Fed's Tough Balancing Act Between Inflation and Deflation

Economics / Credit Crisis 2008 Nov 03, 2008 - 01:52 PM GMTBy: Captain_Hook

Save me – I'm sure that's exactly the sentiment many hedge fund managers share today. Why would this be? Answer: Because as Doug Noland aptly puts it in his regular column this week, The Arb Game Is Over , meaning that on a macro-basis the larger speculation / credit cycles have turned lower; and, they will continue to fall for some time, taking many an unaware hedge fund manager with them. In fact, and to be more blunt about it, the cash strapped hedge fund industry has likely also topped with the larger credit cycle, where increasing redemptions necessitate margin contraction on an accelerating basis. In this regard it should be noted aggregate margin debt levels remain high, meaning no matter what policy measures are taken to stem the tide, authorities are just pushing on a string. Of course this is not a problem in my estimation, as you will read further below.

Save me – I'm sure that's exactly the sentiment many hedge fund managers share today. Why would this be? Answer: Because as Doug Noland aptly puts it in his regular column this week, The Arb Game Is Over , meaning that on a macro-basis the larger speculation / credit cycles have turned lower; and, they will continue to fall for some time, taking many an unaware hedge fund manager with them. In fact, and to be more blunt about it, the cash strapped hedge fund industry has likely also topped with the larger credit cycle, where increasing redemptions necessitate margin contraction on an accelerating basis. In this regard it should be noted aggregate margin debt levels remain high, meaning no matter what policy measures are taken to stem the tide, authorities are just pushing on a string. Of course this is not a problem in my estimation, as you will read further below.

The following is an excerpt from commentary that originally appeared at Treasure Chests for the benefit of subscribers on Tuesday, October 21 st , 2008.

The dollar ($) is going up because de-leveraging is creating a net draw on the money supply as negative wealth effects from deflating bubbles work their way through the system. We know this is the case because all asset categories are deflating – stocks, commodities, and even sovereign debt is under pressure now for the same reason. What is happening is the gamblers (hedge funds) are going bust in not realizing the degree of the event currently unfolding (and policy mistakes authorities are making right now), which will most likely continue to bring down asset values in dramatic fashion . Some think this will eventually lead to a US debt default , and the need to reintroduce an international gold standard . The $'s role as global hegemony is now inked in stone, as is the case with all fiat currencies , although it should continue to remain buoyant until deleveraging trends abate sometime next fall.

With central planners now regionalizing fiat currencies in a desperate attempt to cling onto what vestiges of the Western globalization model that remain, the eventual return of some form of gold standard comes closer. Popularity for such a move will gain momentum when business leaders realize banks will not extend letters of credit for import procurement and international trade without a gold backed currency, which will happen once governments are brought to their knees due to deflating asset bubbles and economies. A successful outcome for Obama on November 4 th should accelerate this process as his policies are seen as a repeat of the mistakes made in Roosevelt's New Deal , which essentially socialized the US economy, a condition thought to have drawn out the Great Depression .

The parallels here are undeniable and frightening, significantly increasing the probability of similar outcomes in the markets and economy. This opinion is fortified in the fact the monetary base and Fed Reserves have gone parabolic, however this largesse is not getting through to the economy, as reflected by contracting growth rates in the M's and multiplier velocity . This is partly because of rampant deleveraging , which is just beginning to gain momentum now. It's also due to the fact much of the largesse associated with the bailout plan is still being held-up within the system by reluctant bankers unwilling to lend, meaning badly needed liquidity is not making its way down to cash strapped consumers and businesses.

And while it's true LIBOR rates softened slightly last week, suggestive credit between banks has begun to flow again, one should not get too excited about this in terms of the big picture, where again one would do well to remember the deleveraging process is just getting started. Moreover, in spite of the fact the Fed will begin lending directly to private companies beginning next week, which could act to stabilize the economy temporarily, this will only delay the inevitable, especially with Bernanke's narrow and targeted policy measures continuing to starve the larger economy of liquidity. This next point is very important to understand, so please follow along closely.

It's important to understand this point because like in the 30's, not only is the fiscal policy response to a crumbling post financial bubble economy likely to be misplaced via Obamanomics, making any contraction last longer; but also, and perhaps more importantly, it appears that in spite of the real threat of deflation, Bernanke's Fed continues along with narrow, targeted, and ineffectual monetary policy measures that will in the end potentially bring the house of cards down. (i.e. their derivatives empire.) Of course the irony here is that Bernanke prides himself on being a self-proclaimed expert on the mistakes made that led to the Great Depression, so it's almost mind boggling to see this playing out. And this is especially true in the sense not many others see it happening, and are not discounting the possibility of a Great Depression II developing because of what would be looked back on as policy errors.

