Socialist Global Central Bank Crime Syndicate QE-4-Ever Inflation Theft

Stock-Markets / Quantitative Easing Oct 01, 2012 - 12:40 AM GMTBy: Nadeem_Walayat

It is barely four weeks since the European arm of the global central bank crime syndicate (ECB) announced its policy of wanting to print unlimited euro's to monetize bankrupting PIIGS debts that was welcomed by the markets who's participants would be lining up to offload PIIGS bonds bought at far higher interest rates (lower prices) onto predominantly German tax payers because it is Germany that backs the Euro as a sound currency rather than the Greek or Spanish versions of the Zimbabwean Dollar.

It is barely four weeks since the European arm of the global central bank crime syndicate (ECB) announced its policy of wanting to print unlimited euro's to monetize bankrupting PIIGS debts that was welcomed by the markets who's participants would be lining up to offload PIIGS bonds bought at far higher interest rates (lower prices) onto predominantly German tax payers because it is Germany that backs the Euro as a sound currency rather than the Greek or Spanish versions of the Zimbabwean Dollar.

However the promise made by Super Mario Draghi for unlimited Euro-zone PIIGS bond buying programme "One More Try" (OMT) is already unraveling because the fine print of a list of strings attached does not match the promises made and because of the fundamental fact that just like all of the previous bailouts, all it would do at its very best was to buy a little more time for the Euro-zone by kicking the can into the middle of 2013, because it does near nothing to address the problem at the core of the Euro-zone which are the persistently very high and expanding deficits as a percentage of GDP right across the euro-zone that ensures bankruptcy as a consequence of inability to cover government spending let alone service debt interest repayments.

So already it looks like GAME OVER for Super Mario Draghi as we see PIIGS bonds rates rising and escalating protesting populations of Greece and Spain rampaging through the streets of Meditarian cities with threats of revolution and even a breakup of whole countries as the bankrupt decentralised regions of Spain attempt to play the blame game by offloading responsibility for their own failures onto the central government.

In my opinion the populations of these countries are increasingly delusional in their response to the latest round of announced austerity measures that always amount to a mere fraction of the bailout funds that they are seeking to extract from primarily German tax payers for the purpose of delaying debt default bankruptcy on the hopes of cutting the deficits to a sustainable % of GDP, and the word truly is delusional because they do not understand that what they are demanding is impossible!

Countries such as Spain and Greece and much of the rest of the euro-zone are living well beyond their means as illustrated by government budget deficits that are sending debt to GDP ratios soaring into the stratosphere, all the way towards infinitely, yet the populations are unable or unwilling to grasp the fundamental fact that they are to blame for this crisis because they (the population collectively including their bankrupt banks) have spent the previous 10 years in the lead up to the debt crisis getting drunk on a debt induced spending binge, inflating wages without a like for like increase in productivity, paying low interests rates that did not reflect the risks involved and at least Greece publishing bogus economic statistics that sought to hide the true level of indebtedness, all by virtue of the fact that they were part of the Euro-zone and therefore was no market mechanism to reveal the truth of the true state of their economies, as they no longer had currencies that would reflect such reckless behaviour in loss of purchasing power - INFLATION.

Many in the press mistakenly put much of the blame on the Germans because it is their banks that are in significant part recipients of the bailout funds via the bankrupting PIIGS. That and the fact that a relatively weak euro against what would have been a stronger Deutschmark has resulted in a captured market for German exports. However a deeper investigation beyond that the mainstream press appears capable of reveals a contrary picture, as the German economy has actually grown less than it would have done had it been outside of the Euro-zone because of the divergence amongst euro-zone countries that had seen German wages fall by 10% whilst many euro-zone nations labour costs rose by as much as 40%. Similarly the Germany inflation rate has been higher than it would have been due to a weaker currency resulting in depressing real wages further thus resulting in less net consumer spending, that is as a consequence of importing Inflation from Euro-zone nations going on a spending spree. Additionally we can see that much of the trade surplus generated via the weak euro has and is being squandered first on worthless U.S. Subprime mortgage junk and then on bailout out of the PIIGS, so in fact German workers have spent the last decade working hard for nothing! Lower wages, higher prices and the trade surplus investments going up in smoke all for the socialist euro project that is virtually guaranteed to fail!

