ECB Draws a Line in the Sand for Euro Currency at $1.40

Currencies / Euro May 01, 2014 - 06:18 PM GMTBy: Gary_Dorsch

Two years ago, the big worry in the global markets was the possibility that Greece would opt to leave the Euro, which in turn, would set off a chain reaction, in which Portugal, Ireland, Greece, Spain, and Italy might also choose to do the same. The Euro’s credibility was at risk as it plummeted towards US$1.200. Nervous investors were thinking about withdrawing monies held on deposit with European banks. A mini-flight of capital was already underway. Businesses and households had withdrawn €80-billion ($103-billion), from banks in Greece, Ireland, Italy, Portugal, and Spain, during the first five months of 2012.

Two years ago, the big worry in the global markets was the possibility that Greece would opt to leave the Euro, which in turn, would set off a chain reaction, in which Portugal, Ireland, Greece, Spain, and Italy might also choose to do the same. The Euro’s credibility was at risk as it plummeted towards US$1.200. Nervous investors were thinking about withdrawing monies held on deposit with European banks. A mini-flight of capital was already underway. Businesses and households had withdrawn €80-billion ($103-billion), from banks in Greece, Ireland, Italy, Portugal, and Spain, during the first five months of 2012.

Earlier, in December ’11 and February ’12, the European Central Bank (ECB) injected €1.1-trillion of excess liquidity into the banking system, with 3-year loans, in order to create a buffer for Europe’s biggest banks against the threat of deposit flight. The ECB’s actions helped to calm financial markets for a few months, but the relief was short-lived. Doubts about the health of Spain’s banks and questions over Greece’s future continued to linger.

Foreign investors were convinced that Greece, Ireland, and Portugal could not survive their crushing debt loads. Their debt-to-GDP ratios were high enough to make a default a serious possibility. Madrid had already asked for €100-billion in rescue loans to prop-up Spanish banks. Spooked about the possibility of a break-up of the Euro, foreign investors had already dumped €242-billion worth of Italian bonds, lowering their exposure to 35% of bonds outstanding in May ‘12, compared with 51% a year earlier. Foreign investors also slashed their exposure to 26% of Spain’s bonds, from 40% a year earlier.

Belatedly, the rating agencies weighed in with their opinions. S&P cut Spain’s sovereign credit rating to BBB-minus, or 1-notch above junk territory, citing a deepening economic recession. Moody’s also issued a Baa3 rating, and put Spain on review for a possible downgrade. S&P lowered its long-term sovereign credit ratings for Italy to BBB from BBB+, or two notches above junk status, citing the size of Italy’s public debt which is today is 132% of gross domestic product, the second highest in the G-20 world, behind Japan.

However, the banks in Italy and Spain took a contrary position, and were acting as lenders of last resort for their governments, and ended up as the biggest winners from the crisis. Spanish banks borrowed more than €300-billion from the ECB, and plowed much of the money into Spanish government bonds. Likewise, Italian banks borrowed €255-billion in ECB loans, between late 2011 and early 2012, and used it to buy sovereign bonds. As a result, Italian banks controlled 57% of Italy’s marketable debts, and Spanish banks owned 67% of Spain’s marketable debt by the summer of 2012. Without the ECB’s “backdoor QE” scheme, borrowing costs for Italy and Spain could’ve spiraled sharply higher, like in Greece, and increased the odds of a default - on the very bonds held by the banks.

As such, the Spanish government and Spanish banks became perilously co-dependent, in what was called a “doom loop,” in which frail banks and troubled debtors states recycle the same money to prop each other up. However, the difference between the return offered on the sovereign bonds and the low cost of borrowing from the ECB generated enormous net interest income and spectacular capital gains for the Italian and Spanish banks. In Kaiserstrasse, the Frankfurt home of the ECB, Mr Draghi delivered a clear message, “If we are to do an operation similar to the LTRO, we’re going to make sure this is being used for the economy. And we’ll make sure this operation is not going to be used for these “carry-trade” operations.”

A Greek exit from the Euro currency could’ve opened-up a “Pandora’s box,” and left the door wide open to other disasters. Europe’s biggest banks were still sitting on $1.2-trillion worth of debt issued by Spain, Portugal, Italy, and Ireland, and nursing huge losses, and with traders piling up bets on the break-up of the 17-country Euro currency bloc, the situation looked grim. On May 9th 2012, the Euro Stoxx Banks index, a basket of 30-Euro-region banking stocks tumbled below the depths of March of 2009, “Great Recession” lows. The Markit iTraxx Financial Index of credit-default swaps on the senior debt of 25 European banks and insurers reached 308-bps, matching the highest since the days before the ECB’s first offering of 3-year repos. The Euro fell to a 21-month low against the US-dollar.

