“Back Door” Method For The Government To Pay Down The Federal Debt Using Private Savings?

Interest-Rates / US Debt Oct 01, 2014 - 03:56 PM GMTBy: Dan_Amerman

The United States government is currently about $17.5 trillion in debt. To place this number in perspective: if we assume that only the above-poverty line households will be making net contributions towards paying this enormous debt, this means that the national debt equals about $180,000 for each "able to pay" household in the US.

The United States government is currently about $17.5 trillion in debt. To place this number in perspective: if we assume that only the above-poverty line households will be making net contributions towards paying this enormous debt, this means that the national debt equals about $180,000 for each "able to pay" household in the US.

With traditional financial planning, the most common way of dealing with this problem – is to completely ignore its existence. Rather than try to incorporate the effects of this massive debt that could transform interest rates, economic growth and rates of return for decades – most investment plans for individuals simply pretend it doesn't exist.

However, if one is to make reality-based financial decisions over the long-term, then there is no substitute for understanding just how nations actually deal with massive debts in the real world, whether in the United States or in other Western nations with extraordinary levels of debt.

In practice, there are four primary methods which nations use to pay down huge government debts when they have borrowed in their own currency:

1) Decades of austerity with higher taxes and lower government spending. This painful choice can lower economic growth rates for decades, and fundamentally change investment returns. It is also overt and clearly understood by voters, and can thus have devastating political implications.

2) Defaulting on government debts. This radical option can devastate bond and stock portfolios, bank deposits and retirement accounts. It is also clearly understood by voters, and thus can have devastating political repercussions.

3) Inflating away the value of the debt through rapidly slashing the value of the currency. Very high rates of inflation rapidly reduce the value of savings, bonds, deposits and retirement accounts. Because collapsing the purchasing power of savings and salaries powerfully impacts the day-to-day lives of voters, this can have devastating political implications.

4) Using "Financial Repression", a process that is complex enough that the average voter never understands how it works, thus allowing governments to use this potent but subtle method of taking vast sums of private wealth, year after year, decade after decade, with almost no political consequences.

This fourth method that nations use to control or reduce the real value of debt is by far the least known or understood. Which is why if you are a senior government official in a nation that has a huge "sovereign debt" problem – like the United States and almost all of Europe – and you want to stay in power, this method is of keen interest and appeal.

Financial Repression has strong advantages for the government. First, it works in practice – and professional economists understand this very, very well indeed. As published in a working paper on the IMF website, Financial Repression is what the US and the rest of the advanced economies used to pay down enormous government debts the last time around, with a reduction in the government debt to GDP ratio of roughly 70% between 1945 and the early 1970s.

Second – and of crucial importance – is that there was almost no political damage, even while most major nations deployed it over a period of 25+ years to pay down the debts of World War II. So Financial Repression is proven not only to be effective, but in practice to carry very few if any negative political consequences, quite unlike the better known "high drama" solutions of austerity, default or high inflation.

This avoidance of any political cost is also proven by current events since 2010, for even while the major components of classic Financial Repression have been reappearing for the first time in decades in the United States and other nations – there has been relatively little media coverage or general discussion.

To understand this "miracle" debt cure for governments requires understanding the source of the funding. That is, the essence of Financial Repression is using a combination of inflation and government control of interest rates in an environment of capital controls to confiscate much of the purchasing power of a nation's private savings.

Rephrased in less academic terms – the government methodically destroys the value of money over a period of many years, and uses regulations to force a negative rate of return onto investors (in inflation-adjusted terms), so that the real wealth of savers shrinks by an average of 3-4% per year (in the postwar historical example).

Indeed, over time Financial Repression can be every bit as destructive to wealth building through savings and retirement accounts as is austerity, default or high rates of inflation.

And because of the sheer size of the problem – most of the population must be made to participate, year after year. Financial Repression therefore uses an assortment of carrots and sticks to ensure that investors have little choice but to participate – on a playing field that has been rigged against them as a matter of design – even if they are among the small minority who are aware of what is being done to them.

Understanding Financial Repression

Financial Repression and its devastating impact on retirement investors was the subject of a recent Bloomberg article, and it has also been previously covered by the Economist magazine, which included the following summary:

"... political leaders may have a strong incentive to pursue it (Financial Repression). Rapid growth seems out of the question for many struggling advanced economies, austerity and high inflation are extremely unpopular, and leaders are clearly reluctant to talk about major defaults. It would be very interesting if debt (rather than financial crisis or growing inequality) was the force that led to the return of the more managed economic world of the postwar period."

The phrase "Financial Repression" was first coined by Shaw and McKinnon in works published in 1973, and it described the dominant financial model used by the world's advanced economies between 1945 and somewhere between 1970 to 1980 (the specific duration varied by nation). While academic works have continued to be published over the years, the phrase fell into obscurity as financial systems liberalized on a global basis, and former comprehensive sets of national financial controls receded into history.

However, since the financial crisis hit hard in 2008, there has been a resurgence of interest in how governments have paid down massive debt burdens in the past. And in 2011 a fascinating study of Financial Repression, "The Liquidation of Government Debt", authored by Harvard economics professor Carmen Reinhart and M. Belen Sbrancia, was published by the National Bureau of Economic Research.

