U.S. Corporate Bonds Show Recovery Progress

Interest-Rates / Corporate Bonds Dec 28, 2008 - 06:02 PM GMTBy: Richard_Shaw

Several US bonds types have mostly recovered from the steep losses of October. The differences in recovery generally correspond to the position of the bonds in the capital structure, or to credit quality.

Several US bonds types have mostly recovered from the steep losses of October. The differences in recovery generally correspond to the position of the bonds in the capital structure, or to credit quality.

After this difficult year, we expect more investors will consider bonds as part of their portfolio and a volatility moderator.

Aggregate US Bonds:

Aggregate bonds (excludes short-term and muni bonds) are ahead, due to the strong performance of Treasuries.

The two leading ETFs for the Lehman Aggregate US Bond index are AGG from Barclays and BND from Vanguard. The Barclays product has more trading volume, and uses limited sampling to track the index. The Vanguard product has lower fees and holds many more securities in its sampling.

[shown: AGG, BND]

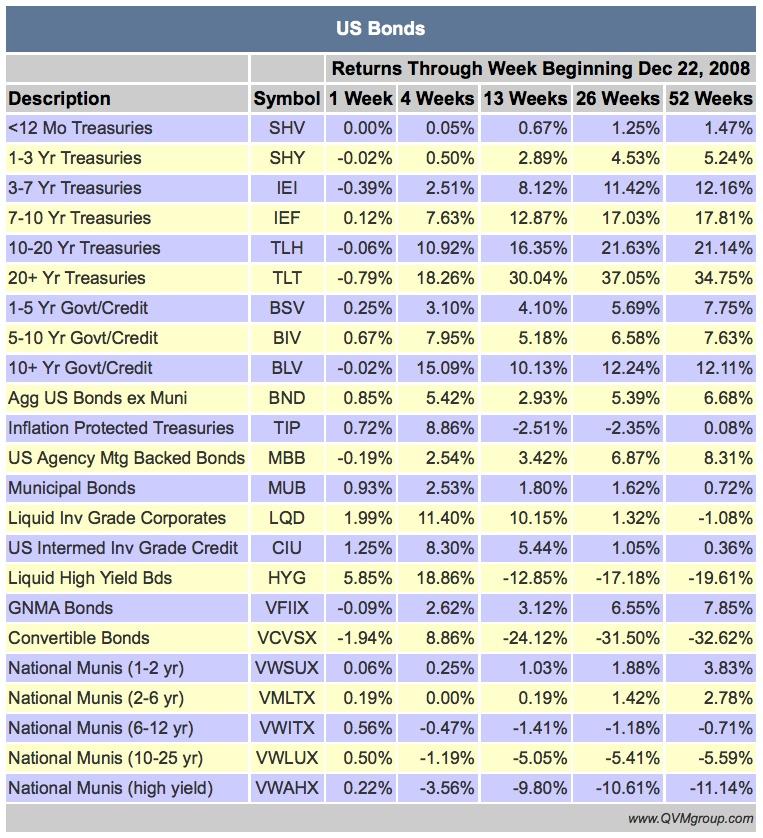

US Bond Types:

Treasuries are bubbly and showing fatigue at the long end (see prior articles: 12/24/2008 and 12/25/2008 ). Mortgage-backed securities (MBB: mostly from FHLMC and Fannie, with some GNMA; and VFIIX: primarily GNMA) are well ahead for the year. Investment grade corporates are nearly recovered. High yield corporates are beginning to show life.

click image to enlarge

[shown: SHY, IEI, IEF, TLH, TLT,

MUB, MBB, VFIIX LQD, HYG]

High yield bonds, investment grade corporate bonds and some other types of bonds available through ETFs experienced some large premium and discount deviations from net asset value in the October - November period. Mutual funds that trade at NAV did not deviate. (See our article on Broken Arbitrage for bond funds). Note, however, that some of our readers suggested that the ETF deviations were a better “finding of value” in the frozen credit markets than the bid information used by mutual funds to calculate NAV — we have no way to tell which is the correct view.

Weekly line charts (instead of the daily candlesticks above) for key bond types are in a recent article .

National Municipal Bonds:

National municipal bonds appear to be doing well by looking at MUB (an ETF), but that view is not fully supported by looking at a series of Vanguard muni funds shown below. The shorter-term munis are not too far off earlier 2008 levels, but the other maturity ranges have a way to go.

click image to enlarge

[shown: VWSUX, VMLTX, VWITX, VWLUX, VWAHX]

The muni funds invest in bonds within different maturity ranges (or quality in the case of high yield):

- VWSUX (1-2 years)

- VMLTX (2-6 years)

- VWITX (6-12 years)

- VWLUX (10-25 years)

- VWAHX (high yield).

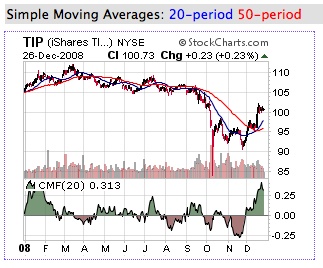

Inflation Protected Treasuries:

Inflation Protected Treasury Bonds are in a class by themselves, because the are “real assets” that fluctuate interest payments with the CPI and mature at the greater of par or cumulative inflation adjusted principle (see Tip on Tips ). They have a way to go to recover and are not likely to do so until inflationary concerns become more prevalent.

[shown: TIP]

Convertible Bonds and Preferred Stocks:

Convertible bonds and preferred stocks (which have both bond-like and stock-like attributes) also have a way to go to recovery. Because preferred stock is always subordinated to bonds, and since convertible bonds are generally subordinated to non-convertible bonds, these two types of securities would be expected to recover later in the economic cycle.

[shown: VSCVSX (convertibles) and PFF (preferreds)]

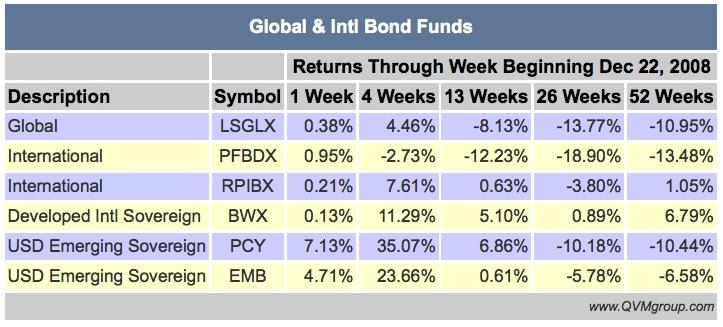

International Bonds:

Among non-US bond index funds, BWX (investment grade, local currency denominated sovereign debt of developed market countries) is mostly recovered. EMB (US Dollar denominated sovereign and quasi-sovereign debt of emerging market countries) is making strong recovery progress.

[shown: BWX and EMB]

US Bond Fund Short-Term Returns:

This chart is updated weekly on Saturdays and available on our website .

Global and International Active and Index Fund Short-Term Returns:

This chart is updated weekly on Saturdays and available on our website .

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.