Think Beyond Oil And Gold: Interview With Mike 'Mish' Shedlock

Commodities / Commodities Trading May 26, 2016 - 03:13 PM GMTBy: Mike_Shedlock

This past week I was interviewed by James Stafford at Oilprice.com.

This past week I was interviewed by James Stafford at Oilprice.com.

We discussed, oil, gold, lithium, other natural resources, global opportunities, and even biotech plays.

Here is the full interview, conducted several days ago.

Think Beyond Oil And Gold: Interview With Mike 'Mish' Shedlock

The energy sector was certainly a bargain in January, but no one really knows where oil will be around Christmas. While we may have already seen the bottom, stock prices are not the bargain they were.

There are other plays. Think electric vehicles and even driverless cars. Find what's undervalued now and get in on some of the games that will dictate glorious future wealth.

In an exclusive interview, Oilprice.com talked to Mike "Mish" Shedlock, an award-winning economic commentator who has been providing millions of readers with investment advice for years.

In this interview, Mish discusses:

• The oil bounce

• The confluence of events that brought oil down

• The manufacturing recession

• The battery revolution

• Lithium, EVs, and driverless cars

• Demographics

• Opportunities in beaten up stocks, bios, potash

• Global opportunities, Brazil, Russia, Japan

Oilprice.com: What do you see as being next for oil prices? Is the rally here to stay? Where do you see oil prices at Christmas?

Mish: I certainly don't know, and no one else does either.

Early this year, many resource plays were massively undervalued and priced for possible bankruptcy. Had I known the precise timing, I would have sold everything 2-3 years ago and bought in December.

My intent was to buy a lot of energy companies when oil dropped into the 30s. I didn't. Instead, gold miners and other resources were a bargain at the same time. I did pick up more of those.

In regards to oil, there are a lot of companies still going bankrupt. With the slowing global economy, oil prices may simply level off here. I am inclined to think that the bottom may be in, but one never knows with these political pushes against petroleum and fossil fuels.

It's interesting that when oil fell from $100 to $80 to $70 to $60, people kept saying the bottom was in, every time oil bounced a few bucks.

I was thinking $35-45. Oil went even lower.

Then when oil broke $30, people threw in the towel. Writers started talking about oil in the teens!

The same thing happened in gold. When gold fell from $1,900 to $1,050 people started talking about gold in the $600 range again.

Neither oil nor is gold is going to zero.

The best energy plays are companies that have little debt and are profitable at or near current levels. They will survive another trip south in oil prices. Debt leveraged companies may not.

Oilprice.com: Do you buy into the theory that Saudi Arabia has been pursuing a strategy to bankrupt the U.S. energy sector and maintain its own market share?

Mish: No. We had a confluence of numerous things made for a "perfect storm" in the oil sectors.

1. The Fed drove down interest rates to ridiculously low levels.

2. Companies saw an opportunity to get cheap financing and they got it.

3. Extraction technology improved.

4. President Obama worked out a deal with Iran to end the embargo. This added to global oil supply.

5. Cash strapped Russia pumped more oil to support its economy in the wake of EU and US sanctions.

6. Growth in China slowed.

Drill baby drill!

The U.S. drilled like mad and so did everyone else.

Despite the crash in oil, production in the U.S. dropped only 6 percent, maybe 8 percent. So we have huge numbers of bankruptcies already filed and pending, and companies are struggling -- yet, they are all still pumping.

The Fed kept these companies alive artificially.

Oilprice.com: What do you see happening at the June OPEC meeting?

Mish: A lot of talk and nothing else. We see the same thing with trade discussions. Every year there are two rounds of trade discussions and nothing ever happens.

Even the Trans-Pacific-Partnership (TPP), looks like its dying on the vine. It will die if Trump is elected, maybe even if Clinton is. She stated on 45 occasions while in office that she was for it. Now, she isn't.

TPP is a massive monstrosity, all done in secret. Few have read it outside those working on the deal. Only 20% of it relates to trade.

I believe a proper trade agreement would be to drop all tariffs and stop all subsidies regardless of what anyone else did.

Any country that did that would see investment pour in. But no one wants to try that. Everyone claims they are for free trade except when it hurts their exports.

So here we are. This is another one of those "we have to pass the bill to find out what's in it kind of things." No thanks!

I have written about the TPP many times, here's a pair of them:

- Obama's Trans-Pacific Partnership Fiasco vs. Mish's Proposed Free Trade Alternative; How Will TPP Function in Practice?

