Credit Default Swap Dealers the Big Winners from Fannie and Freddie Takeover

Interest-Rates / Credit Crisis 2008 Sep 09, 2008 - 01:38 AM GMTBy: Mike_Shedlock

Bloomberg is reporting 1.4 Trillion in Fannie, Freddie Credit-Default Swaps May Be Settled .

Bloomberg is reporting 1.4 Trillion in Fannie, Freddie Credit-Default Swaps May Be Settled .

Investors may be forced to settle contracts protecting more than $1.4 trillion of Fannie Mae and Freddie Mac bonds against default after the U.S. seized control of the companies in a bid to bolster the housing market.

Thirteen "major" dealers of credit-default swaps agreed "unanimously" that the rescue constitutes a credit event triggering payment or delivery of the companies' bonds, the International Swaps and Derivatives Association said in a memo obtained by Bloomberg News today. Market makers for the privately traded contracts will discuss how to settle them in a conference call at 11 a.m. in New York, the document said.

"This is a big deal," said Sarah Percy-Dove, head of credit research at Colonial First State Global Asset Management in Sydney. "The market is not experienced at settling a credit event for a name of this size, so it is a bit of an unknown."

"Although the settlement effort will be massive, we do not see it as necessarily a negative," Gus Medeiros, credit analyst at Deutsche Bank in Sydney, wrote today in a research note. "Write downs are potentially an issue for holders of preferred equity, but the Treasury said financial institutions exposed to these securities will work with regulators to restore capital positions."

Largest Non-Event In history

I saw reported figures of $1.4 trillion of derivative blowups when I got up this morning, before I saw any real news. However, the market was not acting as if there was a $1.4 trillion blowup. The market was still functional. Whatever was going on, and lots of things were going on to be sure, but something that most assuredly was not going on was a $1.4 trillion event.

Big Payments Expected

The New York Times has a notable headline Big Payments Are Expected in Credit Default Swaps . Inquiring minds want to look at the details.

The government's takeover of Fannie Mae and Freddie Mac may lead to one of the largest ever payments in the credit default swap market, analysts said on Monday.

Losses to protection sellers, however, are expected to be minimal because of the high trading levels of the $1.6 trillion of outstanding Fannie Mae and Freddie Mac debt.

It is the first time a company in the benchmark investment-grade credit derivative index has had a credit event, a JPMorgan analyst, Eric Beinstein, said in a report on Monday.

“This will likely be the largest credit default swap credit event in terms of the amount of credit default swap contracts outstanding that has occurred,” he said.

When a credit event occurs, sellers of protection pay the buyer the full amount insured, and the buyer gives the seller debt underlying the contracts or a cash sum based on the debt's value.

“If bonds rally and trade close to par, recovery could be close to 100 percent, with sellers of protection having little to pay out despite a technical default,” CreditSights analysts said on Monday.

Technical Default

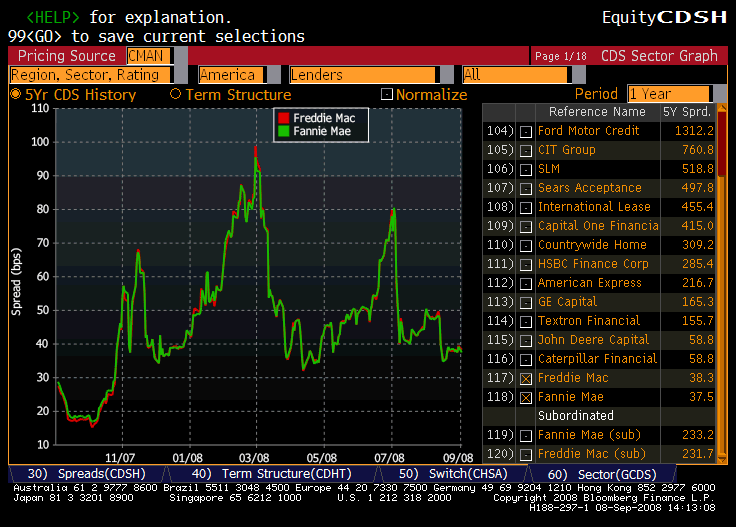

There was a default alright, technically, but that is about it. Earlier today I asked Chris Puplava at Financial Sense for a chart of Fannie and Freddie credit swaps. Here is that chart.

Fannie and Freddie Credit Default Swaps

Fannie and Freddie swaps were as high as 80 basis points in July. They are under 40 today in spite of the "default". To put things into perspective let's take a look at Washington Mutual (WM), Capital One (COF), and American Express (AXP) credit default swaps.

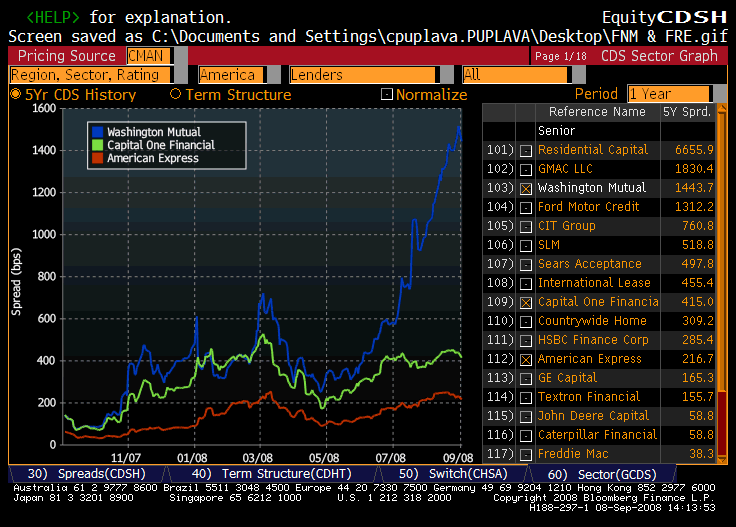

WaMu, Capital One, American Express CDS

Washington Mutual at 1400+ basis point vs. 30+ basis points for Fannie and Freddie just ought to put things into perspective as to what a non-event this was.

Over a trillion dollars were bet but it did not matter. Or did it? Let's go back to a statement from the first article.

Thirteen "major" dealers of credit-default swaps agreed "unanimously" that the rescue constitutes a credit event triggering payment or delivery of the companies' bonds, the International Swaps and Derivatives Association said in a memo obtained by Bloomberg News today.

Hmm. Interesting that this was such a unanimous declaration. I wonder when the bulk of those CDS contracts were initiated. Could it by any chance be March or July of 2008? And who was on the other side?

Imagine betting on a default, getting it, and losing your ass. It seems to me that is what happened.

Who Lost?

- Taxpayers

- Small Banks holding F&F preferreds

- Investors holding F&F common or preferreds

- Thirteen "major" dealers of credit-default swaps.

- PIMCO

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.