Gutting the U.S. Armed Forces, Committing Economic Suicide, France Imploding

Stock-Markets / Financial Markets 2014 Jul 11, 2014 - 12:29 PM GMTBy: Ty_Andros

This week was interesting to say the least and it is ending with a bang. We are covering a number of brief subjects this week. I hope you enjoy them.

This week was interesting to say the least and it is ending with a bang. We are covering a number of brief subjects this week. I hope you enjoy them.

- Gutting the armed forces

- Politically correct, but practically incorrect economic suicide.

- Farmland disaster DEAD ahead

- Repressed to Death

- NOT a SMIDGEN of Corruption!

- France is IMPLODING economically: Vive la France

- Bonfire of the Vanities!

- This will not have a HAPPY ending!

Gutting the armed forces

No matter where you look you will find the incumbent administration in Washington DC gutting every part of America they can. It is quite obvious from their ACTIONs (their words are carefully disguised double entendre and pithy slogans used to disguise their betrayals) they despise America, her people, our history, our freedoms, our institutions and culture and are working overtime to KILL IT. Monday's Gartman letter contained a deep insight that is being REPORTED nowhere by the main stream media. The gutting of our military during a time of high and rising global military tensions. Dennis quotes Bill Crystal (I am no fan of this NEO con):

There is one thing President Obama's Pentagon is resolute about: firing military officers who've served the nation. As Brendan McGarry of Military.com reported last week, A U.S. Army captain with more than a dozen years in the service, including multiple tours of duty in combat zones, assumed his job was safe. . . . What's more, he had just received orders to move to a new duty station. So he and his wife, who's newly pregnant with their first child, signed a lease and put a deposit on a home at the family's next location. A few days later, he was called into his post's commanding general's office and informed that, effective almost immediately, he would no longer be in the military. This isn't an isolated case.

As McGarry goes on to explain, this week the Army began notifying about 1,100 captains and about 500 majors that their active duty careers are over.

The Army, having already shrunk under President Obama from 570,000 soldiers to fewer than 520,000, "is on pace to shrink to 490,000 soldiers by next year." The Pentagon's proposed budget for fiscal 2015 calls for further cuts to fewer than 450,000 by 2017. And "if sequestration remains in effect, the number may fall to as low as 420,000 soldiers -- tens of thousands less than what the Army's top officer, Gen. Raymond Odierno, said is needed to adequately respond to conflicts around the world." But in Obama's America, who needs an Army large enough "to adequately respond to conflicts around the world"? And in Obama's America, does the country feel an obligation to these men anyway? In Obama's America, all compassion is owed to illegal immigrants and every effort is to be made for Bowe Bergdahl. But for the men and women in the military, and for the people of Iraq and Afghanistan, including those who fought side by side with us. . . nothing. Not even a phone call from "the real secretary of defense," - Chuck Hagel

Bill has it right, and foreign intelligence services and our adversaries around the globe see the weakness CLEARLY. Look for challenges to escalate and for the administration to RETREAT from them. It is a sad time for America. The damage done to date and over the next two years will take years if not decades to fix and reverse. The very idea that the EMERGING NEXT GENERATION of military leaders is being cashiered should send chills up the spines of all around the world that depend on them for protection. The US, Europe, Asia and the Middle East are ripe for conflicts as our enemies EXPLOIT our WEAKNESS! Makes you feel SAFE, warm and COMFY doesn't it?

Politically correct, but practically incorrect economic suicide.

Very Few things are as upsetting as socialist progressives ignoring history and national security concerns when formulating policies to protect the future of its citizens. Look no further than the Germans who are committing Hari Kari with domestic energy policy's. Mandating Green energy policies which are bankrupting its citizens and its manufacturing sectors as well as destroying competitiveness was just the beginning. Now the Mandarins in Berlin are outlawing Natural gas energy production for 7 years due to CONCERNS about environment. Quoting the Wall Street Journal:

"'There will be no fracking for economic purposes in Germany in the near future,' German Environment Minister Barbara Hendricks announced at a press conference on Friday. Under her proposal, most forms of hydraulic fracking will be prohibited until 2021."

You must understand that Germany get 30% plus of its energy from RUSSIA, but many other countries get up to 100% from the russkys. How is energy dependence working out for Ukraine? Anyone who knows the history of Gazprom knows they are GOUGERS from hell, require one sided contracts and play the GOTCHA game with regularity. These GERMAN politicians have put their constituents completely at the mercy of an adversary. Benjamin Arnolds and traitors to the very people they are sworn to protect. Germany is on a roll now but the next 7 years should be downhill as they are rendered internationally uncompetitive by public servants with NO VISION or knowledge of HISTORY! Blind PROGRESSIVE socialist ideologues destroying the future one policy at a time.