The Germans would have been much better to have joined their Meditarian cousins and also gone on a debt fuelled 10 year party, at least then they would find it easier to print money because they would all be in a very similar boat.

Therefore the PIIGS having gone on a 10 years spending binge with a German Credit Card now want to continue to carry on having a free lunch at German expense whilst at the SAME time retaining SOUND MONEY, the Euro, so that the purchasing power of earnings and savings is relatively secure. THIS IS DELUSIONAL, because they are defacto demanding the primary backer of the Euro currency, Germany to either bankrupt itself or destroy the Euro by inflating it's value away because the Spanish and Greek people do not want to look in the mirror and acknowledge the role that they played through their individual, state, corporate and government actions in large part creating the debt crisis they now find themselves in.

Therefore the PIIGS having gone on a 10 years spending binge with a German Credit Card now want to continue to carry on having a free lunch at German expense whilst at the SAME time retaining SOUND MONEY, the Euro, so that the purchasing power of earnings and savings is relatively secure. THIS IS DELUSIONAL, because they are defacto demanding the primary backer of the Euro currency, Germany to either bankrupt itself or destroy the Euro by inflating it's value away because the Spanish and Greek people do not want to look in the mirror and acknowledge the role that they played through their individual, state, corporate and government actions in large part creating the debt crisis they now find themselves in.

The problem with countries such as Greece and Spain and in fact the West in general is that somewhere along the way they have forgotten what free markets are and instead increasingly have operated as socialist money and debt printing states by following bankrupting economic ideologies such as that of Keynes. This is at the core of the problem and why there is no logic to the argument for demanding both sound money and the ability to print money for socialist government spending to infinity and beyond.

The solution for the peoples of Euro-zone countries such as Spain and Greece is for once and for all to choose which they prefer -

a. Do they want sound money, in which case wages have to deflate to enable them to become more competitive and spending needs to be cut to reduce the budget deficit whilst at the same time most of the debt is written off so that interest payments do not consume tax revenues and thus result in an downward economic spiral. The key metric to focus on here is the real budget deficit (excluding interest payments), where Greece is concerned that's about 5%, as the interest of 6% and ALL of its debt repayments and AND financing much of the budget deficit are covered by the ECB. We all know by now that none of the debt that is being accumulated will ever be repaid as Greece is heading for a 100% write off. So that strategy for staying in the Euro-zone should be to eliminate the deficit and then default on ALL of the debt. However this clearly does not appear palatable to the demonstrating masses who demand government hand outs that can only be provided for via the money printing presses.

b. Or do the Greeks and Spanish et-al want the illusion that money printing inflation brings ? Where the central bank just prints money to buy the governments own bonds from the market thereby the government can go on an indefinite deficit based socialist spending spree knowing full well that the debt will never be repaid and that the exponential Inflation Mega-trend that it induces will do the job of erasing the value of the debt, purchasing power of the wages and savings and thus increasing competitiveness as the market price of the Drachma / Peseta will fall in line with the true state of the respective economies and thus enabling these countries to export whilst reducing imports as prices rise (Inflation). Off course following this root also means a debt default because they cannot devalue debt denominated in foreign currency (Euro's) though they could in a sleight of hand redenominated the debt in their new currency on a 1 for 1 basis and thus perform a stealth default.

