Top 10 AI Stocks Investing to Profit from the Machine Intelligence Mega-trend (6-10)

Companies / AI May 28, 2019 - 10:11 AM GMTBy: Nadeem_Walayat

This is my latest analysis in my machine intelligence investing mega-trend series that warns to prepare for EVERYTHING to change EXPONENTIALLY when average machine intelligence surpasses average human intelligence following which it will be off to the races. When the pace of change will leave everything that has happened before far behind. And in my opinion that key date will occur sometime during 2022, i.e. in less than 4 years time! Which means if you have not already got your act together by getting onboard this investing gravy train then you really need to take action or kick yourself many years down the road, when you will be asking yourself why I did not invest in those AI stocks before they went stratospheric!

If you've not already done so then watch my following video from November 2016 which illustrates why everything will start to change exponentially by 2022.

Machine Intelligence has become a broad church that has fragmented or branched off into a myriad of sectors and the number keeps expanding every year. Many years ago I broke the machine intelligence mega-trend down into 9 key sectors that I have now further fragmented into 10 by basically adding Cyber Security as the following list illustrates, the 10 key machine mega-trend sectors to invest in.

However the grand daddy of ALL of the 10 sectors is Artificial Intelligence, which is the PRIMARY FOCUS for investing. All of the other sectors are DERIVATIVES of AI. Which means one could ignore most if not all of the other sectors and just focus on investing in Artificial Intelligence, for most of the AI stocks by nature encompass aspects of the derivative sectors.

AI STOCKS

So what do I mean by investing in Artificial Intelligence stocks. Basically this is investing in companies that are at the very forefront of developing self learning technology as the back bone of their business rather than for instance a company that is just focused on developing a self driving car, usually using AI already developed by another corporation.

So when investing in Artificial Intelligence I am basically focus on 10 Tech giants that have both existing DEMAND for raw processing power of self learning algorithms and the resources to to commit to the development of artificial intelligence i.e. billions of dollars sat in the bank. So you should not be surprised if you recognise most of the stocks on my Top 10 AI investing list.

How to Invest in Stocks

First a brief primer of how to actually invest in stocks and no I don't mean the dynamics of placing orders with brokers.

1. ACCUMULATE - The objective is to accumulate positions over time so as to avoid major peaks and troughs. Timing doesn't make much difference because you don't have the benefit of hindsight when investing i.e. it does not really matter if the stock market is soaring or plunging. So set yourself a monetary target of how much of each stock your aiming to accumulate over a period of time.

2. Target Stocks List - You are going to have a list of target stocks that you are always ready to accumulate into whenever the opportunity arises. So that whenever the stock market does take a tumble, your not sat twiddling your thumbs trying to work out which stocks to buy because you already have a list of stocks PLUS a target amount to buy based on your AI investing game plan.

3. Best Stock Picking Indicator - Most analysts obsesses over stock fundamentals. However whilst significant, in my opinion the most important indicator of how the stock is doing is its performance relative to the general stock market indices, as you want to be wary of buying a stock when it is UNDER PERFORMING against the general stock market indices, which is a warning sign that something could be going wrong that may take a while to show up in corporate data.

4. Remember you are INVESTING NOT TRADING. So you are going to be committing funds for at least 5 years and likely more than 10. My strategy is basically to invest and forget. I don't do use online portfolio updaters, which can result in people wasting time checking the value of their portfolios several times a day! Instead I use manually updated spreadsheets that at best I update quarterly, and usually a less frequently. Because I am INVESTING NOT TRADING. For instance I have held some stocks for DECADES!

So basically don't think too much about what your invested in after you have invested. i.e. avoid regular monitoring otherwise you may end up making the mistake of bailing out that you will likely regret selling later.

5. Market Timing - I know its hard to tell you not to time your entries, especially after the market has had a good run and ones instincts are wait for a correction, but then you'll end up waiting that bit longer and the stock will start to rise again, and so you'll want to wait for it get back to where it was when you were going to buy but you didn't because you thought it would go lower, instead it goes even higher. Now you think to yourself DAMN I've missed the move, and then wait for it to fall again. All the while the stock keeps trending higher as one would expect a good stock to do!

Firstly, this there is NO such thing as a missed market move! Because everything is always clear in HINDSIGHT! ACCUMULATE! Don't worry about what the price is doing at any particular point in time, it's just noise, instead ACCUMULATE! Keep your eye on the big picture. For instance I have been accumulating some XXX every year for the past 10 years! Regardless of where the price its trading i.e. every year I put money into my ISA's and Pension Fund and then INVEST that into the list of target stocks. Trying to time for a few extra percent is just a waste of time. YES, if the market takes a PLUNGE and presents one with an buying opportunity then TAKE IT, but don't try to time entries for individual stocks, because then you will likely fall foul of the "missed market move" syndrome and become stuck.