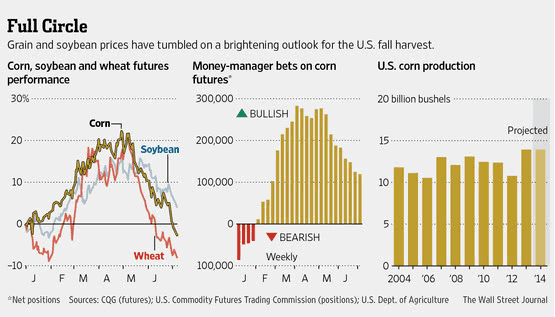

Farmland disaster DEAD ahead

Three years ago we had one of the worst droughts in DECADES and the politics of ETHANOL drove prices to previously UNSEEN highs. Those who did harvest had a BONANZA and the scramble for farmland BEGAN. Combine this with INTEREST rates at Zero and Quantitative easing also known as printing money out of thin air and you had a recipe for MALINVESTMENTS second to none. Some farmland exploded 200 to 500% in value in short period of time. Investors chased the markets as they always do and BOUGHT the top, created investments with little or no yield and expected the high prices to continue. Sounds like stocks and bonds today in a financially repressed world.

Now it is all BLOWING UP as we had one bumper crop last year and this year's crops are just about MADE with record yields. Investments which require $8.00 dollar corn or $17.50 soybeans are completely UNPROFITABLE at $4.00 corn and $13.00 beans. Most of those who financed their purchases are on the CHOPPING block and those who bought with cash are nursing BIG losses. These losses are rising by the Day. Last year's low prices on crops were a shot across the bows of those who participated in the Madness. This year's record crops are a DIRECT hit to them. Expect a crash in land values and problems in the banks that made loans based upon a boom in prices and a rarity when it comes to crop failures.

Repressed to Death

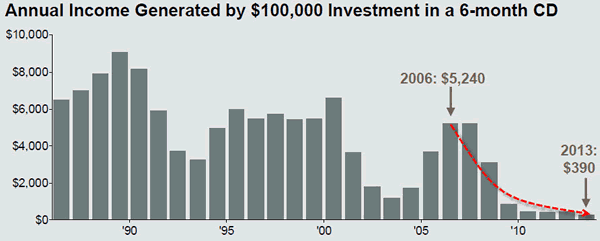

Yesterday's Zero hedge had a frightening chart for those who save. It illustrated how people (financially repressed) who spent a lifetime saving their money are now on the short end of the stick courtesy of the Federal Reserve. It illustrates how the return on their savings has been transferred to the banking system since 2008:

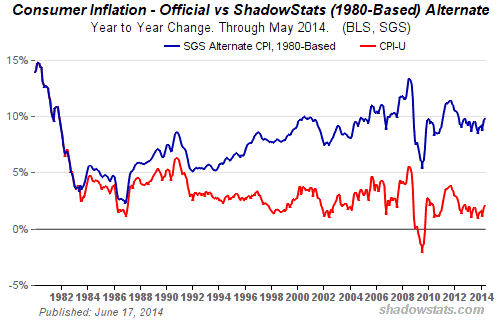

This is not a new story but it is a TRAGIC one of OFFICIAL moral and fiscal insolvency. Quite simply the financial system is more fragile now than when the crisis began. The financial assets are more over valued than at most anytime since the crisis. The government has almost doubled its debt since 2008. In real purchasing power terms their paper money has lost about 9% compounded annually since that time (chart courtesy of www.shadowstats.com);

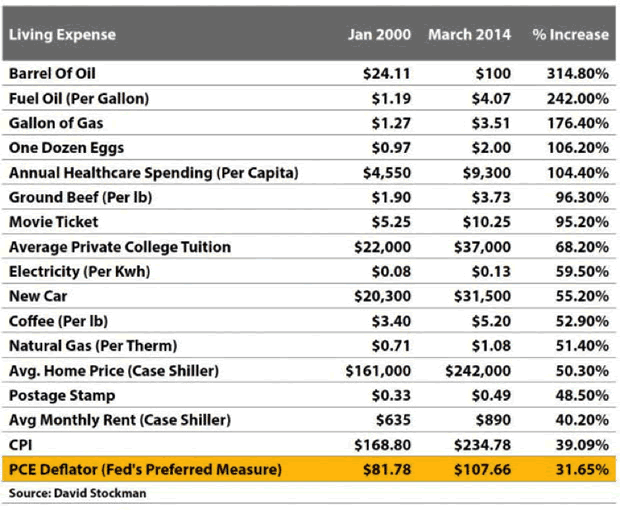

Using the rule of seventy two their purchasing power is CUT IN HALF every 8 years. Since 6 has transpired their savings have been cut by approximately 38% with the purchasing power proceeds being transferred to the banks in exchange for their toxic mortgage securities and to the US government to service their deficit spending. Do you think I am exaggerating? Let's take a look at another table from www.Zerohedge.com outlining inflation over the since 2000 in the real things you use daily:

