Stocks Bull Market End Game Bear Start Strategy

Stock-Markets / Stocks Bear Market Aug 04, 2025 - 07:20 PM GMTBy: Nadeem_Walayat

Dear Reader

This article Stocks Bull Market End Game Bear Start Strategy was first made available to patrons who support my work, so for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Thanks to Agent Orange the S&P is down 10% whilst Russian stocks are up 30%, so at least the Russian stocks I bought Feb / March 2022 are soaring! I get asked is the bull market over, it could be but that's not my base case so I did what I've done for the duration of this bull market which is to buy the dip in target stocks as opps materialise. We are getting a bounce off a 10% drop but what the markets are really waiting for the next leg up proper apart from Agent Orange to shut his mouth is for the Fed to indicate that the money printer is about to go brrrr again and for that we have Wednesdays Fed interest rate decision at 6pm GMT followed by Powell's forward guidance speech that will likely be dovish in the wake of the carnage inflicted by Agent Orange. Biden handed President Dump a goldilocks economy that was delivering near S&P 30% per annum, and what does Trump do? he goes and crashes it by pressing the reset button back to 1929! Alls he had to do was nothing and we'd be coasting along with probably a couple more years of easy S&P gains.

Some say there's reason to the madness because Trump is a genius and he's playing 4d chess, he's going to earn the US hundreds of billions of dollars in tariffs per year, though what about the $10 trillion in wealth destroyed over the past few weeks? Reality is that Trump is increasingly going to become like the Fuhrer in his bunker moving imaginary pieces around a map as the economy crumbles towards recession and what power he thinks he has erodes, cue Mid terms.

You know when you reboot a server there is a chance that it doesn't come back online..... that's what's Trumps trying to do to the US economy, a hard reset. The risk is he kills the economy with his 1930's tariffs playbook. What would I do if I was in Trumps shoes, I would do NOTHING! The system has been in place for over 50 years and is well embedded, start messing with it and face unintended consequences such as the derivatives markets or the banks blowing up, remember the banks are weapons of mass financial destruction and now so is President Dump!

The system generates cycles of expansion then contraction which leads to the next cycle. Whilst Trump as I have been stating for over a year is the harbinger of the stock market apocalypse! Trump is destroying demand for US goods and services and attempting to turn allies info foes never mind outright threats of annexation which are severely damaging the system that we have lived under for 50 years.

Every time President Dump opens his mouth he brings the next bear that bit closer where the best case scenario would be similar to 2022, worst case like 2008-2009. So I don't expect something long lasting i.e. 1965-82, more like 1-3 years for my portfolio anyway, maybe the nothing burger S&P will get stuck in a range, but the AI tech stocks should eventually rebound to new all time highs.

So if I were President I would continue with the system as is with minor tweaks here and there, and that is what will deliver a sustained bull market that typically runs for 5 to 6 years to be followed by a corrective bear market. Anything more significant such as tariffs will result in unintended consequences though with Trumps chaos the consequences are rather obvious i.e. a major recession and that's not even allowing for if the nut job engages in actual warfare with the likes of CANADA!

American Power = Trade + Military + US Dollar + Alliances + Tech

Trump is undermining at least 4 of the corner stones of American power! Where the risk we are now running is that of a Sept 2008 event, a collapse of the global financial system, which we came within hours of happening during September 2008! So far we have had a 7% drop in the dollar and 10% drop in the S&P, and maybe loss of GDP of 0.5%, but the more damage Trump does then the risks of Systemic Event increase that takes control of the agenda away from Trump and into the hands of the Fed in attempts to prevent financial armageddon. I suspect it could happen in the Bond Market, similar to what happened when Liz Truss crashed the UK bond market. So many countries that the US is busy alienating hold US bonds that it does not take much to spark a run on the US financial system, confidence is fragile as President Dump may soon find out.

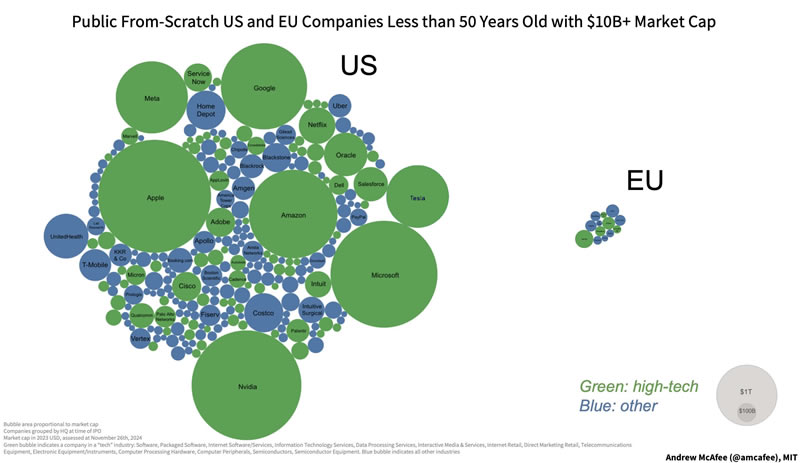

Hey I get it Americans want to bring back jobs to America because of perceived loss due to Globalisation, reality is that the US is a globalisation winner! You want to know who really should have a big beef with globalisation? EUROPE! It should be Europe imposing tariffs on the likes of the US and China given the damage globalisation has done to EUROPE which has been forced to play follow the US leader in virtually every action!