6. Dividend vs Buy back - Most will be aware that even some of the biggest tech giants don't tend to pay dividends. Instead what investors usually get are share buy backs that result in capital appreciation rather than income. So annual dividend payments should be seen as a bonus as the primary return is capital appreciation, in significant part courtesy of share buy backs. That also tends to act as support in times of falling stock prices, i.e. companies step in to buy their own shares because they deem them to be cheap. In terms of total returns, investors tend to do best in companies that regularly buy back their stock.

7. LIMIT RISK - Investing in the stock market is high risk! So investors should aim to minimise that risk, and one such way of doing so is to NOT to invest in SMALL and Medium cap stocks, where you will basically be gambling with your money. So if you have come here for a list of small cap get rich quick stocks then you will be disappointed. My investing objective is to maximise long-term returns whilst minimising risk to capital, which is why I don't have sleepless nights worrying about how my stocks portfolio is doing following the latest flash crash because I understand that the stocks I have selected have a very high probability of delivering in the LONG-RUN.

My Top 10 AI stocks are ranked in terms of risk vs reward and volatility. So I consider my Top 5 stocks as primary, then the next 3 as secondary and the last 2 as far more risky tertiary stocks. And remember that when investing in the stock market that your capital is at risk. There are NO SURE BETS!

The stocks analysis will follow in two parts (newsletters) stocks 6 to 10 first then stocks 1 to 5.

Note this analysis was first been made available to Patrons who support my work: https://www.patreon.com/posts/top-10-ai-stocks-25779914

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

SECONDARY STOCKS

6. FACEBOOK - FB

6. FACEBOOK - FB

You don't need me to remind you of who Facebook are and what they do. Personally, I have been skeptical of investing in Facebook right from its IPO in 2012, warning at the time that this stocks not a winner (18 May 2012 - FaceBook $100 Billion Internet IPO Emperor Has No Clothes, Investors Could Lose 85%) and for its first few years of trading I was proven right as the stock price collapsed to less than half of its IPO high, falling from $45 to $18.

However, after those first 2 years, the Facebook stock built a base and started a relentless climb higher to stand today as a tech giant heavily reliant on the development of Artificial Intelligence for it's success as Facebook has effectively embraced the advertising model for its primary business, in the management of its social media architecture, that and its acquisitions of a string of companies such as Whatsapp, Oculus, Instagram etc. having gone on $20 billion+ spending spree. Clearly today's, facebook is a lot different to the Facebook of 2012, so definitely makes it into my Top 10 AI investing list.

Facebook Financials

| Current Price | $166.8 | |

| Market Cap | $475bn | |

| Enterprise Value | $432bn | |

| Total Cash | 41.1bn | |

| Net Income | $22.1bn | |

| P/E Ratio | 22 | |

| Forward P/E | 18.8 | |

| Dividend Yield | ||

| Sales Growth | 37.4% | |

| Price to Sales Ratio (lower better) | 6.86 | |

| Price to Cash Flow Ratio (lower better) | 13.08 | |

| PEG Ratio (lower better) | 1.3 | |

| Debt to Equity (lower better) | 0.59 | |

| Stock Price 3 Year Change | 44% | |

| Ratio to S&P | 114% |

Nothing surprises me more about Facebook then the fact that it has gone from a loss maker to making profit of $22bn (2018). So I admit I was wrong to write off Facebook 7 years ago when I thought it would be lucky to make a profit of $1 billion per year, because where the internet is concerned everything is free so when speculation was rife that Facebook would seek to monetize itself through membership fees, I KNEW that would NOT WORK, and luckily for Facebook they never went down that route, instead have embraced advertising and selling of user data. Facebook profits and revenues are growing FAST which on P/E of 22 has Facebook fairly priced. Facebook's financials today are strong, that and its huge cash balance of $41.1bn definitely supports its continuing exponential expansion as it gobbles up other Tech stocks.

Trend - Facebook IPO'd in 2012 at just over $45, fell to $18 during its first year where it remained for another year, following which the stock began a relentless climb to its recent peak of $220. A huge ten fold increase for all who bought the stock during its first 2 years. However, as the 3 year chart shows FACEBOOK IS VOLATILE, having suffered a nose bleed dive from its 2018 peak of $220 to $120! You can't get much more volatile than that which is why I don't consider Facebook a primary AI investment, it's just too volatile for that status!

