Stock Market Expensive: Traumatic Correction Approaching

Stock-Markets / Stock Markets 2019 Jul 31, 2019 - 10:24 AM GMTBy: QUANTO

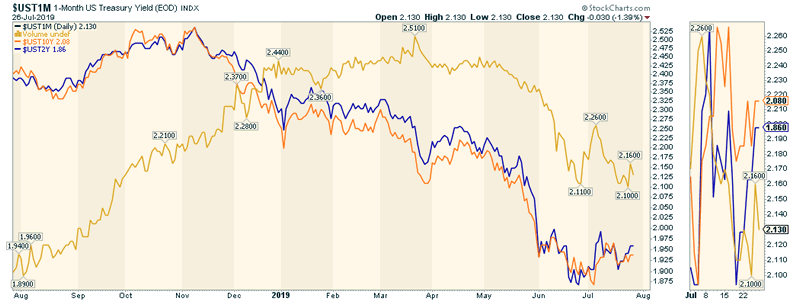

As S&P climbs to new highs and closes another week into 3000s levels, we believe that the ground underneath is starting to slip. The economy per say may not be the problem. However the same cannot be said about valuation. The S&P500 is valued over 100% to its traditional mean and median levels on price to earning ratio. The one month treasury yield is now above US 2 year and 10 year yield thus effectively inverting. Money is often borrowed in the short term markets. A rise in short term rate is a warning signal of the coming mayhem. Rising yield will force models to reset after certain threshold are hit and this automatically converts into equity market cash outs. This sets of a chain reaction as sell momentum can spread across.

As S&P climbs to new highs and closes another week into 3000s levels, we believe that the ground underneath is starting to slip. The economy per say may not be the problem. However the same cannot be said about valuation. The S&P500 is valued over 100% to its traditional mean and median levels on price to earning ratio. The one month treasury yield is now above US 2 year and 10 year yield thus effectively inverting. Money is often borrowed in the short term markets. A rise in short term rate is a warning signal of the coming mayhem. Rising yield will force models to reset after certain threshold are hit and this automatically converts into equity market cash outs. This sets of a chain reaction as sell momentum can spread across.

THe current S&P earning yield is 4.5% down from 6% thus contracting the returns investors make. This becomes even worrying when the short term yield is closing in on the earning yield at its fastest pace in over 10 years. We believe traumatic correction is on its way.

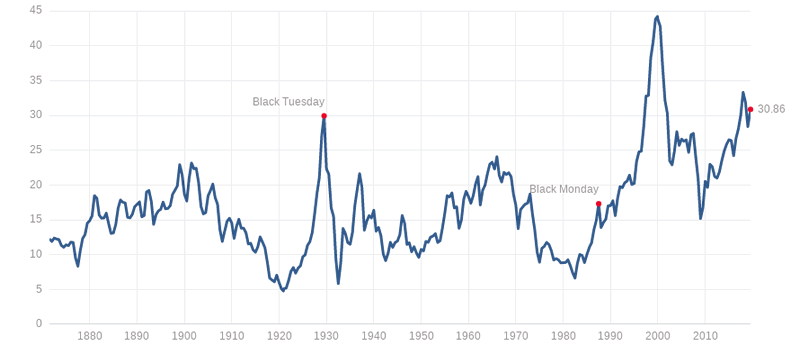

PE Ratio

Current Shiller PE Ratio: 30.86x is at the top end of the range. The mean has 16.64 and median at 15.73 suggest that the market is nearly 100% overvalued. The premia enjoyed by investors is astounding and how long will it last is just a matter of speculation. The black monday 1980s crash was at 18x while the black tuesday of 1930 was at 30.4x which is precisely where the index is currently. Mean: 16.64 Median: 15.73 Min: 4.78 (Dec 1920) Max: 44.19 (Dec 1999)