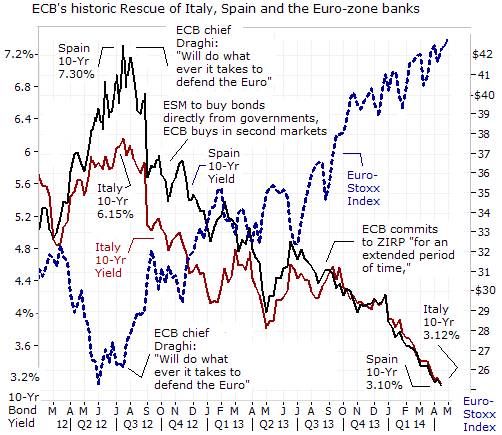

However, on July 26th, 2012, with 23 ad-libbed words, ECB chief Mario Draghi changed the course of the Euro-zone debt crisis. “Within our mandate, the ECB is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough,” he warned. It was a master stroke. Draghi never needed to back up his tough words with action. Draghi’s “Jawboning” proved to be a game changer, - it took the systemic risk out of the Euro-zone’s financial markets with the ECB implicitly guaranteeing the bonds of the troubled debtors in the Euro-area, and thus, reducing the likelihood of a break-up of the Euro.

Today, the ECB can look back and rightly claim to have staved off a financial disaster. The ECB’s pledge made on Sept 6th, 2012, to throw its unlimited financial clout behind an effort to protect Spain and Italy from financial collapse by pledging to buy their bonds on the secondary market, was enough to ultimately drive Italy’s and Spain’s 10-year bond yields dramatically lower. Since then, Italy’s 10-year borrowing cost has dropped a stunning -325-basis points (bps) lower and Spain’s tumbled -450-basis points lower, from their peak crisis levels.

The nightmare scenario was averted. Subsequently, sharp declines in Greek, Irish, Italian, Spanish, and Portugese bond yields, fueled a huge +60% increase in the market value of the Euro-Stoxx index fund, (NYSE ticker; EZU), to above $42.50 /share in New York. On April 10th, 2014, the ruling politicians in Athens celebrated the return of Greece to the global bond markets. Crazed investors placed €20-billion worth of bids to buy €3-billion of 5-year Greek notes, even though Moody’s rates Greece’s at nine notches below investment grade at Caa3, and S&P and Fitch rank Greece’s debts at B-. Still, buyers accepted an interest rate of 4.75% on the 5-year note issue. The ultra- low interest rate signals a supreme level of confidence among investors that the ECB would act to backstop the bonds, if necessary.

Currency carry traders decided to hop on the bandwagon, by borrowing monies in Japanese yen and US-dollars, and plowed the cheap cash into high yielding Euro-zone bonds. Carry traders bid-up the value of the Euro’s exchange rate to above ¥140, from less than ¥100. The Euro rebounded +16% against the US$ to as high as $1.3950. These leveraged bets helped to depress the yields on Italian and Spanish bonds to within spitting distance of yields offered by British Gilts and US Treasury notes.

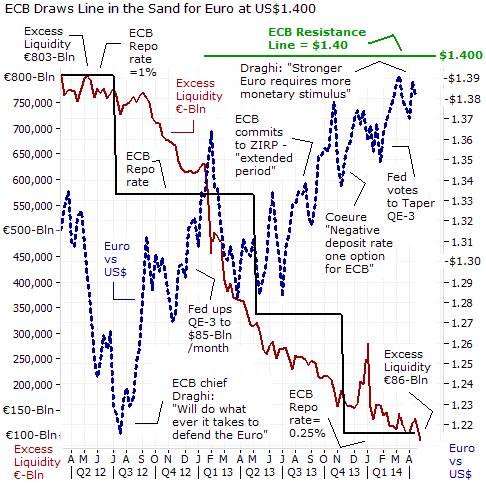

Also bolstering the Euro’s advance is a tightening of liquidity conditions in the Euro-zone’s banking network. Over the past two years, banks have repaid more than €700-billion of the ECB’s 3-year repo loans (LTRO’s). Excess liquidity, - the amount of money beyond what banks need for their day-to-day operations - fell to €86-billion this week, the lowest since late 2011. Excess liquidity peaked at €804-billion in early 2012. As a result, the Euro is buoyant, and bumping up against the psychological US$1.40 level and hovering above ¥140.