Long-term Investing - Despite its recent collapse Facebook is still up 44% and out performs the S&P.The stock is consistently experiencing strong earnings growth as it is leveraged itself to the machine intelligence mega-trend, therefore it is only a question of time before Facebook surpasses its $220 high and carries on into the stratosphere.

Conclusion - Facebook is definitely a AI machine mega-trend investing stock to hold as long as you are prepared to ride its roller coaster which on the plus side can from time to time generate buying opportunities as we witnessed during the past few months.

7. IBM

IBM or Big Blue as it used to be called is unfortunately prone to making huge blunders from time to time such as failing to realise that the real enemy was Microsoft not Apple! I bet few remember OS2 created for IBM by Microsoft well all that money paid to Microsoft to develop OS2 directly resulted in the far superior Windows operating system. And so Microsoft went on to BECOME IBM. Another blunder was failing to compete for the desktop PC's market because IBM was a mini computer company. Unfortunately the desktops put IBM's minis out of business and so IBM became history as since the early 1980's has consistently been a tech under performer. However, now AI may offer IBM the possibility of riding the machine intelligence mega-trend back to computing dominance as I am sure you will all have heard of Watson, IBM's Deep Mind AI project that has featured in countless TV appearances.

The thing is IBM is good in terms of big hardware projects and not so good in terms of software projects. Thus IBM could well be positioned to leap frog the rest via it's machine learning development projects such as IBM's cloud based Quantum Computing services basically making the development of smart phones and other smart devices obsolete as the processing power would be in the cloud rather than on the device.

So I am basically including IBM in my Top 10 AI stocks not because of its previous track record in delivering stock price gains but rather it has the potential to WIN the AI race via Quantum Computing. So bare that in mind when looking at it's past performance.

IBM Financials

| Current Price | $141 | |

| Market Cap | $125.6bn | |

| Enterprise Value | $159.6bn | |

| Total Cash | $12bn | |

| Net Income | $8.72bn | |

| P/E Ratio | 14.84 | |

| Forward P/E | 10 | |

| Dividend Yield | 4.45% | |

| Sales Growth | 0.6% | |

| Price to Sales Ratio (lower better) | 1.31 | |

| Price to Cash Flow Ratio (lower better) | 6.83 | |

| PEG Ratio (lower better) | 10.5 | |

| Debt to Equity (lower better) | 272.8 | |

| Stock Price 3 Year Change | 6% | |

| Ratio to S&P | 15% |

IBM Saddled with debt, virtually no sales growth, a crazily high PEG of over 10! On the plus side investors get a good reliable dividend yield. So basically it's current performance is not particularly bullish for the stocks prospects.

Trend - Again IBM's past performance has been abysmal, showing a gain of just 6% over the past 3 years! About 1/6th that of the S&P. And even what little growth there is has been is at great volatility that has seen the stock price fall from $168 to $100 before recovering to stand at $141. Furthermore the stock price trend is not particularly inline with the S&P. So IBM in technical chart terms does not look particularly appealing.

Long-term Investing - IBM's basically gone nowhere for the past 7 years! Even Warren Buffett gave up on his stake in 2018. So in terms of past performance IBM has failed to deliver. However that's ignoring the 4.45% dividend yield. So one should view IBM in terms of paying a decent dividend rather than on expectations for regular capital appreciation. It's just that it's got the potential to beat the rest. Otherwise you earn a small dividend.

Conclusion - In my opinion IBM is a low risk gamble. Your basically gambling that their Quantum Computing tech pays off. Otherwise you get to earn a dividend and maybe some capital growth. Obviously if you were only to buy ONE AI stock then IBM would NOT be that stock, but it is fine as part as a portfolio of stocks.

8. SAMSUNG - BC94.L

Here's one you were probably not expecting to make it into my AI list. However if I am including APPLE then I should definitely include the South Korean electronics giant Samsung that like Google, Amazon, Apple and the rest has embraced the quest to develop AI to implement across it's internet connected devices foremost of which are its pocket super computers such as the Galaxy range of smart phones. The current incarnation of Samsung's quest for AI is its Bixby intelligence assistant that Samsung is seeking to imbed in all of its products from TV's to fridges, ultimately an HAL 9000 in every home!

