Crude Oil WTI/ Brent Premium Inversion

Commodities / Crude Oil Feb 12, 2009 - 09:55 PM GMTBy: Rob_Kirby

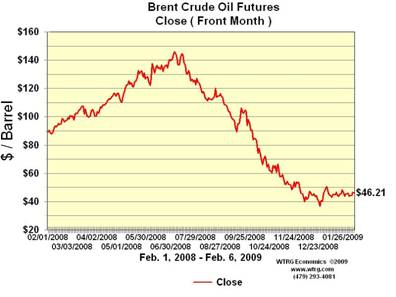

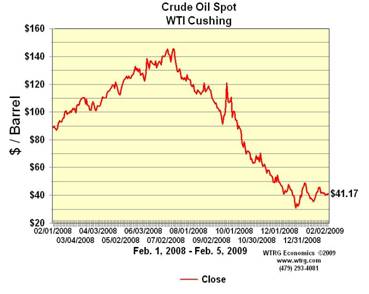

Oh Yes They Did! - I've been trying to resolve what's behind the recent inversion of the historic premium that West Texas Intermediate [WTI] Crude Oil has enjoyed versus Brent Crude? Historically, West Texas Intermediate Crude Oil trades at a premium price to Brent Crude Oil for quality as well as logistical reasons. In recent weeks and months – WTI has been trading at a deep discount to Brent Crude:

Oh Yes They Did! - I've been trying to resolve what's behind the recent inversion of the historic premium that West Texas Intermediate [WTI] Crude Oil has enjoyed versus Brent Crude? Historically, West Texas Intermediate Crude Oil trades at a premium price to Brent Crude Oil for quality as well as logistical reasons. In recent weeks and months – WTI has been trading at a deep discount to Brent Crude:

From an historical perspective, this price disparity pictured above is BACKWARDS. There is a reason:

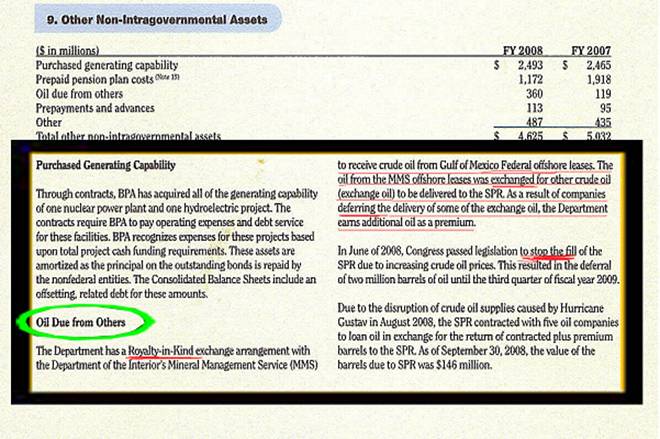

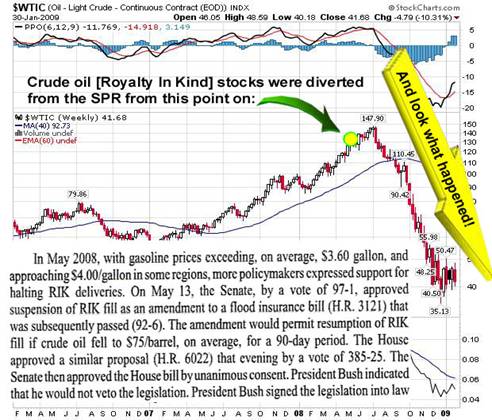

Recently, I shared with my subscribers some unusual machinations which are acknowledged to have occurred by the U.S. Dept. of Energy [DOE] back in May / June 2008 – from the DOE 2008 annual report:

The excerpt above illustrates that the DOE stopped filling the Strategic Petroleum Reserve [SPR] as of last June [2008] – an activity that had been underway – more or less continuously – since 1999.

But the above excerpt says more than just that; it specifically states that,

“Oil from the MMS offshore leases has been exchanged for other crude oil”

The “exchange” cited in the aforementioned quote above is also known as an “ OIL SWAP .”

Where Else Has the U.S. Government Done Swaps?

There is proof that the U.S. Government is involved in Gold Swaps. From James Turk's, The US Gold Reserve is Now in Play :

I have long suspected that the US Gold Reserve is being used by the gold cartel as a tool to help it try capping the gold price. See for example the April 23, 2001 press release by the Gold Anti-Trust Action Committee [ http://www.gata.org/node/4223 ] which refers to my then recently published article, “Behind Closed Doors”. The complete article is available at the following link: http://www.fgmr.com/clsddoor.htm

“Behind Closed Doors” provided compelling evidence that part of the US Gold Reserve had been swapped for gold in the Bundesbank. Gold was then removed from the Bundesbank's vault and loaned into the market as part of the gold cartel's price capping scheme.

We now have more evidence that all may not be well in Fort Knox . Many thanks go to Bill Rummel of Charleston , South Carolina for bringing the following to my attention.

