Investment Momentum for Infrastructure is Building

Stock-Markets / Infrastructure Dec 16, 2008 - 03:47 PM GMTBy: John_Derrick

We've been talking infrastructure for a long time, and more people are now listening after President-elect Obama revealed that his best idea for stimulating the U.S. economy is through a massive infrastructure spending program.

We've been talking infrastructure for a long time, and more people are now listening after President-elect Obama revealed that his best idea for stimulating the U.S. economy is through a massive infrastructure spending program.

While details are still being worked out, it appears that Mr. Obama will quickly propose a two-year fiscal stimulus package worth up to $800 billion and that much of this amount would be directed toward infrastructure programs. To put this number in perspective, $800 billion is equivalent to about 5.5 percent of the nation's GDP.

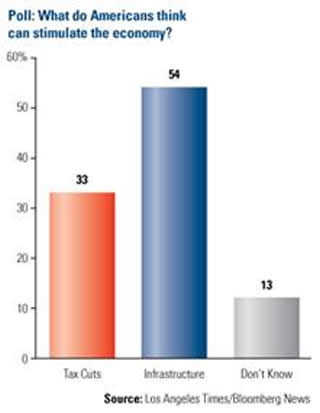

And while Americans are divided on the wisdom of the TARP rescue program for financial companies and whether to throw a federal lifeline to the Detroit carmakers, they clearly support spending to repair or replace the aging stock of U.S. infrastructure assets.

A recent Los Angeles Times/Bloomberg survey shows that the public strongly believes that “an economic agenda focused on spending for improvements to the country's infrastructure such as roads, bridges, and schools” would be more effective than tax cuts in stimulating the nation's economy and creating jobs.

Stock markets responded well to Mr. Obama's emphasis on infrastructure to revive the economy, which makes some sense because many sectors would be affected, among them steel and cement companies, engineering and construction firms and heavy equipment makers. For those who produce industrial commodities like copper and oil, Mr. Obama's vision could help reverse declining prices.

State highway officials say they have $64 billion worth of road and bridge projects that could be under way within six months. These projects could create nearly 2 million jobs. Tens of billions more dollars could be allocated for projects addressing repairs and upgrades in water, mass transit, airport, school and other infrastructure.

Governments around the world are also seeing the possibilities. UBS Investment Research estimates that the global fiscal stimulus is equivalent to 1.5 percent of global GDP and, as in America , a significant portion of this stimulus will fund infrastructure projects. Countries that are investing a significant portion into infrastructure include China , Australia , France and the United Kingdom .

The Chinese government has been particularly aggressive – roughly 75 percent of the recently announced $586 billion fiscal stimulus measure is being targeted for infrastructure projects. China 's stimulus program will cover affordable housing, rural infrastructure, railways, power grids and post-earthquake rebuilding in Sichuan .

The stimulus program is only a part of China 's allocation to infrastructure.

In its current five-year plan (2006-11), the government plans to spend more than $650 billion on infrastructure projects, most of it on highways, railways and other transportation projects. On top of that, roughly $1 trillion more has been approved for roads, rails, ports, water systems and other infrastructure in the next few years.

The accelerated infrastructure spending is intended to help offset lower exports and lower property related investment in China . Beijing has a fiscal surplus, large foreign exchange reserves and low government debt levels to help pay for the planned spending.

We've long believed in the global infrastructure build-out in large part because it is driven by government policies for growth. In the case of both the U.S. and China , it's a win-win economic stimulus—jobs are created to kick up the economy and many needed projects get done.

By John Derrick

John Derrick is Director of Research at U.S. Global Investors, Inc., a boutique investment advisory firm based in San Antonio that specializes in the natural resources and emerging markets sectors. Mr. Derrick is also the co-manager of the Global MegaTrends Fund (MEGAX) , a mutual fund focused on global infrastructure investments.

For more insights and perspectives from the U.S. Global Investors team, visit CEO Frank Holmes' investment blog “ Frank Talk” at www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

John Derrick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.