Precious Metals rally early in 2021

Commodities / Gold & Silver 2020 Jan 11, 2021 - 04:10 PM GMTBy: Chris_Vermeulen

If you follow our research, you already know my research team and I have authored multiple articles related to how Metals and Miners are poised for a big rally in 2021 and beyond. But do you understand what this means for other market sectors and assets? Are you ready for one of the most dynamic investing environments we’ve seen since 1945 or earlier? Gold and Miners are showing very clear signs that the Depreciation cycle phase our researchers identified recently is strongly in place.

Precious Metals vs. Miners in a Depreciation Cycle Phase

Gold and Miners are showing very clear signs that the Depreciation cycle phase our researchers identified recently is strongly in place. Both Gold and the Mining sector have been rallying since early 2016. This rally initiated in the midst of an Appreciation cycle phase (between late 2010 and the end of 2019). The rotation between Appreciation and Depreciation cycle phases directly correlates with the underlying strength of the US Dollar, precious metals, and other market sector trends. At this point, the new Depreciation cycle phase means the global markets will transition away from Appreciation phase trends and into new defensive/sector rotation trends.

If our research regarding these Appreciation/Depreciation cycle phases is correct, the new Depreciation cycle phase will usher in a period of 9+ years of very dynamic global market and sector rotation. This will happen because of two key factors: depreciation/decline of the US Dollar (resulting in strong upward trending for precious metals, rare earth minerals and other key commodities) and the Capital Shift that takes place as traders/investors attempt to chase strength in various capital sectors/global markets looking to offset currency trends.

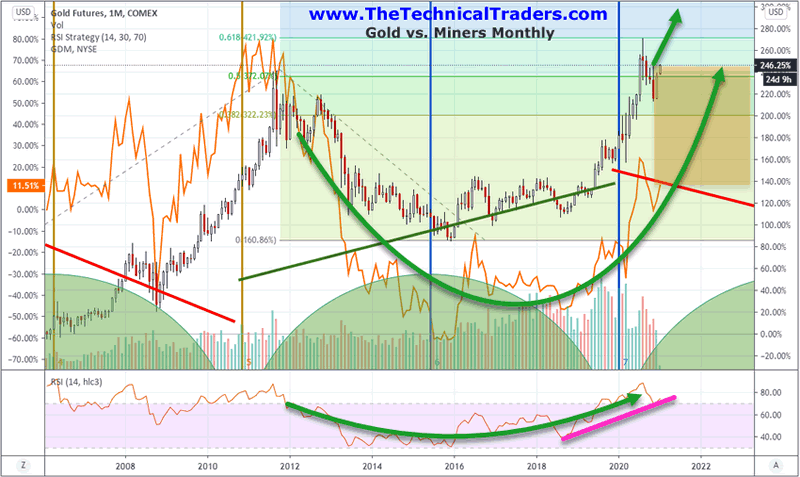

The following Monthly Gold vs. Miners chart (where Gold is displayed as Candlesticks and Miners are displayed as the GOLD line) highlights the last Appreciation cycle phase and how both Gold and Miners collapsed within this cycle phase. What we find interesting is the strength of the trend in Gold while Miners have just recently started to broadly advance higher. We believe the transition away from Appreciation phase assets is now firmly taking place – which suggests Miners may have a lot of catching up to do over the next 12+ months while precious metals continue to move higher.

Within the last Depreciation cycle phase (1999 to late 2010), Gold rallied from $253 to $1923 – an incredible 640%. If a similar type of rally takes place from the recent $1040 lows, in November 2015, then a peak level above $7500 is not out of the question for Gold. Some analysts are suggesting $10k or more as the potential peak level. What would this do for other precious metals (like Silver, Platinum, and Palladium) and how would the mining sector react to a huge rally phase in Gold?

Miners Should Attempt To Rally 35%+ Over The Next 12+ Months

The big rally in Gold and Silver that started on the first trading day in 2021 is likely a continuation of the Depreciation cycle phase trending that our researchers identified many months ago. We are still very early in this Depreciation cycle phase and it will likely last until sometime near 2026~2029. What this means is that we can expect an unraveling of the Appreciation cycle phase investments (deployed in technology, healthcare, biotech and other broad market sectors) and new sector trends to establish in core commodities, energy, emerging markets, and sectors where a falling US dollar will likely prompt bullish trends.

