Stock Market Crash Chart Price Pattern

Stock-Markets / Financial Crash Oct 11, 2008 - 08:33 AM GMT

“I set a watchman over you, saying, ‘Give heed to the sound of the trumpet!' But they said, ‘We will not give heed!' Therefore hear, O nations, and know, O congregation, what will happen to them. Hear O earth; behold, I am bringing evil upon this people, the fruit of their devices , because they have not given heed to my words; and as for my law, they have rejected it.”Jeremiah 6:17

“I set a watchman over you, saying, ‘Give heed to the sound of the trumpet!' But they said, ‘We will not give heed!' Therefore hear, O nations, and know, O congregation, what will happen to them. Hear O earth; behold, I am bringing evil upon this people, the fruit of their devices , because they have not given heed to my words; and as for my law, they have rejected it.”Jeremiah 6:17

This chart has been on my desktop since April, when the Dow Jones fulfilled its first head and shoulders pattern. I have showed this chart to all of my clients at one time or another. Most simply shrugged their shoulders and immediately forgot what the chart implied. Some remembered and took prudent action. Those people are calling me to congratulate me on my insight. The others avoid making eye contact. I simply tell them, “I am only the messenger.”

The identical pattern occurs in the S&P 500 index. It appears that we are days away from breaking through the 2002 low.

Please make an appointment to discuss our investment strategies by calling Christian or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

The phone calls and emails are running squarely against the passage of the bailout bill. The Congressman in our district is getting messages against the bill at the rate of 200 to 1. Even Nancy Pelosi's messages are running 95% against the bill, according to one of her staffers. Today's action in the market has been a real see-saw. The markets gained in the morning, seemingly snapping the weekly losing streak. When the tally of the votes came in favor of the bill, the market promptly reversed course. Is this “buy the rumor, sell the news?” It may be more than that. A weekly close at the bottom of the market does not bode well for next week's market action.

Will bonds be positive again?

Treasury prices declined Friday morning, pushing yields higher, after the government said the economy shed more jobs in September than in any month since March 2003, confirmation of weakness that many anticipated in light of the recent roller-coaster ride in financial markets.

Treasury prices declined Friday morning, pushing yields higher, after the government said the economy shed more jobs in September than in any month since March 2003, confirmation of weakness that many anticipated in light of the recent roller-coaster ride in financial markets.

The decline may be a fake-out, however. The operative pattern is a triangle, which normally calls for higher prices in the near term.

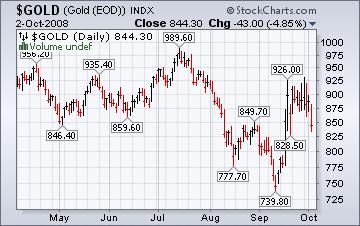

Gold tanks!

Precious metals have been declining this week as a massive liquidation by hedge funds and major players as the need to raise cash to meet redemptions grew severe. Traders are also looking at a stronger dollar after the approval of the bailout and losing confidence in gold as the ultimate store of value. Another assumption being made is that the bailout might ease the financial constriction enough to lure investors out of gold and back to the market. The most compelling argument, however, is that a shrinkage in money available for investments will also shrink the pool of funds willing to hold precious metals.

Precious metals have been declining this week as a massive liquidation by hedge funds and major players as the need to raise cash to meet redemptions grew severe. Traders are also looking at a stronger dollar after the approval of the bailout and losing confidence in gold as the ultimate store of value. Another assumption being made is that the bailout might ease the financial constriction enough to lure investors out of gold and back to the market. The most compelling argument, however, is that a shrinkage in money available for investments will also shrink the pool of funds willing to hold precious metals.

Fundamental view of the world changing in Japan.

Japan's stocks fell, capping the worst week in 13 months, on concern demand will decrease in the U.S. after economic reports showed the nation's largest overseas market is faltering. The bailout plan seems secondary to the slowing of the economy in the U.S. Their view is that the fundamentals that have kept their economy alive in the past are changing.

China's stocks still aren't cheap.

Just because China's stocks have fallen more in the last eight months than they did in their previous bear market doesn't make them a bargain. For example, the Shanghai index price-to-earnings amounted to 21.5 times earnings at yesterday's close. This compares with a PE ratio of 16.4 at the July 2005 low. There seems to be quite a distance to fall yet.

