Hyper-Deflation Capital Destruction And Gold & Silver

Commodities / Gold & Silver 2020 Aug 13, 2020 - 05:18 PM GMTBy: Darryl_R_Schoon

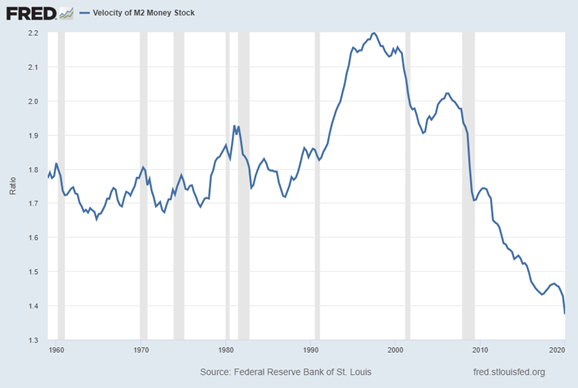

When aggregate demand contracts, debts default, credit tightens, the velocity of money plunges, deflation ensues and capital, i.e. circulating credit and debt, is destroyed. In the extreme state of hyper-deflation, central bankers try to offset fatally accelerating capital destruction by creating even more money to replace that which is being destroyed.

The United States printed more money in June than in the first two centuries after its founding.

Cointelegraph, July 31,2020

Velocity of M2 Money Stock 1960-2020

US banks are ‘swimming in money’ as deposits increase by $2 trillion amid the coronavirus. The wall of money flowing into banks has no precedent in history: In April, alone, deposits grew by $865 billion, more than the previous record for an entire year.

CNBC, June 21, 2020

TODAY’S RATE OF CAPITAL DESTRUCTION IS REFLECTED

IN THE UNPRECEDENTED GROWTH OF THE MONEY SUPPLY

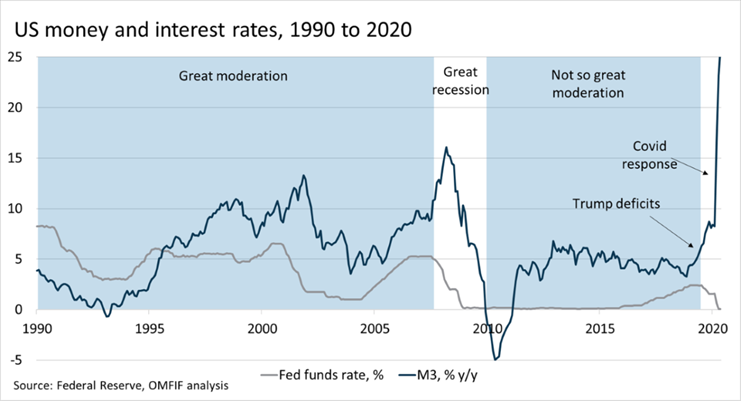

The money supply, M3 (M2 monetary aggregates + institutional money funds and large time deposits), ascended vertically in 2020 (see below) when global economies suddenly contracted; forcing bankers to create unprecedented amounts of money to replace previously-created money now disappearing into deflation’s exponentially expanding monetary maw

Capital destruction unleashed after the 2008 financial crisis absorbed tens of trillions of dollars created by central bankers in the decade between 2009 and 2019, negating concerted central bank efforts to artificially create growth through money printing.

Zero interest rates and QE gave central bankers a temporary reprieve to solve an insolvable problem. In 2020, COVID-19 rendered their desperate efforts futile. More vulnerable to COVID-19 than the elderly with underlying health conditions, COVID-19’s global economic contraction fatally impaired capitalism’s ability to pay the interest due on mountains of unpayable debt compounding daily.

Today’s hyperbolic increase in the money supply may not end in a hyperinflationary blowoff as previous bouts of monetary excess have done. Because of today’s extreme hyper-deflation, capital destruction may absorb all the money central bankers print without inflationary consequences; and, if not, hyperinflation is inevitable.

CAPITAL DESTRUCTION’S FIRST PHASE

DEFLATION (2009-2019)

CAPITAL DESTRUCTION’S FINAL PHASE

HYPER-DEFLATION (2020–2030)

(reposted with the permission of Sandeep Jaitly)