These are the facts, in 1980 the US economy was 25% of global GDP, today it is 26%, the US has BENEFITED FROM GLOBALISATION! Yes not to the extent of CHINA which as gone from about 1.5% to 16.8%! As for Europe, was 26%, today that has collapsed to near half at 14.9% of the global economy. Europe needs to stand on its own two feet and take charge and not be harassed and bullied by the US, Russia or China else continue to die an economic and political death. The US should be seeking a stronger partnership with Europe so can be called upon when the US goes to war with China but no Agent Orange has hit Europe harder than China, Agent Orange wants to push Europe into a depression as if that won't effect the US Economy! Most of Europe's woes and the rise of the far right are down to the huge negative impact of globalisation on Europe that as I pointed out in a previous article has NO tech giants! Despite many of Europe's institutions giving birth to technologies that have been siphoned off to the United States as the US seeks to do with ASML and TSMC, if you hear Trump speak it's as though what TSMC has was stolen from the US and thus he wants to take it back!

Therefore the primary focus of this article is to how best prepare for the next bear market during the last legs of this bull market as President Dump is accelerating the demise of the bull and what to do to maximise opportunities during the next bear market.

CONTENTS

Money Printer Getting Ready to go Brrr

Trumponomics Breaks the US Dollar

S&P Correction Trend

Deviation Against Stock Market Trend Forecast

Recession Self Fulfilling Prophecy

Next Stocks Bear Market How Bad Could it Get?

AI Stocks Portfolio Current State

Buying the Dip

Elon's Butt Must Hurt

Stocks Bull Market End Game Strategy in Brief

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Bull / Bear Strategy To Do List

The During the last legs of the bull market

During the bear market

Road Maps and Ongoing Analysis

Post bear market

FX Impact - Sterling Bear Market Hedging

AI Tech stocks During a BEAR MARKET

Draw downs from 2021 highs to lows 2022 lows

Best and Worst Stocks to Hold During the Nest Bear Market

Agent Orange Stock Market / Financial System Doomsday Scenario

Most Recent analysis -

This Time It's Different! AI Tech Stocks Q2 Blow Off Top Earnings Season

CONTENTS

S&P SEASONAL ANALYSIS

Presidential Election Cycle - Year 1 Seasonal Trend

Stock Market Volatility

Retail FOMO

S&P Blow off top current state

Why I'm Not Waiting for the Final Pump

Shorting Stocks Using -1X Leveraged ETFs

AI Tech Stocks Earnings Season

Google $192 - EGFS +10%, +10%, Dir +6%, PE ranges 34%, 8%

TSLA $332 - EGFS -40%, 1%. Dir -44%, PE Ranges 283%. 280%

IBM $282 - EGF -17%, 10%, Dir -21%, PE Range 132% / 111%

FLEX $52 - EGF's 3%, 17%, Dir-14%, PE ranges 107% / 82%

ULH $26.2 - EGF's -64%, -21%, Dir -15%, PE ranges 69%, 118%

Bitcoin Enters $120k to $170k Target Zone

COIN Comes Full Circle

My Total Wealth Breakdown

Money Printer Getting Ready to go Brrr

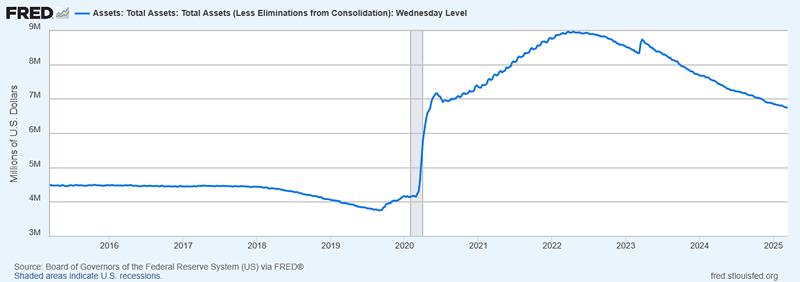

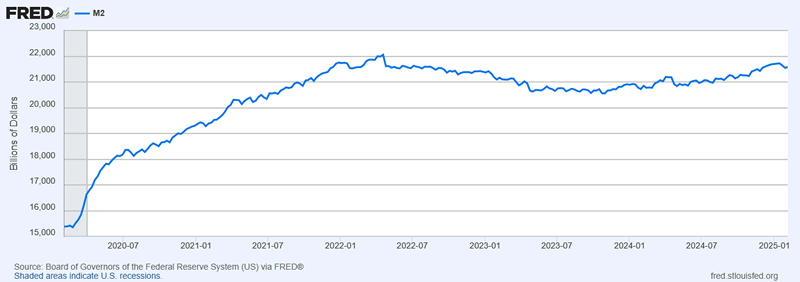

The Fed is likely to soon announce perhaps as soon as Wednesday an end to its QT programme which will usher in the next phase of QE4Ever expansion of the Fed balance sheet to monetize US government debt. the chart shows the explosion in the Feds balance sheet under Trump and then Biden, all the way to the point runaway inflation prompted the Fed to start Quantitative Tightening that it has continued at a slow pace every since punctuated by the mini banking crisis of March 2023. An end to QT will be taken as a major bullish signal for asset price inflation.

The fundamentals for the inflating asset prices has been under way since the October 2023 10% correction when US M2 money supply bottomed and ever since has been in an upward trend which is about to push to a new all time high that has been one of the primary reasons for the stocks bull markets strength as the US continues to print money to inflate asset prices, as do all central banks.

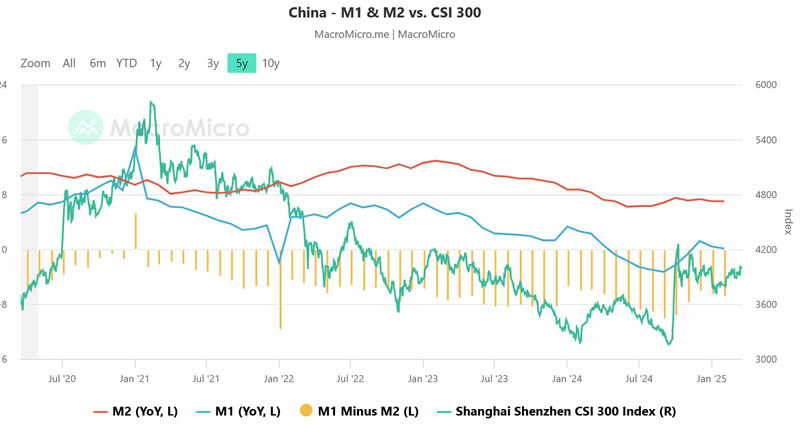

meanwhile China has continues to inflate its money supply at the rate of 7% per annum (red line) and now rising which is showing through in Chinese tech stocks.

