AI Mega-trend Tech Stocks Buying Levels Q2 2020

Companies / AI Jun 01, 2020 - 11:52 AM GMTBy: Nadeem_Walayat

Perceiving Coronavirus as a Disruptive Technology

The 'scientists' say that viruses are not alive. We'll for something that's 'technically' not alive it sure does behave like it is! Perhaps just as scientists will deem AI to be 'not alive' all the way until they take all of the jobs.

So lets leave the academic world behind, for their moronic obsession's has gotten us into this mess, certainties of solutions adopted by the likes of the UK and US to achieve 'herd immunity' when commonsense would have served our nations far better that of isolating and quarantining all those even suspected of being infected! Such as every flight entering the UK from virus infested China during January and February.

The whole of this extensive analysis was first made available to Patrons who support my work: AI Mega-trend Stocks Buying Levels Q2 2020

- Stock Market Trend Forecast Summary

- Britain's FAKE Coronavirus Death Statistics Exposed

- Implied Case Fatality Rate

- United States Coronavirus Trend Trajectory Update

- Perceiving Coronavirus as a Disruptive Technology

- The AI Mega-trend

- When to Sell Your AI Stocks

- AI Mega-trend Stocks Buying Levels Q2

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Instead lets focus on what the coronavirus has achieved which is lockdown's of whole nations, traditional industries in a complete state of collapse which regardless of size have seen production seize and sales evaporate. However, there are some corona winners and those are the beneficiaries of disruptive technologies which is the tech sector.

Amazon, Google, Facebook, Twitter, Apple and so on are prospering from them the disruption of the 'real' economy as the economic world temporarily splits in 2, the 'real' world and the 'cyber' world.

The disruption of the real world is a trend that has been in motion perhaps since the early 1970's when the first microprocessors started to appear where Moores law warned of where this would ultimately lead to that of machine workers replacing human workers, be those machine workers robots, or machine learning algorithms that were already starting to replace the highest of professions going into the Corona catastrophe.

This exponential trend of machine intelligence gradually replacing human intelligence is nothing new for I have been writing and posting articles and videos on the subject for a good 5 years as this video from 2016 illustrates.

Where the only solution I could see for us mere mortals to survive the coming Quantum AI storm is to OWN the technologies, for which we have 2 strategies -

Firstly, to own stocks in key AI Mega-trend drivers that have the greatest probability of achieving superiority in an Quantum AI, which has been the focus of my AI Mega-trend investing series of analysis towards which the 1/3rd across the board collapse in stock prices was seen as perhaps a once in decade opportunity to get on board this mega-trend courtesy of the coronavirus disruption.

Secondly, to immerse oneself in AI technologies, so that one can actually understand and be able to program machine learning. Which in today's age is infinity easier to do given the myriad of development platforms that have emerged over the past decade than when I first approached the subject some 22 years ago! That and today's desktop computers are exponentially more powerful.

Still, for most it's a case of learning what machine learning is, and what AI could become, for we mere mortals lack the critical component of Quantum Computing, so unless one hits lucky in ones application of machine learning, tinkering with AI on your desktop is not going to get you rich so the primary focus should be on investing in the deep pocketed AI tech corps such as Google, IBM, Intel, Amazon etc... who have hundreds of billions at their disposable to drive the exponential trend towards the explosion moment when the Quantum AI is born.

So the Coronavirus has helped us in 2 respects.

1. Accelerated the size, scope and certainty of the cyber mega-trend.

2. Resulted in panic that has driven down the stock prices of those corporations that are actually PROFITING from the corona collapse, case in point being Amazon that has typically jacked up prices by 10% to 20% as have bricks and mortar supermarkets.

The corona disruption should also act as a wake up call to the 80% sat at home having 80% of their salaries being paid to them by the government because you are deemed not to be a key workers. For THIS IS the future for MOST workers!

And where today's workers in the UK are in receipt of a 80% subsidy, in the not to distant future all adults at least will receive a universal basic income that will likely be a fraction of what most professionals earn today which will ensure a widening gap between the rich, those who OWN the AI and the rest of society who will no longer even be necessary as slave workers due to AI having made most, perhaps 80% of workers obsolete that the governments will only be able to contain the consequences of i.e. a collapse of societies into anarchy through means of universal basic incomes.