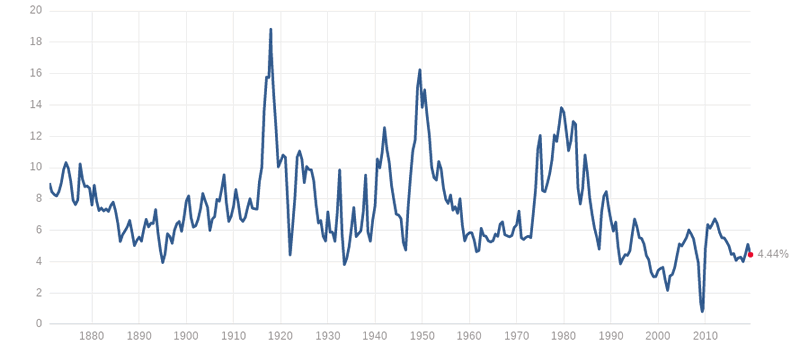

Earning Yield

The earning yield at 4.44% is in a downward spiral. Despite the good earning reported, the yield is much lower and thus will affect future attractiveness of equity over bond markets. Mean: 7.35% Median: 6.7% Min: 0.81% (May 2009) Max: 18.82% (Dec 1917)

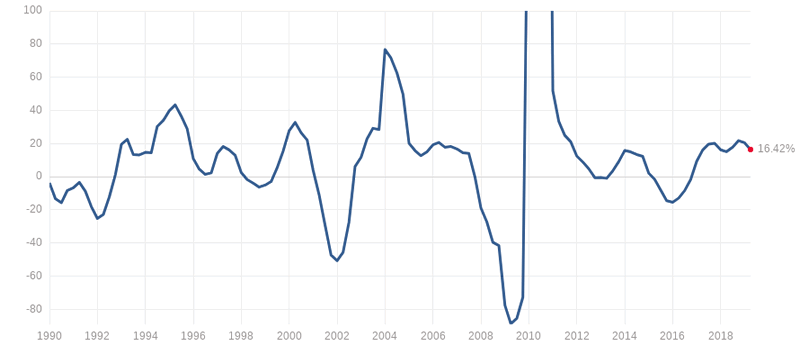

Earning Growth

Current S&P 500 Earnings Growth Rate: 16.42%. Mean: 24.46% Median: 12.54% Min: -88.64% (Mar 2009) Max: 793.48% (Jun 2010)

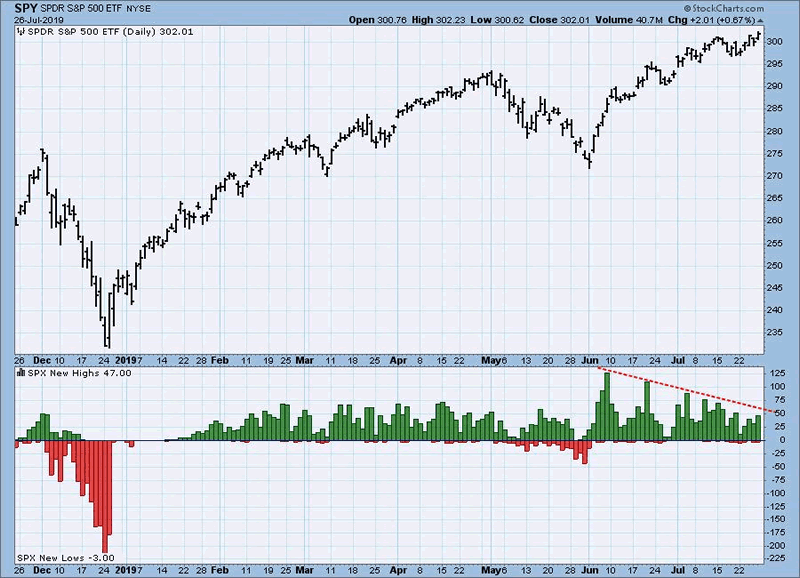

Warning signs: New highs is lagging

S&P new highs is falling even as index is making a new high. This is a sign of poor health as individual stocks are not being bought even while money flows to the index possibly as portfolio flows or hedging flows.