Samsung Financials

| Current Price | $979 | |

| Market Cap | $258bn | |

| Enterprise Value | $253bn | |

| Total Cash | $32bn | |

| Net Income | $40.5bn | |

| P/E Ratio | 6.3 | |

| Forward P/E | 6.2 | |

| Dividend Yield | 3.17% | |

| Sales Growth | -5% | |

| Price to Sales Ratio (lower better) | 3.42 | |

| Price to Cash Flow Ratio (lower better) | ||

| PEG Ratio (lower better) | 0.86 | |

| Debt to Equity (lower better) | 5.92 | |

| Stock Price 3 Year Change | 69% | |

| Ratio to S&P | 181% |

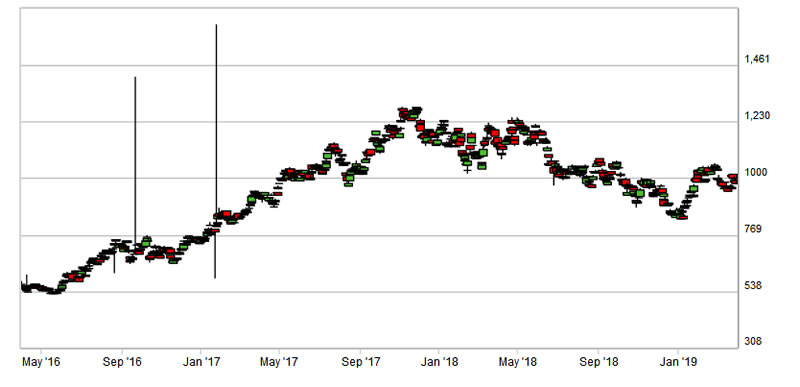

Trend - Samsung has been in a corrective bear market for the past 18 months since its peak in October 2017, falling from a peak of $1267. Nevertheless the stock is still up 70% for the past 3 years so still beats the S&P. Volatility is lower than most other AI stocks so gives ample time for investors to react to accumulate or distribute into. As a Korean stock it's obviously not going to track the S&P trend. Though importantly it does beat the S&P in dollar terms by a healthy 80% margin.

Long-term Investing - I akin Samsung to being a sleeping giant. At a P/E of 6.3 its AI potential is definitely not being priced in by the market. So whilst it may remain a sleeping giant, nevertheless it does pay a dividend in compensation and it does out perform the S&P over the long-run.

Conclusion - In amidst the volatiles are the calmer stocks such as Samsung, yes it may remain calm for many years but that's not so bad when one considers the volatility of the likes of Facebook. That and it's off the radar of most investors. So it may turn out to be one of those stocks that people wake up to in 10 years time and wish they had invested in it when it was trading at just 6X earnings when most would not touch it given its annual falling sales. And especially when one compares it to its smart phone competitor Apple which is trading at 15X earnings.

TERTIARY STOCKS

9. NVIDIA - NVDA

If your a gamer then you will have grown up with Nvidia graphics cards or GPU's. Whilst many will fail to make the connection between AI and a GPU chip maker, but NVidia has already gone well beyond its gaming origins for instance many emerging sectors require FAST GPU's such as self driving cars. NVIDIA basically got lucky, it's GPU's are well suited towards machine learning applications and so the company has been fast morphing towards becoming a retail applications AI company giving AI hardware to retail desktop users to plug into its GPU's as well as off the shelf solutions for small to medium sized companies. Already NVIDIA is touting Jetson an AI bolt on card for its GPU's for just $99!

Of course it's mostly a gimmick along the lines of those programming cartridges for the Atari games console 40 years ago that never really delivered what they were promising. Still a 472GFLOP card is a start, a precursor of what's to come and even that not being the first to do so, for the AI Tech front runner Google already announced it's AI kit priced at $150. Straightforward AI boards that plug into GPU's (graphics card) and off you go, your desktop computer is optimised for deep learning neural network applications! Though not at $99, maybe wait for AI cards that deliver hundreds of teraflops of processing power than NVIDIA Jetson's 472 gigaflops.

Of course it's mostly a gimmick along the lines of those programming cartridges for the Atari games console 40 years ago that never really delivered what they were promising. Still a 472GFLOP card is a start, a precursor of what's to come and even that not being the first to do so, for the AI Tech front runner Google already announced it's AI kit priced at $150. Straightforward AI boards that plug into GPU's (graphics card) and off you go, your desktop computer is optimised for deep learning neural network applications! Though not at $99, maybe wait for AI cards that deliver hundreds of teraflops of processing power than NVIDIA Jetson's 472 gigaflops.

This illustrates that NVIDIA is targeting it's AI products towards ordinary home computer users and small and medium sized companies application of AI, all without having to study a computer sciences degree for 5 years. Off the shelf easy to apply AI. Much as the myriad of desktop applications we have grown accustomed to such as spreadsheets and graphics software over the past few decades, so we will get used to using AI development environments courtesy of the likes of NVIDIA.