The last two lines at the bottom are the official numbers from politically correct but practically incorrect public servants. This is supposedly the risk free way to store a lifetime of your labor in money designed to ROB you. Your financial advisors tell you it is risk free. If you had $2,000,000 dollars saved in 2008 and it buys $1,350,000 of goods and services in 2008 prices would you call it RISK FREE. In our collective economy the progressives say they owe this money. Since 2008 nominal incomes are off about 10% roughly ($55,000 to $50,000) and the money they are paid in has lost about 38% of its purchasing power. It is a clear display of what's happening to the MIDDLE CLASS; murdered by money printing and deficit spending for the WELFARE STATE. It is criminality on plain display.

NOT a SMIDGEN of Corruption!

The odds of winning the Florida lottery are 1 in 22,957,480. The odds of winning the Powerball are 1 in 175,223,510. The odds of winning Mega Millions are 1 in 258,890,850.

The odds of a disk drive failing in any given month are roughly one in 36. The odds of two different drives failing in the same month are roughly one in 36 squared, or 1 in about 1,300. The odds of three drives failing in the same month are 36 cubed or 1 in 46,656.

The odds of seven different drives failing in the same month (like what happened at the IRS when they received a letter asking about emails targeting conservative and pro-Israeli groups) is 37 to the 7th power = 1 in 78,664,164,096. (That's over 78 Billion) In other words, the odds are greater that you will win the Florida Lottery 342 times than having those seven IRS hard drives crashing in the same month. Unbelievable odds of it being the truth in my opinion.

You decide if you believe the official storyline is the truth...

France is IMPLODING economically: Vive la France.

Over the last several years most Europe's economies have struggled to grow other than Germany and most recently the UK have provided more robust expansions. But for France it has been a one way ticket on a down Elevator since Francois Hollande was swept into power shortly after the Global Financial crisis began in 2008. After the crisis began most European governments changed leadership except for Angela Merkel in Germany and most swung from socialist to conservative leaning. But France was the exception as Nickolas Sarkozy was replaced by UBER socialist Hollande.

He immediately expanded the welfare state, increased entitlements, hiked taxes to confiscatory levels (75%) on the private sector and expanded regulations (sounds like the chosen one in Washington DC doesn't it?). In France the private sector is the property of the socialists in power and its citizens who are all on the dole in one way or another. Look no further than the recent GE purchase of Alstom where the Government demanded a 20% government stake in the new company":

"It's a prerequisite that France takes 20pc of the capital," ... "If that's not realized, GE's bid will be blocked." - French industry minister Arnaud Montebourg

This deal was blocked until GE caved in and Jeffrey Immelt the consummate crony capitalist worked his magic as he so regularly does in Washington DC. This deal was as Mr. Montebourg put it:

"A political success for the return in force of the state in the economy."

A pyrrhic victory indeed for the state as since 2007 when the crisis began foreign direct investment has COLLAPSED 94% from $84 billion in 2007 to 5 Billion annually today! Talk about a collapse in confidence. This has been accompanied by a stampede out of the country by its most productive citizens as over 400,000 of them have voted with their feet to avoid becoming slaves to the WELFARE STATE since Hollande ascended to power. Do you know how much 400,000 top producers represent in leadership, investment, earning power past, present and future? He has CUT the head off those that must build the recovery. They won't be returning soon.

Unemployment is at all-time highs at about 12% and Youth unemployment is at 25%. Its banks are loaded to the gills with dubious lending to the Ukraine and Russia to name a few. Although as Chuck Prince once said, they "are still dancing".

