US Debt Revelation Numbers

Interest-Rates / US Debt Oct 31, 2017 - 04:06 PM GMTBy: Michael_Pento

The federal budget deficit widened in the fiscal year 2017 to the sixth highest on record, creating a budget shortfall of $666 billion. That is up $80 billion, or 14%, from the fiscal year 2016. The overspend resulted primarily from an increase in spending for Social Security, Medicare, and Medicaid, as well as higher interest payments on the debt due to rising rates that drove up outlays to $4 trillion, which was 3% higher than the previous fiscal year.

The federal budget deficit widened in the fiscal year 2017 to the sixth highest on record, creating a budget shortfall of $666 billion. That is up $80 billion, or 14%, from the fiscal year 2016. The overspend resulted primarily from an increase in spending for Social Security, Medicare, and Medicaid, as well as higher interest payments on the debt due to rising rates that drove up outlays to $4 trillion, which was 3% higher than the previous fiscal year.

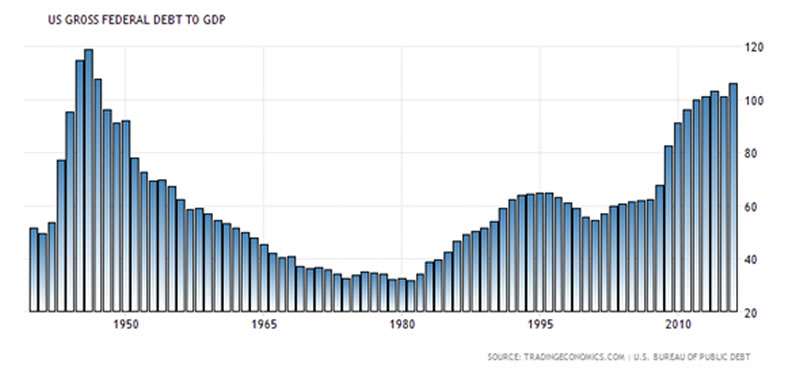

The deficit as a percentage of gross domestic product (GDP), totaled 3.5%, up from 3.2% the year prior. This budget gap will be piled on to the ballooning National Debt that in the fiscal year of 2016 grew to whopping 106% of GDP.

But the Trump administration isn't spending a lot of time tweeting about the looming debt crisis. In fact, they would like us to believe that their recently proposed tax reform will not only pay for itself but will actually reduce debt and deficits. Treasury Secretary Steven Mnuchin noted recently that, "Through a combination of tax reform and regulatory relief, this country can return to higher levels of GDP growth, helping to erase our fiscal deficit."

But the truth is that the proposed tax reform will not completely pay for itself--let alone reduce the deficit or pay down the debt. The Senate has recently congratulated themselves for approving a budget resolution that would allow Congress to collect $1.5 trillion less in federal revenues over the next ten years, yet they are still in search of new revenue to pass tax reform.

And since there are still some remnants of the fiscal hawks in Congress, Republicans are in a frenzy to find new revenue opportunities to get the necessary votes; in search of an elusive "sacred cow" that isn't that sacred.

Following the election of Donald Trump, the House supported a Border Adjustment Tax (BAT); a cash windfall that dovetailed brilliantly with Trump's America first agenda. However, it didn't take long for lobbying groups to crush that proposal, and the BAT tax wound up biting the dust.

The next target was the deductibility of state and local taxes and the mortgage interest deduction--but the Republicans soon realized they have representatives seeking re-election in high tax states too...and this idea has also quickly fallen by the wayside.

On October 20th, the New York Times reported that "House Republicans are considering a plan to sharply reduce the amount of income American workers can save in 401(k) accounts, reportedly to as low as $2,400 per year (The current figure is $18,000, rising to $18,500 next year, with $6,000 additional in catch-up contributions permitted to those 50 and over.)" However, President Trump quickly killed this with a tweet too.

Now we hear rumblings of a higher tax bracket; this may get the support of some Democrats, but the truth is there are not enough one-percenters to make the numbers work.

The Senate can pass tax reform with a simple majority but there is a catch. To use what is called the budget reconciliation process it cannot add to the deficit beyond the 10-year budget window. Therefore, a feasible solution may be to include an additional upper-income bracket to throw a bone to the Democrats and bring some on board to get to 60 votes. But the problem is that under either Reconciliation or Regular Order, passing tax cuts would mean that deficits would soar.

Our economy did prosper after the Regan tax cuts. But here is the rub, in the 1980's the National debt was 45% of GDP; but now it is 106% of GDP.

According to Carmen Reinhart and Ken Rogoff, in their book, "This Time Is Different" - 800 years of financial history proves that high government debt ratios lead to low economic growth. And though some of their data have been questioned regarding the magnitude of their findings, their basic premise that high debt leads to weaker growth has held true under aggressive scrutiny.

Cutting taxes in an environment of massive debt and ballooning deficits, without a commensurate reduction in spending, is not going to grow the economy over 3%--at least it hasn't worked in the past 800 years.

Declining government revenues and long-term costs associated with an aging population, including higher Social Security and Medicare spending, are expected to continue pushing up deficits over the coming decades. Real tax reform is needed but it should be paid for in order to ensure that we grow the private sector as we shrink the public sector. That means cutting taxes, eliminating loopholes and reducing spending. Sadly, few in Washington espouse such an agenda. Without such cuts, the economic boost from lower taxes would be more than offset by spiking debt service payments on the record amount of outstanding debt.

The S&P hit a bottom of 666 in March of 2009, which led to the most humongous intrusion into free markets by the U.S. government in its history. Now we have that same foreboding number 666; this time regarding the amount of red ink during the 2017 fiscal year. A mere coincidence I'm sure. Nevertheless, we must pray this rapidly rising debt figure does not forebode yet another step closer for the demise of the middle class.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance www.earthoflight.caLicenses. Michael Pento graduated from Rowan University in 1991.

© 2017 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.