The GLD vs GOLD

Commodities / Gold and Silver 2016 Aug 26, 2016 - 05:41 PM GMTBy: James_Anderson

The case for owning precious metals has already been made. We live in a world of unprecedented and ever expanding debt, devaluing fiat currencies and negative interest rates. Even Wall Street’s heralded “Bond King”, Bill Gross, now admits the world will continue to have difficulty paying its debts without further price inflations.

The case for owning precious metals has already been made. We live in a world of unprecedented and ever expanding debt, devaluing fiat currencies and negative interest rates. Even Wall Street’s heralded “Bond King”, Bill Gross, now admits the world will continue to have difficulty paying its debts without further price inflations.

Investors wisely seeking exposure to precious metals must deliberate between the convenience of buying shares of an electronically traded fund (ETF) and the ultimate security of owning physical gold and silver bullion. We tasked ourselves to take a closer look at each to understand their important distinctions.

Firstly, let’s define these two different investment vehicles for the sake of clarity:

Bullion - (n) physical precious metal in a bar, coin, or round form almost entirely valued by its market or melt value alone.

ETF - (n) exchange traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities (e.g. gold), or bonds, and trades close to its net asset value over the course of the trading day.

Which is a better vehicle for silver and gold investors?

One is more convenient for short-term trading (ETF). The other is a proven bedrock safe haven you own and control directly (physical bullion). Your preference will likely be determined by your investing time horizon and world view.

ETFs

For short-term traders, over the last ten years or so, precious metal ETFs have become a simple way to gain price exposure to gold, silver, palladium, and platinum’s futures spot price.

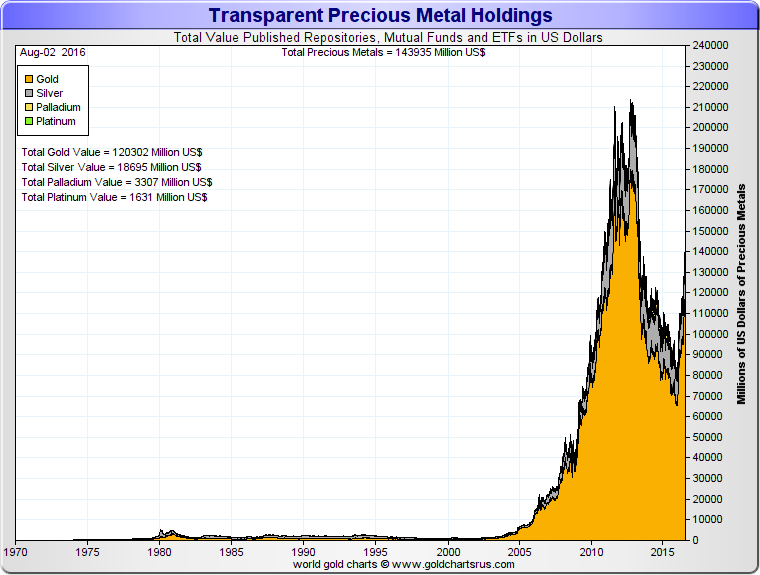

The world’s largest gold ETF (symbol: GLD) was launched at the end of 2004 while silver’s largest ETF (symbol: SLV) was launched in 2006. These and all other precious metal ETFs, mutual funds, transparent bullion depositories, and futures exchanges combine for a total market capitalization of about $150 billion USD today. That’s just a little less value than the entire world’s gold mining supply per year.

Today if you were to ask a trusted financial advisor or institution to have a portion of your investment portfolio allocated to precious metals, chances are very high they will attempt to steer you into the realm of either ETFs or precious metal mutual funds.

I suppose the biggest reasons for this is that we (1) live in a world of increasing over-financialization and (2) precious metal derivatives and paper asset proxies keep investors within a financial professional’s fee matrix. In other words, if an investor were to withdraw some funds for an outright purchase of physical bullion they would be escaping future fees of financial advisors, institutions, and other interests involved (mainstream financial media outlets, custodians, sub-custodians, etc).

