anything. Right?

Well, it seems the bears and Newtonian-based analysts had to stretch for their “reason” as to why the market dropped, mind you, exactly where it should have dropped, at least based upon our perspective. They found an analyst at JPMorgan who issued a statement that noted that volatility was hitting all-time lows, and could be due for a reversal. Yes, my friends. There are people who believe that an analyst noting that "volatility hit an all-time low and could reverse" is what supposedly caused this pullback.

Now, if you cannot see the issues with this Newtonian-based analysis, allow me to point them out.

First, this analyst has put out many notes over the last year and a half about how the market is too stretched to the upside, yet not one has seemingly “caused” a downside reaction. But, we are to believe that this one magically “caused” the downside this time? Was there something special about THIS pronouncement which was different than all the others? This seems like a wonderful example of a broken-clock syndrome to me.

Second, ask yourself how many articles you have seen over the last several months noting how oversold VIX is, and how many people expect an “imminent reversal?” Now, let’s put our reasonable hats on, and recognize that none of them “caused” a reaction as we saw on Thursday. So, could it simply be that this note did not “cause” the reaction but was simply put out around the same time as the market topped – and topped at the point we even expected it to top?

Third, if Newtonian-based analysts have to stretch so far to find some event or news such as an analyst telling us that VIX is historically low to present a “causation” argument for the drop we experienced in the market on Thursday, then it certainly tells us how desperate the bears have become, and how specious such “analysis” really is. Has not every analyst and their mother explained to you for the last year that volatility is too low and will reverse imminently? Did even one of them “cause” a drop in the market?

At some point, if you want to have a better chance at outperforming the market, you will have to begin to think differently than the rest of the market. Whereas the great majority of market participants are focused upon news events (which have clearly meant nothing during this 40% rally), or Wall Street analyst perspectives (which have also meant nothing during this 40% rally), or other economic matrices suggesting that the market is topping for the last two years, if one maintained a simple focus only upon market sentiment, one would have outperformed the great majority of market participants, and especially the ones who “knew” the market was wrong.

In the short term, as long as the market maintains over the 2450SPX region, I still believe we have one more short-term rally phase until our longer-term wave (3) off the February lows has completed. My ideal target for that is in the 2500SPX region. However, should we break 2450SPX, and follow through strongly below 2440SPX, it opens the door to us having topped in wave (3) just a little earlier than I had expected.

My next article, likely coming out tomorrow, will discuss my broader views on the equity markets.

See charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2017 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.