Trumponomics Breaks the US Dollar

The system is finally balanced (just like the climate) when you play around with it there be unintended consequences such as economic depression, an INFLATIONARY depression for the US, not that it WILL happen just that stuff like TARIFFS make it MORE probable. Trends are made at the margins. There are tipping points, as with the climate, we have runaway global warming underway that many remain blind to for political reasons, but if Trump imposes the tariffs he states for any more than a few months then there will be a tipping point beyond which the depression will be baked in the cake. I will try to capitalise on this tipping point should it come to pass.

At the end of the day trumponomics is literally half baked, it's the Dunning–Kruger effect, Trumps plan is so clever that it is stupid, and should it come to pass you will find out why the the winner will be CHINA!

I mean has the genius worked out that if the dollar falls by say 50% that will mean the US economy is now worth HALF what it previously was? All that economic power is GONE! The chinese economy immediately doubles in dollar terms! CHINA WINS! This is why the US will instigate a war with China because else under the Trump plan the US will be toast so China needs to be wrecked militarily..... unintended consequences..... Trump who barked about no more wars will lead the US into the mother of all wars!

And who is going to buy all of these cheap US goods?

I mean the Trump plan will crush the EU, put it into depression, so where is the demand going to come from?

See what's happening in Canada in response to tariffs threats?

They are buying far LESS american goods!

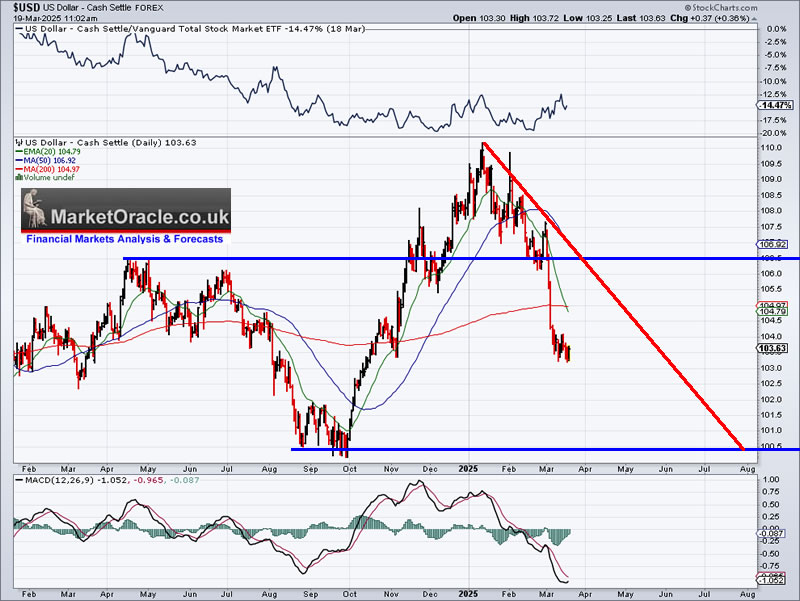

The swap rates continue to point US dollar weakness especially against the Yen and Euro where even the UK despite lack of interest rate differential has strongly trended higher now at £/$.1,30, next enroute to 1.34 and then 1.38 and eventually to above 1,40 which has been my base case expectations for sterling since October 2022! As you see I don't change my forecasts, when sterling fell to around 1.22 when asked if it would continue lower, I replied sterling is in a bull market and should next target a trend to 1.34, and a few weeks later here we are at 1,30.

The USD index is clearly targeting a trend to $100 after having topped at $110 as soon as President Dump took over. And it's not a done deal that the dollar will hold support at $100 it could continue lower towards $90 which will translate into a lot higher prices, the good news is it also means a lot higher ASSET prices! So a falling dollar despite the chaos should be supportive of stocks and crypto's as long as the recession does not come early. Anyway will act as a wind behind our portfolios sails.

S&P Correction Trend

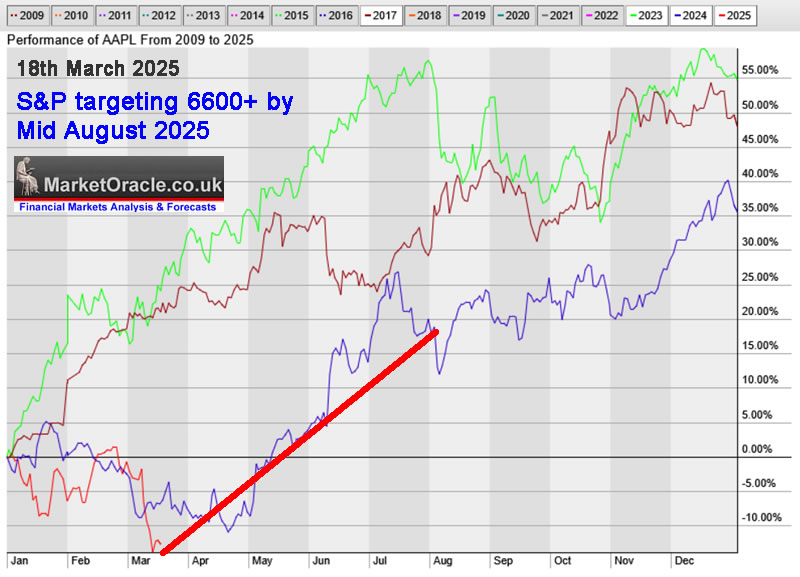

Whilst doom and gloom prevails in the wake of Agent Orange tariffs, the actual S&P trend to date in terms of the current correction has been both expected and normal. The S&P falling from 6150 to 5520 for a 10.34% swing is normal for this bull market that bottomed October 2022 since which time the S&P has now had FIVE swings of between 9% and 11%, and where each time its happened it has always been seen as an end of the bull market moment for stocks. Yes this time could be different, after all President Dump is undermining the fundamentals that underpin this bull market but so far in the context of the correction trend S&P down 10.34% is normal and thus I have done the same as what I have done for the duration of this bull market which is to BUY the dips in target stocks.