Though the problem is as we are already seeing with the corona collapse, that if most people are paid for doing nothing then that results in a surge in REAL inflation which for most Brit's is already 10% to 20% rise in prices that WILL NOT BE REFLECTED in the fake official inflation statistics! But everyone will be experiencing when they go to do their weekly shops in supermarkets that already limit what people can buy with their unearned fiat currency.

So it does not matter the amount paid as a basic income, real prices will always rise to erode the value of unearned incomes that ensures a lower standard of living for those wholly reliant on basic universal incomes.

The AI Mega-trend Stocks Investing - When to Sell?

Amidst such prevailing doom and bloom just remember that the AI mega-trend is one of the most powerful mega-trends of our time, maybe even more so than the climate change mega-trend because the AI mega-trend could change the very nature of our reality.

Which is why I have been repeatedly warning for 5 years to PREPARE FOR EVERYTHING TO CHANGE!

We can guess at what is to come but the only way we mere mortals can have a piece of the AI pie is through owning the AI stocks. For which we still have some time to get invested into, maybe several years before the two exponential curves of AI (machine intelligence) and Quantum computing converge and then literally EXPLODE!

Maybe 8 years away? Maybe 15 years? It's hard to say when the explosion of convergence will happen BUT the closer we get the more that future will be discounted by stock prices.

Which is one of the primary reasons the AI stocks have recovered most of their Corona panic declines, dragging the general stock market indices up with them, whilst many other sectors have barely nudged from their lows given the dire economic consequences of the Chinese virus.

And as I stated a couple of weeks ago, the only real risk I see on the horizon for our stock holdings are severe windfall taxes levied on the tech sector that instead of suffering is profiting from the global pandemic following the mad dash to do everything online.

The bottom line is that things are NEVER going back to the way they were, many sectors of the economy will be downsized or completely cease to exist, whilst other sectors are already booming and it is that sector we want to be exposed to - AI tech stocks!

When to Sell Your AI Stocks

I get many comments asking when to sell the AI stocks given the sharp rallies over the past 6 weeks so as to capitalise on their gains. Which in my opinion defeats the whole point have having invested at deep discounts for 20-30% or so gains from March purchases, which is trading stocks rather than investing and in my opinion is nothing compared to what is to come, for instance imagine all those who bought Amazon at say $1700 and then sold it at $2000, and now are regretting doing so at $2375, hoping that it will fall to $2000 again so they can buy back in, which just illustrates investors in the AI mega-trend need to adjust their mindset.

a. TIME which is to be invested in for YEARS, and likely more than a decade, that's not to say AI stocks are not likely to rise by double digits most years but you want the acorns to grow into a HUGE Oaks!

b. The AI trend is EXPONENTIAL which means the stock price accounting for splits should be heading exponentially higher than where ever it trades this year.

So personally I am not even thinking of selling any AI stocks, instead my mindset is focused on trying to buy more, and this is AFTER having increased my exposure significantly during March!

Anyway lets see if we can get lucky with more discounting ahead before most of the AI stocks follow Amazons lead and trade to new all time highs.

AI Mega-trend Stocks Buying Levels Q2

If you have taken one message away thing from my articles during the Coronavirus bear market then it should have been that this Coronavirus stocks bear market is presenting investors with a BUYING OPPORUTNTY OF A LIFE TIME in AI stocks! For instance in my analysis of 16h March I wrote: US and UK Coronavirus Containment Incompetence Resulting Catastrophic Trend Trajectories

Remember that whilst the current spread of the Coronavirus may be exponential, so is the AI mega-trend. And who do you think is going to profit from the current crisis? Amazon, Google, Facebook, that's who! i.e. the coronavirus is reinforcing the importance of the virtual world.