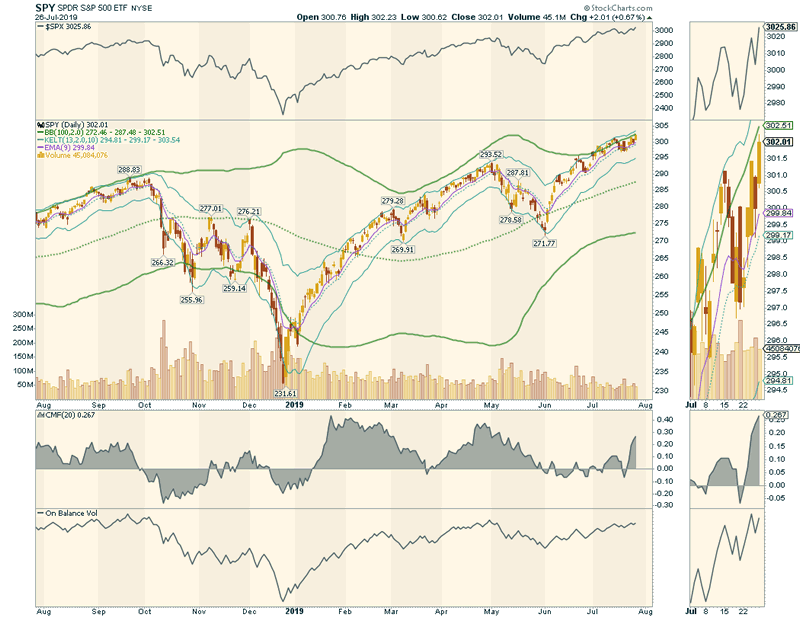

SPY Daily

The daily trend is on a accelerating uptrend with prices above the 9DAY EMA. A break under 2990 will be the first sign of a impending down move.

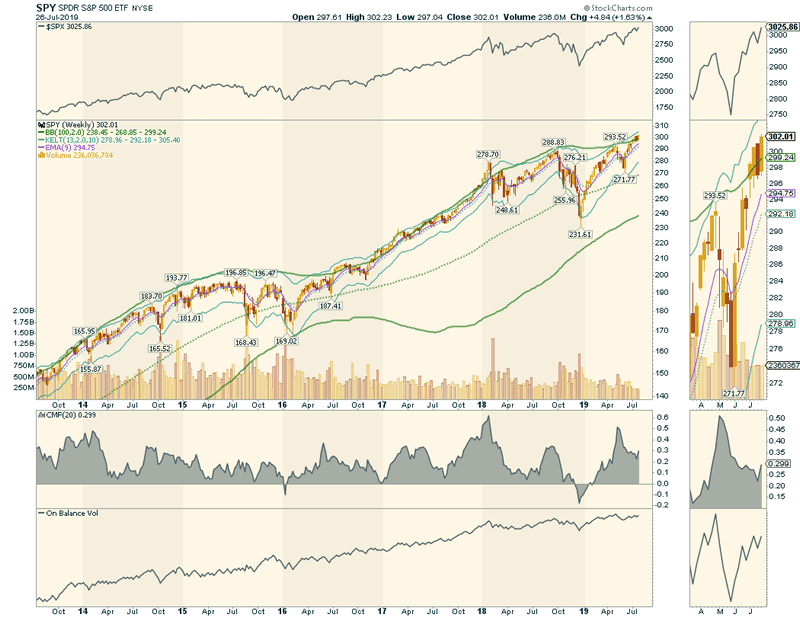

SPY Weekly

The SPX weekly is at new highs but extremely overbought.