So we remain in a normal correction where the time to start to get worried will be if the S&P falls below 5400 as then we will be entering into an ABNORMAL correction that risks triggering a trend change especially if the 5120 August 2024 low breaks! So 5400 is the canary in the coal mine and 5120 is the End of the Bull Market Signal following which one can expect the subsequent rally to fail to run to a new all time high..

So in terms of the correction to date whilst it may feel bad, it's normal and thus the bull market should resume to target a new all time high. Yes CI18 got triggered at 5850 which implied to expect at least 5530 i.e. a 10% correction, that technically could run all the way to 5400 so the correction could run as deep as 12%, without risking an end of the bull market.

Deviation Against Stock Market Trend Forecast

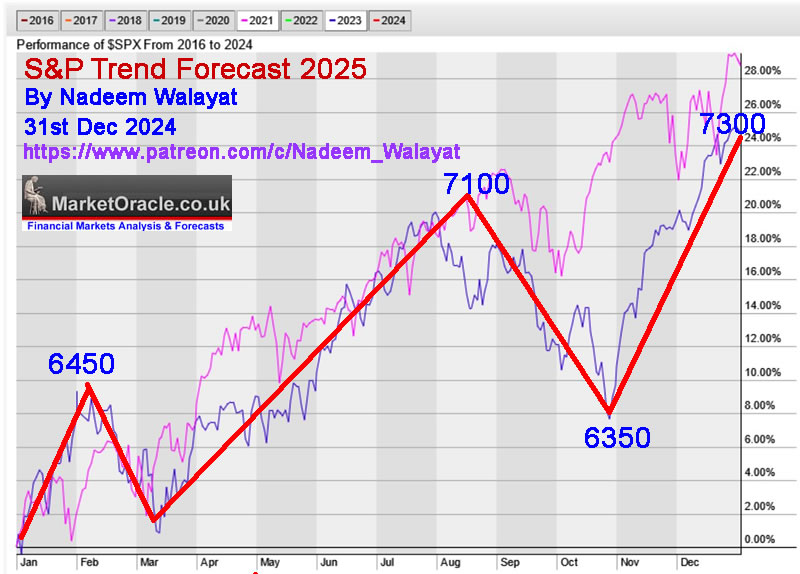

My 2025 forecast as of 2nd Jan -

2nd Jan 2025 - Squid Game Stock Market 2025, S&P Detailed Trend Forecast

To target a gain of about 24% for the year, virtually identical to that of 2024 which on the last S&P 2024 close of 5881 suggests a year end target of 7300 which is within my original target range of 7200 to 7800 for 2025, so folk will already have known what to roughly expect for 2025 for virtually the whole of 2024!

So I expect 2025 to be a pretty straight forward bullish year punctuated by at least 2 significant corrections Feb / March, and August to October that I am sure will trigger much fear and panic as the severity of which will catch many off guard prompting the crash is always coming crowd to reach their most vocal just as stocks bottom and reverse sharply higher during late October.

Seasonal trend pattern is pretty much inline with expectations for a weak February to resolve in a early March low to set the scene for a bull run all the way into Mid August with probably a dip during May / June, where the first price to target would be 5850 and then the previous all time high of 6150 for a 650 point rally from 5500 that will likely resolve in the May / June correction.

Is 7200+ still doable?

Well even I would be surprised IF we get to 7200+ this year, I mean that's 1700 points and +31% from the 5500 low we just hit. It would take epic market euphoria and alls I see is increasing doom, not MSM fake doom but real doom! TARIFFS DOOM! GDP Now DOOM! So I rate S&P getting to 7200+ a 50/50 coin flip.

S&P 7000 - 1500 points off the 5500 low, +27%, is still a tough ask to achieve, I'd give it a 65% probability.

S&P 6600+ - 1100 points off the low, +20%, now that is doable. Given that we are still in a bull market then right now I would give 6600+ a 80% probability.

What if I am wrong and the top is already in, well I'd rather be wrong ONCE then every month like the Crash is always coming brigade.

But don't write the bull market off just yet because White Swans are far more common than Black Swans and the thing about bull markets they tend to surprise to the UPSIDE so maybe that coin flip is 51% to 49% in favour of 7200+

Trump chaos is unwinding ALL of the carry trades! Money flowing back to other currencies pushing down yields and local asset prices higher. Trump is talking a strong economy into a recession which is what the stock market discounts in the present so take the expected bull run to lighten exposure especially as from the comments despite a 2.5 year bull market many folk some how are still in a draw down, selective amnesia? instantly forget profits as soon they are booked? Hence in perpetual draw down. How you going to cope with the next bear market when the draw downs will be real!

Recession Self Fulfilling Prophecy

As stocks fall in response to Trump chaos that undermines the certainty and confidence that investors seek which then RESULTS IN REDUCTION IN ECONOMIC ACTIVITY. A 10% drop in the S&P has cut economic activity to some degree, i.e. animal spirits is in reverse.

So stocks falling to discount a recession will be acting to CREATE the recession that it discounts!

