Crude Oil Manipulation Reality, Close Look at the Almost Perfect Crime

Commodities / Market Manipulation Sep 11, 2009 - 09:29 AM GMTBy: Rob_Kirby

Some time ago, GATA Secretary / Treasurer Chris Powell gave a speech titled, There are no markets anymore, just interventions. These sage words have stuck in my head. While Mr. Powell was specifically referencing manipulations in the precious metals markets, I am revisiting the concept as it relates to the crude oil market.

Some time ago, GATA Secretary / Treasurer Chris Powell gave a speech titled, There are no markets anymore, just interventions. These sage words have stuck in my head. While Mr. Powell was specifically referencing manipulations in the precious metals markets, I am revisiting the concept as it relates to the crude oil market.

The ongoing surreptitious “management’ of strategic commodity prices by the U.S. Government and its agents needs to be exposed for what it really is – UNFAIR TRADE and AN ABUSE OF PRIVILEGE. These practices have resulted in a litany of unsustainable, unfair and damaging outcomes in many markets with results that favor privileged insiders at the expense of the common good. I continue to be amazed at the lack of uptake by the media to these over-arching issues that impact the well being and daily lives of all citizens and media’s feeble attempts to explain the ‘unexplainable’ based on free market principles when markets are not free.

7 months ago I published a research paper which examined the root cause of last year’s crude oil price collapse, Oh Yes They Did!. With the passage of time, and a little bit more poking around, I came to the conclusion that there was a lot more mileage in the original material than first reported.

With a show of hands, how many of you out there really know how the U.S. Strategic Petroleum Reserve [SPR] is filled anyway? Because I did not see many hands, compliments of the Congressional Research Centre [pg. 3 of pdf doc.], I present you all with this little refresher:

Congress authorized the Strategic Petroleum Reserve (SPR) in the Energy Policy and Conservation Act (EPCA, P.L. 94-163) to help prevent a repetition of the economic dislocation caused by the 1973-74 Arab oil embargo. The program is managed by the Department of Energy (DOE). Physically, the SPR comprises five underground storage facilities, hollowed out from naturally occurring salt domes in Texas and Louisiana. The SPR, with a capacity of 727 million barrels, currently holds roughly 692 million barrels.

In mid-November 2001, President Bush ordered fill of the SPR to its current capacity of roughly 700 million barrels, principally through oil acquired as royalty-in-kind (RIK) for production from federal offshore leases. This level will be attained during FY2005. However, the Bush Administration has been periodically criticized for continuing to fill the SPR with RIK crude as crude prices have continued to rise and be volatile……

From this document supplied by the U.S. Congress, we can see that oil in the SPR is, by definition, referred to as royalty-in-kind [RIK] crude.

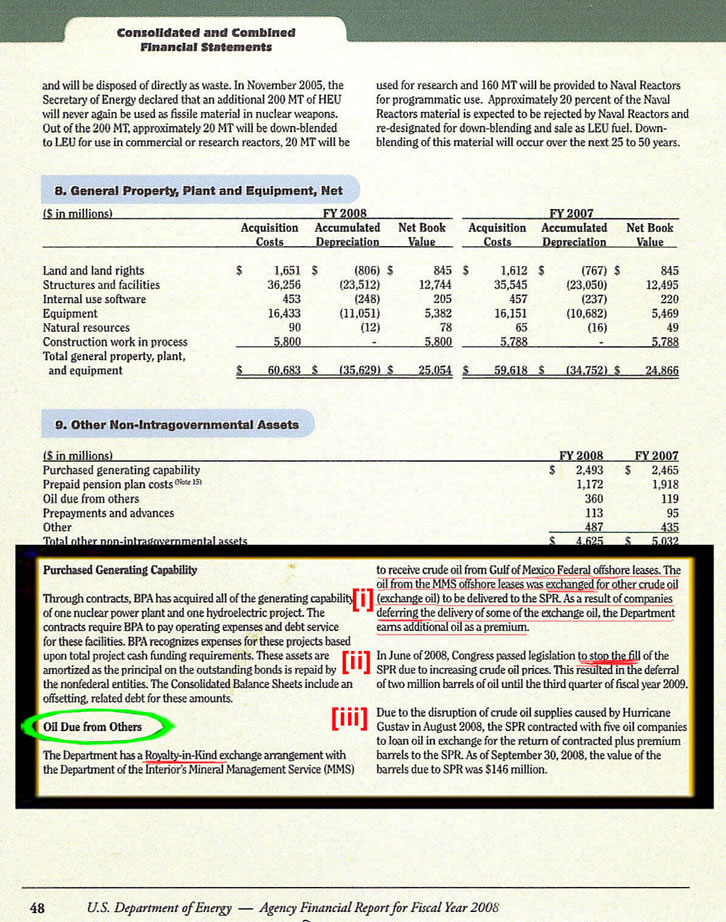

I’d like to draw everyone’s attention to the fact that the United States Department of Energy admits, in the notes on page 48 of their 2008 financial report, that they “swapped” RIK crude for ‘other’ [to be delivered] crude oil [i].

A swap of this nature requires the REMOVAL of physical crude from the SPR through pipelines.

source: U.S. Dep't of Energy

Interestingly, the U.S. government chose not to publicly disclose that they were involved in crude oil swaps – because their intention was to stall manically rising prices, creating a temporary “physical glut” in the market place - and to DRIVE CRUDE OIL PRICES DOWN. Their actions were only recorded “buried” in foot notes of the Department of Energy’s Annual Report where, I’m certain, they assumed no one would ever look.