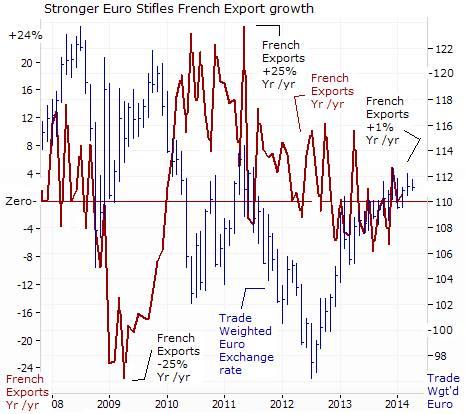

The problem for the Euro-zone however, is that one monetary policy doesn’t impact all the members the same way. When it comes to exports, each individual country has its own threshold of pain, when a too strong Euro begins to undermine the competitiveness of their top exporters in world markets. For instance, Germany’s threshold is estimated at $1.370.

In the case of France, exports begin to stagnate when the Euro /US$ exchange rate exceeds $1.24. And exports account for 25% of France’s economic output. This key engine of economic growth has been stagnant for the past 14-months. In Feb ’14, French exports totaled €3.62-billion or only +1% higher than a year earlier. For Italy, the threshold of pain for its exporters is estimated at $1.170. Italy’s export growth has been stagnant for 18-months. At €31.8-billion in February, Italy’s exports were +3% higher than a year earlier.

The Euro’s trade weighted index against a basket of its top trading partners is hovering at the 111.5-level, around its mid-point for the past six years. Still, French political leaders are worried that further gains for the Euro can make matters much worse. On April 29th, France’s Prime Minister Manuel Valls addressed the parliament, and took aim at the strong Euro. “The EU has to introduce measures to promote economic growth, ranging from encouragement of major investments to labor policy. But also a more appropriate monetary policy, because the level of the Euro is currently too high,” Valls declared.

French President François Hollande has struggled to breathe new life into the Euro-zone’s second-biggest economy and to keep his oft-repeated promise to get unemployment falling. The French unemployment jumped +0.9% in February, with roughly 3.35-million out of work, which is +4.7% higher than a year earlier. Some 177,800-workers joined the jobless register in 2013, after 283,800 were added in 2012. According to a recent poll conducted by France’s Opinion-Way, some 82% of the French are not satisfied with the government’s handling of the economic and social issues, and Hollande’s failure to tame the jobless rate has driven his approval ratings to record lows for a president in modern France.

The European Commission said that with weak growth, employers are likely to favor increasing productivity instead of job creation in France. It forecasts the unemployment rate will remain stuck at a 17-year high of 11% through 2014 and 2015. The French government forecasts its economy will grow by an anemic +1% this year after posting very slight growth in 2013. A quarter of against its trading partners’ currencies since July ’12.

Mr Draghi, who famously declared in July ’12, that the ECB would do “whatever it takes to save the Euro,” is now making a 180-degree U-turn, saying at a Jan 9th news conference that that the Euro has become too strong, and a further appreciation could threaten the Euro-zone’s tepid recovery. While the ECB does not profess to have a target level for the Euro, there’s been a steady drumbeat of comments, issued by most ECB members, since the Euro first cleared the $1.370-level, and the rhetoric escalated as the Euro approached $1.400.

On April 12th, Draghi himself threw down the gauntlet, saying that Euro’s exchange rate is important first and foremost for price stability, because when we say price stability, we mean price stability in both directions. So whenever we are distant from a +2% inflation rate we are in a situation of having a problem of reaching price stability. The Euro’s exchange rate is an important dimension for us,” he said.

The Euro’s increasing strength has also undermined the ECB’s attempts to stabilize the rate of inflation - which slowed to +0.7% in March, and well below its target of +2%. It was the seventh straight month that inflation remained below the “danger zone” of +1%. The ECB figures the Euro’s 21-month rally has shaved -0.5% off the region’s inflation rate. While the phenomena of “Low-flation,” is not as damaging as deflation, (a broad-based decline in prices), it still threatens the same perils of delaying consumer spending, undercutting corporate revenue, and often leads to companies stop creating jobs.

“We know that the longer the inflation rate stays below +1%, the higher will be the risk that it will not go back to +2% in any reasonable time - in other words, inflation expectations could actually be dis-anchored, and we don’t want that.” Therefore, “a further strengthening of the Euro’s exchange rate would require further monetary stimulus,” Draghi warned on April 12th. ECB member Benoit Coeure chimed in on April 11th, “The level of the Euro is important in our monetary policy making. Why? Because it impacts the inflation rate and we have an inflation mandate. The stronger the Euro, the more need for monetary accommodation.”

