The Sun is Rising in the East, The Asian Century

Stock-Markets / Asian Economies Mar 13, 2012 - 04:19 AM GMTBy: Chad_Bennis

Check out what Australia’s largest exchange operator(ASX) had to say about the Asian century.

Check out what Australia’s largest exchange operator(ASX) had to say about the Asian century.

“Australia will only truly advance its long-term position in the Asian region and fully participate in the Asian century by developing deeper partnerships and true integration with the region.”

Australia is hungry to participate in the Asian century. Money is flowing eastward. Don’t be the guy with paper fiat certificates when the buying of dollars begins to dry up. Money has been moving east for an entire decade. True asset prices have risen while the price of cash has weakened. Holding US dollars is a trading position. By holding US dollars you are taking a long dollar trade, a buyer of the dollar.

Steve Goldstein goes on to say, “The currency war – a term coined by Brazilian Finance Minister Guido Mantega – is set to enter a new phase, according to Societe Generale strategist and uber-bear Albert Edwards, as governments try to boost competitiveness by lowering their exchange rate.”

The currency war is set to enter a new phase. The foundation is already set and that is QE to infinity. As governments around the world lower their exchange rates it will cause a chain reaction in which all countries involved in trade will need to weaken their own currency to bring it into a ratio of exchange that is acceptable to their perceived valuation.

Then there is this headline:

China’s yuan set for more international role

The Chinese currency rose 4.3% against the dollar in 2011, and is up about 23% since China first ended its formal currency peg to the U.S. currency in July 2005.

China is also doing this:

China to make yuan loans to Bric nations: FT

This shows that China is entering the bond market and emerging economies are going to be their customers making China’s yuan a more versatile and widespread currency in today’s currency war.

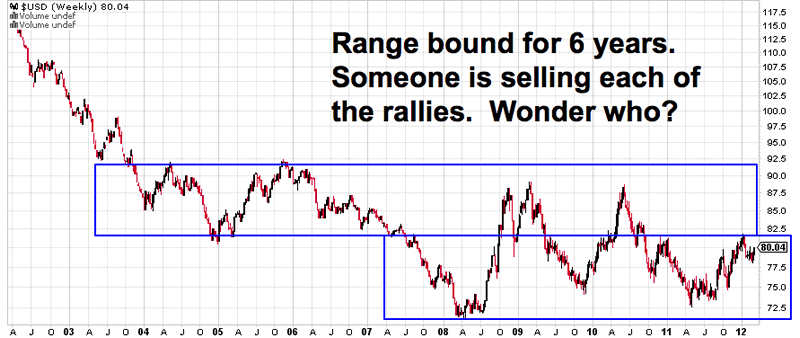

China is making moves to use their own currency for trade thus taking the largest player of the long dollar trade out of the market. China is a seller into strength when the dollar rallies taking the bear trade. Take a look at the range the US dollar has traded since 2004. That’s eight years long. The dollar trade from the long side looks like this for the past 8 years:

The chart above went no where for eight long years.(Although, if one were savvy enough there is quite a range to trade.)

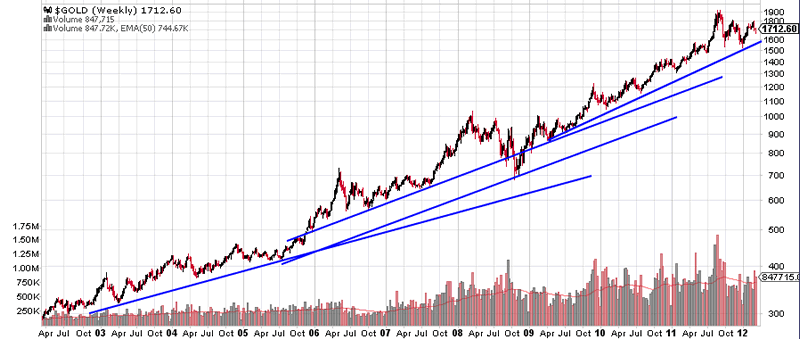

As the US dollar trades in a range another story unfolds rather quietly over the last eight years. Against all odds and naysayers gold has surged higher and higher. In a clear, definite and steepening uptrend gold continues to find buyers.

Gold is behaving as a strong currency in the new phase of the currency war mentioned above. Gold as a defensive position in this new phase of the currency war reflects the banks attempts to collectively boost their competitiveness by lowering interest rates. The central banks weaken their currency by selling dollars on the rallies while gold is continuously met with buying. Gold is the currency of strength as it continues to make new highs in this decade long trend. This strength will continue to move upwards in gold until the central banks end this war of easy money.

Then we have these headlines:

China’s central bank bought gold in late 2011-report

Swiss central bank posts higher-than-expected profit on gold gains and foreign currency

The same banks that are trying to weaken their interest rates to remain competitive in trade are making money off the gold trade.

The world economy is supported by cheap continuous fiat currency. Its akin to running on the treadmill, when the treadmill of easy money stops the economy stops. The central banks want the economy to run so they feed the treadmill with cheap dollars. This fact is why the banks will continue to print their way out of trouble and into a seemingly never ending economic expansion.

In conclusion, until central banks around the world begin to increase their interest rates and curb the flow of cheap fiat money into the world’s financial markets the long gold trade will continue to prosper.

CA Bennis

www.wheatcorncattlepigs.com

© 2012 Copyright CA Bennis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.