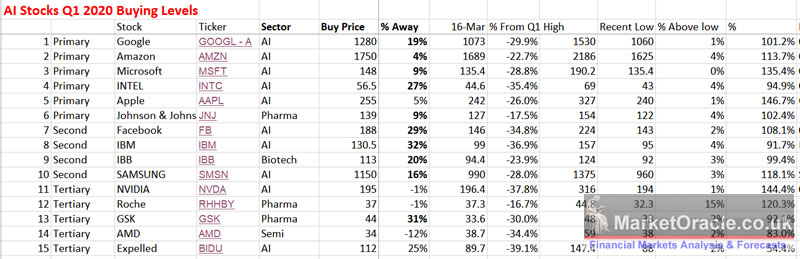

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The recent panic sell off also acts as an important indicator of underlying relative strength of Apple and Amazon. One would have imagined that these two stocks having greater exposure to the real world than the virtual world would have faired worse then the likes of Google, i.e. being disruptive to Apples production of iphones and Amazon's supply chains. But no, so far they are showing that the market is already starting to discount recovery for these two stocks. And if one thinks about it then it makes sense that China will lead the V shaped economic bounce back by a couple of months ahead of the West, and thus improve the prospects for Apple and Amazons supply chain.

That and so many people choosing not to risk catching Coronavirus will increasingly put greater demands on Amazon for all sorts of goods and services.

This analysis will now seek to update potential buying levels for AI stocks during Q2 of where stocks could trade down to in terms of technical support levels during the anticipated general stock market correction of about 15% that should be imminent.

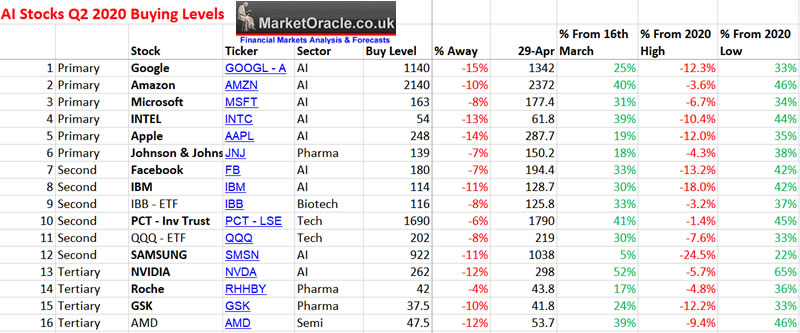

Top 5 AI Stocks are all primary, the ordering of which is arbitrary for instance of the 3 Google, Amazon and Microsoft it's a toss up of which comes first. For instance If I was compiling the list today then I would likely put Amazon at No1 ahead of Google. So keep in mind that the rankings are more in terms of primary, Secondary and Tertiary rather than their number order.

1. GOOGLE (Alphabet) - GOOGL (Class A)

Google had a spectacular bull run to it's 2020 high of $1530 before giving ALL of it away in the Corona collapse of 2020, falling to a low of $1008, a drop of about 35% which has been followed by a rally of about 35% to $1360, recovering 66% of the decline to currently trades at what I would consider fair value for this stock. For remember that $1530 was EXPENSIVE for Google as at the time I repeatedly stated that I would not consider buying Google unless it fell below $1280.

The Google stock price has hit and breached resistance on multiple levels, so is trying to go higher, but it's not cheap or expensive, so should resolve lower in line with the general market. A 15% drop here would take it to $1140 which coincides with the technical level of $1150. Therefore Google during the anticipated correction should be targeting a trend to sub $1150 that could range down to $1080. So I would expect it to trade at a Buying level of $1140.

2. AMAZON (AMZN)

I am sure you are all probably aware that if there is one tech giant that was going to profit from the Corona catastrophe then that would be AMAZON! In fact I have already warned not to waste time dithering on whether to buy this stock because I was pretty certain that the stock would soon trade to all time highs given that Amazon is likely heading for record profits all whilst most companies are in state of paralysis or worse have descended into the corona black hole that could see them all but evaporate by the time the lockdown's end.

Patrons have had plenty of chances to buy Amazon, for instance at $1689 in my update of 17th March. Then at $1940 in my update of 30th March, when i warned that the stock would within a few short weeks be trading at NEW ALL TIME HIGHs!

30th March 2020 - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

The bottom line remains, the Coronavirus continues to present a buying opportunities of life time in AI Mega-trend stocks, whilst it will clearly take some time for the general stock market indices to recover to anywhere near their all time highs. However, I would not be surprised to see financial press headlines in a few weeks time stating that the Amazon stock price just set a new record high with many of the other stocks on this list not far behind.