Overall, it means we need to prepare for broad market rotations in nearly all market sectors and trends. This transition away from the end of the Appreciation cycle phase means that capital will eventually shift into new forms of investment opportunities – Metals and Miners being one component that we believe is just starting a big upside price trend.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

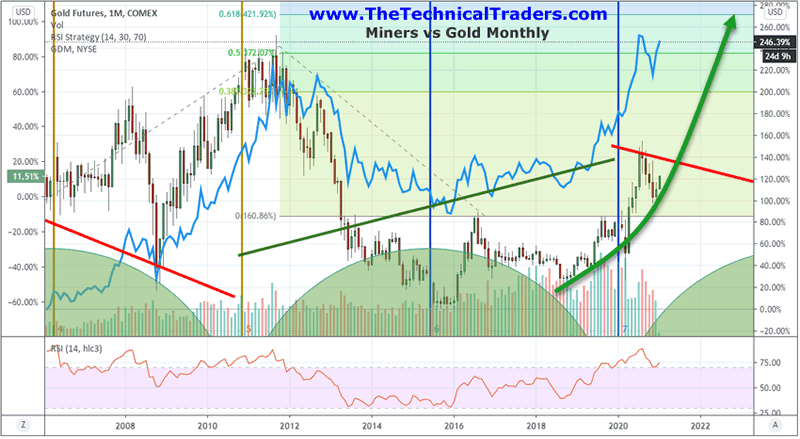

The Miners vs Gold Monthly chart below, where Gold is represented as a BLUE line and the Miners Index is represented as Candlesticks, highlights the very mild uptrend we’ve seen in Miners recently. Gold has already rallied to levels above the 2011 highs where Miners are still far below the 2008~2011 high price levels. This suggests that Miners may see a big 35% to 55%+ rally over the next 12+ months to catch up with the continued price appreciation in Gold and Silver.

The key takeaway from this article should be that traders need to prepare for a global market shift away from what has been traditionally strong trending sectors over the next 12 to 24+ months. Our research suggests a broad market shift is taking place that will likely end many current trends and start new rally trends in traditionally defensive sectors.

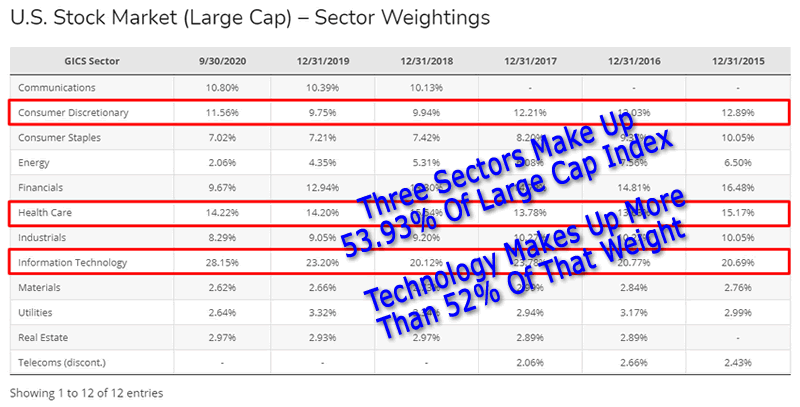

Over 53% of the current Large Cap Index Weighting is directly tied to Technology, Healthcare and Consumers. Of that, more than 52% of that weighting is tied to Technology. If broad global sectors begin to transition away from over-weighted sectors and into undervalued and under-weighted sectors, we believe the major global market indexes may be uniquely setup for very big price rotations/declines in the near future. The weighting of these three sectors have overtaken the total weighting of the other 8~9 sectors. Thus, three unique sectors make up more than 53% of the total weighting whereas the other 8~9 sectors make up only 47% of the total weighting.

To illustrate our point, Materials make up only 2.62% of the Large Cap index. The total weighting of the Industrials, Materials, Utilities, and Real-Estate sectors is only 16.52% – which equals up to only a third of the value of the Technoilogy, Healthcare and Consumer sectors. This disparity of weighting in the Large Cap index presents a very real potential that any moderate downside price trends as capital shifts to new opportunities within the new Depreciation cycle phase may result in a very big and aggressive price decline in the US and Global major indexes.

2021 and beyond are going to present great opportunities for traders in the right sectors. If you are able to see these setups and prepare for them as various sectors roll in and out of favor, while properly hedging your assets, you will likely do really well over the next 5 to 7+ years. If not, you will probably chase failed trends as they continue to collapse or move into deep downward/sideways trends.

The Depreciation cycle phase will not likely end until sometime after 2027. Therefore, we have at least 5 to 7 more years of very broad market rotation to look forward to – where investment capital shifts very quickly away from overvalued risk assets and into undervalued assets and sectors. This means traders must adapt very quickly to how these trends setup and mature. Be prepared, the trending you are probably used to seeing over the past 4+ years is about to become unrecognizable.

Right now is the time to learn how to better prepare for very fast trend and sector rotations and to trade them to your benefit. With the markets near all-time highs, we fear some of you will get caught on the wrong side of these trends – just like what happened after the DOT COM bubble burst. Take a minute to visitwww.TheTechnicalTraders.com to learn more about the services we offer and don’t forget to take my FREE webinar on how to spot and trade the Best Assets Now!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.