Stock Market Wave 4 Rally Scenario Intact

Stock-Markets / Elliott Wave Theory Jan 03, 2009 - 08:50 AM GMTBy: Mike_Shedlock

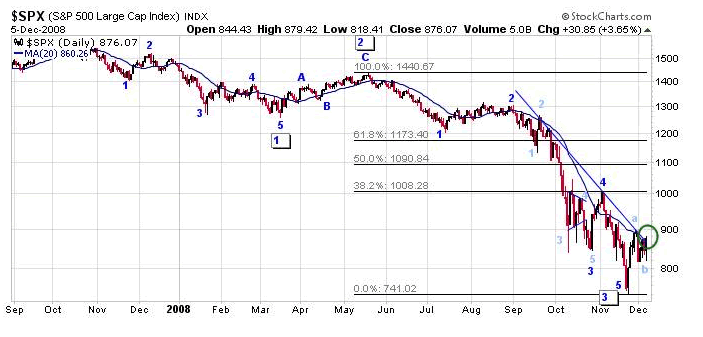

The "wave 4 theory" is alive and fine. Here is the chart from December 8th Bullish Looking Charts: S&P 500, Nasdaq, BKX describing possible targets for Wave 4.

The "wave 4 theory" is alive and fine. Here is the chart from December 8th Bullish Looking Charts: S&P 500, Nasdaq, BKX describing possible targets for Wave 4.

In Elliott Wave terms we are looking for a "wave [4]" bounce. The short term implications are bullish with possible retrace targets of 1008 for a 38.2% retrace or 1090 for a 50% retrace of "wave [3]". The long term implications are rather nasty. Our "Wave [5]" target back down is approximately 600.

$SPX - S&P 500 Daily Chart

In Elliott Wave terms we are looking for a "wave [4]" bounce. The short term implications are bullish with possible retrace targets of 1008 for a 38.2% retrace or 1090 for a 50% retrace of "wave [3]". The long term implications are rather nasty. Our "Wave [5]" target back down is approximately 600. Please see S&P 500 Crash Count for more details.

The S&P 500 closed today at 931, shrugging off a lot of bad news in its wake. There is no point to redraw the chart, just make a mental note we are one step closer to the Fibonacci target of 1008.

Market Shrugs Off Another Wave Of Bad News

Here are a few headlines.

US Manufacturing Orders at 60 Year Low, China Contracts 5th Straight Month

Manufacturing is contracting in the US, Eurozone, Russia and China. The Institute for Supply Management's factory index [Manufacturing ISM] fell to 32.4, below economists' forecasts and the lowest level since 1980, from 36.2 the prior month. Readings less than 50 signal contraction. The group's new-orders measure reached the lowest level on record and prices slid the most since 1949.

Visteon plans pay cut, shorter work week

Visteon Corp. will cut pay by 20 percent for about 2,000 salaried employees as the employees transition into a four-day work week beginning Monday.

Two thousand employees at Visteon's Van Buren Township offices and 50 workers at its testing center in Plymouth will be affected by the move, spokesman Jim Fisher said Friday. The action comes as Visteon is in the process of eliminating 800 salaried jobs globally.

"This is a way to reduce our operating costs while eliminating layoffs," Fisher said. "We realize this is a hardship for our workforce," Fisher said. "We have told our employees all along that we are committed to working through these tough economic times."

The auto supplier's three core products are electronics, interiors and climate control devices, Fisher said. "We have increasingly diversified our customer base," he said. Visteon only counts 40 percent of its revenue from Ford, GM and Chrysler, Fisher said.

Semiconductor sales fall 9.8% in November

Jan. 2, 2009

Worldwide sales of semiconductors fell 9.8% to $20.8 billion in November, compared with $23.1 billion in the year-earlier period, the Semiconductor Industry Association said Friday.

Workers Ordered to Give Up City-Owned Cars

Economic hard times are about to hit New York City's employees where it hurts: in their driveways. As the Bloomberg administration scrambles to cut spending, it is ordering city agencies like the police, parks and health departments to give up nearly 700 city-owned cars, a cherished perk for their workers.

The move would save $20 million over the next two years, according to a copy of the memorandum sent to city agencies.

The decision to sell off scores of Toyota Prius cars and Ford Escape sport utility vehicles is very likely to irritate many city workers, who use the them to travel around the city inspecting sites or rushing to meetings.

Bear Market Rallies Frequently End On Good News

On December 19th in Catch A Wave I wrote ....

The market may rally in a sloppy choppy fashion until Obama is inaugurated and signs the bill Nancy Pelosi has waiting, with an overshoot of 1-3 days, culminating in a big gap and crap event.

This thesis is based on the idea that major bear market rallies frequently end on good news, not bad news. Likewise, bull market corrections often end on bad news. With that in mind, the market may be rallying now in expectation of a huge economic stimulus package, something that the news media and most economic pundits thinks is "good news" even if the reality is otherwise.

Under this scenario, the rally lasts until Obama signs that economic stimulus bill plus a 1 to 3 day euphoric blowoff or gap and crap when the world realizes that a true recovery was actually postponed by the recovery package.

This theory may or may not happen, but the key now is that regardless of "why", and until proven otherwise, we are still in a choppy overlapping wave 4 up. Either catch the wave or stand aside. Swimming against the tide is simply no fun.

MarketWatch is reporting First session of 2009 locks in a weekly advance .

U.S. stocks rallied Friday to lock in solid weekly gains, with the Dow Jones Industrial Average ending above the 9,000 mark for the first time since Nov. 5, as investors shelved one of the most bruising years on record to ponder moves by the new administration.

"Expectations for another big stimulus package once Barack Obama is sworn into the presidency in about three weeks' time is helping lift stocks," said analysts at Action Economics.

Whether or not a big "sell the news" event is coming, the fact remains this market is not cheap. Bennet Sedacca noted on Minyanville today that the S&P is on track to report $42 in earnings this year.

At 1008 and $42 in earnings, the S&P would have a PE of 24, assuming those earnings stick smack in the midst of rising unemployment, consumer retrenchment, and massive deleveraging by consumers and corporations alike. Good luck on that.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.