My opinion for sometime (at least a year) is that most of the general populations of countries are unable to do the math and thus tend to prefer the illusion that government money printing offers, just as is taking place in the US, UK and Japan, rather than face what Greece and Spain face which is being forced to increase competitiveness by cutting wages and government spending (they don;t need to worry about the debt because it will never be repaid and instead eventually defaulted upon as we have seen in a series of write downs with Greece). Therefore I am still of the opinion that Greece and Spain and most of the rest WILL leave the Euro0zone because the rioting populations are more easily placated by the illusion that money printing inflation brings. And in my opinion this is the better solution for a short sharp shock Iceland style i.e. for economies to die a quick death, be cleansed of debts and malinvestments and resurrect themselves in a more sustainable manner where the populations no longer have an ECB or Germany to blame as they have full reigns over all of the levers of power as they let their central banks let rip with the printing presses, rather than die a slow economic death that most of the euro-zone nations have been facing for the past 4 years or so, coupled with the increasing obsession of blaming others (Germany) by virtue of their lack of willingness to fire up the money printing presses that they off course are managing in terms of what is best for their own countries rather than what is best for the euro-zone PIIGS.

The bottom line remains that Greece, Spain and most of the Rest WILL Leave the Euro-zone so that they can freely print infinite debt and money to placate their respective populations and existing Euro debt will either be redenominated in new currencies or defaulted upon, in this respect I am surprised Greece has managed to make it through September. There is also the wild card that Germany could decide to exit first rather than become the next France or Italy.

What about the Bankster's?

I hear you ask. Yes, the situation is complex and I have written at length over the past few years of the role the bailout of the banks has played, in which respect my view has been consistent right from the very beginning of the financial crisis in that the bankrupt banks MUST be allowed to go bankrupt! Otherwise a large part of the bailout funds (depending on the nation involved), is going purely to keep bankrupt banks afloat as we have witnessed time and time again for ALL western countries since September 2007 (Northern Rock).

However bankster's are part and parcel of the system that at its core has the central bank crime syndicate and corrupt politicians that use the debt and money printing fraud to buy power via the illusion of democracy, when the reality is that western nations are on a slow steady slide towards becoming totalitarian socialist police states and to see what the final destination is we need only look at the Soviet Unions last decade where it's own central bank was busy printing rubbles out of existence.

The situation is even worse where the Euro-zone is concerned as we see with the example of Spain making the news, as its banks are demanding another Euro 60 billion bailout that the Spanish government wants to dump the responsibility of onto the ECB because it is unable to print euros to cover the liabilities of Spain's bankrupt banks in a similar manner to the £375 billion that the UK has engaged in to date. Europe's banks are another primary reason why the Euro-zone will break itself apart because it is resulting in an ongoing run on PIIGS banks with cash flowing into primarily German bonds, resulting a huge drain of liquidity.

The Euro-zone bottom line is this - Germany is not big enough to bailout Greece let alone the other members of the euro-zone because what the central bank crime syndicate has been proposing is exponential, that's what happens when you print money Euro 1 notes become 10, then 100, then 1000, and eventually Euro 1000,000. The same holds true for the dollar and sterling and all other fiat currencies.

Global Central Bank Crime Syndicate

The ECB's other partners in crime were also busy during September ramping up their own programme's for the stealth theft of wealth and purchasing power by means of debt and money printing socialist government deficit spending inducing inflation, as we have had QE3 from the U.S. Fed, and record UK Government borrowing of £14.41 billion for the month of August (that the Bank of England is busy monetizing) whilst the Coalition Government propaganda has been that its primary objective has been to cut the debt and deficit whilst in reality it is achieving neither.

The ECB's other partners in crime were also busy during September ramping up their own programme's for the stealth theft of wealth and purchasing power by means of debt and money printing socialist government deficit spending inducing inflation, as we have had QE3 from the U.S. Fed, and record UK Government borrowing of £14.41 billion for the month of August (that the Bank of England is busy monetizing) whilst the Coalition Government propaganda has been that its primary objective has been to cut the debt and deficit whilst in reality it is achieving neither.