This is why confidence in governance and a stable economic and trade policy is important because without that there is lack of investor confidence and so they SELL, and the act of selling drives down stock prices which triggers more uncertainty and selling. Folk watching their portfolios go down the tube don't tend to got out and spend more, instead they cut back on spending because they have literally become poorer, someone seeing their 401k fall by 20% will see a drop in value that exceeds their annual salary which will be painful.

This is why I state that Biden handed Trump a goldilocks economy with the stocks bull market primed to continue trending higher for probably a couple more years and alls Trump had to do was nothing in terms of economic policy and trade and the stock market gravy train would have continued to roll on, instead Trumps chaos has triggered a CRASH In investor confidence that is going to be difficult to rebuild so the damage has been done! The potential of this bull market has now been crippled by Agent Orange..

But the dumbness of Trump continues incrementally where the longer he is in power the dumber his actions get. I mean he wants to trigger a recession so the Fed cuts rates so he can say look I forced the Fed to cut rates!

He wants $200-$300 billion in tariffs taxes to achieve that he's probably going to trigger wealth destruction of upwards of $50 trillion in stocks and US housing.

Now to cut a few percent in Panama canal crossing fees he risks making the canal unusable, i.e. insurgency. He's playing President for TV ratings. Leaves every press conference with a cliff hanger.

The US is marching headlong into a one man made Recession, academics will write books about this for decades of how one dumb man destroyed so much wealth unnecessarily.

As I say the damage has been done, and what one does hence forth is to prepare for it in the time this bull market has left. Which is the focus of this article, to be positioned for what is to come in terms of what to do during the remainder of this bull market and how bad the next bear market could get.

There is no trend certainty with President Dump..

Next Stocks Bear Market How Bad Could it Get?

These violent delights will have violent ends, how bad could the next bear get?

Back in Mid 2020 I penciled in expectations for a 50% drop. That was not my base case but my worst case of what follows a blow off top mania in AI tech stocks.

Have we had a mania blow off top in AI tech stocks?

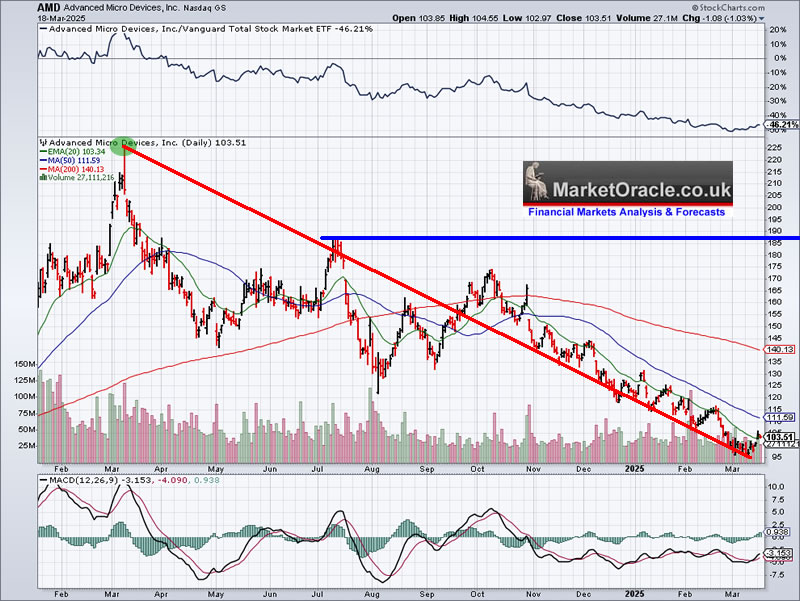

YES we have had a rolling blow off top, take a look at AMD, went loco to $230, we are unlikely to see AMD trade that high for some years, what looks doable is $160+

(Charts courtesy of stockcharts.com)

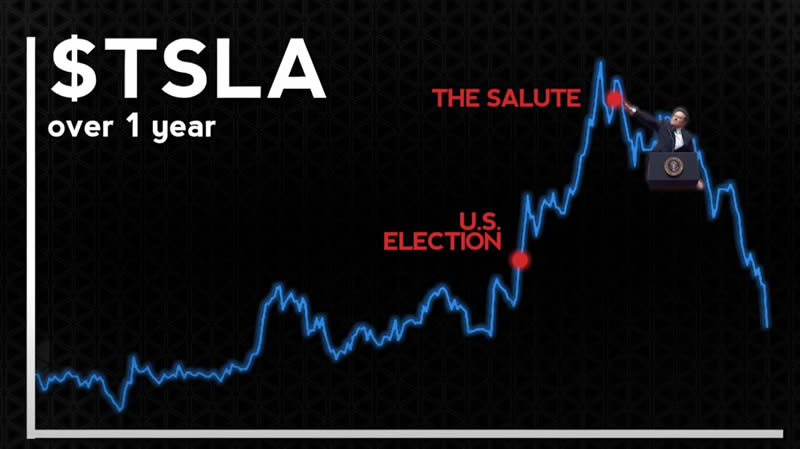

And now Tesla, FOMO mania to $488, after THE top it even gave us a second chance to sell more even after Musk went all nazi on us, though some argued with me at $480 that they would hold for the long-run. I don't think we are going to see $480 anytime soon, at best $360 could be doable.

So not all stocks will peak at the same time in a collective mania and then collapse, therefore this means that the next bear market should see a LESS than 50% drop in the S&P.

My bear range expectations are best case similar to 2022 so a -25% drop, worst case -57% drop. It all depends on how bad the recession gets which we will only know the magnitude of with the benefit of hindsight long after the stock market has rebounded

At this point I am leaning closer towards -25% than -50%, so see the S&P drop by less than 37%, therefore the most probable expectations at this time is to expect the S&P to drop by about 30% during the next recession bear market as a base case and 50% as a worst case and 25% as a best case.

So IF the S&P manages to plow through Trump chaos and resumes it's bull run and say climbs the wall of worry all the way to 7000 this year then what does that imply for the next bear market?