- Hillary Clinton, Dead Rats, Toilet Paper Politics

Oilprice.com: As you've seen over the last few weeks we've seen an increase in demand and many supply outages. Is this the end of the glut or will it hang over the market for a while?

Mish: Supply will hang over the market for a long time to come. China is slowing way more than people realize. What little rebound there was in Europe appears to be on its last legs.

The oil market crashed to take falling demand into consideration, likely overshooting. The rebound is to a more natural level. If I had to guess a range, I would say a $35-$45 range. It could be higher. I have no bets on it.

Oilprice.com: Goldman Sachs' top-end estimate is $60 or above. How would that impact the economy?

Mish: Let's approach that question from the opposite direction.

All the people who said that falling and low oil prices are "unambiguously good for the economy" were wrong.

If oil rebounds to $65, then maybe my idea that the global economy is slowing rapidly is wrong.

But $65 or higher could also happen with some sort of war-caused supply squeeze in the Middle East or if OPEC and Russia voluntarily made huge cuts in production.

In general, if oil is going up in the absence of a supply shock, then it usually means the global economy is improving.

The dip below $30 was likely an overshoot. If so, the subsequent rebound to the mid-$40s was just a bottoming event. Judgments need to be based on what happens next, not a rebound from the depths of hell.

Europe has huge migration problems and voters are fed up. You see it in the rise of some fringe parties all across Europe.

In the U.S., Donald Trump beat all expectations. If the economy was really doing well, people would not be so angry everywhere you look.

Oilprice.com: How big of a stimulus do you think low oil prices have had on the economy?

Mish: At best, little to none, and more likely negative. The economists thought that people would go and spend all their gasoline savings on consumer goods but that didn't happen.

Instead, the savings rate rose. People did spend more on rising rents and rising healthcare costs, not where the Fed wanted consumers to spend.

We lost a lot of high paying jobs in the energy sector and some of the local economies are struggling.

The net effect of all of this was certainly negative as it played out. Last month, we saw a good report or two in manufacturing, but they went down again this month. Manufacturing is undoubtedly still in a recession.

Oilprice.com: What about renewables, and particularly, battery technology? If battery technology improves rapidly, and the driverless cars accelerates, would oil be hit hard?

Mish: It could, but the timeline is in question. I don't think a massive switch to batteries will happen any time soon in most consumer cars.

There are plenty of variables here and more questions than answers -- especially when it comes to time frame and reverberations.

Are people going to stop buying cars and go to Uber? Are those cars going to be battery, gasoline, or hybrids of some sort? I don't know.

I propose a phased progression.

First, long haul truck driver jobs will vanish, then taxi driver jobs will vanish.

When the average person in the city says "I don't need my own car anymore" remains to be seen.

Oilprice.com: How do demographics fit into the picture?

Demographically speaking, millennials don't see things the same way as the boomers do.

Mish: Millennials don't care much about cars - they're content to do other things that aren't as energy intensive as their parents did. They don't want big houses as they've seen their parents lose houses to debt. They live with parents and don't eat out as much. This all cuts into demand energy.

So does a mountain of debt. Yet the economists are still trying to figure out why the economy is growing slowly.

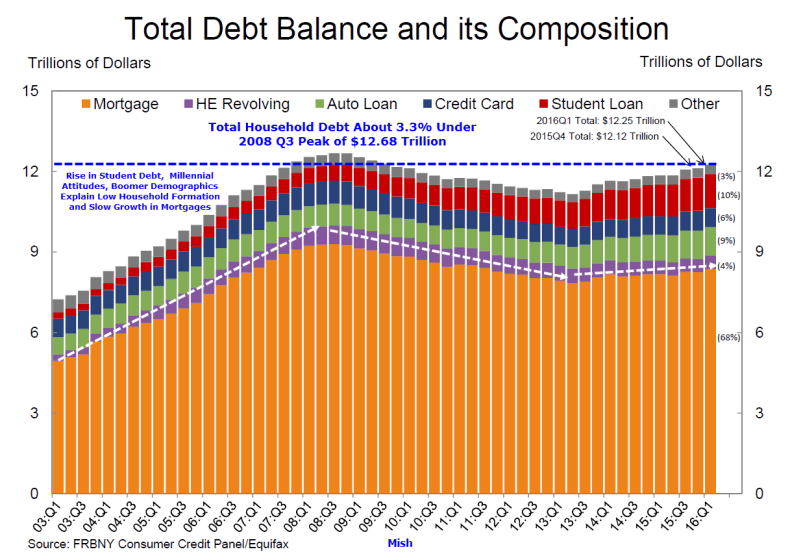

I discussed that in Household Debt Still Below 2008 Peak.

