Forgive me for being blunt, but the U.S. dollar is sinking into the toilet

Currencies / US Dollar Apr 30, 2007 - 10:13 AM GMT

Martin Weiss writes : Yesterday, we enjoyed the gala finale of the ballroom dance competition here in Venice and we finally had some quality time off.

But this morning, we'll soon be on our way to the Venice airport for our flight back to the U.S. So forgive me if my message to you is both brief and blunt:

The U.S. dollar is sinking into the toilet.

No one is able or willing to come to its rescue.

Investors who fail to take protective action could get hurt badly.

And those that act promptly stand to make some of the greatest fortunes in recent memory.

Look at the Big Picture and you'll better comprehend the sheer magnitude of this phenomenon:

Directly or indirectly, every major asset on the planet is measured in dollars. So when the dollar declines, the price tags on those assets naturally tend to rise. And when the dollar plunges, they explode.That's precisely what's beginning to happen right now …

Just this past week, the dollar passed a point of no return. Like a giant boulder that's rolled off a cliff, it is now falling at a faster pace … with far less resistance … and with much broader impact than at any time in recent memory.This is massive. And it has profound consequences. In fact …

The Decline in the Dollar Is So Deep It's Unleashing A Chain Reaction of Price Explosions In Every One of Our Favorite Contra-Dollar Investments.

Major foreign currencies have been the first to react; their rise is the reverse mirror image of the dollar's decline.

On Friday, for example, the euro hit a record high of $1.3682. Just a year ago, the euro was worth less than $1.20. And in October 2000, it was worth only 83 cents.

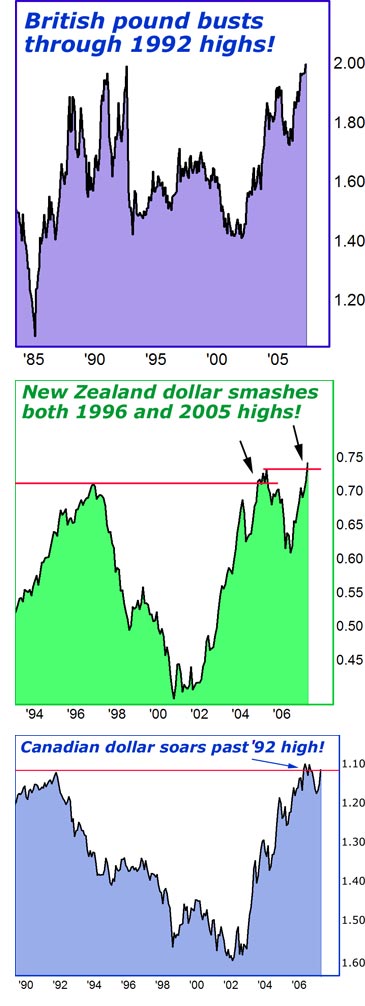

But if you're impressed by the euro's relentless surge, just look at the British pound!

Not long ago, it was the weak sister among the major European currencies.

Not any more! Now the British pound has been surging even more quickly than the euro.

Indeed, a few weeks ago, the pound eclipsed its highs reached in late 2004. And just this week, it busted through its highs reached in 1992, 15 years ago.

The New Zealand dollar is even stronger. It smashed its 1996 record last year. And it just busted through its 2005 record high this week.

It's flying for several reasons: New Zealand's relative proximity to China gives it a strategic advantage over other countries feeding China with resources.

Its government is stable.

And despite concerns about its exports suffering due to its strong currency, its economy is still booming.

Closer to home, the Canadian dollar is also going through the roof … soaring past its 1992 high last year … getting ready to do it again … and likely to soon exceed the value of the U.S. dollar for the first time in three decades.

Even previously downtrodden currencies like the Brazilian real, the Polish zloty, or the South African rand are gaining against the dollar.

According to Bloomberg, it's because their inflation rates have fallen to the lowest in at least two decades … their exports have boomed with rising commodity prices … their deficits have shrunk … and their external debts have been slashed.

But get this:

Since the beginning of the year, the dollar has been the 51st worst performing currency in the world. FIFTY other currencies, some in heretofore shaky, rag-tag economies, have trumped the U.S. dollar.The dollar plunge — and foreign currency surge — is helping to drive up gold, silver, platinum, uranium, and almost every natural resource known to man.

The dollar plunge — and foreign currency surge — is also a big factor behind the smashing record highs in overseas stock markets — Brazil, China, Malaysia, Singapore and dozens of others.

In short, the dollar's plunge is like an ear-shattering booster rocket, greatly enhancing the wealth of those who have bought contra-dollar investments — foreign currencies, gold, and ETFs dedicated to foreign stock markets.

But alas, the dollar's plunge is also a silent killer, threatening to destroy the wealth of millions of Americans who fail to take protective action.

You see, the fall of the dollar (and the rise of foreign currencies) isn't strictly due to the good news abroad. It's also due to the bad news at home, right here in the United States.

U.S. Economy Dragged Down by Housing Bust

Week after week, Money and Markets' Friday columnist, Mike Larson, has been warning you about the spreading danger of the housing bust. And week after week, we see more evidence demonstrating the wisdom of his prognosis.

On Friday, the U.S. Commerce Department reported that the economy grew at an annual rate of a meager 1.3 percent in the first quarter, largely because it was bogged down by a steep drop in homebuilding.

That's among the worst economic performance of the entire community of nations.

And also last week, the National Association of Realtors reported that sales of previously occupied homes in March dropped 8.4% from the prior month to a seasonally adjusted annual rate of 6.12 million units.

That was the largest monthly drop since 1989.

Prices of homes are falling nationwide and beginning to plunge in key areas of the country. Inventories of unsold homes are still bulging. And now, as evidenced by the Friday GDP report, this housing malaise is dragging down the growth of the entire U.S. economy.

Our recommendation: If you haven't done so already, start moving …

- away from investments that are vulnerable to weakness in the U.S. dollar, the U.S. housing market and the U.S. economy …

- to investments that directly benefit from surging foreign currencies, booming foreign economies, and record-breaking foreign stock markets.

We issue new, landmark recommendations on our favorites tomorrow, and today is the last day to jump on board. For more information, be sure to read my Saturday email with the subject line "Heads up: Major New Reco Tuesday."

Unfortunately, due to technical difficulties with our server, it didn't go out until Saturday afternoon. So if you missed it, be sure to read it now.

Good luck and God bless!

By Martin Weiss

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.