What's Next for Crude Oil Price Trend Forecast

Commodities / Crude Oil Mar 13, 2020 - 09:25 AM GMTBy: Chris_Vermeulen

When it comes to our Adaptive Dynamic Learning (ADL) predictive modeling system, we get asked questions from our friends and followers about how it could predict a virus event or how it could predict a price event so far out into the future. The truth of the matter is the ADL predictive modeling system doesn’t predict unknown virus, banking or other types of events.

What it does do, quite well we might add, is identify historically accurate price events (almost like unique DNA markers) and attempts to identify future price events that align with recent price bar (DNA) setups. In other words, it maps the markets highest probability outcomes by studying past price activity and using a unique DNA-like mapping system. Once this analysis is complete for any chart, we can ask it what is likely to happen in the future.

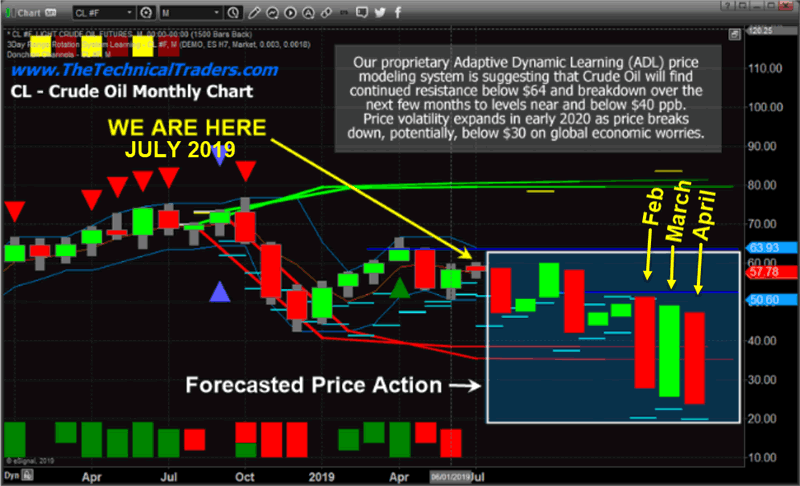

On July 8, 2019, our researchers did exactly that and posted an article regarding our findings that many people continue to write us about. Some, at first, in total disbelief that Crude Oil could fall to levels below $40 ever again and others that wanted to know how we came up with these numbers. We set our ADL system to show us what is expected on a Monthly Crude Oil chart going forward and it draws the likely outcome and volatility (highs & Lows).

Here is a link to the original article: https://www.thetechnicaltraders.com/predictive-modeling-suggest-oil-headed-much-lower-by-early-2020/

This screen capture from the original July 2019 article clearly states…

If our ADL predictive modeling is correct, we will see rotation between $47 and $64 over the next 3+ months before a breakdown in price hits in November 2019. This will be followed by two fairly narrow price range months (December 2019 and January 2020) where oil prices will tighten near $45 to $50. After that tightening, we believe an extremely volatile price move will happen in February through April 2020 that could see oil prices trade as low as $22 and as high as $51 over a two to three-month span.

The most critical component of this early research is the statement we have timed perfectly with our system was “we believe an extremely volatile price move will happen in February through April 2020” and the following price predictions.

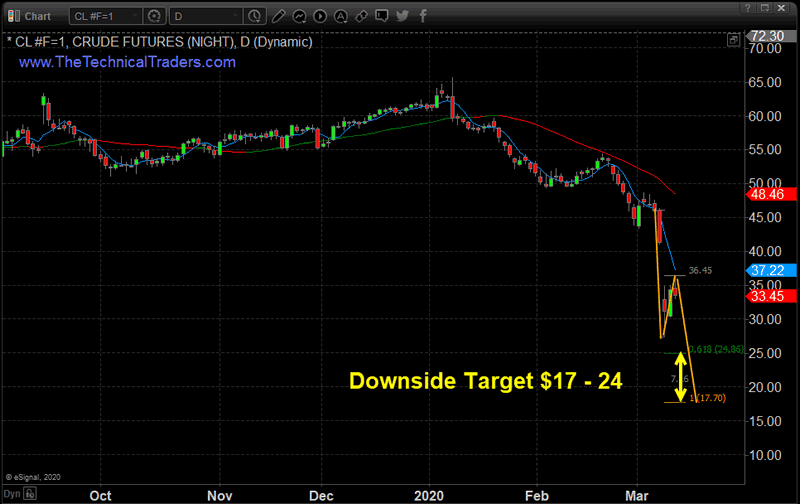

The ADL predictive modeling system provided us with a hint that volatility would skyrocket throughout this time in Crude Oil. And, as we all know, this next Daily Crude Oil chart highlights the incredible collapse from early January 2020 (near $65.00) to levels just below $50 in early February. After that, the high price level was near $54.50 and the current low price level is $27.34. We believe this downward price rotation in Crude Oil completely validates our earlier ADL predictive analysis.

Imagine having this type of forecast for our trading and investing! Be sure to opt-in to our free market trend signals newsletter before closing this page so you don’t miss our next special report!

What’s next with the price of crude oil?

Based on short-term Fibonacci price momentum targets we could see fall as low as $17 per barrel, but this price target will change dramatically over the next few days depending on if oil bounces higher from here it is now.

If our research is correct, Crude oil may find a bottom somewhere near $17 to $24, the potential rally back up to somewhere above $37~41 ppb before staging another massive selloff. The massive volatility suggested by the ADL system also suggests a broad price range over the next 60+ days.

Thus, we believe Crude Oil will attempt to form a bottom below $30, then attempt a brief rally to “fill the gap” (or partially fill the gap). After that, supply-side economics will take over and Crude Oil should begin to move back towards the to $30 price level again – just as our ADL predictive modeling system suggested.

As of today, we are getting dozens of emails asking about what we see for the US major markets and global markets with our systems. Everyone wants to know “what’s next?”. Most of that research is delivered to our active subscribers/members and you can gain access to that information simply by visiting my website. You really don’t want to miss these next huge moves.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.