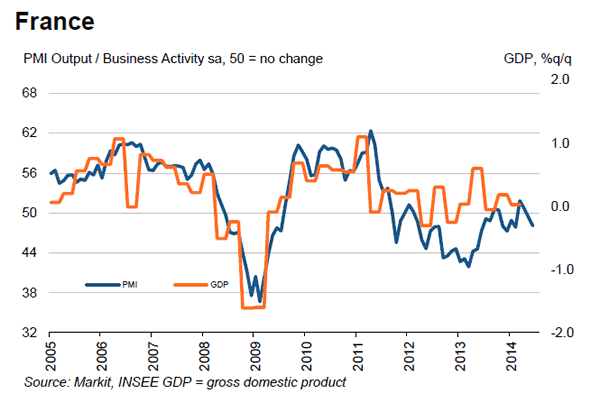

Other than a few months earlier this year the PMI surveys have been under the all-important 50 line (above 50 means growth, below 50 means contraction) for years.

Anyone remotely familiar with FRENCH regulation of the employment market is Orwellian to say the least, firing a worker for economic reasons or poor performance is virtually BANNED and if you want to hire someone the employment contract must be submitted to the government for approval before any hiring can take place.

Government CONSUMES 57% of GDP, suffocating the private sector and its budget deficit is stuck above 4%, and economic growth is virtually NON EXISTENT. It's called a debt spiral. Its debt on the books is 94% of GDP and projected to rise to 103% in 2016 by the IMF and its GAAP adjusted deficit is several times that. France is TRULY one of the SICK MEN of Europe and like the UNITED STATES it is saddled with incompetent socialists at the helm for SEVERAL MORE YEARS before policies can be expected to CHANGE. So ECONOMICALLY and SOCIALLY the downward spirals can be expected to CONTINUE. Gasoline in France is $11 dollars+ a gallon. Ouch. A bowl of soup in Paris... 15 to 20 euros.

France is Europe's second largest economy, so its health is CENTRAL to the EU project. Its POOR economy, aggressive banks, and governance more closely resemble ITALY and Greece. When this country finally IMPLODES it will be a shot heard round the world. To rescue this morally and fiscally insolvent behemoth will REQUIRE TRILLIONS of Euros to be rescued. They no longer have a domestic money printing capability, which now resides at the ECB. So the domestic banks must take up their patriotic duties and load up with government debt as a quasi-printing press, further loading themselves with ultimately TOXIC sovereign debt on their balance sheets. Its debt and economic death spirals are FIRMLY UNDERWAY! When will the world WAKE UP?

Bonfire of the Vanities!

Silver and gold are ROCKETING higher this morning as Portugal's second largest bank (Banco Espirito Santo) has MISSED a debt payment, and banks are gapping down as much as 3 to 4% in today's market action across the world. Regular readers of this missive know that the DEVELOPED world Banking problems HAVE NOT been addressed. Creating a rush to the safety of gold and silver pushing them through key technical levels overnight. Looking at the unfolding new BATTLEFRONT illustrates the escalation of the conflict there and its expansion:

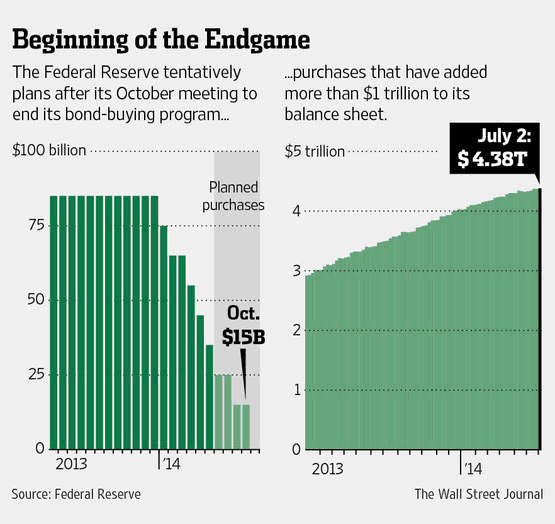

World War III has now opened up new battle lines (now Syria, Iraq, and Israel and Palestine, more to follow) between Israel and Hamas and the end of the TAPER is fully in view. Most metal analysts believe the money printing ending ends the SECULAR BULL market to an end.