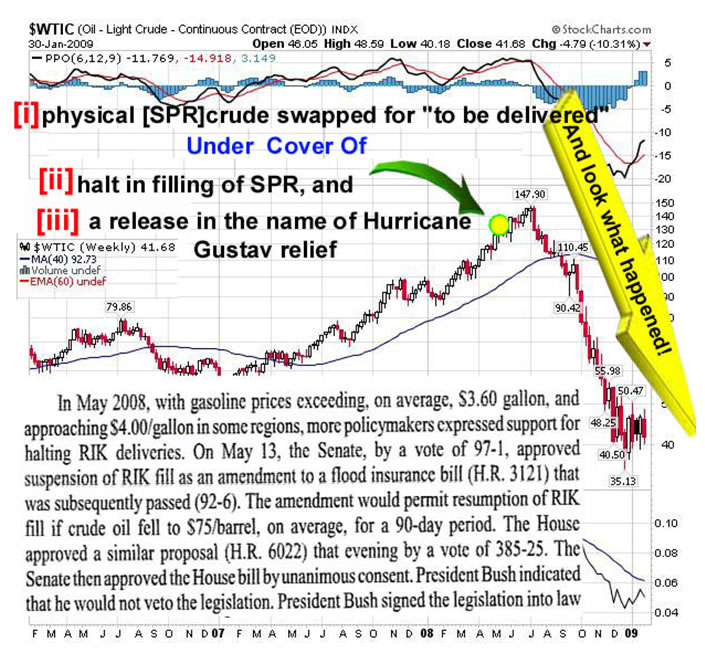

This was done under the cover of [ii] and [iii] making public announcements that they were no longer filling the reserve [net add which had been occurring continually since 1999] and were in fact providing SPR crude to refiners in the aftermath of Hurricane Gustav.

Here’s the intended resulting oil price collapse:

Remember folks, the result of this action produced several effects;

1] A “localized’ glut of crude oil in the Cushing, Oklahoma region – which produced the tell-tale signature evidence of a lack of physical crude storage facilities.

2] The shortage of physical crude storage facilities reverberated back through the supply chain creating the well documented spike in Very Large Crude Carrier [VLCC] super-tanker rates in an otherwise moribund shipping market - as attested by the “then battered” Baltic Dry Index.

3] It was this same criminal interference in the crude oil market which produced the anomalous “flipping” of the historic price premium which the higher grade West Texas Intermediate [WTI] enjoyed over Brent [North Sea] Crude – a price inversion which remains to this day.

Conclusions:

The Foreigners Are Learning

The rigging of markets benefits insiders and strains international relations. The significance of this issue is now becoming clearly evident as we are just beginning to see the empirical manifestations of these unfair dealings:

China warns banks on OTC hedge defaults -report

Sat Aug 29, 2009 9:47am IST

BEIJING, Aug 29 (Reuters) - Chinese state-owned enterprises (SOEs) may unilaterally terminate derivative contracts with six foreign banks that provide over-the-counter commodity hedging services, a leading financial magazine said.

China's SOE regulator, the State-owned Assets Supervision and Administration Commission (SASAC), had told the financial institutions that SOEs reserved the right to default on contracts, Caijing magazine quoted an unnamed industry source as saying.

It did not name the banks or the firms in question, but said Keith Noyes, an official with the International Swaps and Derivatives Association, had confirmed he was aware of the letter to the banks. He declined to comment further to Caijing.

It also cited a SASAC official as saying that almost every SOE involved in foreign exchange or trade had some exposure to derivatives such as crude oil, non-ferrous metals, agricultural commodities, iron ore and coal, although only 31 SOEs were licensed to do so.

Nobody at SASAC was immediately available to comment on Saturday.

SASAC took over the job of overseeing SOEs' derivatives trading from the securities regulator in February after several Chinese firms reported huge losses from derivatives, and quickly tightened the rules, ordering firms to quit risky contracts and report their positions on a quarterly basis.

In January, Air China (601111.SS: Quote, Profile, Research) (0753.HK: Quote, Profile, Research), Shanghai Airlines (600591.SS: Quote, Profile, Research) and China Eastern (600115.SS: Quote, Profile, Research) reported book losses of almost $2 billion on aviation fuel hedging contracts, the official Xinhua news agency said at the time.

China is but one example whose voice, as America’s largest creditor, cannot be ignored. Their recognition of ponzi-paper markets has led to their repudiation of the market rigging game. The unspoken, yet imminent, extension of this logic is ultimately the repudiation of U.S. Dollar hegemony, as all strategic commodities currently settle in U.S. Dollars. A failure on this level would have catastrophic implications with America being unable to conduct international trade. Additionally, unilateral termination of losing derivatives positions could precipitate a seismic paper avalanche that could overwhelm the global banking system.

Additional tell-tale signs of possible, systemic financial dislocations will be covered in the next few days in a special subscriber’s report analyzing Barrick Gold’s apparent capitulation and announced intention to cover all existing gold hedges [in the next 12 months] still on their books.

In closing, I re-present this to you in greater detail now because – when the article was first published 7 months ago – there were some that said, “the oil price collapse may have been caused by a release of crude from the SPR”.

Ladies and gentlemen, the notion that the oil price collapse “may have been caused” by a secretive release of crude from the SPR is as debatable as the notion that the sun “may have risen yesterday”.

For the record, both are indisputable, documented, historic facts.

Invest wisely and understand who and what you’re dealing with and remember, there’s no such thing as the perfect crime.

Subscribe here. Buy gold, silver and/or platinum bullion here.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.