NVIDIA Financials

| Current Price | $180 | |

| Market Cap | $108.8bn | |

| Enterprise Value | $103.4bn | |

| Total Cash | $7.4bn | |

| Net Income | $4.14bn | |

| P/E Ratio | 27.1 | |

| Forward P/E | 25 | |

| Dividend Yield | 0.36% | |

| Sales Growth | 20.6% | |

| Price to Sales Ratio (lower better) | 8.54 | |

| Price to Cash Flow Ratio (lower better) | 26.74 | |

| PEG Ratio (lower better) | 3.92 | |

| Debt to Equity (lower better) | 21.3 | |

| Stock Price 3 Year Change | 500% | |

| Ratio to S&P | 1300% |

NVIDIA is clearly priced for fast growth, a high volatility AI play that has enjoyed huge growth over the past couple of years. Though sales at 20.6% could be stronger.

Trend - Looking at the stock price, the word bubble comes to mind! NVIDIA soared from about $30 to $290 in just 2 years!

Long-term Investing - Given the amount of volatility, NVIDIA is not really a long-term stock, not yet anyway, it needs to settle down, but for now it's basically a trading stock until it matures in its transition from a medium cap to a big cap stock. So NVIDIA is for those who are willing to entertain higher risk with greater potential.

Conclusion - Nvidia will definitely prosper as one of the drivers of the machine intelligence mega-trend. But I am reluctant to buy it given how volatile the stock price is i.e. it could easily halve in price as well as double over the coming year. Then there are the new entrants to the AI processor market who have taken note of Nvidia's success and so joining the market, most notable of which is INTEL. So it looks like Nvidia investors are in for an even bumpier ride. So perhaps a case of wait and see rather than to rush to accumulate this stock right now.

10. BAIDU - BIDU

Putting the war with China mega-trend on pause for the moment and considering China's Google. We all know that China developed at hyper speed courtesy of stolen western tech given China's army of hackers and stealers of corporate intellectual property. And well, so chinese companies such as Baidu (China's Facebook) get to develop without having to invest anywhere near as much in R&D as the likes of Google are doing. Baidu is definitely a significant competitor to Google in a whole spectrum of AI related sectors from search right down to self drive cars. In fact every time Google announces a new project, a couple of months later Baidu pops up with something similar. So why shouldn't we attempt to profit from it as well? Even if investing in Chinese stocks is higher risk given that China is a totalitarian state with far less transparency of what is actually going on under the corporate hood.

Baidu Financials

| Current Price | $164.8 | |

| Market Cap | $58bn | |

| Enterprise Value | $57bn | |

| Total Cash | ? | |

| Net Income | $4.15bn | |

| P/E Ratio | 13.9 | |

| Forward P/E | 13.9 | |

| Dividend Yield | ||

| Sales Growth | 23.2% | |

| Price to Sales Ratio (lower better) | 3.61 | |

| Price to Cash Flow Ratio (lower better) | 10.26 | |

| PEG Ratio (lower better) | 47.6 | |

| Debt to Equity (lower better) | 36.93 | |

| Stock Price 3 Year Change | -13% | |

| Ratio to S&P | -34% |

Baidu is quite indebted with apparently slow earnings growth. Though sales growth is strong.

Trend - The Baidu stock prices poor performance reflects the Chinese stocks bear market. The stock stands up just 18% in 3 year, under performing the S&P by 50%. Though it should be noted 9 months ago the stock was up 50% since which time it has been in a severe bear market. Given the drop from 280 to 165, one could say that the stock is cheap, though it could get cheaper yet.

Long-term Investing - Baidu 'should' prosper from the machine intelligence mega-trend which ultimately means Baidu is set to target and break its previous high of $280 set about 9 months ago.

Conclusion - Baidu is a more risky AI play, but on the plus side it's outside of the US TEK basket of stocks so offers AI portfolio diversification. In terms of its poor performance during the past few years, we'll that reflects the chinese stocks bear market, and given that one of my investing rules is to accumulate when markets plunge then Baidu trading at $165 looks like a classic long-term buying opportunity even if the stock is riskier than most on this list.And there you have it my top 10 AI stock picks for long-term investing exposure to the machine intelligence mega-trend.

The Top 5 stocks will follow in the next newsletter. Again this the whole of this analysis has first been made available to Patrons who support my work: https://www.patreon.com/posts/top-10-ai-stocks-25779914

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.