Best case 7000 - 25% = 5250 - Not far from where the S&P is trading right now! And given that we will be fully prepared for it will feel like a nothing burger.

Most likely 7000 - 30% = 4900 - To around the preceding bull markets peak, which WILL result in draw down probably along the lines of what we experienced during 2022.

Worst case 7000 - 50% = 3500 - To around the preceding bear markets low. By the time the S&P is falling below 4000 all hope will have evaporated and along with it most folks ability to buy the dip, many will be contemplating throwing in the towel and want to forget that they ever heard about the stock market.

The S&P dropping to the previous bull market peak would fit well with the technical picture it would present. Whilst the worst case depends on just how much damage President Dump can do to the US and wider global economy.

What if the S&P has already topped at 6150?

Best 4600 - Would be painful but survivable,

Target 4300 - Would be very painful.

Worst 3075 - Even my balls of steel will have shrunk to pellet size.

Ironically, if the S&P has already topped then I would lean towards the Best case outcome as being most probable. So it looks like all roads lead to about 4800 as to where the next bear market could target regardless of where the S&P tops.

The S&P is currently trading at 5550, down 620 from it's high and 730 from 4800, so IF the bear market has already begun then we are already not far from the half way point and well I don't know about you but it doesn't feel THAT bad.

So even if the S&P continued to fall and alls I did was continue to buy the dips, yes the draw downs would get bigger and more painful but it would be survivable and set us up for what is to follow.

So whilst folk fear the bear market, understand that we could already be near the half way mark and so it's not quite as bad as what folk will fear it to be, it won't be the end of the world but a necessary part of the stock market cycle of optimism vs pessimism.

Yes I am positioned for a further bull run towards 7000 but IF it does not materialise because of Trump Tariffs triggering a global recession then it's not the end of the world. At worst we get a couple of years of pain and dips to buy into.

Of course I am game playing how bad things could get, especially if the bear market has already begun, realistically we need to hope for the best but prepare for the worst, so whilst 4800 seems like most probable right now, I' ld want to aim to prepare for something like 4300 as the best one can do without the benefit of hindsight.

So if the market has already topped, I suspect that the S&P will target 4800, but that one needs to be prepared to see 4300.

Whilst a bull run to 7000 would translate into expect 5250 but prepare for 4800.

AI Stocks Portfolio Current State

Stock markets down 10% from it's high and some folk are in despair, wait it gets worse! Nasdaq is down 15%! So we have definitely experienced a significant correction whilst my actual portfolio according to my IBKR ISA account dashboard is down just -1.61% YTD vs Nasdaq -7.93% so I must be doing something right! IBKR use Trade weighted return (TWR). It's all to do with managing EXPOSURE, trim expensive stocks when they rip, and accumulate target stocks when they dip. and THIS despite sterling working AGAINST me in terms of percent return i.e. sterling is up 3.6% YTD which should work against my portfolios value given that its priced in GBP whilst the Nasdaq is priced in USD, so in GBP terms the Nasdaq is 3.6% lower at -11.53%.

Anyway I just concentrate on trimming and accumulating as I go along so draw downs are good because they generate opportunities to accumulate target stocks that I can later trim that acts to drive down the average cost per share..

The metrics have been updated with focus on PE ranges, EGFS and direction of travel.

Spreadsheet - https://docs.google.com/spreadsheets/d/1_xBKK7voTFbfGFEyHgqS0MM0SgpnOxVIED2BLHKPzeE/edit?usp=sharing

Primary AI Stocks

We are seeing a contraction in EGF's, 100% vs 137% 22nd Dec, whilst forward EGF's have expanded from 153% to 229%, which means growth prospects are being kicked a year down the road.

Direction of travels are negative for all except Qualcom, but not hugely.

PE Ranges have moderated to well under 100%, and even more so for the forward range.

This means the Primary AI tech stocks are in a good healthy state, the lower the PE range the better the state of these stocks. There isn't any sign of distress in the metrics so I have been buying the dips and increasing my exposure to ALL, even META which is probably the most over valued of the bunch.

AI Secondaries are a mixed batch, there's Amazon which sticks out as a no brainier to add to, and I've piled into AMAT and ASML during the dip that has lifted my exposure to 91% and 84% invested of target.

The others are a case of how much risk one is willing to take, Micron is risky but the forward percent drops hard, which is keeping the stock price stable for now. KLAC is expensive, IBM is expensive which is why I have sold a lot of IBM, Tesla is a gamble on robot workers. We got the FOMO to sell into now the stock has halved and I am lightly buying the dip, the stock could halve once more or get FOMO and make a run for $300+ It's a coin flip, alls I can do is be positioned for either outcome, have exposure to capitalise on a bull run and have cash to buy the dip.

Overall Secondaries are not cheap but there are opps in there to accumulate (Amazon, AMAT, ASML) and opps to trim (IBM). So I'm just continuing to do what I have done for the duration of the bull market, accumulate when cheap and distribute into FOMO.

Buying the Dip

My largest buys during the correction (not in any order) -

NVDA - Whilst folk were crying I was buying :)

MSFT - Rare opp to see this dip below $400.

Google - I already hold a lot but it is numero dos.

AMD - I already held too much, now I hold even more! Ready to trim north of $130. Though the buys at $100 art not as painful as they may appear i.e. I did sell down to about 30% invested on it's pump to $230, which I said at the time was AMD going loco! So it would need to fall to something like $70 before I am actually in draw down.

META - Finally got an opp to accumulate!

TSMC - Rebuilding position after earlier heavy trimming.

AMAT - Bought a lot of AMAT.

AMZN - This stock gets better with each earnings report, I am still too light weight, I want to own more Amazon.

TSLA - Sold the rip now rebuy on the dip at half what I sold at, though at limited extent, does not matter if I miss the next rip, Its done it's job TWICE during this bull market, once is great, twice is fantastic! Third time would be getting very lucky, so I'm not going to chase the dragon.

