Bailed Out Banking Stocks Dividend's Dilemma

Companies / Dividends Jan 15, 2009 - 02:56 PM GMTBy: Richard_Shaw

Obama said he will order the Treasury Department to limit dividends paid by commercial banks and investment banks that receive “exceptional assistance” from the government to “de minimis amounts”.

Obama said he will order the Treasury Department to limit dividends paid by commercial banks and investment banks that receive “exceptional assistance” from the government to “de minimis amounts”.

That order will not likely receive any material resistance in Congress. Both Barney Franks and Chris Dodd have expressed similar views in the last several weeks.

Here are four questions to consider:

- What would be the quantitative effect on the S&P 500 index yield overall?

- How would cumulative preferred shares be treated under such an order?

- Are bond holders next to be asked to take an income “haircut”?

- Would municipal bond holders be far behind corporate bond holders on the chopping block?

Several key banks have already dramatically cut dividends, and more would surely follow based on internal decisions, but the Obama order could be a real game changer for equity income investors (read that “retirees” in substantial part).

The S&P Financial Sector has less than a 12% weight in the S&P 500 index, but on a tailing basis has contributed more than 25% of the yield of the index. Since the big banks are the ones receiving “extensive assistance” and are also the primary sources of a large portion (perhaps the bulk) of the dividends for the Financial Sector, are we facing up to a 25% reduction in S&P 500 yield? Quite possibly.

Cumulative preferred stocks have contractually specified dividends, as opposed to the common stock dividends at the discretion of the company, but in the “share the pain” philosophy that is evolving in Washington, there is a distinct possibility that preferred dividends will be held to “de minimis amounts” also.

Given that investors sacrifice upside with preferred shares in exchange for more certain income and a higher distribution priority in bankruptcy, government limitation of preferred dividends might be expected to create a more negative price reaction for preferreds than would a dividend cut on the common.

The political pressure for such dramatic suppression of payouts is building, as exemplified by the recent BusinessWeek editor blog statement:

“And while BofA is slashing its dividend to ordinary stockholders, what about preferred shareholders? On Jan. 5, the bank announced the payment of dividends of various classes of preferred stock—a class of stock that takes priority over common stockholders when it comes to dividend payouts. What's a bit disturbing about BofA's move is that it apparently came at the same time management was asking Treasury for more money to help it digest the Merrill transaction. In other words, at the same time Bofa CEO Ken Lewis was going to the federal government with his hand out, he was reaching into the bank's coffers and recommending a payout to preferred stockholders. Of course, this action also raises questions for BofA's board, which approved the dividend payout.

If the federal government really wants to get tough with the banks, it could even demand that bondholders start feeling some pain. If workers across the country are being asked to take unpaid vacations to save their jobs, why shouldn't bank bondholders take some haircuts on their investments to help save these institutions? The Big Three auto manufacturers were forced to make concessions before receiving some $14 billion in government aid. So Treasury should demand that the banks go to their bondholders and ask for concessions on interest payments—at least until the financial crisis passes.”

More sacred than preferred dividends are the contractual obligations to pay interest on bonds, but as the BusinessWeek blog says, some believe that bondholders should not be paid in full either. If the government can force the breaking of a union pay contract, it is no stretch of the imagination that the government can force the breaking of a bond interest payment obligations.

Muni bonds would be an interesting problem if corporate bonds were limited in interest payments. States are in difficult situations, and are asking for extensive assistance. Would the federal government possibly offer state bailout packages in exchange for a reduction in muni interest payments? On the one hand, we cannot imagine that, but on the other hand, we could not have imagined most of what happened in the financial world in 2008.

Suppressing common dividends to receive government assistance will not likely be seen as “wrong” although it will have adverse stock market valuation implications.

Suppressing preferred stock dividends will be probably be perceived as wrong; would ravage the shares, may raise challenging legal questions, and would change the appeal and perception of preferred stock for a long time to come.

Suppressing corporate bond interest payments (while paying dividends to government preferred shares), would be perceived as wrong by a large portion of the investment world, drive assets out of US credit markets into Treasuries or non-US credit markets, and effectively put impacted companies into some kind of quasi-bankruptcy status (stated or unstated), driving the common further down.

Suppressing muni bond interest payments, would be devastating to the ability of non-federal governments to raise new debt. If that happens, we just don't know what to say — but whatever, it would be ugly.

In not too many days, we will learn more specifically what “extensive assistance” means, and what classes of capital will be subjected to the “de minimis amounts” rules.

As we have said in prior articles, until the government stops announcing new programs and stops changing the rules of the game, it is impossible to make credible predictions about the future price levels of the stock and bond markets.

We moved controlled accounts to 100% cash in July, now have about 70% cash, 25% corporate bonds, 5% preferreds, and 0% common stock. We continue to recommend large cash positions until the smoke clears and the battlefield becomes visible again.

We believe that loss control is more important today than gain pursuit, and that it would be better to be late to a new bull market, than early to a new leg down in a continuing bear market.

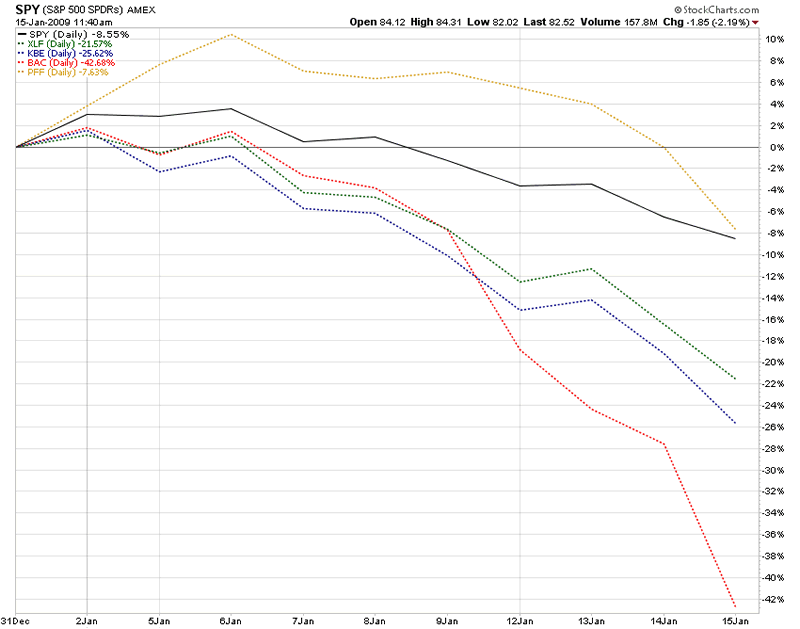

[related securities: all of them really, but in particular SPY, IVV, KBE, XLF, PFF, BAC, BACpL and BACpE]

YTD Percent Relative Performance

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.