Stock Market Conflicting Evidence for a Bottom

Stock-Markets / US Stock Markets Oct 29, 2008 - 11:10 AM GMTBy: Richard_Shaw

The fact is that today's stock markets were extraordinary in their strength. Emerging markets (proxy EEM) up about 20% and the S&P 500 (proxy SPY) up about 11%.

The fact is that today's stock markets were extraordinary in their strength. Emerging markets (proxy EEM) up about 20% and the S&P 500 (proxy SPY) up about 11%.

There are important positive facts to consider:

- for the past couple of weeks SPY has been trading sideways — that's good.

- SPY went up 11% today — that's good (although going up 11% after going down about 41% in the past 52 weeks, puts the index at about 35% down from its starting point).

- according to Bloomberg, before today, the MSCI World Index was trading at about 10.5 times trailing earnings — an historically attractive multiple.

- according to a table published by dshort.com, today's rise in the S&P 500 was the 7th largest percentage gain since 1928 — that's good (although dshort.com points out that almost all of the really powerful one day rallies in the past were inside bear markets that continued after the rally).

- the Fed has begun to buy commercial paper and that has allowed many corporations to borrow again, that being important to inventory build and general business activity — that's very good.

- Governments are now accommodative and injecting much liquidity and beginning to coordinate relief — that's good for now (although the long-term price we must pay for today's relief is not clear).

Here are some generally positive thoughts from the press:

New York Times - Oct 28 Even as Dow Soars 11%, Skeptics Lurk

“For me, the best part about today is that the market went up in the wake of what was some really discouraging economic news,” said Stuart Schweitzer, global markets strategist at J.P. Morgan Private Bank. “When the markets go up on bad news, it holds out hope that the bad news has been digested.” …

“People are feeling much more comfortable that the financial system is stabilizing, and that allows them to focus on fundamental valuations of stocks,” said Todd Steinberg, head of equities and commodity derivatives at BNP Paribas-Americas. “The caveat to that is there is still a lot of economic issues to come.” …

… some prominent investors like Warren E. Buffett and R. Jeremy Grantham, who had been bearish in the past, have in recent days said that they think stock prices had fallen far enough for them to start buying …

“Circle today as one of those days that the fundamental issues trumped panic and fear,” said Robert J. Froehlich, vice chairman and chief investment strategist with DWS Investments. But, he added, he was not ready to declare that stocks would not fall below the closing level on Monday.

Not So Positive Information:

Our concern is how to possibly reconcile the enthusiasm shown today with the really terrible news on other fronts.

We do recognize that when markets rise in the face of bad news, that is a good sign for the market — climbing a wall of worry and all that. However, we have so much to worry about that the wall seems too tall still.

Consider these negative points from today's news and decide for yourself if they can coexist with a reversal from bear to bull in the stock markets.

Financial Times - Oct 28 Wall St gains strongly despite grim data

US equities soared on Tuesday … in spite of a fresh glut of grim economic data.

… swings in the S&P 500 were tightly correlated with moves in the exchange rates of the euro and dollar against the yen. That suggested widespread selling of yen positions had left traders with cash to invest in US stocks.

… The market's late afternoon surge came even after figures showed consumer confidence slumped to a record low in October, which Ian Shepherdson, of High Frequency Economics, described as “extraordinarily awful.” Separate data showed prices of single-family homes plunged by a record percentage in August.

Business Week - Oct 28 Corporate bond rates keep rising, portend defaults

The recent decline in bank-to-bank lending rates is having no effect on corporate bonds, which continue to plunge in value — a sign that the market believes more loan defaults and a wave of bankruptcies are ahead for U.S. companies.

… market rates on corporate bonds have continued to rise compared to Treasury yields for nine straight days, said John Atkins, a fixed-income analyst at IDEAGlobal.com. This trend is hitting non-investment grade bonds, or junk bonds, the hardest, but is occurring in investment grade bonds as well.

Bloomberg - Oct 28 Emerging Market Credit Risk Signals Test for IMF's Resources

The cost of default protection on bonds sold by 11 emerging-market nations has surged near distressed levels, triggering speculation the International Monetary Fund's ability to bailout countries may be stretched.

…“The resources of the IMF may not be sufficient for wider bailouts if needed,” said Vivek Tawadey, head of credit strategy at BNP Paribas SA in London. “If it can't raise the money, some of the more distressed emerging markets could end up defaulting.”

Bloomberg - Oct 28 Home Prices in 20 U.S. Cities Fell From Year Ago

House prices in 20 U.S. cities declined at the fastest pace on record as foreclosures climbed before the credit crisis deepened this month.