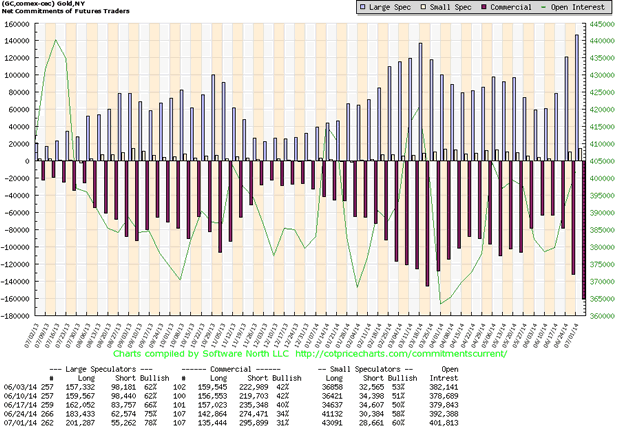

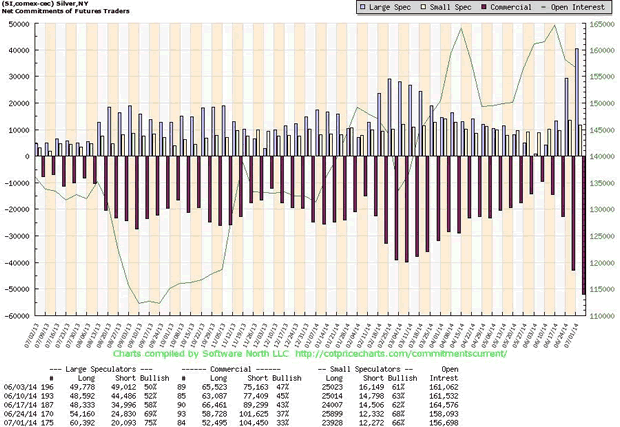

No, it marks the beginning of the next leg higher, the money has already been printed and we are just waiting for it to seek shelter. The smart money commercials are as heavily short as they have been in almost 2 years in both the gold and silver markets:

GOLD

SILVER

Hedge funds are LONG and commercial SHORTS have been caught with their PANTS DOWN on the news. SPARKS should fly and a war on the floor is happening. An explosive SHORT COVERING rally could be at HAND?

This will not have a HAPPY ending!

A number of issues called FIAT currency and credit paper printed out of thin air are piling up around the WORLD. Today we will outline a few. They are the tip of the iceberg of the coming crack up boom! Look at what's sitting in central banks around the world:

WOWEE. Those reserves are SURGING and are up almost 500% in 11 short years. IOU's denominated in IOU's.

"Asia isn't happy to buy foreign-exchange reserves;" ..."They're forced into this. The distorting factor in all of this is the Fed's QE." - Frederic Neumann, co-head of Asian economic research at HSBC Holdings

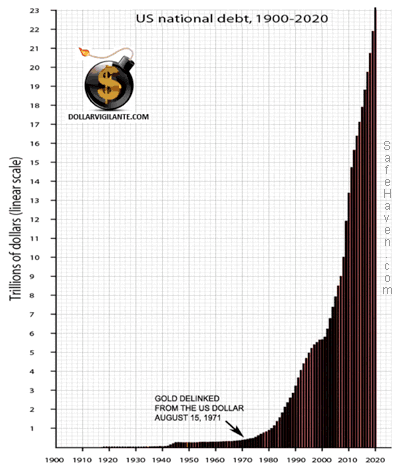

What happens if they want to repatriate their money or sell their treasuries someday? When this tide turns the mayhem will really begin, you can count on it. The national debt has gone BALLISTIC as the welfare STATE runs out of other people's money and borrows the rest from our children's futures and the crony capitalist regulatory state destroys future prospects for growth.

If that doesn't frighten you, nothing will. And where is this pile of paper sitting? In institutions, pensions, IRAs, money market funds etc. Most people don't realize that no provisions have been made to pay back one penny. Since 1960 federal debt has gone down in ONE YEAR ONLY. A one way trip to bankruptcy for the federal government and those who believe in the full faith and credit of morally and fiscally bankrupt central government known as Washington DC (district of corruption). Hint: don't worry they will print the money.

In closing: Frankly, there has been too much to cover. I left out an important vignette about Germany changing its banking laws which will allow it to Cypress depositors. The cost of the president wants to address the immigrant disaster on the southern border of the US has now climbed to $70,000 dollars per child (might as well send them home in first class). Globally tensions are high and rising and maybe the highest in my lifetime. China is pushing to see what the limits are to its expansionism. The continuing MASSIVE buildup of gold reserves in Asia and Russia. To Name just a few.

See you next week and may God Bless you ALL... Ty

This Weekly Wrap is posted as Daily Exercises on the Tedbits Blog (www.Tedbits.com) and available through Twitter and on Facebook. The Tedbits Newsletter and Weekly Wrap can also be delivered into your inbox and subscriptions are FREE - CLICK HERE.

Author's Note: In my opinion the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which are designed with the potential to thrive (up and down markets) regardless of what unfolds economically or politically? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

Did you enjoy this post? Subscriptions are free at CLICK HERE.

By Ty Andros

TraderView

Copyright © 2014 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.