WDC - The split buggered me up a little, sometimes act first ask questions later does not work! So now I have overbought WDC! No ones perfect.

ADSK - A fav of mine that trends well, does not give huge profits but it's an easy ride, reaccumulating what I sold north of $300.

MGNI - Reaccumulating a fav range trader after selling allot on pump to $20.

SPGI - Not in public portfolio, with an eye on a probable recession, its a good defensive

AXP - Not in public portfolio, same as SPGI, no matter what happens it will eventually trade to a new all time high.

COIN / MSTR - Added on the dip given that I have deliberately crippled my ability to buy the dips in crypto's because of the risk the party is over, so I await BTC $120k to offload most of what I hold.

Sterling trading at $1.29 helped pull the buy triggers. One of the stocks that I wanted to add to that failed to deliver an opp was ASML, another is probably IBM.

Elon's Butt Must Hurt

TESLA car crash resumes. Musk's eyes will be welling up again, watch out for more interviews on Reich News of how he sacrificed $120 billion for the fuhrer.

Tesla complains about Trump Tariffs hurting Tesla sales - No one wants to buy Swasticars in Europe at least. FElon has yet to comment after his cringe White house $100mln infomercial. Still waiting for tears to stream down his Nazi face, it will be worth the draw down to see, came close to in recent interviews but not quite there yet, $160 should do it!

We got lucky with Tesla because we got two bites at the SELL Cherry and not only that but we got a pump after the zieg heil salute SELL SIGNAL that many not wanting to believe what it implied i.e. that Musk was Nazi and that Tesla's are Nazi cars, and so most folk suffered cognitive dissonance, their brains could not process it and thus failed to sell on hopes it would soon all be forgotten and Tesla can pump to $500+

As a reminder as soon as I saw the salute my immediate take was that Tesla is going to go below $200, so I need to sell more, and lucky for us Tesla did pump into a lower high enabling one to SELL more, though of course looking back from $236 at $450 then one wishes one had sold even more, even though at the time I thought I have probably sold too much! That's hindsight for you!

This illustrates that most folk find it painful to act, and thus fail to act when they should act, to be able to take action then one needs to become experienced in the act of buying and selling i.e. trimming, and accumulating as ones default setting. And thus one is focused through the act of selling on the opportunities that Tesla was generating as it marched above $400 all the way to $488 to SELL, as I was doing on a near daily basis.

So folk need to trim and accumulate so that they have gained the ability to take action when they need to else will be like deer caught in the headlights and fail to act when they should.

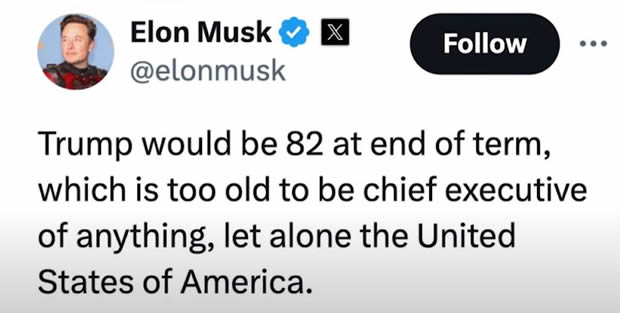

Somewhere along the line Musk lost the plot.

The problem TESLA faces is that Musk has alienated all those who would have BOUGHT EV's whilst appealing to those who HATE EV's. So Tesla gets all of the downside and none of the upside to Zeig Heil!

As I've often stated, Tesla's going sub $200 which would next target $140 and if that breaks its going to target $100! At this point I am seeking to accumulate a fair chunk in the range $200 to $140 some thing like 30% of target exposure, where the risk is $140 breaks and we see $100 and it has little to do with Musk, it's simple math, Tesla is currently trading at 188% of it's PE range, at $140 it will be trading at 57%, which is where it should be trading right now when one looks around at the other AI stocks. I mean one can pick up Nvidia at 53% of its PE range, Google at 26%, Qualcom at 37% so why buy Tesla at $188%? Even at $200 it won't be cheap i.e. at 120% of it's range, which is why I was fairly confident at $480 that Tesla falling to sub $200 was doable because it still would not be cheap! At $140 is when it starts to become CHEAP! And very cheap at $100 (16% PE range). Simple maths folks, alls I am doing is simple maths, and taking cues from Zeig Heil's as a SELL SIGNAL to target sub $200.

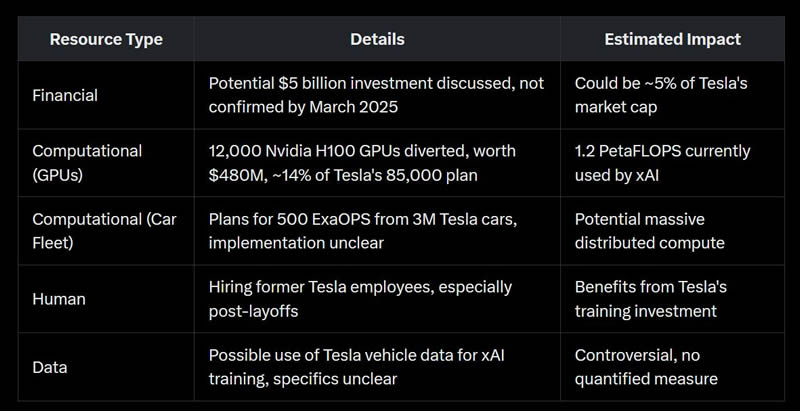

Folk have to remember that Elon has USED Tesla resources to build his OTHER companies such as SpaceX, Twatter and X-AI which should not be a separate company to Tesla! Musk is literally siphoning off resources from Tesla into X AI that warrants investigation. and he has the cheek to call ordinary federal employees fraudsters! Look at what he is taking from Tesla!