Before we go any further readers really do need to understand that the central banks really do operate as a crime syndicate, it is not a club of colleagues working together but rather bankster's with fingers on the triggers of monetary weapons of mass destruction as they seek to play the game of maximising the theft of wealth for their dual masters of the elite and respective governments in their never ending pursuit to buy votes and stay in power. The currency war between central banks is akin to the cold war of ever escalating money supply that competes against one another without triggering outright monetary war that would result in the collapse in confidence of all fiat currency resulting in an hyperinflationary panic event. In the pursuit of the monetary cold war, central banks deploy a number of propaganda tactics at their disposal by conjuring economic statistics out of thin air such as inflation and unemployment data that does not reflect economic reality and propagating economic theories that support their debt and money printing policies such as Keynesianism which is liberally reported on as fact by the mainstream press. That and the obsession with exchange rates that give the illusions of relative fiat currency stability when the reality is that of competing central bankster's ensuring that each of their respective country exchange rates are freefalling together, thus all that the exchange rates exhibit is the volatility the differing rates of free fall as central banks vie for one up-man ship against one another without triggering all out monetary war.

Again I need to emphasis once more that the core of the problem is lack of free markets, as western economies such as the UK, USA and Euro-zone actions have been akin to what we would see in the Soviet Union, such as the socialist bailout of the banks (the rich) in fact socialism for EVERYONE! The market response would have been to let them go bankrupt and cleanse the system of malinvestments. Instead all we are seeing is bailouts of the banks, and bailouts to finance socialist government deficit spending to buy power.

Socialism is the greatest evil that the west faces that if let to run its course will destroy western civilisation by means of the money printing presses operated by the central bank crime syndicate just as past empires were destroyed by money printing i.e. Roman Empire, Ottoman Empire, British Empire and off course the Russian Empire.

People have been brainwashed into thinking that the government is working for them when it is in fact stealing from them to funnel wealth to vested interests. People have been brainwashed that the NHS is good for them when the people of Britain are paying for TWO health services and barely in receipt of one as I have illustrated at length over the years (03 Mar 2011 - NHS GP Doctors Putting Profit Before Patient Care, Channel 4 News Investigation). The problem is lack of free market competition that the government in reality does not want because it diminishes government power over individuals. Instead it wants the population to be wholly reliant on the government and its officials.

Free markets in a west are an illusion as we have seen with the wholesale socialist bailout of the banking sector at unlimited liability.The government seeks to control and manipulate virtually every facet of individual action, and the people in general have been brainwashed to believe it is all done for the good for them.

Profiting from the First Call on Debt and Money Printing Inflation

The consequences of money printing or QE has been apparent form the start that it would induce inflation that the elites (dark pools of capital) would have first call on that inflation which was targeted at the asset markets, specifically the government bond markets to drive down interest rates to support government debt printing and to make the banks liquid to give the illusion of solvency as the bank used QE to buy government bonds thus improving their capital ratios as well as creating risk free profits i.e. borrow at near zero from the central banks and invest in higher interest rate longer dated government bonds that they sell to the Central Bank at a higher price.

The second call on Inflation or phase 2 was aimed at inflating the stock asset prices, so that boosting the value of bank holdings and wider speculative holdings would encourage economic activity.

The third call on Inflation or phase 3 is to to inflate property asset prices so that the banks stop being bankrupt i.e. their mortgage holdings are no longer defective, the remainder of what they are sitting on as the worst of which has already been offloaded onto the tax payers with countries such as the United States announcing their true intension's of inflating to infinity as per the September announcement of $40 billion per month of money printing to buy defective mortgages from the likes of Fannie and Freddie and thus keep pushing ever increasing amounts of liquidity into the bankrupt banks until they literally burst their banks and the money floods out right across the US economy triggering what ? INFLATION!

Welcome to Weimar Britain!

The truth of the money printing asset buying game being played for the benefit of the wealthiest was revealed by no other than the Bank of England itself, as hidden away in a recent report was acknowledgment that most of the rise in UK stock prices was as a consequence of £375 billion of QE.