The US Treasury quietly made a subtle change to its weekly reports of the US International Reserve Position, which includes the US Gold Reserve. This change was first made on May 14th. The differences can be seen by comparing the report's old format release on May 8th to the new format used the following week. Here are the links: http://www.treas.gov/..

Note the additional description of gold provided in the new reporting format. It says the US Gold Reserve is 261.499 million ounces and importantly, that the gold is now reported “ including gold deposits and, if appropriate, gold swapped ” [emphasis added].

This description provides clear evidence that the US Gold Reserve is in play. Gold has been removed from US Treasury vaults and placed on deposit, presumably in the couple of bullion banks the Treasury has selected to assist with its gold price capping efforts.

The U.S. Treasury has only recently acknowledged that they have been involved in gold swaps. Not withstanding, for accounting purposes, they still claim to possess the SAME NUMBER OF PHYSICAL OUNCES . When gold is swapped or leased – it almost always physically leaves the vault and it is sold into the market – and it is replaced with an IOU.

As evidenced above, crude oil has also been swapped – likely sweet crude, WTI - for less expensive sour crude. Under such a scenario – physical sweet crude left the SPR – creating a market glut of “premium sweet oil”. This set off an engineered over-supply chain reaction in the crude complex which depressed WTI's price relative to Brent Crude. Because supply chain storage facilities are finite and were completely filled in the Texas / Cushing region – this also contributed to further price declines in the crude complex.

This would also explain the phenomena of the world's VLCC [very large crude carrier] Fleet being fully booked for storage purposes while the Baltic Dry Index is at or near record lows.

Like the price trend of gold - the price trend of WTI crude is widely viewed as a benchmark for inflationary expectations in the economy.

In the scenario described above, there would be NO APPRECIABLE ACCOUNTING CHANGE to the reported gross number of barrels in the Strategic Petroleum Reserve [SPR] – but only the “subtle acknowledgement” of the composition alluded to in the DOE's annual report.

We know that such actions were contemplated because of law makers' unsuccessful attempt [in May of 2008] to pass a law making such actions legal and above board when H. R. 6067 failed to pass into law – because it was deemed to compromise long-term U.S. energy security:

H.R. 6067, The Invest in Energy Independence Act

This item is from the 110th Congress (2007-2008) and is no longer current. Comments, voting, and wiki editing have been disabled, and the cost/savings estimate has been frozen.

Detailed Summary

` Invest in Energy Independence Act - Instructs the Secretary of Energy to publish a plan to: (1) exchange light grade petroleum from the Strategic Petroleum Reserve (SPR) for an equivalent volume of heavy grade petroleum plus certain cash bonus bids received that reflect the difference in the market value between light grade and heavy grade petroleum and the timing of deliveries of the heavy grade petroleum; (2) deposit into the SPR Petroleum Account, from the gross proceeds of the cash bonus bids, the amount necessary to pay for the costs of the exchange; (3) deposit 90% of the remaining net proceeds from the exchange into the Energy Independence and Security Fund established by this Act; and (4) deposit the remaining balance into the SPR Petroleum Account to acquire additional petroleum for the SPR.

So we do know that efforts were made to do this “above board”. Heck, even then candidate for President Obama liked the idea ,

ANALYSIS-Obama oil plan may weaken U.S. emergency stockpile

Tom Doggett

Reuters North American News Service

Aug 07, 2008 11:43 EDT

WASHINGTON (Reuters) - Democratic presidential candidate Barack Obama's plan to release oil from the Strategic Petroleum Reserve may lower crude and gasoline prices in the short term, but it could also leave the United States more vulnerable in a supply emergency.

Obama called this week for easing fuel prices by releasing some 70 million barrels of light, sweet crude from the nation's stockpile and swapping it for less expensive heavy, sour oil.

The hope is that putting more oil on the market will push down crude prices and those savings will be passed on to consumers at the gasoline pump.

Cheaper crude would make it more profitable for refiners to make gasoline, diesel fuel and heating oil, and encourage them to produce more of those petroleum products. The additional supplies would lower the prices for the fuels.

"Would it bring down prices initially? Sure," said Sarah Emerson, managing director of Energy Security Analysis Inc, a Massachusetts-based consulting firm. "It's more supply and the price will go down."

Obama says releasing oil from the reserve is meant to provide short-term relief for consumers, and is not a long-term solution to the nation's energy problems……

From all of this evidence – and yes it is EVIDENCE – it is now highly likely that after failing to gain legal authority to utilize sweet crude in the SPR – DESPERATE authorities – who, no doubt will wrap themselves in the flag and claim they acted in the name of National Security – DID CONDUCT oil swaps. The timing of all these events lines up perfectly with the Waterfall decline in oil prices:

The smoking gun is the counter intuitive “lingering wide price discrepancy” with West Texas Intermediate trading at a big discount to Brent Crude Oil.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietary Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.