Mr. Draghi has argued, though, that low inflation is largely the result of falling energy prices and other one-time factors and the inflation rate will pick up in May, without the need of the ECB’s intervention in the marketplace. He might be right. For most of the second half of 2013, the Continuous Commodity Index, a basket of 17-equally weighted commodities, was submerged -15% lower on a year-over-year basis, against the Euro. Given the time lag between the advanced movements of commodity prices, and the subsequent reporting of official government statistics on inflation, today’s sub +1% inflation rate is not surprising. However, the Continuous Commodity Index has recently surged +10% higher, and finds itself unchanged compared with a year ago, - and unwinding deflationary pressures.

The ECB says it will “wait and see” awhile longer, to see if how EuroStat’s numbers on inflation play out in the weeks ahead. Until, then, the ECB is relying on “Jawboning,” or verbal threats, in an attempt to discourage traders from bidding up the Euro above the psychological $1.400-level. That’s where the ECB has drawn its red-line in the sand, yet the Euro is less than 1% away from the key resistance area. Perhaps, many traders believe the ECB is bluffing on its threats to block the Euro’s advance, with a more radical monetary policy, such as QE, and are trying to probe and test the ECB’s resolve, with a few quick stabs at $1.400, in order to see if the forays trigger a forceful response from the central bank.

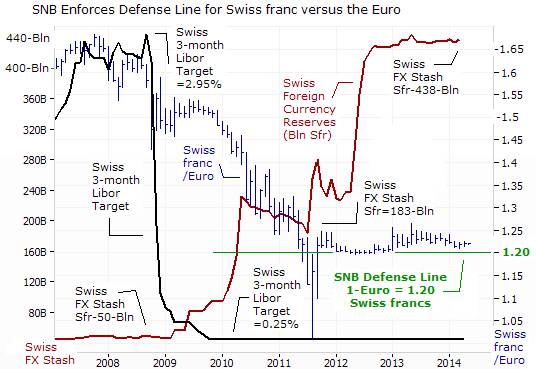

Since November ’13, ECB officials have been saying they would invent new policies, if necessary, in order to insure the Euro zone does not fall into the deflation trap. Six months later, the marketplace is still hearing the same message. On April 14th, Bank of France chief Christian Noyer warned “we will use every instrument within our mandate, including unconventional ones, in order to cope effectively with risks of a too prolonged period of low inflation.” However, the ECB doesn’t have to invent a new scheme to enforce a ceiling for the Euro’s exchange rate, it can simply follow the blueprints of the Swiss National Bank (SNB), which has enforced a floor for the Euro against the Swiss franc for the past 2-½ years.

The SNB put a floor under the Euro at 1.20 Swiss francs in Sept ‘11 in order to help stave off a recession and the threat of deflation. It had to intervene heavily in mid-2012, to maintain the floor, purchasing $205-billion worth of Euros, as the Euro zone crisis flared. “The European crisis may have become somewhat less virulent, but it has not been overcome, SNB chief Thomas Jordan warned on April 25th. “With Swiss interest rates close to zero and a high Swiss franc, the minimum exchange rate is still the key monetary policy instrument for the SNB.”

Jordan said the SNB is ready to enforce the policy by purchasing foreign currency in unlimited quantities and would take other measures if necessary. That verbal threat has been sufficient enough to keep currency traders at bay for the past year. Jordan said it was hard to predict the impact of the ECB launching QE in the Euro-zone, on neighboring Switzerland, but the SNB is determined to continue battling currency traders. The SNB is a veteran of battles with falling consumer prices, navigating through two years of negative inflation and a currency shock in the summer of 2011 that briefly knocked the Euro to parity with the franc.

Bundesbank chief Jens Weidmann, - the council’s arch hawk, has tossed aside “moral hazard,” and says charging negative rates on bank deposits held at the ECB should be the first line of defense against a too strong Euro exchange rate. Weidmann says he’s open to suspending the sterilization of the ECB’s previous bond purchases. “If we’re discussing how to inject liquidity into the market, instead of creating a new instrument, the most straight-forward manner would certainly be to either pause the absorption operation or reduce them in size.” Ending the sterilization would add about €175-billion into the financial system. After digging in his heels as a matter of principle, Weidman even gave his qualified support for launching QE, as the last option, to prevent “low inflation” from becoming entrenched.

On April 4th, a report in the Frankfurter Allgemeine Zeitung said the QE-option of purchasing bonds would need to be of a massive scale in order to impact consumer prices in the 18-member currency bloc. The newspaper said one ECB model showed €1-trillion of bond purchases spread over a year would boost inflation by +0.2%, while another model pointed to a +0.8% uplift. “If we are talking about generalized asset purchases, it will have to be about asset purchases in all countries,” ECB deputy, Vitor Constancio said. It’s widely expected that the ECB would begin to unveil a liquidity injection scheme in the month of June, as it seeks to enforce a ceiling for the Euro at $1.400 vs the US and 144-yen.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2014 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.