Japan Recession Ends, but Will Economic Problems Continue?

Economics / Japan Economy Nov 15, 2011 - 05:21 AM GMTBy: James_Pressler

What does it say about the world when the best economic news is coming from Japan? Perhaps a better way to approach this would be to say that Japan’s latest economic figures offer some reassurance that debt worries have not paralyzed all the major economies.

What does it say about the world when the best economic news is coming from Japan? Perhaps a better way to approach this would be to say that Japan’s latest economic figures offer some reassurance that debt worries have not paralyzed all the major economies.

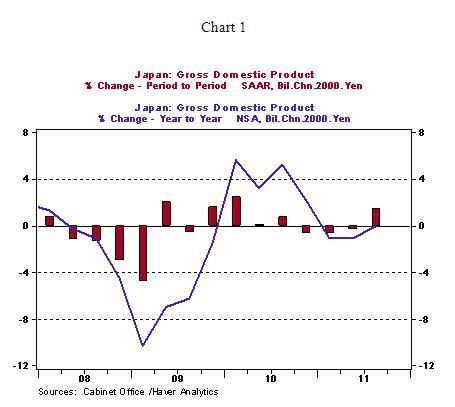

After three quarters of contraction, Japan’s economy emerged from its latest recession with GDP growth of 1.5% on the quarter for Q3, finally shaking off the effects of the March tsunami and returning real production to just about the same level witnessed this time last year. But as the effects of that disaster filter out of the national data, concerns now turn toward whether the post-tsunami economy can maintain some level of self-sustaining growth. We are not getting our hopes up.

For now, the Q3 figures offered short-term assurances. Consumption (both private and public) and fixed capital formation figures were both up on the quarter, and net exports rose after a prolonged slide. The improvement in exports was undoubtedly a response to the recovery of supply chains in northern Japan that were disrupted by the tsunami and nuclear crisis, but the rebound in private consumption (+1.0% q-o-q) came as a bit of a surprise. Overall, this quarter had the best growth since Q1 2010, with a number of figures returning to pre-crisis levels. Looking forward, however, we do not think that the recent GDP report is the start of a trend but rather just the catching-up of some delayed production.

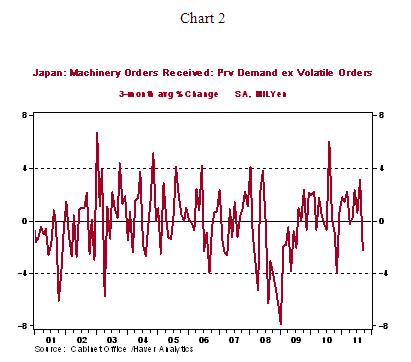

One of our favorite leading indicators of the Japanese economy’s performance is core machinery orders (machinery orders less volatile components). The reasoning is simple – today’s orders initiate tomorrow’s manufacturing – and this conveniently shows the impact of one-off disasters and the delayed effect they have on the economy. And as fate would have it, this indicator has been weakening through the course of 2011. After all the tsunami-related factors are resolved, the bottom line is that Japanese manufacturers are easing back on their big-ticket capital purchases. While this could just as easily reverse itself in Q4, such a recovery would not be felt until Q2 2012. The current trend suggests GDP will slow over this quarter and next.

Our other concern has to do with natural disasters – but not in Japan. This time, the markets are looking at flooding in Thailand and how it is impacting those factories that produce the low value-added goods that eventually go into Japan’s higher-end exports. Whereas the March tsunami impacted the domestic supply chain, Thailand’s problems will have a delayed effect as the impact will be transmitted through longer transportation chains, different inventory situations and the uncertainties regarding Thailand’s ability to restore its infrastructure. Therefore, the effects will be hard to determine at this point but the impact will be felt as early as the end-2011 reports for Japanese manufacturing.

So while we take comfort in the Japanese economy’s ability to rebound from its latest recession, it is too early for a sigh of relief. Rather, it might be wise to take in a deep breath in case things go back under in the next six months.

James Pressler — Associate International Economist

http://www.northerntrust.com James Pressler is an Associate International Economist at The Northern Trust Company, Chicago. He currently monitors emerging markets in sub-Saharan Africa, as well as several European and Asian countries.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.