So I continue to view any market PANICS during April as BUYING OPPORTUNTIES. As I continue to view this coronavirus stocks bear market in AI stocks at least as being TEMPORARY! Which is being reflected in the likes of Amazon now just 11% away from their Q1 high. SO BUY FEAR! And given the current Coronavirus trend trajectory there's likely to be many more fear opportunities ahead against this we have investors increasingly starting to wake up and start buying AI stocks on this list which means don't waste time waiting for dips, scale in because the trend trajectory for most of this stocks on this list is towards new all time highs, this year!

I am pleased to report that Amazon is now trading at $2372, down from a recent new all time high of $2461!

So is it too late to buy Amazon?

The bottom line where stocks are concerned is EARNINGS GROWTH, and Amazons earnings growth is EXPONENTIAL! As this mega-corp capitalises on not just the corona crisis but continues to expand into cloud computing services via its Amazon Web Services.

So if your thinking it's too late to buy Amazon then again check your mindset in the way you are approaching these tech giants that are on exponential trend trajectories.

In fact Amazon's trend trajectory could see the stock trade to a high of $3000 THIS YEAR! Remember folks the bottom line is EARNINGS growth and Amazon's earnings are expected to continue to rocket higher! So I would not be surprised if Amazon hits $3,000 this year! On route to $5000 over the next few years which puts into perspective when one compares $2362 to $1940 of a few weeks ago.

The only fly in the ointment is as I covered several weeks ago is a possible windfall tax that could be levied on the tech giants that have profited from the corona catastrophe that if your lucky just may give you another bite at the Amazon cherry, but we are unlikely to see the likes of Mid March lows again!

(Charts courtesy of stockcharts.com)

The amazon stock price has recovered ALL OF the Corona Crash, rising by 51% from it's March low of $1626. Pushing it's way to a new all time high of $2461. A 15% drop would take the stock price down to about $2040 which coincides with previous resistance levels, though its going to be tough getting there as there is strong support at 2185 that could hold any decline. So this analysis is resolving to a wide Buying range of between $2185 and $2040 depending on whether the level breaks or not on to what extent. Therefore this analysis concludes in a Buying level of $2140.

Whilst there does not appear to be much downside for Amazon, however there is still a lot of upside. Especially if the stock price gets anywhere near achieving $3000 this year!

3. MICROSOFT (MSFT)

Microsoft faired a lot better than Google during the Corona crash by barely trading down to where it was 6 months earlier to it's March low of $132.5, a decline of 30%. With the subsequent rally adding 36% to a high of $180. Whilst a 15% drop off it's recent high would take Microsoft down to $153 which is probably the lowest we could expect Microsoft to trade down to.

Microsoft likes to trend, which gave clear warnings early 2020 that it had over extended itself and also then again in March that it was over sold. Current price action has taken Microsoft towards the top of it's trading channel. With the bottom currently around $162. So there does not appear to be much downside to Microsoft. The chart is suggesting to me it's unlikely to trade below $160 and if it does is going to be very temporary. Therefore this analysis resolves towards an achievable buying level of $163 as any lower has a much lower probability of success. The stock is too strong and too technical in it's trading to give another free lunch like March 2020.

4. INTEL (INTC)

INTEL is an EASY stock to get invested in as it has given countless opportunities to accumulate at sub $50. The Corona crash saw the stock trade down to $43.63. Those looking to buy had NO EXCUSES for not doing so! CLEARLY there was no more downside given the string of support levels that run from $42 to $48, where any price in that range is a great price to accumulate in this Chip giant that is increasingly incorporating AI INTO it's microprocessors whilst also working on Quantum computers.

The stock price fell by 37% and then rose by 43%. Whilst a 15% drop would take Intel down to $53. Support is at $56, $58 and then $53. So it looks highly probable that the stocks going to find it difficult to trade below $53. Therefore the expected range for Intel is $56 to $53, with the Buying Level thus $54.

5. APPLE (AAPL)

The Apple stock price had run away with itself to £327, well beyond my Q1 buying level of $255. At the time it seemed impossible that this stock would ever trade down to $255 for which it would take a catastrophic event the likes of which not seen for a decade. Cue the Corona catastrophe that saw Apple dance with $255 for several weeks before finally swinging to a low of $212.6!