So Musk has his EXIT strategy and alls he is doing is milking Tesla into the ground so even at $140 folk want to be careful of how much exposure they have to Tesla given the Nazi in charge of it who sees Tesla shareholders as sheep to slaughter for personal gain.

There are far better companies out there that are not under the iron grip of a Nazi, I mean he does not even do much work at Tesla these days.

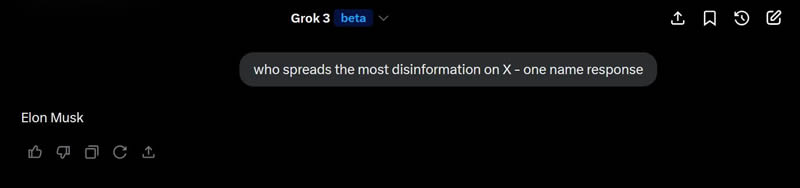

I asked Grok who spreads the most disinformation on X.

Answer - Elon Musk

Try it your self.

At $480 I was commenting I would not be surprised to see Tesla trade below $200, now at $236 we are firmly on the path towards achieving that objective. Whilst I am buying the dip, I keep moving my larger limit orders lower. I'm also approx 5% short of what I hold. In terms of a target, a lot of the math resolves to $168.

I want to see Musk's eyes bleed when he see's sub $200. It must act as a wake up call, as for Musk is was -

$480 - I am a God! I can even do Zeig Heil's!

$399 - Okay no more zeig heil's until I see $500+

$299 - This is temporary it will recover,

$249 - Ouch this hurts, even my rockets are starting to to explode!

$199 - I want my mommy!

$99 - Shit the board is trying to oust me from my own Company! HELP ne Trump! Trump? Why isn't Trump picking up my phone any more!

$49 - Musk gets deported back to South Africa and will concentrate on impregnating black slaves.

The rest of this extensive anaysis continues in Part 2..

Stocks Bull Market End Game Strategy in Brief

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Bull / Bear Strategy To Do List

The During the last legs of the bull market

During the bear market

Road Maps and Ongoing Analysis

Post bear market

FX Impact - Sterling Bear Market Hedging

AI Tech stocks During a BEAR MARKET

Draw downs from 2021 highs to lows 2022 lows

Best and Worst Stocks to Hold During the Nest Bear Market

Agent Orange Stock Market / Financial System Doomsday Scenario

Your preparing for the next bear market analyst.

Nadeem Walayat

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis -

This Time It's Different! AI Tech Stocks Q2 Blow Off Top Earnings Season

CONTENTS

S&P SEASONAL ANALYSIS

Presidential Election Cycle - Year 1 Seasonal Trend

Stock Market Volatility

Retail FOMO

S&P Blow off top current state

Why I'm Not Waiting for the Final Pump

Shorting Stocks Using -1X Leveraged ETFs

AI Tech Stocks Earnings Season

Google $192 - EGFS +10%, +10%, Dir +6%, PE ranges 34%, 8%

TSLA $332 - EGFS -40%, 1%. Dir -44%, PE Ranges 283%. 280%

IBM $282 - EGF -17%, 10%, Dir -21%, PE Range 132% / 111%

FLEX $52 - EGF's 3%, 17%, Dir-14%, PE ranges 107% / 82%

ULH $26.2 - EGF's -64%, -21%, Dir -15%, PE ranges 69%, 118%

Bitcoin Enters $120k to $170k Target Zone

COIN Comes Full Circle

My Total Wealth Breakdown

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Stock Market Blow off Top vs Trump Uncertainty Syndrome

CONTENTS

Birth of the AI God

Economic War

Dieser ist der Führer

CPLIE and US Interest Rates

US DOLLAR

When's the Next PANIC Event?

US Bond Market Crisis

Bond Market Panic Event

CI18 Crash Indicator

S&P Fake Rally to New All time Highs

Signs of a Stock Market Blow off Top

Current State of the Getting Lucky Rally

Where to Start Investing?Trimming the Bull Market

Buy the Dips Trim the Rips Strategy

REINFORCEMENT LEARNING

How to Read Momentum

AI Stocks Portfolio Current State

Quantum Computing Bubble Mania

Investing in Demographics - Brief

Safe UK Dividend Range Trading Stocks - Brief

European Defence Stocks in Brief

Bitcoin ETFs Cripple Bitcoin

Gold and Silver Brief

How Gain Your Freedom!

The God of Trade War vs AI Inflation Mega-trend Stock Market 2025

CONTENTS:

The Getting Lucky Rally

The Trump US Debt Downgrade

Trade War Day 105

US Supply Chain Disruption Inflation

US Dollar Bear Market

BOND Market Vigilantes

Trump Regime First Three Months

Trump Regime Next 100 Days

The Technical Analysis Paradox

Sell Rising Prices, Buy Falling Prices

Yen carry Trade unwind...... CONTINUES!

What if the US WINS the Trade War?

Trump Trade War is ACCELERATING the AI Mega-Trend

OIL PRICE SIGNALLING RECESSION

Gold Save Haven

Trends are Made at the Margins

Why The Risk is Always to the Upside!

Extreme Bearish Market Sentiment

S&P 6150 AND 4800

The 50% indicator.

S&P Sector PE Ratios

Presidential Election Cycle - Year 1 Seasonal Trend

Stock Market Deviation Against the Trend Forecast

S&P Trend Forecast May to December 2025

AI Stocks Portfolio

TESLA Rebounds As Musk Retreats from Nazism

Bitcoin Tops Spectrum Analysis

Bitcoin - Betting on One Last Pump

Bitcoin Exit Strategy

MSTR & COINBASE

Stock Market Tarrified as President Dump Risks Turning Recession into a Stagflationary Depression

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series.

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst "with friends everywhere".

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.