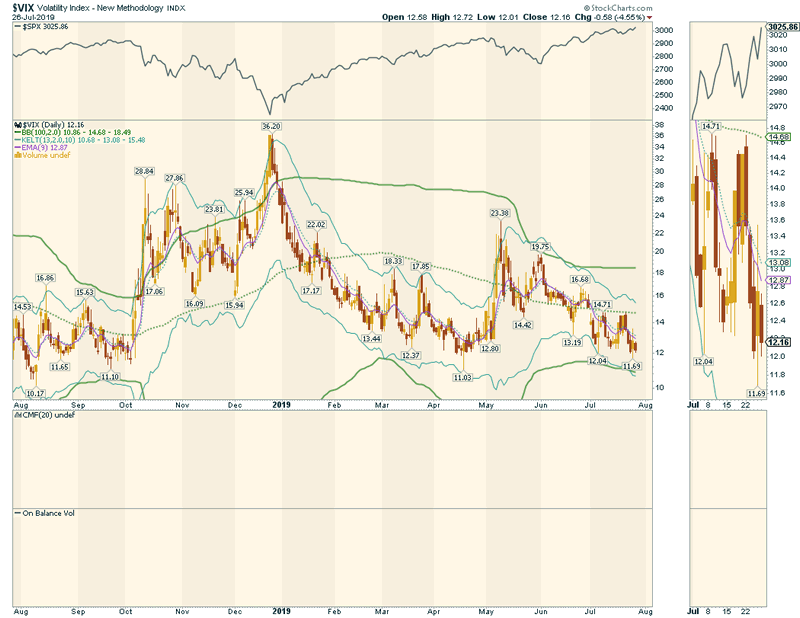

VIX: Calm waters

VIX is under 15 and below the 100 DMA. No major panic seen in option market. Any jump over 20 mark will mean that nervousness has started to creep in.

Interest Rate Inversion is a big risk

The 1 month us yield is more than the 2 year and 10 year yields. The 1 month has been rising all thru 2019 and this could escalate into a major model reset as funds which borrowed lower to invest high yield equity markets will start forced liquidation. This is how all bear markets start.