Just because China's stocks have fallen more in the last eight months than they did in their previous bear market doesn't make them a bargain. For example, the Shanghai index price-to-earnings amounted to 21.5 times earnings at yesterday's close. This compares with a PE ratio of 16.4 at the July 2005 low. There seems to be quite a distance to fall yet.

The “rescue package” is not beneficial to the dollar.

The U.S. Dollar may have made its last gain for a while after the passage of the so-called rescue package. Additional liquidity in the U.S. economy will water down the value of the dollar vis-à-vis the other trading currencies. In addition, the bill proposes that the Secretary of the Treasury can bail out European banks with taxpayer money.

The U.S. Dollar may have made its last gain for a while after the passage of the so-called rescue package. Additional liquidity in the U.S. economy will water down the value of the dollar vis-à-vis the other trading currencies. In addition, the bill proposes that the Secretary of the Treasury can bail out European banks with taxpayer money.

The Employment Situation for September did not build confidence for the Dollar, either.

Bankers – 1; Homeowners – 0.

With the economy on the brink and elections looming, Congress approved an unprecedented $700 billion government bailout of the battered financial industry on Friday and sent it to President Bush who quickly signed it. The problem with the bill and the prior actions of Ben Bernanke and Henry Paulsen is that there is no punishment for bad (or even criminal) behavior. A case in point is the executives of AIG partying down in the swanky St. Regis Monarch Beach Resort on the California coast. What financial crisis?

With the economy on the brink and elections looming, Congress approved an unprecedented $700 billion government bailout of the battered financial industry on Friday and sent it to President Bush who quickly signed it. The problem with the bill and the prior actions of Ben Bernanke and Henry Paulsen is that there is no punishment for bad (or even criminal) behavior. A case in point is the executives of AIG partying down in the swanky St. Regis Monarch Beach Resort on the California coast. What financial crisis?

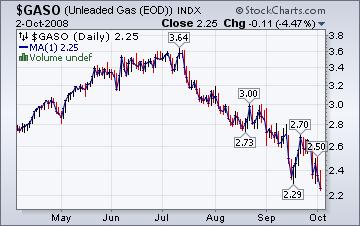

Refiners still unable to fill the pipelines.

The Energy Information Administration reports that, “ While Hurricanes Gustav and Ike did not cause the degree of damage to refineries and other petroleum infrastructure sustained during Katrina and Rita, the affected refineries had been slow to return to operation due to lack of power. With refineries unable to fill pipelines that move refined products into the Midwest and East Coast, inventories had been dropping; and spot shortages, mainly of gasoline, have been occurring in the Lower Atlantic and Midwest regions of the country, even with increasing imports beginning to arrive to help fill the gap. ”

The Energy Information Administration reports that, “ While Hurricanes Gustav and Ike did not cause the degree of damage to refineries and other petroleum infrastructure sustained during Katrina and Rita, the affected refineries had been slow to return to operation due to lack of power. With refineries unable to fill pipelines that move refined products into the Midwest and East Coast, inventories had been dropping; and spot shortages, mainly of gasoline, have been occurring in the Lower Atlantic and Midwest regions of the country, even with increasing imports beginning to arrive to help fill the gap. ”

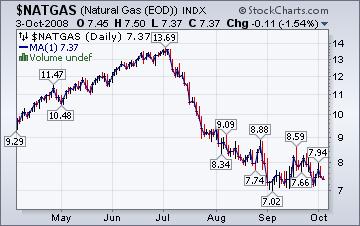

Energy prices going lower.

The Energy Information Agency's Natural Gas Weekly Update tells. “ The likely driver of the recent decreases is the lack of significant demand as all areas of the country, with the exception of the desert Southwest and inland California, experienced mild temperatures. The natural gas spot prices, along with both natural gas and crude oil prices in the futures market, decreased significantly on the week.”

The Energy Information Agency's Natural Gas Weekly Update tells. “ The likely driver of the recent decreases is the lack of significant demand as all areas of the country, with the exception of the desert Southwest and inland California, experienced mild temperatures. The natural gas spot prices, along with both natural gas and crude oil prices in the futures market, decreased significantly on the week.”

S.h.u.t. U.p.!

Senate Has Underestimated Taxpayers.....United & Pi$$ed!

a grassroots movement.....

now go forth and multiply....and spread the word.

This has been borrowed from www.urbansurvival.com . Another great website.

Where it all began…

Democrats love to demonize the President for the pickle we are in. The truth may be more complicated than you may think. Pointing one finger leaves the others pointing back. Could it be a Democrat that started this mess?

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.