Stock Market Volatility: A Dangerous Game Made Safe

Stock-Markets / Stock Market 2017 Aug 08, 2017 - 01:49 PM GMTBy: Harry_Dent

In the coming years, we’ll see much more volatility in the market.

In the coming years, we’ll see much more volatility in the market.

The fact that the VIX (or volatility index) has hit its lowest levels ever this year is of course prompting concern that a bear market is lurking in the shadows.

The market boom from late 1982 through late 2007 was based on real fundamentals: the spending wave of the largest generation in history; falling interest rates from rising productivity after the greatest peak in history in 1980 to 1981; the movement of internet and portable computing into mainstream markets.

But since the economy collapsed in 2008, it’s been all about endless QE and stimulus measures to fill the gap of unprecedented debt and slowing demographic trends in spending and productivity.

The retail apocalypse we’re witnessing is more than simply a case of Amazon and internet retailers taking over market share. They only command 8% of the market. It’s really all about the aging Baby Boomers slowing their spending before the Millennials fully enter the workforce and ascend.

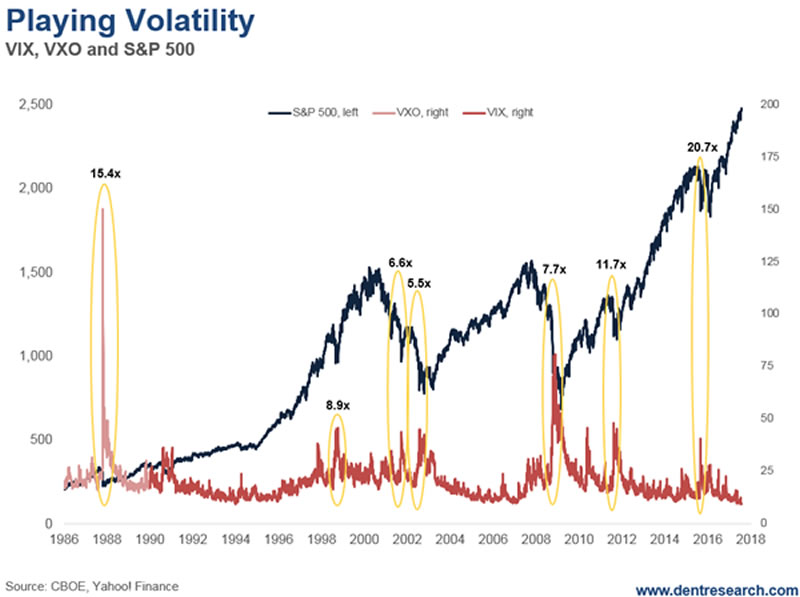

Look at this chart on volatility in the stock market. I compared the VIX and the S&P 500.

As you can see, there’s a roughly 10-times ratio between VIX spikes and stock market drops during times of crisis.

In the last crash in 2008 the VIX went up 7.7 times what the S&P 500 went down. The highest ratio was in late 1987, at 15.4 times. In the brief 1998 crash, it was 8.9 times and the double spikes in 2001 and 2002 saw ratios at 6.6 and 5.5 times, respectively. Even in the 20% crash in late 2011, the VIX went up 11.7 times what the S&P 500 went down.

I mention this because I’m sure you’ve heard us talk a lot recently about Adam O’Dell’s newest trading strategy – the 10x switch – promising unbelievable returns. And seeing as we’re tackling hype everywhere else in Economy & Markets, I thought this a good time to share some non-hype insights into this unique and lucrative niche that Adam has captured.

Turning $10,000 into $100,000 and eventually $1 million is absolutely possible… by playing volatility booms and busts, particularly in an excessively overvalued market that’s looking for the biggest crash since the early 1930s!

The fact is, I think Adam has come up with his most genius investment strategy yet. Just bet on the cyclical booms and busts in the VIX, with a simple and effective strategy. You don’t have to trade individual stocks or sectors, which he is also expert on.

And volatility accelerates up and down both ways in a bear market, which is all the better.

Adam has taken one of the most dangerous games in town and made it safer, easy and accessible to anyone.

I have always warned investors that bear markets are trickier to play than bull markets, although the profits are much higher because bear markets tend to crash twice as fast and hard as bull markets build, especially in bubble booms like this one.

So Adam uses his proven volatility model, which has no market bias, to play both sides of this leveraged equation!

Come and see Adam speak at this year’s Irrational Economic Summit in Nashville, TN.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.