"By pushing up a range of asset prices, asset purchases have boosted the value of households' financial wealth held outside pension funds, although holdings are heavily skewed, with the top 5% of households holding 40% of these assets,"

"QE has caused the price of gilts to rise and yields to fall, in turn leading to an increase in demand for, and price of, a wide range of other assets, including corporate bonds and equities,"

http://www.bankofengland.co.uk/publications/Documents/news/2012/nr073.pdf

Therefore the Bank of England's QE program that has sought to stuff every orifice of British banks with tax payer cash to the tune of about £120 billion a year has rewarded the holders of stocks and bonds and other assets whilst punished savers and those attempting to retire (low annuity rates) as there is no incentive for British banks to offer decent rates of interest because they make risk free profits by borrowing from and lending to the Government!

The consequences of which is that of an exponential inflation mega-trend as illustrated below that shows that despite the British economy having been in economic depression for the past 4 years, yet it has still suffered official CPI Inflation of 15%.

And just as holds true for the US financial system so holds true for the UK that the QE to date, let alone future QE is enough as a consequence of he fractional reserve banking system to ignite an epic inflation inducing monetary flood that would lift asset prices across the board and accelerate consumer price inflation, whilst academic economists remain obsessed with statistics that have been pointing in the exact opposite direction due to the process I can only describe as systemic central bank crime syndicate sponsored brain washing.

The Quantum of Quantitative Easing Inflation

My recent in-depth article (20 Jul 2012 - The Quantum of Quantitative Easing Inflation is Coming!) explained in detail where this game of money and debt printing is going in terms of the REAL debt burden that my next article on Inflation will expand upon but basically the real UK debt burden is about 30% lower than the actual reported debt to GDP ratio suggests because of the fact that the government is paying interest to itself via the Bank of England which in effect acts to cancel 30% of the public debt, which is why the Debt to GDP ratios that academic economists tend to obsess over are now meaningless as a consequence of the Quantum of Quantitative Easing, which is why they cannot see the inflationary consequences of what is going on. Know this that the Quantum of Quantitative Easing is PERMMANET, so whilst the monetized debt may still officially exist, it HAS in effect been cancelled out because it will NEVER be repaid but instead rolled over in perpetuity as Inflation does its job of eroding away ALL of its value.

The more debt the bank of England monetize's then the greater will be the impact of Quantum of Quantitative Easing. Were I can easily imagine a couple of years from now an official Debt to GDP ratio of 100% will in reality will just be 50% and the price of this will be INFLATION, the same is taking place right across the world such as the US Fed engaged in the similar activities of employing the Quantum of Quantitative Easing to erase the debt burden, which is why strategies to protect ones wealth from the inflation consequences of money printing need to be implemented as I have been advocating since at least Jan 2010 (inflation Mega-trend ebook) to:

a. Ignore the deflation propaganda.

b. Seek out a home for your wealth that cannot be easily printed or is leveraged to the exponential Inflation Mega-trend.

Glimmer of Hope for the UK Economy

There remains ONLY one real solution which is for the bankrupt to go bankrupt and for money printing QE to sustain the velocity of money by boosting the real economy via loans and investments in real enterprises that actually have profit generating business models as I advocated as long ago as March 2010 rather than what we see today which is QE for the banks and government deficit spending on socialist public sector black holes.

31 Mar 2010 - Solving Britain's Economic Crisis Through Micro Business Capital Investments and Credit

A Government run investment bank would ensure that at the very least new start-ups and small business would no longer fall victim to the banking sector and city of London's misplaced priorities that are NOT in the long-term interests of Britain.

The only party that I can see that could implement such a major shift in financial and economic policy would be the Liberal Democrats, though off course they have zero chance of winning the next election, at best as part of a hung parliament they could bring some influence to bear, which is far from an ideal outcome.

