World Trade – Currency Movements in the Near Future

Currencies / Forex Trading Aug 08, 2021 - 09:11 PM GMTBy: Russell_Fenton

Nowadays, when talking about world trade and currency movements, there’s more than the actual currency that we have to take into account. Naturally, we have to keep in mind that cryptos are also currencies now – and they shouldn’t be ignored!

Certain countries, cities, and industries now accept crypto payments, and the very CEO of Tesla claimed that people will be able to pay for their Tesla cars with Bitcoin in the future. In short, you can now see why forex brokers decided to implement more than just currencies into the pool of trading instruments that they have available for their clients.

Let’s take a look at the potential currency movements that we might experience in the near future!

Currency Weakness is Predicted

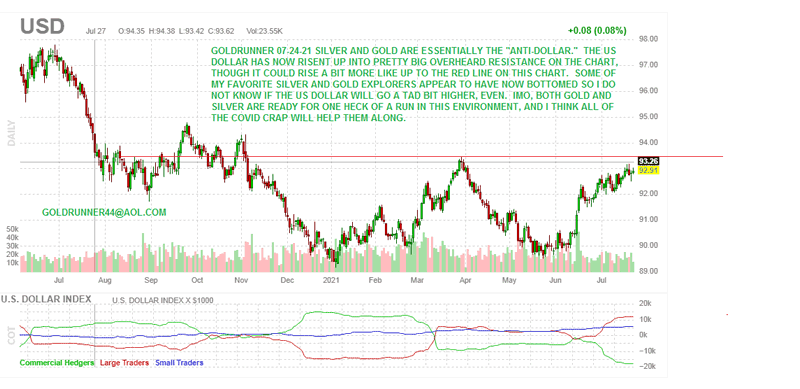

Considering conventional currencies and certain precious metals, analysts think that we are heading towards the weakness of the US dollar as an international currency. This is mainly due to the uncertainty in the US and its position in the global market.

Given that the dollar has lost the edge it gained during the first year of the pandemic and is now struggling to stay on top, people believe that the US itself might be a thorn in the side of the world economy.

Currency will Diversify

According to multiple predictions of the future, it is believed that the world will soon have a single currency – just one bill to rule them all. However, given the massive growth of crypto, that prediction might soon crash and burn.

As we mentioned above, cryptocurrency and blockchain are paving the way to a seemingly better and more accessible financial future. Nowadays, you can see the Bitcoin sign on vending machines and payment processors all around the world. In comparison, exchanges and banks often can’t provide citizens with all the currency types they might want or need to exchange.

In short, currency just keeps on diversifying and growing in numbers. While the number of countries stays the same, the number of blockchain creators will continue to increase.

Trading in the Currency Context

We all know that there are a lot of trading options out there, from CFDs to binary options and stocks. However, we also have NFTs which seem to have turned into a currency of their own.

These non-fungible tokens can be easily used to represent someone’s monetary value. More or less, the world seems to be going back to an item-trade based economy where random things (represented via NFTs) have more value and power than actual currency.

Naturally, this is still only a prediction at the moment, and possibly even an incorrect one.

The Bottom Line

The conventional currency will move as it has moved until now, but with a slight weakness due to the influence from the pandemic that doesn’t seem to be going anywhere anytime soon. The new, digital currency, on the other hand, is constantly growing and evolving.

Cryptos are the craze when it comes to both solutions for making people rich and ways to scam them. With so much diversity, one could say that currency movements will be characterized by uncertainty and volatility, high risks and high rewards.

By Russell Fenton

© 2021 Copyright Russell Fenton - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.