The 100% Gold Portfolio

Commodities / Gold & Silver 2020 Aug 24, 2020 - 06:18 PM GMTBy: Nick_Barisheff

When I founded BMG Group Inc. (formerly Bullion Management Group Inc. – BMG) over 20 years ago, I thought that my main challenge would be to get approval for our first fund from the Ontario Securities Commission (OSC). My premise was that there was no approved way for retail investors to hold bullion in their RRSPs and other registered accounts. In addition, I wanted to structure the fund in a way that would not compromise the three fundamental attributes of bullion: liquidity, no counterparty risk and independent of management skills. Upon investigating closed-end funds, exchange-traded funds (ETFs), and proxies, such as mining stocks and futures contracts, I found that all of these structures either compromised the liquidity of physical bullion or were not bullion at all, and were therefore dependent on counterparties for their performance. Other attributes compromised the direct ownership of bullion due to dependence on a portfolio manager to make trading decisions and to manage the asset. In addition, bullion leasing and leverage could distort the pure performance of bullion.

It took four years of negotiating with the OSC to obtain grants for six exemptions from the mutual fund rules in order to establish the first open-end mutual fund that held physical bullion. The main attribute—liquidity—was therefore maintained, as US$63 billion of physical bullion trades every day. We also established a fixed investment policy, and we were granted an exemption from requiring a portfolio manager. As investor funds flowed in, BMG simply purchased bullion for the fund without trying to time the market. Leasing of the holdings or leverage of any kind was not allowed, and the fund could not purchase paper proxies or derivatives. The approvals from the OSC were received in early 2002 and immediately after, in March of that year, BMG’s first precious metals fund was launched—the Millennium BullionFund (a tri-metal fund known today as the BMG BullionFund). BMG went on to launch two other funds: BMG Gold BullionFund in 2009 and BMG Silver BullionFund in 2016.

I initially expected that the fund would be supported and endorsed by mining companies, since it would be buying the product that mining companies produced. BMG’s success would be their success, as the fund would increase demand for their product. As demand increased, so would the price of bullion, and correspondingly their share price.

Unfortunately, that was not the case. Mining companies were reluctant to recommend purchasing bullion to their investors because of their mistaken belief that it could negatively affect their future share issues.

I was also perplexed by the lack of interest that I received from retail financial advisors and portfolio managers. While I assumed that they understood that adding precious metals to a portfolio of stocks and bonds historically has reduced volatility and improved returns, their lack of understanding and ingrained negative biases was astonishing. Any manager with access to portfolio management software would have easily confirmed the benefits that I was trying to convey. I found that they simply did not want to invest any time to educate themselves on the history of gold and silver as monetary assets, nor on the benefits of bullion. Thus, many advisors and portfolio managers were reluctant to recommend the product to their clients. In addition, I found there were a lot of unfounded biases and deeply ingrained myths toward precious metals bullion among the management of the dealer firms.

For the past 20 years, BMG has been actively educating the investor community, as well as financial advisors and portfolio managers, on the benefits of precious metals in an investment portfolio. I have written a book, $10,000 Gold—Why Gold’s Inevitable Rise Is The Investor’s Safe Haven, that is available on Amazon, and we recently produced an audiobook. BMG also distributes a free weekly newsletter, the BullionBuzz, designed to keep investors informed and up-to-date on gold and the precious metals markets, which are not typically covered by the mainstream media. My relentless drive to educate the public has not been easy; in fact, it has been a bigger challenge than getting regulatory approval. I have thought long and hard about why there is such a lack of acceptance or interest in precious metals, and I have come up with many reasons why; a few stand out.

First, there isn’t a single university-level course, other than that taught by the Mises Institute, that teaches the fundamentals of money.

Gold has been money for many thousands of years. Gold is mentioned repeatedly in the bible. Every civilization and every government in history has treasured gold. Western United States was built on the ’49ers quest for gold. It’s been said that gold is built into man’s DNA. If you can’t accept the thesis that gold is the ultimate money, then you’re ‘out of it’ and in denial. And most likely, you will not understand the coming ‘big picture’.”

Richard Russell

In addition, none of the MBA courses or regulated investment courses or portfolio management courses make any mention of gold, silver or platinum as a portfolio diversifier. Instead of evaluating the benefits of precious metals bullion, many advisors, portfolio managers and even pension funds have completely dismissed precious metals as an asset class.

Most advisors simply ignore precious metals as an asset class, because they believe that since precious metals do not pay any interest or dividends, analysts can’t apply their models to evaluate price. Warren Buffett’s attitude towards gold provides insight into this negative bias on gold. See his quote below:

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

The most important reason is that financial advisors and portfolio managers have not shed their biases: normalcy bias, cognitive dissidence and recency bias. The reason is that they are simply not old enough, and therefore lack the personal experience to truly understand precious metals.

If you don’t own gold…there is no sensible reason other than you don’t know history or you don’t know the economics of it…“

Ray Dalio

The average age of portfolio managers is currently 50 years old. This means they are likely to have started in the business in the 1990s. They have no direct knowledge or experience of the gold bull market of the 1970s; they were only 10 years old at that time. They primarily remember the bear market that lasted between 1980 and 2002, and that’s it!

They have experienced a tech bubble followed by a crash in 2001. Many investors lost 70% of their portfolios when some of the biggest, most popular tech companies melted down.

In 2008, the real estate markets all over North America became a bubble and crashed. Many investors lost the majority of their investments, and some even lost their homes. Well-established REITs, such as the Dundee Dream Office REIT, lost 84% in just one year!