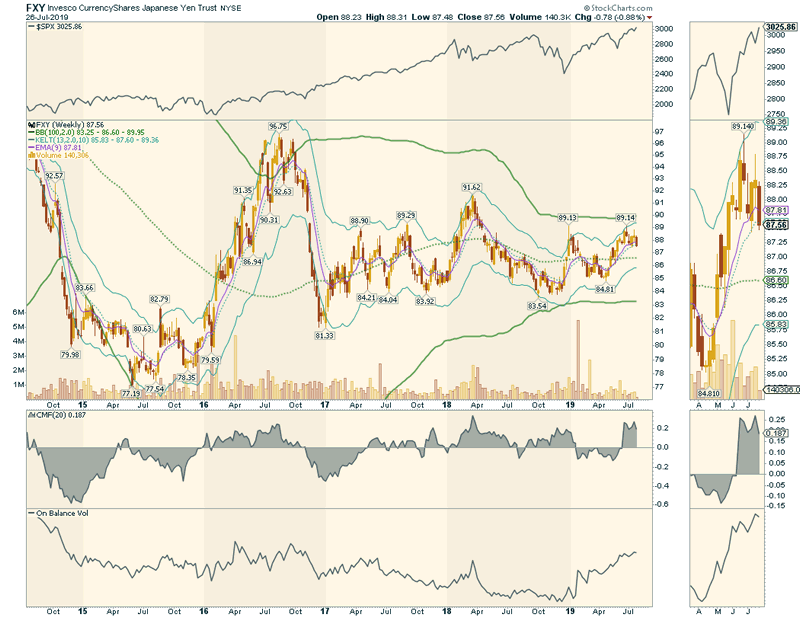

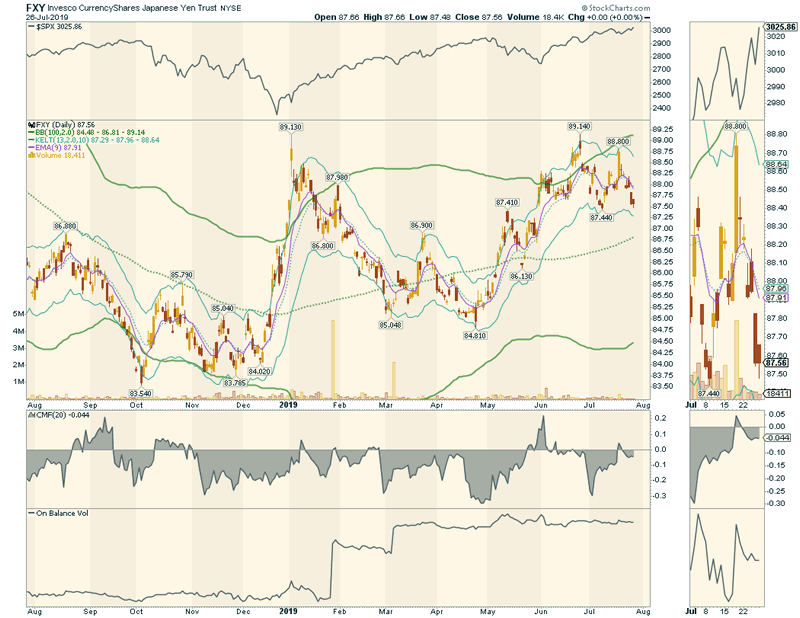

Yen weekly

Yen ETF

The japanese ETF has stayed at 87.5 levels. A rise in yen is seen as approaching risk aversion. The weekly chart show it is breaking the uptrend line from 2018.

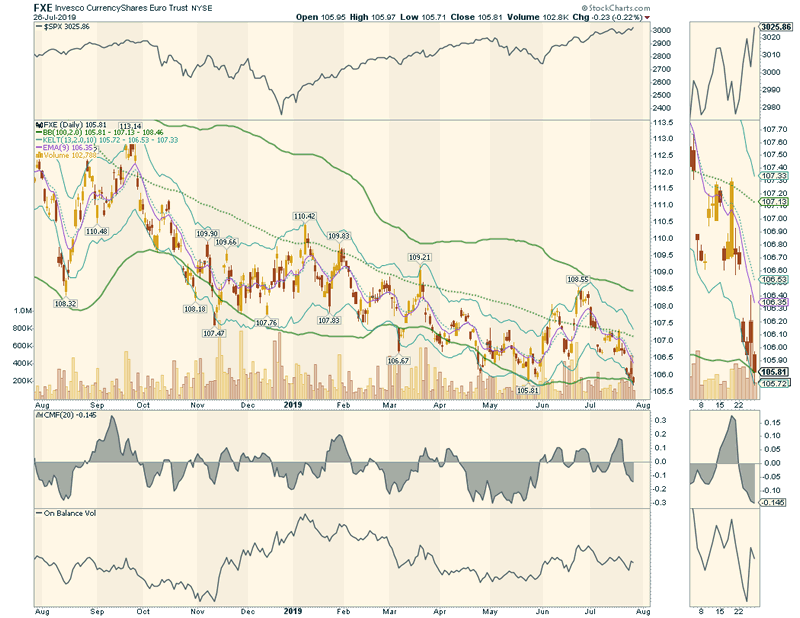

FXE EUR ETF

The EUR etf is breaking to new yearly lows. The ECB potential QE and downbeat inflation has contributed to EUR weakness.

Quanto TradeCopier

Market timing is never easy. While we lay out the scenario which will play out, it is always better to allow a automated trading system to trade markets and make wealth. The trade copier run by us has now made over +65% since launch in May. The DD has been limited and July has made over +23% return

Weekly returns since start of copier

On an average, it makes abput +5%. This week it made +3.5%.

Cumulative pip growth

Not only is the returns being added, the pip value is continually rising. This will comfort you that this is not a grid system as each trade is being added to the pip value with no major losses. No averaging.

Cumulative returns

Cumulative returns have crossed +65%.

QUANTO is a trading system which combined Market Profile Theory and Kletner channels. It is hugely profitable. There was a trader back in If you would like to start right away, please contact us. Our email: Partners@quanto.live

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.