The Driverless Car Revolution Has Begun—Here’s How to Profit

Companies / Auto Sector Aug 28, 2018 - 07:44 PM GMTBy: Stephen_McBride

It’s happening right now…

It’s happening right now…

Self-driving cars are on American roads. Hundreds of them are driving around Arizona as you read this article.

And before yearend, the company that operates these cars will launch a self-driving rideshare service to the public in Arizona.

It’ll operate just like Uber. You press a button on your phone and a robot taxi comes to pick you up.

There will be no driver in the car. It will be driving itself.

I’ll Repeat: Self-Driving Cars Are Here Right Now

The company achieving all this is called Waymo. As I explained in June , it’s a subsidiary of Alphabet, which you may know as Google’s parent company.

If Waymo were a standalone company, it would be the hottest stock on Wall Street. But because its tucked away inside the world’s third-biggest publicly traded company, the financial media ignores it.

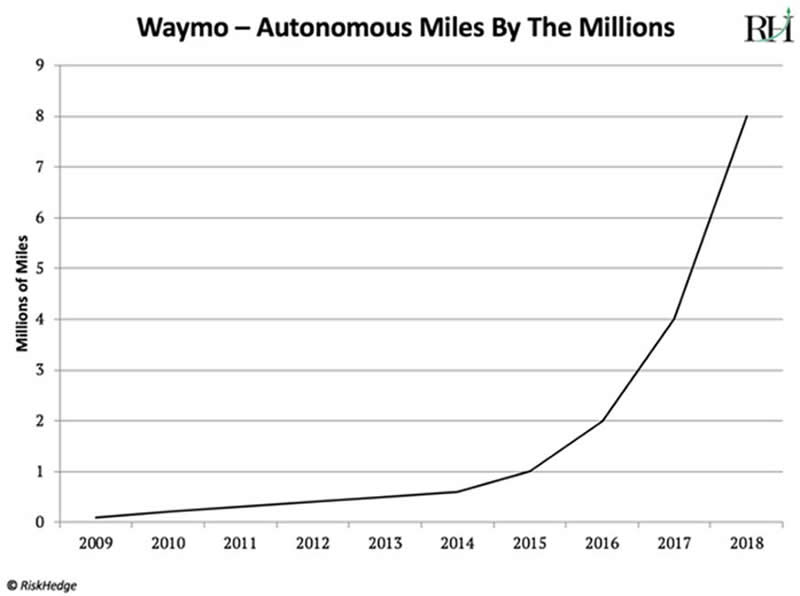

Waymo’s driverless fleet has already covered 8 million miles and is clocking up 1 million miles per month.

As you can see in the chart below, Waymo has been testing driverless cars since 2009. This year, its progress has gone parabolic:

Source: Waymo

This is key because Waymo cars run on a centralized computer “brain” that learns from every mile driven.

Waymo is absolutely dominating all rivals in self-driving technology. Tesla, Uber, and many others are years behind it.

Driverless Cars Are an Existential Threat to the Car Industry

I’ve focused a lot of my time and research lately on understanding how self-driving cars will change the world. I’m convinced they’re going to hollow out the car-ownership culture in America and elsewhere.

Think back to when ridesharing services like Uber and Lyft were new. Many experts predicted these services would kill car ownership. That didn’t happen, mostly because of the cost.

By far the biggest cost of operating any car today is paying the driver. Last year, Uber took in $37 billion in fares. $30 billion—or 81%—went to the drivers. Self-driving cars slash this to zero.

A recent estimate from investment bank UBS arrived at a similar number. It suggests driverless ride-sharing services will be 70% cheaper than Uber.

Even after factoring in regulatory costs, which will likely be substantial, driverless ridesharing services will cost much less than Uber. That will be a game changer.

Tens of Millions of Americans Will Ditch Their Cars in the Next Few Years

Why pay for car loans, insurance, registration, inspections, repairs, parking, oil, and gas when you can summon a safe, inexpensive driverless car to pick you up anytime you want?

63% of Americans live in urban areas. I think it’s safe to assume at least half the folks who own cars in cities today will ditch them in the coming years.

Did you know that 2017 marked the first year auto sales fell since the financial crisis? It’s an early sign of the unfolding disruption that will eventually shatter the auto industry.

But plunging car sales are not the only worry for automakers. The disruptive effect of self-driving cars will ripple out to other, less obvious corners of the market.

For example, self-driving cars will cut down on car accidents big time. Today, over 6 million car accidents happen in the US each year. Self-driving cars should ultimately reduce this by around 90%.

This will eat into car sales, as we won’t need to replace totalled cars often. Fewer accidents also means plunging revenue for car insurance companies. Less wear and tear will eat into the revenue of companies that sell auto parts.

Not to mention, fewer speeding tickets means less revenue for local governments.

Politics Will Be an Important Battleground for Waymo

The auto industry is responsible for 4% of US GDP and millions of jobs. In fact, “truck driver” is the most common job in America. Self-driving vehicles put all 4 million American truck-driving jobs in jeopardy.

It’s easy to see how this could go bad politically.

Waymo has smartly gotten out ahead of this by building partnerships that enhance its image. For example, it has partnered with the City Council in Phoenix to provide cheap bus and rail connections to underserved communities and the elderly. It has entered a similar partnership to drive folks to and from Walmart to buy groceries.

This is a genius move by Waymo. Instead of a job killer, it will be seen as the friendly service that takes Grandma to Walmart.

How Do We Make Money from This?

At 51 times earnings, Alphabet (Google) is too expensive to buy today.

I expect Waymo to achieve rocket ship growth. But Google is a colossal company worth $865 billion.

Analysts at Morgan Stanley value Waymo at $175 billion today. That sounds way too generous to me. My calculations show Waymo is worth around $100 billion. But even if we play along with Morgan Stanley’s big number, Waymo makes up only 20% of Google’s value.

I’d consider buying Google if it dips about 15% to around $1,050/share. This would push its valuation down into a more reasonable range. And it would shrink Google’s market cap enough so big growth in Waymo can move the needle.

To be clear, I don’t believe you should buy Google’s at today’s price. But instead wait for a pullback of around 15%. And don’t worry about missing out. Google’s stock had two corrections of 15% and 14% earlier this year.

By Stephen McBride

© 2018 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.