The S&P/Case-Shiller home-price index dropped 16.6 percent in August from a year earlier, as forecast, after a 16.3 percent decline in July. The gauge has fallen every month since January 2007, and year-over-year records began in 2001.

The decrease in property values, which helped boost sales last month to the highest level of the year, will probably intensify in coming months as the latest tightening of credit markets threatens to dry up mortgage financing. Prolonged price declines may push even more houses into foreclosure, weakening consumer spending and the economy.

“There's still quite a bit further for prices to go down, even though the volume has probably bottomed out,” William Cheney, chief economist at John Hancock Financial Services Inc. in Boston, said in a Bloomberg Television interview. “Prices will probably find a bottom sometime next year.”

Bloomberg - Oct 28 U.S. Economy: Consumer Confidence Drops to Record Low

U.S. consumer confidence fell to the lowest level on record in October as stocks plunged and banks shut off credit, raising the risk spending will collapse.

The Conference Board's confidence index tumbled to 38, lower than forecast and the worst reading since monthly records began in 1967, the New York-based research group said today.

Forbes - Oct 28 IMF Has So Much Umpf

The International Monetary Fund is supposed to be the world's lender of last resort, but disturbing questions were being raised Tuesday about whether it had all the money it needed to help the world's most troubled economies in the wake of the subprime crisis.

The IMF's first deputy managing director, John Lipksy, said on television that if the the world's financial problems continue to grow, “we might think about whether we would need additional resources.” He added that the IMF was discussing that possibility with its members. “For now we have record liquidity,” he said.

BBC - Oct 28 Hungary to get $25bn rescue deal

Hungary has been granted a multi-billion dollar rescue package by the IMF, the EU and the World Bank.

The deal, worth $25bn (£15.6bn;19.6 euro), is intended to help Hungary cope with the ongoing effects of the world financial crisis.

It follows similar measures taken by the IMF to prop up the economies of Ukraine and Iceland.

Forbes - Oct 28 Pakistan Urged To Take IMF Money

LONDON - Pressure is piling on Pakistan to accept financial help from the International Monetary Fund, or face a financial meltdown.

WSJ - Oct 28 Argentina's Pension Plan Presses On, Driving Down Markets and the Peso

Argentina's leftist government pressed forward with its controversial plan to nationalize private pension funds, laying out investment guidelines for the funds it wants to seize and lobbying Congress to approve the proposal.

Taking over the $30 billion in pension fund assets will ease the cash crunch faced by President Cristina Kirchner's government, but it has jolted investor confidence and triggered a dollar outflow.

Bloomberg - Oct 23 China's Home-Sales Stimulus May Fail to Protect Economic Growth

China's measures to encourage home sales aren't enough to stop a cooling property market from dragging down growth in the world's fourth-largest economy, said Credit Suisse AG and Standard Chartered Bank Plc.

The government yesterday trimmed costs, including mortgage rates, taxes and down-payments, for first-home buyers.

“This is the biggest property rescue package in China's history, but it didn't touch the two most critical areas that are dragging down the property market — property developers' stressed cash flows and consumers' expectations for further price drops,” said Tao Dong, chief Asia economist at Credit Suisse in Hong Kong. “The measures won't do the job.”

Our Take:

These news items don't include important geopolitical issues relating to countries such as North Korea, Iran, Pakistan, and Venezuela that have the potential to cause market havoc.

This news also does not deal with rising unemployment, a likely weak Christmas retail season, probably poor Q4 earnings reports, and an entirely new team running the US government and the Treasury in January (3 months from now) with unknown and potentially surprising programs.

We certainly could be wrong, but all this doesn't seem like were are ready to resume a sustained rise in market prices. It's commonly said that markets anticipate about six month in advance, but normalization of the situation seems farther than six month away to us.

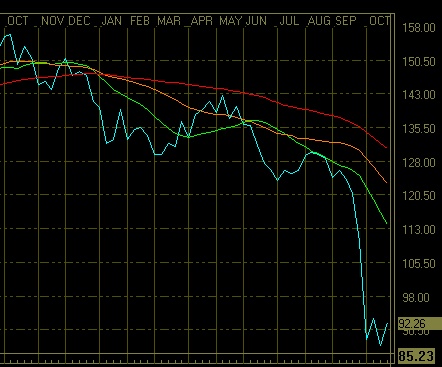

SPY in October

SPY for 52 weeks

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

LP

06 Jan 09, 22:44 |

LP

I have to disagree with that last comment...doesn't make sense |