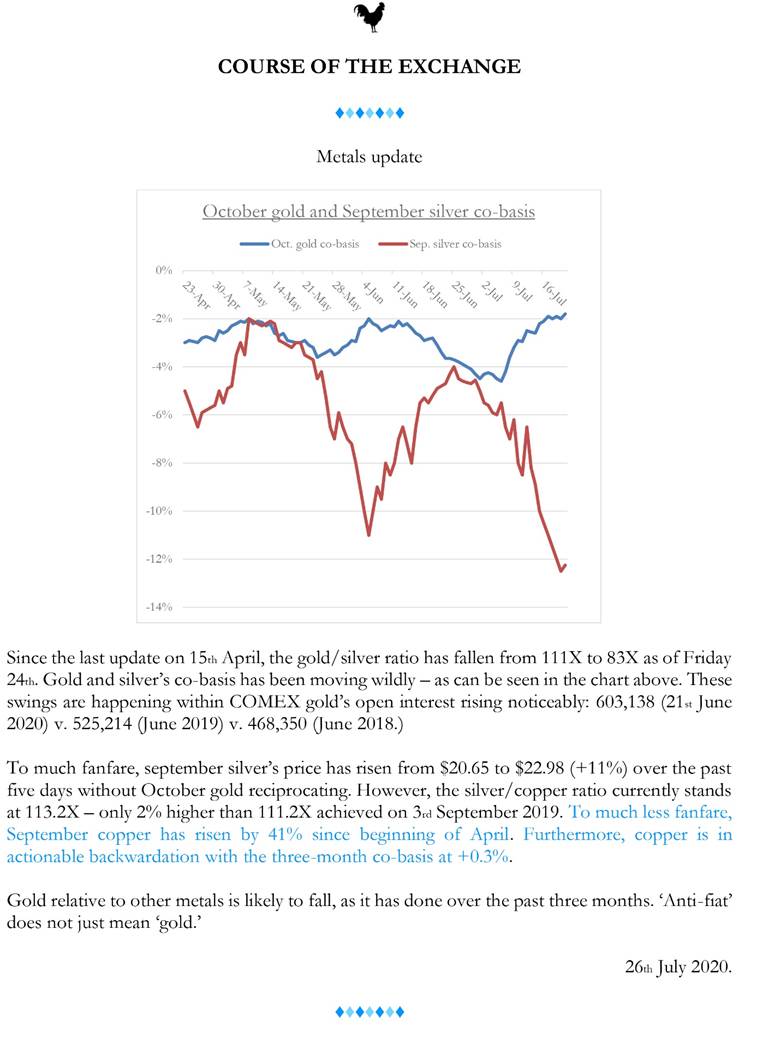

GOLD & SILVER

In August 2020, gold and silver are rising even as central bankers hope to slow their ascent. Whether gold and silver will continue to ascend or be forced lower as in 2011 when central bankers flooded markets with gold bullion offered at negative interest rates remains to be seen.

What is certain, however, is that COVID-19 has backed central bankers into a monetary corner with no exit. Central bankers are now in retreat. Previous concerns about economic growth are now subrogated to the desperate desire to survive along with the capital markets that have allowed them to obscenely profit from the enterprise of others for 325 years.

Fiat paper money first appeared in Szechwan, China in 1024. Its thousand-year anniversary, i.e. 2024, is four years away. Paper money’s Happy Anniversary song, however, may be a funeral dirge. The central bank substitution of real money for debt-based paper coupons is about to end in dramatic fashion.

GOLD AND SILVER’S FINAL ASCENT WILL BE ACCOMPANIED BY

THE CATASTROPHIC COLLAPSE OF DEBT-BASED ECONOMIES AND CURRENCIES

A BETTER WORLD WILL FOLLOW

THREE PREDICTIONS ABOUT THE FUTURE, i.e. NOW

- In 1981, in “Critical Path”, Buckminster Fuller predicted humanity was entering a crisis that would end in the collapse of nation-states, economies, e.g. communism and capitalism, and religious institutions. The Universally-intended crisis will transform humanity from a competitive, warring, state of scarcity into an interdependent, interharmonious, cooperative whole with a higher standard of living for all.

- In 2004, COVID-19’s appearance was predicted by Sylvia Browne, the psychic, in her book, “Prophecy: What the Future Holds for You:By 2020 we’ll see more people than ever wearing surgical masks and rubber globes in public, inspired by an outbreak of a severe pneumonia-lie illness that attacks both the lungs and the bronchial tubes and is ruthlessly resistant to treatment. This illness will be particularly baffling in that, after causing a winter of absolute panic, it will seem to vanish completely until ten years later, making both is source and its cure much more mysterious.

In End of Days, Predictions and Prophecies about the End of the World(2008)Sylvia Browne wrote: … Sometime between 2008 and 2020, I see a sitting president dying in office of a heart attack. The vice president who assumes the presidency will stun the world by announcing his intention to declare war on North Korea in light of his accurate belief that they actually are in possession of weapons of mass destruction. His efforts to rally congressional and international support for this declaration of war will be resoundingly unsuccessful and the source of enormous alarm, and he will be assassinated before his term ends.

2020 will mark the end of the US presidency and the executive branch of the government. America will finally be fed up …By 2020, we’ll seen the end of IRAs, mutual funds, pension, and retirement plans, and…the stock market.

- Ralph Terry Foster, author of Fiat Paper Money: The History and Evolution of our Currency, after reading Sylvia Browne’s prediction of COVID’s ten-year disappearance, made a prediction: Very interesting--ten years sounds right--but a more permanent phenomenon is happening before our eyes, August 2020: In a mere matter of weeks the world wide fiat monetary structures built over the last several decades will crumble to worthlessness--our monetary systems will go back to those of the middle ages where hard money commands. The purchasing power of gold and silver coins will reach all time historic highs. With modern technology people will demand hard sound honest money units if society is to remain civil. Few grasp the enormity of this change.

Ralph Foster, August 2, 2020

In 2008, Sylvia Browne’s predictions seemed far-fetched. In August, 2020, they seem less so. We have four months left in 2020. A lot can happen in that time. A lot already has.

THE WORLD ISN’T WHAT IT APPEARS TO BE

IF IT WAS, WE’D BE IN TROUBLE

Should the pandemic end next spring after “a winter of absolute panic” (Sylvia Browne’s words), Ralph Terry Foster, Sandeep Jaitly, Peter Von Coppenolle, Martin Hickling and I will be speaking April 10 & 11, in London.at Imperial College School of Mines. The subject will be Money: Rock, Paper, Scissors,For details, see http://www.drschoon.com/events . It should be interesting.

My interview, China, Power & Money , part 1, is posted at https://www.youtube.com/watch?v=4pZQlRFzeNA&t=187s ,

Part 2 of the interview, The Pendulum of Change is a Wrecking Ball, is posted at https://www.youtube.com/watch?v=f71AdWpyRTs&t=162s .

Conspiracy Theories Revisited is the subject of another interview posted at

https://www.youtube.com/watch?v=uFtn2EnTkLg&t=468s

See you in London, God willing.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.drschoon.com

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.