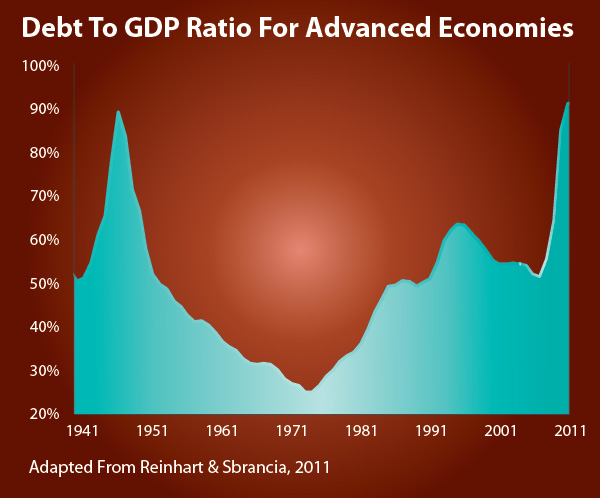

The paper was circulated through the International Monetary Fund, and to understand why it has caught the full attention of global investment firms and governmental policymakers, take a look at the graph below:

The advanced Western economies of the world emerged from the desperate struggle for survival that was World War II, with a total stated debt burden relative to their economies that was roughly equal to that seen today. The governments didn't default on those staggering debts, nor did they resort to hyperinflation, but they did nonetheless drop their debt burdens relative to GDP by about 70% over the next three decades – and the very deliberate, calculated use of Financial Repression was how it was done.

What the IMF-distributed paper effectively constitutes is a Sheep Shearing Instruction Manual. The "way out" for governments is effectively to fence the world's savers and investors inside of pens, hold them down, and shear them over and over again, year after year. Uninformed and helpless victims is what makes Financial Repression work, and it worked very well indeed for 25 years.

On the other hand, if you understand what is truly going on, then you do have the ability to turn this to your substantial personal financial advantage. With a genuinely out of-the-box approach to long-term investment, the more heavy handed the repression – the more reliable the wealth compounding for those who reject "flock" thinking.

The Mechanics Of Financial Repression

The specifics of Financial Repression have taken somewhat different forms in each of the advanced economies, but historically they each come down to two fundamental components: A) creating a mechanism for "shearing", i.e., a way to transfer wealth from savers to the government on an extraordinary scale – but without ever explicitly saying that is what is being done; and B) using the government's control over laws and regulations to erect a series of "fences", making it very difficult for investors to escape the "shearing" pen, but again, without ever explicitly saying that this is being done.

As covered in the IMF working paper / governmental tutorial, this combination of shearing and fencing in the postwar era shared four to five core characteristics: 1) inflation; 2) governmental control of interest rates to guarantee negative real rates of return; 3) the funding of government debt by financial institutions; 4) capital controls; and 5) discouraging (or even outlawing in some cases) precious metals investment.

As further explored herein, most of these historical components have reappeared since 2010, in response to the extraordinary rise in government debt levels which resulted from the attempts to contain the damage from the 2008 crisis. The specifics for how the modern version works are in some cases quite different from the well studied postwar example, but they share the following features:

1) Inflation (Shearing #1). First and foremost, a government that owes too much money destroys the value of those debts through destroying the value of the national currency itself. It doesn't get any more traditional than that from a long-term, historical perspective. Without inflation, Financial Repression just doesn't work.

Historically, the rate of inflation does not have to be high so long as the government is patient, but the higher the rate of inflation, the more effective Financial Repression is at quickly reducing a nation's debt problem.

For example, per the Reinhart and Sbrancia paper, the US and UK used the combination of inflation and Financial Repression to reduce their debts by an average of 3-4% of GDP per year, while Australia and Italy used higher inflation rates in combination with Financial Repression to more swiftly drop their outstanding debt by about 5% per year in GDP terms.

2) Negative Real Interest Rates (Shearing #2). In a theoretical world, some would say that governments can't inflate away debts because the free market would demand interest rates that compensate them for the higher rate of inflation. Sadly, this theoretical world has little to do with the past or present real world.

For if we look at the current market, the substantial majority of US government debt is outstanding at rates that are less than even the official rate of inflation. This has been true for several years now, even as it was true (on average) for decades in the past.

In the past there were formal government regulations that determined the maximum interest rates that could be paid. As an example, Regulation Q was used in the United States to prevent the payment of interest on checking accounts, and to put a cap on the payment of interest on savings accounts.

Regulation Q is long gone, but government control of short, medium and long term interest rates has nonetheless been near absolute since 2010 in the United States. As described in detail in this article, the Federal Reserve has been using its powers to massively manipulate interest rates in the US, keeping costs low for the government while cheating tens of millions of investors.

First, creating inflation, and then second, holding interest rates beneath the rate of inflation, comprises the two blades of the shears. Working in combination, this transfer of wealth on a wholesale basis from savers to the government has created what has at times been a hidden $500 billion a year tax on savers in the United States.

So long as the Federal Reserve maintains control, there is no need for explicit interest rate controls – or even necessarily for ongoing Quantitative Easing (QE). However, should the Fed begin to lose control, there is a strong possibility that either interest rate controls or another sharp increase in QE will return to the US financial landscape, with similar controls or changes in monetary policy returning in other nations.

Three Fences, Coincidental Timing & Cheating Investors

The 2nd half of this article explores:

1) The three "fences" used to contain investors, including Fed actions, capital controls and precious metals;

2) The extraordinary timing with how quickly all the key components of Financial Repression were simultaneously reassembled for the first time in over 35 years - almost without media comment; and

3) The subtle but powerful "low drama" way in which tens of millions of savers and investors are being systematically cheated, without their realizing what is happening.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2014 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.