So I am afraid, we may have to wait for many years for a politician to emerge that is able to ignite real grass roots capitalism that would usher in a new era of prosperity that is outside of the tentacles of the bankster elite whose primary purpose is to turn everyone, including individuals, corporations and governments into perpetual debt slaves. Therefore the party I will most likely vote in the forthcoming election is the one that has a policy that could form the genesis of a national state run micro investment and credit bank.

There is a glimmer of hope as right on schedule (luck?), 2 years later the Lib Dems as part of an improbable coalition government have finally announced Cables Business Bank that they had signaled in their pre-election manifesto. Though £1 billion is a mere drop in the ocean compared to the estimated £100 billion that would be needed. £1 billion will only help about 10,000 businesses, £100 billion would help as many as 1 million and make a huge difference to the British economy and really could ignite sustainable economic recovery that I am sure many other countries would seek to emulate, and yes it would be sowing the seeds of the next bubble because it would still be a form of socialism, but it would be better then shoveling hundreds of billions into unproductive public sector black holes for which the spiral is endless and downwards, because true sustainable economic recovery only follows when the slate has been wiped clean! When the bankrupt have been allowed to go bankrupt be they small corporations, banks or even whole countries.

The real evil of our time is socialism, where the unproductive get rewarded and the productive get penalised in a race to the bottom. That just like the soviet union will meet its crunch point and be forced to unravel in short order.

Embryonic Housing Bull Markets

All of this backs up my increasing view since the start of the year that the UK and the US housing markets should start to turn this year, as ever increasing flood of leveraged liquidity will wash over the housing markets that I aim to cover in a series of in-depth articles (ensure you remain subscribed to my always free newsletter).

My last forecast for the UK housing market was for a depression into the end of 2011 and then base building during 2012 - 03 Sep 2010 - UK House Prices and GDP Growth Trends Analysis.

My last forecast for the US Housing market was for a continuing bear market into the end of 2010 - 29 Jun 2008 - US House Prices Forecast 2008-2010.

All those who point to dire economic data are making the mistake of looking in the rear view mirror and forgetting a fundamental factor that bull markets FEED on themselves. Once ignited they run all the way to the final bubble stage and in my opinion the money printing inflation to date has ALREADY ignited embryonic bull markets. By 2016, plenty will be written with the benefit of hindsight of how a stealth bull market in housing resulted in far stronger than expected economic growth during the preceding 3-4 years, and many will regret not buying way back in 2012 when they had the chance of lifetime!

Another Inflationary War Brewing?

All wars are inflationary, it's the final solution for governments to accelerate debt and money printing via their criminal central banks and take away peoples rights to protest and criticise the government in which respect there are clear signs of another middle east war brewing. For many years I have brushed aside the media coverage of an always imminent attack against Iran for a number of reasons such as US military being bogged down in Iraq and Afghanistan and plenty of fingers in pies elsewhere that have meant that the US has had no appetite to further stretch its military by allowing Israel that the US supports to the tune of about $10 billion per annum to strike. Let alone the cost of conflict with Iran that could easily top $2 trillion over the first 2 years of economic damage to add to the ever expanding official debt mountain of $16 trillion (that the Fed is busy monetizing).

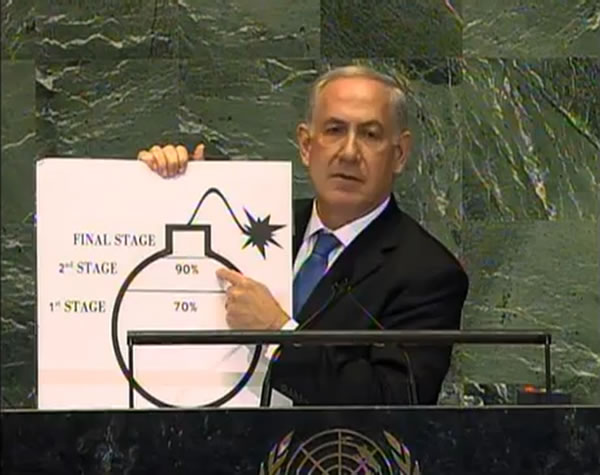

However, the Israeli PM Benjamin Netanyahu went into overdrive at the UN the past week by presenting a propaganda cartoon of an exploding bomb in a play for the need for an near imminent attack on Iran as he clearly see's a window of opportunity with the US governmental response weakened by the impending election and Israel's primary neighbouring foe Syria being paralysed by its own decent into hell.