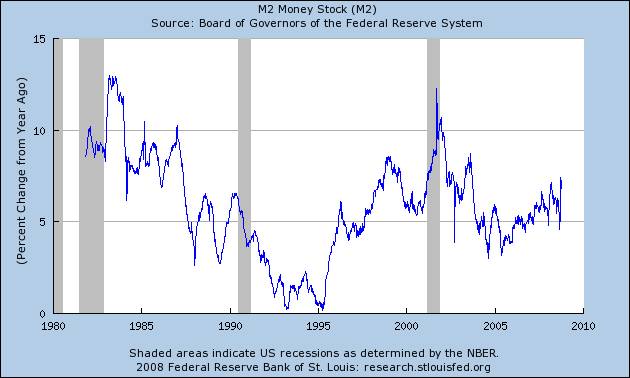

Exactly what do we mean by the term ‘policy errors'? If the Fed's goal is to extend the inflation cycle, which is of course the source of its power, it must attempt to balance cause and effect with respect to monetary policy, which becomes more difficult as the larger credit cycle matures. Of course if the Fed does not realize the larger credit cycle has rolled over, or assumes it can extend it indefinitely absent the consumer , which it's attempting to do by only bailing out select companies (keeping re-inflation narrow as to not re-ignite commodity prices), increasingly, policy errors can be made, which is the situation at present in my opinion. You see the Fed should be inflating with abandon at present if the goal is to avoid another Depression, and they are not, which is evidenced in struggling money supply growth rates. (See Figure 1)

Figure 1

Source: Federal Reserve Bank Of St. Louis

So please, do not be confused about this, because it's very important to recognize that despite regular rhetoric out of the Fed, continued narrow policy measures will likely keep growth rates of the M's contained, which could cause dire consequences to develop past what appears to be a ‘deflation scare' to many at present. What's more, with headlines like “BERNANKE-INCREASE IN FED'S BALANCE SHEET DOES NOT CREATE PROBLEMS FOR MONETARY POLICY, INFLATION RISK” and “BERNANKE-PROVIDING EXTRA LIQUIDITY DOES NOT INCREASE MONEY SUPPLY, HAS NO INFLATIONARY EFFECT”, make no mistake about it, the Fed is more concerned about the threat of hyperinflation than deflation at present, and is doing it's damndest to prevent triggering it while attempting to keep the economy afloat. It's a ‘balancing act' you see.

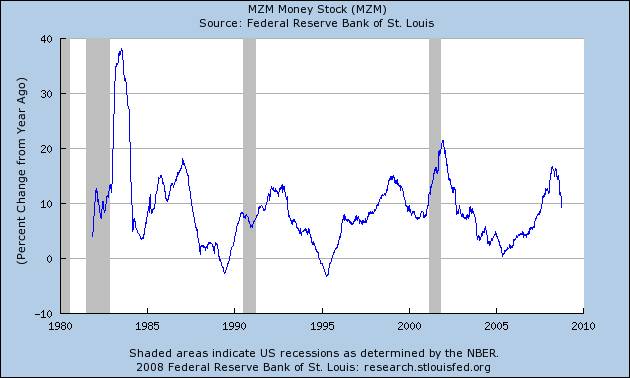

And as you can see below in a declining growth rate of Money At Zero Maturity (MZM), which you can think of as liquid cash available to the public to spend and invest, the balancing act is presently being skewed in favor of inflation containment, which again, could prove economically fatal if Obama follows through on tax-heavy campaign promises. This is why an Obama win on November 4 th could cause surprising market reactions in both stocks and bonds, consistent with the 1929 patterning , corresponding to interim lows in stocks potentially stretching into next month. In this respect investors are still sufficiently bullish to garner further losses in stocks as measured by index open interest put / call ratios (at historic lows), the Gold / Silver Ratio (100ish is the target), the Nasdaq / Dow Ratio (.13 bottoming area) and the Rydex Ratio (.70 topping area), where it's evident that although premiums investors are will to pay for bear funds are rising, they're still not yielding topping thresholds as of yet. (See Figure 2)

Figure 2

Source: Federal Reserve Bank Of St. Louis

Another worrying development that transpired in the financial markets last week was the penetration of Golden Ratio retracements in precious metals indexes, suggestive a move down to the 78.2% thresholds could be vexed in coming days. And of course you can take the negative possibilities associated with a real ‘screw-up' in above mentioned policies even further, as can be seen on this attached Amex Gold Bugs Index (HUI) plot, where one can see the potentially negative implications associated with prices moving back down to the 78.2% retrace at 140. Although not necessarily carved in stone, a move down to this level has potentially long lasting bearish implications from a technical perspective to say the least.

Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our continually improved web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. For your information, our newly reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts , to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented ‘key' information concerning the markets we cover.

And if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these matters.

Good investing all.

By Captain Hook

http://www.treasurechestsinfo.com/

Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2008 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

Captain Hook Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.