As of March 31, 2016, total household indebtedness was $12.25 trillion, a $136 billion (1.1%) increase from the fourth quarter of 2015. Overall household debt remains 3.3% below its 2008 Q3 peak of $12.68 trillion.

Check out the trend in mortgage debt vs. the trend in student loan debt. The two items are not unrelated.

Household formation is low because of student debt, boomer demographics, and changing attitudes of millennials.

Oilprice.com: Outside of gold, where do you see undervalued investments?

Mike Shedlock: I like Lithium but some of the plays in that space have had a big run-up.

There could be a pullback. In terms of market timing batteries, three to four years away may as well be light-years from now. The markets typically don't care much about things more than a year away.

I am in some tiny companies. And I am willing to be patient. My intention is to hold them until I think they have met their value.

I am in a couple of biotech plays. I like Sarepta (SRPT), but pull up a chart. Volatile does not begin to describe the gyrations. I caught an entry in the teens. The next day it fell to $8. Earlier this year it was at $38.

This volatility is a sad testimonial to the power of the FDA.

Doug Casey calls the FDA the "Federal Death Agency".

Sarepta has a drug for MD that patients say works, but the FDA says doesn't.

A Group of Senators Wrote the FDA seeking approval. Janet Woodcock, who heads the FDA Center for Drug Evaluation and Research said to an overflow crowd that included hundreds of kids in wheelchairs "It's possible to reach different conclusions based on the data presented today ... Failing to approve a drug that actually works in devastating diseases -- these consequences are extreme."

This play could easily double or halve depending on the next "Federal Death Agency" review. I make no recommendation, but my point is twofold.

First, look outside the box for opportunities. The FDA created a panic opportunity when it issued a preliminary ruling against the drug. A final ruling is expected later this month.

Second, I wanted to mention the perverse influence of the FDA approving drugs that have serious side effects and not approving one where an overflow crowd of parents turned up begging the FDA to approve something that they believe does, especially when there have been no serious side effects.

The key is not to buy into blind plunges, but rather to see if unexpected news creates a favorable opportunity.

From a Libertarian standpoint, the decision on Sarepta was pure nonsense.

[OilPrice note: On Wednesday, the Wall Street Journal reported Sarepta: FDA's Decision on Dystrophy Drug Delayed.]

Oilprice.com: What about cobalt and other resources?

Mike Shedlock: I haven't looked at cobalt, but perhaps I should. I am in a Potash play now.

These are the kind of plays that aren't on mainstream media radar. It takes a bit of research. The smaller companies are kind of like lottery tickets. They are also similar to cheap options that don't expire.

If you don't put a lot on these plays, and can take a bit of volatility, you only have to be right on one in 10.

Oilprice.com: How close are we getting to a real breakout with autonomous trucking, which you've written about recently?

Mike Shedlock: Four ex-Google engineers broke away and started their own Driverless Vehicle Company Called "Otto".

They've been testing driverless trucks in Nevada without a backup driver. The "Otto" approach is a little different: They retro-fit existing trucks with their technology. The clincher is that "Otto" will soon be commercially ready.

I bumped up my timeline for driverless trucks from 2020 to 2019. I now expect we will lose millions of jobs by 2022 instead of 2024.

Oilprice.com: Do you see the EV revolution taking place sooner than many are projecting?

Mish: I do. I bought a couple of lithium stocks - one on the Toronto exchange and one here in the U.S. But yes, I believe people need to look outside of gold and energy as to how this will take hold.

My opinion on these things is if it takes a government subsidy to work then it doesn't work. And we are not seeing subsidies going into this industry (unlike wind for example).

The free market seems to be adapting on its own to deal with emission issues.

Oilprice.com: What about global opportunities?

Mish: Brazil is going through huge turmoil right now. When the political dust settles in Brazil there will be opportunities.

Why buy a general basket of stocks in the U.S. when Median PEs are near the highest ever?

I like Russia and Japan. With Japan, one needs to think about Yen hedging. Who knows what crazy thing Abe might do?

Think globally! But be prepared for a currency crisis. Don't give up your gold.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.