Physical bullion on the other hand, can be conveniently bought outright, owned and held first hand completely unencumbered from price tracking promises or liability exonerating 40+ page prospectuses which generally govern the terms and conditions of an ETF.

Being that ETFs are particularly vulnerable to mis-pricing, their prospectuses are usually infused with convoluted clauses allowing them to operate in spite of significant price divergences from the underlying assets they intend to track.

Their prized liquidity is limited to market trading hours, a mere 6.5 trading hours, 5 days a week, holidays excluded. ETF investors are further exposed to overnight risks such as stock market trading halts, bank holidays, and financial market meltdowns that heavily hamper their high liquidity posing.

Physical bullion could go supernova in both price and value, yet ETF proxies could deflate or possibly go bankrupt. All long term investors with exposure to exchange traded funds should reexamine the inherent risks associated with these investment vehicles.

Physical Bullion

For many years now, central banks and eastern government regimes have been actively buying physical gold bullion outright. Sovereign government actions are generally guided by longer term perspectives. More and more individual investors are also acting as their very own central banks, by literally also taking these precious matters into their own hands.

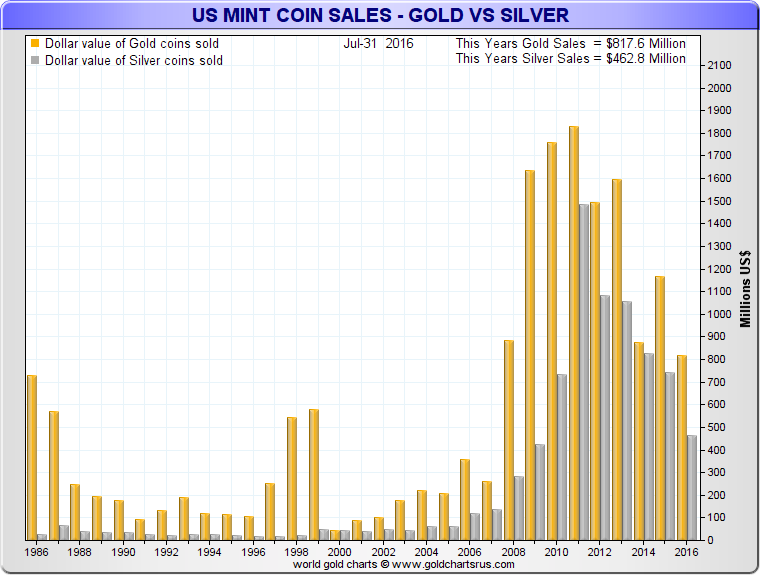

Physical bullion bar, coin, and round demand has persistently increased every year since the 2008 financial crisis. Bullion buyers typically buy and hold for the long haul. These buyers tend to have mid to long-term time horizons and generally have better understandings of the fundamental drivers in this 21st century bullion bull market than retail ETF traders do.

Many bullion buyers choose to store their metals privately within their homes, yet often higher net worth investors utilize fully insured non-bank vaults like this one.

According to the World Gold Council, about 40% of the world’s annual gold supply is used for investment purposes (individual investors, ETFs, and central banks reportedly purchase about 50 million ounces annually). Central banks have been net positive purchasers of physical gold bullion since 2010.

Approximately 25% of the world’s annual silver supply is used in .999+ fine investment grade bullion products. According to Reuters, in 2003 this figure was only 4%. The world has made a massive increase in silver investment buying over the last decade.

Most silver and gold bullion buyers believe physical precious metals owned outright offers them:

- A wealth-preserving safe haven asset.

- A true portfolio diversifier to hedge against other asset classes’ downside risk.

- An undervalued asset compared to equities, bonds, and even real estate.

- Defense against both potential inflation and deflation.

- Protection against potential bank failures and account freezes (bailouts / bail-ins).

