Goldrunner: Gold Could Jump To $1,900-$2,100 In Next 30 days – Here’s Why

Commodities / Gold and Silver 2021 Jul 15, 2021 - 09:54 PM GMTBy: Lorimer_Wilson

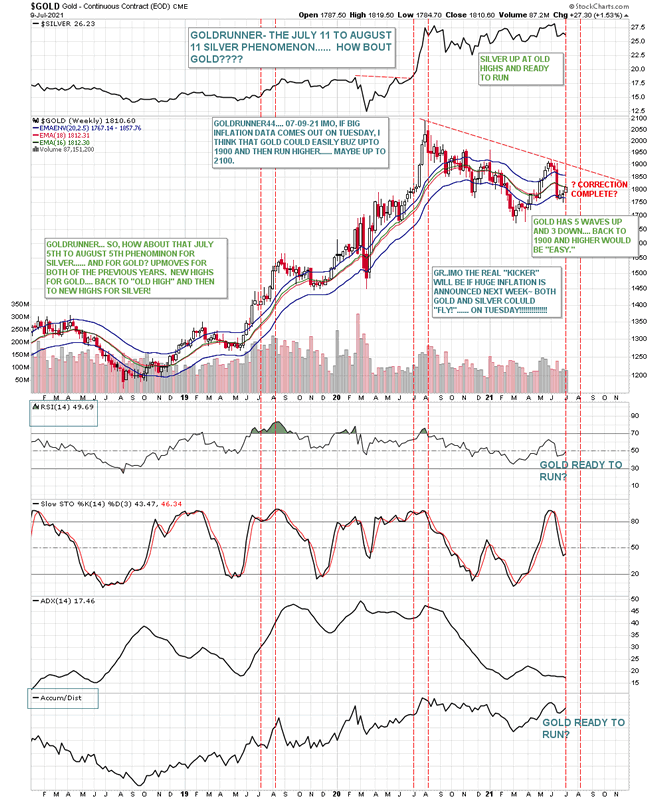

For the past two years at this juncture, the Precious Metals Sector has risen sharply in a month-long up cycle for Silver and with the high inflation expectations going forward a similar ramp up for the Precious Metals Sector is a real possibility.

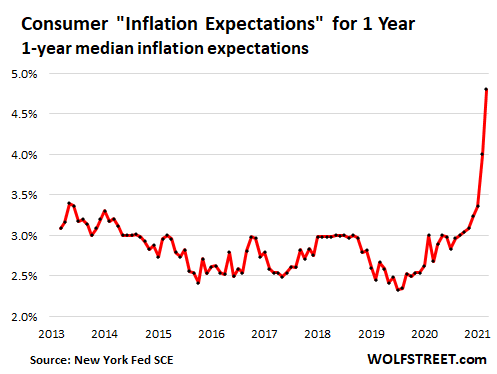

Inflation Expectations

According to the New York Fed’s Survey of Consumer Expectations:

- the under-40 crowd expects inflation to hit 3.8% a year from now,

- the 40-60-year-olds expect inflation of 4.7% and

- the over-60 crowd expects inflation to hit 5.7%

- for an average inflation expectations for one year from now of 4.8%.

These inflation expectations tracked by the New York Fed roughly match the inflation expectations tracked by the University of Michigan’s Survey of Consumers, whose latest reading jumped to 4.6%.

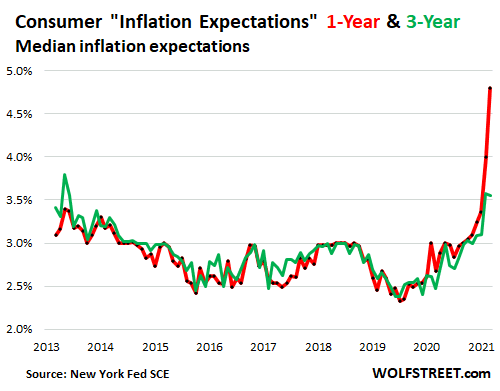

The Fed and the government claims, echoed by the major news outlets, that this bout of inflation is just “temporary” or “transitory” are resonating with consumers to some extent as inflation expectations for three years from now have jumped, but not as high, reaching nearly 3.57% in May and 3.55% in June.

Silver Expectations

With such high inflation expectations, in combination with the 30-day up cycle (July 12th to August 11th) for Silver, Goldrunner’s fractal work suggests that Silver might start a run up to $34 per troy ounce and perhaps as high as $37/ozt. over the next 30 days.

Lorimer Wilson is editor of www.munKNEE.com (Your Key to Making Money!), publisher of a daily FREE Financial Intelligence Report which can be subscribed to here and a frequent guest contributor to www.PreciousMetalsWarrants.com which also offers a FREE newsletter (sign up here) and a subscription service (see details here).

Disclaimer: Please understand that the above is just the opinion of a small fish in a large sea. None of the above is intended as investment advice, but merely an opinion of the potential of what might be. Simply put:

The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.