In March 2020, the COVID-19 pandemic struck the world. People were ordered to stay home and to work remotely if possible. Businesses were ordered to shut down, and the financial economy tumbled to levels never imagined. The S&P 500 declined by 34% and the TSX by 37%. Thanks to central banks printing an enormous amount of new money and the world’s governments incurring massive amounts of debt, the markets have corrected to their previous highs. However, the markets, by all traditional measures, are more overvalued than ever before, and all the major currencies have been devalued. Many experts believe that the next leg down will be worse than 1929.

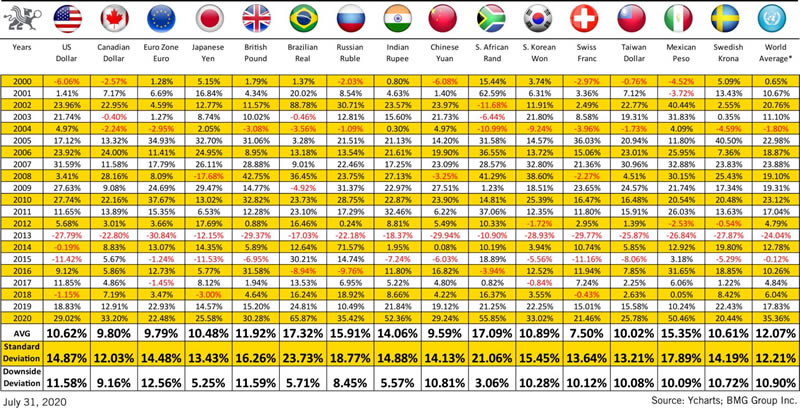

What investors, financial advisors and portfolio managers, as well as pension funds, seem to be missing is that since 2000, there has been a paradigm shift, and gold has risen on average 10% per year.

Most people adapt to and eventually extrapolate so they become overdone, which leads to shifts to new paradigms in which the markets operate more opposite than similar to how they operated during the prior paradigm.”

Ray Dalio

Since 2000, gold has been the best-performing asset class in six of the 20 years. Most portfolios would be lucky to have averaged a 5% return, and most pension funds require a 6% annual return to meet pension obligations. They would have done much better if they had simply held gold bullion.

Recently, with a triple bubble forming in stocks, bonds and real estate before the COVID-19 crisis, holding gold and silver became critical to preserving your wealth.

I am often asked, “How much gold do I need?”

To fully understand gold, you need to know that gold is money, and everything that is referred to as money is actually just debt. If you understand that gold is money and you keep it in a safe or a vault, you need to evaluate the risk/reward relationship of taking your money—gold—out of the vault and investing it by giving the proceeds to someone else. For that to make sense, you should be convinced that by liquidating your gold and investing it, you will eventually get more ounces of gold back than the ounces you invested. Unless that is the case, at a reasonable level of risk, you might as well leave the gold in the vault.

While the average since 2000 has been 10%, it was 19% in 2019 and 29% YTD. It has now surpassed the previous high of $2,000 per ounce, and many experts believe it will exceed $15,000 per ounce in the near future.

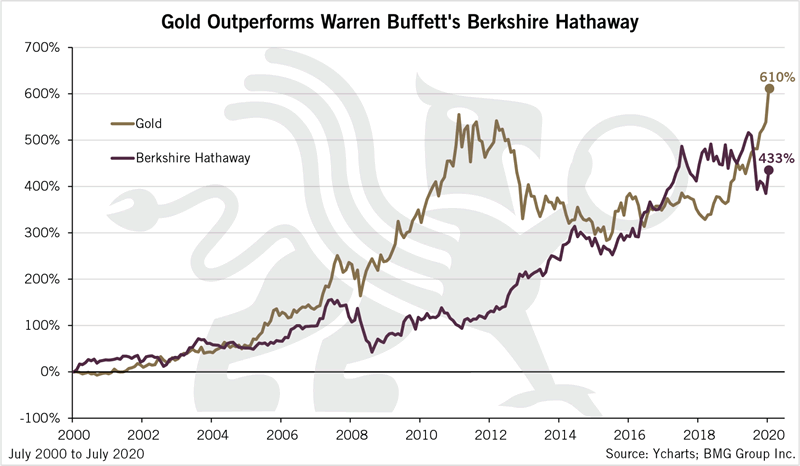

The most pronounced example of gold’s performance compared to equities is the comparison to Warren Buffett’s company, Berkshire Hathaway. Since gold has outperformed Berkshire, it is highly unlikely that most financial advisors, portfolio managers or pension funds will outperform gold. In fact, the vast majority do not even outperform their indexes.

Gold has experienced some corrections since 2000. It fell 27% in 2012 and 11% in 2016. But these declines were far less painful than the tech crash of 2000 and the real estate crash of 2008. During those crashes, many investments declined to zero. It is important to remember that gold will never decline to zero.

With GDP poised to decline further because of the COVID-19 shutdowns, the enormous amount of currency that the world’s governments will have to borrow for financial aid and the endless printing of currency by the world’s central banks, it is very likely that the price of precious metals will rise significantly in the next few years. Apart from not losing money during the correction, investors should consider the strategy of only holding gold and silver until the correction completes. The opportunity will then be to redeploy some of the increased precious metals holdings into stocks, bonds and real estate at major discounts. At that time, it will be worth taking some gold or silver bullion out of the vault and investing at close to a bottom.

While it is a totally contrarian viewpoint, instead of talking about allocating 10% – 20% to gold in your portfolio, start with 100%. If you determine that you should liquidate your gold, then you need to be sure that you will get more gold ounces in return than the gold ounces you are investing, at a reasonable level of risk. If that isn’t the case, then it doesn’t make sense to sell your gold, invest it in a financial asset and get less gold back.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2020 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.