- A private asset which cannot go bankrupt yet also enjoys virtually no counterparty risks.

- Safety amongst record low interest rate yields (ZIRP / NIRP) and experimental central bank policies which consistently devalue fiat currencies long term.

- One of the most easily traded spendable assets similar to physical cash notes.

Costs and Important Features

Below we examine some of the costs associated with holding ETFs vs. using a fully insured non-bank vault in a politically stable location like the Grand Cayman islands. Aside from the hard costs, we look at the other features that distinguish ETFs from physical bullion ownership, such as:

Do you know where your metal is?

Can you visit your metal?

Can you easily withdraw your very own physical bullion bars or coins?

Unlike private storage’s transparent and stable pricing model, when you examine the overall fees of ETFs looking backwards, you will inevitably find higher costs associated than their supposedly simple upfront quoted “management fees”. Commissions and even operating expenses are often added on in arrears, making total expenses for many ETFs much higher than what was originally perceived.

Also note that most large ETFs (i.e. GLD or SLV) only allow “Authorized Participants” to take physical delivery of bullion from a fund. Essentially these participants are only the largest approved commercial banks, billionaire institutional investors, hedge funds etc. In other words, most retail investors cannot take physical delivery, and only some approved financial insiders can redeem physical bullion from the world’s largest silver and gold ETFs.

Storage Costs and Important Features - Gold ETFs vs Gold Bullion in Private Storage

Vehicle |

Total Annual Fees |

Specific Coins/Bars Allocated? |

Visitation Permitted? |

Home Delivery Possible? |

Private Storage @ SWP Cayman Islands |

0.50 - 0.65 % |

Yes. Fully allocated and segregated for each owner. |

Yes. |

Yes. |

GLD |

> 0.40% |

No. Only large industrial bars. |

No. |

No, only “Authorized Participants”. |

IAU |

> 0.25% |

No. Only large industrial bars. |

No. |

No, only “Authorized Participants”. |

SGOL |

> 0.39% |

No. Only large industrial bars. |

No. |

No, only “Authorized Participants”. |

PHYS |

> 0.35% |

No. Only large industrial bars. |

No. |

Yes, minimum 400 oz. |

Storage Costs and Important Features - Silver ETFs vs Silver Bullion in Private Storage

Vehicle |

Total Annual Fees |

Specific Coins/Bars Allocated? |

Visitation Permitted? |

Home Delivery Possible? |

Private Storage @ SWP Cayman Islands |

0.75 - 0.85 % |

Yes. Fully allocated and segregated for each owner. |

Yes. |

Yes. |

SLV |

> 0.50% |

No. Only large industrial bars. |

No. |

No, only “Authorized Participants”. |

SIVR |

> 0.45% |

No. Only large industrial bars. |

No. |

No, only “Authorized Participants”. |

PSLV |

> 0.45% |

No. Only large industrial bars. |

No. |

Yes, minimum 10,000 oz. |

ZKB |

> 0.60% |

No. Only large industrial bars. |

No. |

Yes, 30 kilogram minimum with an approximate 9.2% delivery, redemption commission, and VAT applied. |

In conclusion, we find that both ETFs and physical precious metals have their place within the investment sphere, however it is important to clearly understand the true costs, limitations and counterparty risks associated with each.

Much like Bill Gross, we must seek to cross the financial rubicon from counterparty dependent assets to physical tangible wealth securely hosted in a politically stable locale. Tangible bullion has always been a favored asset class for those seeking to preserve wealth. Counterparty proof assets, not bonds, are again becoming king.

“I think we should be investing in real assets as opposed to financial assets.” (Source: CNBC)

- Bill Gross, August 3, 2016

***

James Anderson is an industry professional and has worked with precious metals directly for the last decade, notably for industry leaders JMBullion and GoldSilver.com. His professional mantra is to help individuals prudently preserve purchasing power through safely acquiring physical precious metals for the long term.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.