Instead an honest presentation would have had the Israeli Prime Minister Benjamin Netanyahu pulling out a chart to describe the threat that Israel's nuclear arsenal of at least 200 nuclear missiles poses to the middle east and wider world at the UN General Assembly.

The presentation was along the lines of Colin Powell's infamous propaganda play acting in the weeks leading up to the Iraq War, when he presented a model vial of anthrax that he strongly implied was stockpiled by the container load in Iraq and therefore warranted imminent military action that the subsequent invasion revealed did not exist, nor were any WMD's found to exist despite an 8 year occupation.

It does appear that politicians and their elite masters require such simplistic publicity stunts to explain to the brainwashed dumb masses (not this websites readers) of what the threat is and what needs to be done (Orwell's "Animal Farm" style) at the expense of the truth.

The Nuclear iran Propaganda war has been raging for literally decades as an analysis of Imminent Iran Nuclear Threat reveals, for instance Janes Defence Weekly reported that Iran was 7 years away from having a nuke in 1984 (1991). Then we had a much younger Benjamin Netanyahu warn in 1992 that Iran was 3-5 years away from having a bomb (1995-1997). In 1995 Israeli and US officials warn Iran is 5 years away (2000), by 1997 experts warn 8 years away (2005).

June 2008: Then-US Ambassador to the United Nations John Bolton predicts that Israel will attack Iran before January 2009, taking advantage of a window before the next US president came to office.

The actual truth lost in the propaganda war is one of deterrence. Which whether we like it or not is the most probable outcome therefore is it not better to build bridges as Gorby and Ronnie did during the 1980's rather than sow the seeds for a constant finger on the trigger cold war with all of the associate risks that flash points between Israeli and Iranian madmen could bring.

After, all no amount of bombing is going to prevent Iran from eventually developing nuclear weapons, therefore it is infinitely better to erase the conflict than erase the region. Just as the Arab spring is seeking to erase conflicts between east and west as the populations rise up against dictators and totalitarian states, though at the same time that is the precise direction that the West has been drifting towards i.e. becoming totalitarian police states where the brainwashed masses are fed simplistic propaganda messages as illustrated by Benjamin Netanyahu's cartoon in advance of acts of war.

Consequences of Attack on Iran?

To imagine that an attack against Iran would have limited consequences, as the vested interests propagate is delusional for it would be the spark that lights the fuse on a series of escalations as an increasing number of missiles fly and incursions take plus, looking at historic precedent this would at least involve the Israeli invasions of Lebanon and Gaza in addition to the escalation of the existing occupation of the West Bank in response to unrelenting waves of retaliatory missile attacks from these regions that would be in addition to direct Iranian retaliation in the Gulf that Israel strategies would draw the US into a conflict against Iran, the consequence of which would be Inflationary as oil prices soar due to unforeseen consequences on how the escalating war would impact on the regions oil production and transport, let alone sponsoring a wave of attacks right across the world as Israel and Iran engage in a mutual war of terror bombings as we have observed with the tit for tat car bombings in recent years.

And what we have not even considered is the consequences of other countries such as China, Russia and Pakistan coming to the defence of Iran.

Your QQE Inflation Mega-trend monetizing analyst.

Source and Comments: http://www.marketoracle.co.uk/Article36791.html

By Nadeem Walayat

Copyright © 2005-2012 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.