This is another stock exhibiting symmetry i.e. fell by 35% to $212, then rose by 36% to $288. A 15% drop would take Apple down to $245. The stock chart shows a major support zone in the region $235 to $260. Whilst it's primary trading channel extends to between $230 and $330. In terms of determining a Buying level the stock looks like ranging down to between $238 and $258 and thus targeting a buying level of $248.

6. J&J (JNJ)

J&J is the first outlier on my list, a secondary AI stock but a primary stock in it's sector - Big Pharma that AI will revolutionise as I covered in my analysis Mid 2019 so won't repeat. My Q1 buying level for J&J was $139, which was set against it's January high of $153.5 which the Corona catastrophe delivered on and more as the price plunged to just $109!

This was one of the BEST PANIC PLAYS! They were SELLING / MARKING DOWN A PRIMARY BIG PHARMA STOCK THAT WAS PRIMED TO CAPATLISE ON THE CORONA CATASTROPHE!

Then it appears the market woke up and realised the magnitude of it's ERROR and duly marked the stock price higher! Sending it soaring by 44%% to a NEW ALL TIME HIGH.

In terms of a buying level, 15% off $157 would take J&J down to $134. Whilst the range of possibilities is from $132 to $142, though I am inclined to stick with my original buying level of $139 as being most probable achievable so I expect it to show relative strength against the general market.

And those are the 6 primary stocks on my list.

Brief mentions:

7. FACEBOOK (FB)

Facebook should really be elevated to primary given the amount of data this corporation has on everyone in the West and data is the new Black Gold! Facebook algorithms only need users liking about 100 things on their platforms to determine many aspects of ones personality to the extent that they can predict what you are likely to do such as who you would vote for in elections. All of which is deduced from knowing your favourite movies, songs and books! So becareful what you like on Facebook!

8. IBM

Unlike most of the above AI stocks, for IBM we are betting on the future, one of Quantum AI. Let's hope IBM have learned their lessons from earlier decades and capitalise on it unlike when they handed the IBM PC O/S market to Microsoft. Which so easily could have turned out to be just a division of IBM.

And here are all of my updated buying levels for all of the AI stocks on my list. Where I now include the 2 tech funds I mentioned during March, QQQ for US investors and PCT for the UK. Though remember that my preference is always to invest in the underlying stocks because the more removed one is from the underlying stocks then the greater the risk of something going wrong for instance funds tend to deviate to an extent against the underlying assets, usually to the downside, as happened to most funds during the March sell off. Also there is the risk that the fund goes BUST! And that they tend to invest in too many stocks as I only agree with about half the stocks these funds are invested in.

Disclaimer: I am personally invested in all of the stocks in bold.

The bottom line is that you need to PAY ATTENTION TO WHAT IS HAPPENING TO THESE STOCKS! Which whilst everything else is suffering these stocks are MAKING and TRENDING towards NEW ALL TIME HIGHS! That should be SCREAMING to you to LISTEN to the AI MEGA-TREND and act accordingly. So sorry, we are extremely unlikely to be able to pick up the likes of Amazon for $1700 again. Instead to bite the bullet and get exposed to the AI MEGA-TREND else you will be regretting not buying in some months time when the likes of Amazon is trading at $3000!

And finally whilst we wait for the likes of Google, Amazon, IBM and Facebook to develop usable mechanical quantum computers. here's an example of how I used my quantum computer to interpret the unfolding corona trend deviations against which warned of the forthcoming corona catastrophe.

In my next analysis I will take a look at Gold and / or Silver, and then the UK and US housing markets for potential corona depression buying opportunities.

The whole of this extensive analysis was first made available to Patrons who support my work: AI Mega-trend Stocks Buying Levels Q2 2020

- Stock Market Trend Forecast Summary

- Britain's FAKE Coronavirus Death Statistics Exposed

- Implied Case Fatality Rate

- United States Coronavirus Trend Trajectory Update

- Perceiving Coronavirus as a Disruptive Technology

- The AI Mega-trend

- When to Sell Your AI Stocks

- AI Mega-trend Stocks Buying Levels Q2

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst reminding all not to let their guard down due to corona fatigue, as a 3.5% CFR warrants continuing caution.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.